What is the maximum I can receive from my Social Security retirement benefit?

| Age at retirement | Maximum monthly benefit |

| 62 | $2,364 |

| 65 | $2,993 |

| 66 | $3,240 |

| 70 | $4,194 |

How can you maximize your Social Security benefits?

Use these 6 strategies to increase your household's lifetime benefits

- Don’t Take the SSA’s Advice at Face Value. Going straight to the source seems like a great way to get accurate information about the best time to file for ...

- Withdraw Your Social Security Application. Here’s one opportunity to reverse a claiming decision you regret. ...

- Suspend Your Social Security Benefits. ...

- Maximize Your Household Benefits. ...

When should I take Social Security to maximize my benefits?

You can expect the following when applying for Social Security spousal benefits:

- You can receive up to 50% of your spouse’s Social Security benefit.

- You can apply for benefits if you have been married for at least one year.

- If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

- Starting benefits early may lead to a reduction in payments.

How to maximize social security benefits?

- How You Fund Retirement Matters. Let’s say you wait until age 70 to draw benefits. ...

- Age Matters. This may seem counter-intuitive, but the longer you wait to claim Social Security (up until age 70), the higher your benefit. ...

- Planning As a Couple Makes a Difference. ...

Does Social Security still have a minimum benefit?

The benefit amounts are still calculated through both formulas, but with the minimum Social Security benefit provision, the higher of the two benefits is the amount provided to qualified individuals. In 2019, there were 64 million Social Security recipients; about 32,092 of them qualified for the minimum benefit. While it’s not a provision that impacts most people qualifying for Social Security, it’s still an important concept to understand if you want to broaden your full understanding ...

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How much Social Security will I get in 2021?

What is the maximum Social Security benefit? En español | The most an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is: $3,895 for someone who files at age 70. $3,148 for someone who files at full retirement age (currently 66 and 2 months). $2,324 for someone who files at 62.

What is the maximum taxable income for 2021?

The maximum taxable income in 2021 is $142,800.

How much Social Security can I get at 70?

A high earner who enrolls at age 70 could get a maximum Social Security benefit of $3,895 each month.

What is the maximum wage for Social Security in 2021?

The maximum wage taxable by Social Security is $142,800 in 2021. However, the exact amount changes each year and has increased over time. It was $137,700 in 2020 and $106,800 in 2010. Back in 2000, the taxable maximum was just $76,200. Only $39,600 was taxed by Social Security in 1985.

How much does a spouse get if they receive Social Security?

So, if one spouse has a Social Security payment of $3,895 per month , the other spouse might qualify for a spousal payment of $1,947.50 monthly. And after you pass away, your spouse could receive a survivor's payment of the full $3,895 per month, which would also be adjusted annually for inflation.

How long do you have to work to get Social Security?

You need to earn at least the taxable maximum each year for 35 years to get the maximum possible Social Security payment. If you don't work for 35 years, zeros are averaged into your calculation and will decrease your Social Security payments.

How much can a child receive from a family member?

The maximum family benefit all your family members can receive is usually about 150% to 180% of your full retirement benefit.

When can I postpone Social Security?

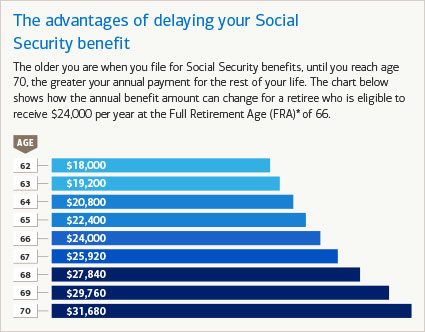

The maximum Social Security benefit changes based on the age you start your benefit. Those who postpone claiming Social Security between ages 62 and 70 become eligible for higher payments with each month of delay.

Can I increase my Social Security if I work for more than 35 years?

If you work for more than 35 years, a higher-earning year will replace a year when you earned less in the Social Security calculation. You can increase your Social Security payments even after you retire if you earn more now than you did earlier in your career .

How do Social Security benefits depend on earnings?

Social Security benefits depend on earnings. The amount of a person's retirement benefit depends primarily on his or her lifetime earnings. We index such earnings (that is, convert past earnings to approximately their equivalent values near the time of the person's retirement) using the national average wage index.

What is the retirement age for a person born in 1943?

c Retirement at age 66 is assumed to be at exact age 66 and 0 months. Age 66 is the normal retirement age for people born in 1943-54. People who retired at age 66 and who were born before 1943 received delayed retirement credits ; those born after 1954 will have their benefits reduced for early retirement.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How is Social Security calculated?

Social Security benefits are typically computed using "average indexed monthly earnings.". This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount ( PIA ). The PIA is the basis for the benefits that are paid to an individual.

What is the AIME amount for 2021?

For example, a person who had maximum-taxable earnings in each year since age 22, and who retires at age 62 in 2021, would have an AIME equal to $11,098. Based on this AIME amount and the bend points $996 and $6,002, the PIA would equal $3,262.70. This person would receive a reduced benefit based on the $3,262.70 PIA.

Can disability benefits be reduced?

In such cases, disability benefits are redetermined triennially. Benefits to family members may be limited by a family maximum benefit.

What is family maximum on Social Security?

Social Security's family maximum rules limit the total benefits payable to a beneficiary's family. Different family maximum rules apply to retirement and survivor benefits than to disability benefits. The rules for calculating family maximum benefits are complicated. In some particularly complex cases, it is difficult to properly implement ...

What are the SSA family maximum rules?

SSA 's family maximum rules are complex and affect beneficiaries in different ways, depending on their earnings levels and benefit types. In particular, the rules that apply to disability beneficiary families differ significantly from those that apply to retirement and survivor beneficiary families.

How does Social Security affect family maximum?

As we have shown in this study, Social Security's family maximum rules are complex and affect beneficiaries in different ways, depending on their earnings levels and benefit types. In particular, the rules that apply to disability beneficiary families differ significantly from those that apply to retirement and survivor beneficiary families. The disabled family maximum affects many more families and a wider range of family sizes than the retirement and survivor family maximum. All disability families with three or more beneficiaries are affected by the family maximum and more than half of families with two beneficiaries are affected. Families of disabled workers, particularly those with low earnings, sometimes lose all of their auxiliary benefits. For all families affected by the family maximum rules, reductions can be substantial.

What is the family maximum for disabled workers?

The family maximum for a disabled worker is 85 percent of the worker's average indexed monthly earnings ( AIME ), a measure of lifetime earnings. 4 However, the family maximum for a disabled worker's family cannot be more than 150 percent or less than 100 percent of his or her PIA.

How many disabled workers are affected by the Family Maximum?

All families of disabled workers with three or more beneficiaries are affected by the family maximum. In addition, more than half (58 percent) of families of disabled workers with two beneficiaries (one worker and one auxiliary) are affected.

Why are disability benefits lower than retirement?

Because of the more restrictive DI family maximum rules, benefits payable to disability beneficiary families are significantly lower than those for retirement and survivor beneficiary families, particularly at the lower end of the earnings scale.

When is the combined family maximum used?

The combined family maximum is used when a person qualifies for auxiliary benefits on more than one worker's record. It is the sum of the family maximums applicable to each worker's record, but not more than the statutory upper limits for combined family maximums. 30