Average Social Security Benefit by Age

| Age | Average Monthly Benefit |

| 66 | $1,745.14 |

| 67 | $1,719.23 |

| 68 | $1,739.24 |

| 69 | $1,736.43 |

How can you get the maximum Social Security benefit?

Social Security benefits ... you've never checked your earnings record, you'll want to go back as far as you can in comparing reported income to the amount you know you made. This could mean digging out old tax records and paperwork. But once you get ...

When should I take Social Security to maximize my benefits?

You can expect the following when applying for Social Security spousal benefits:

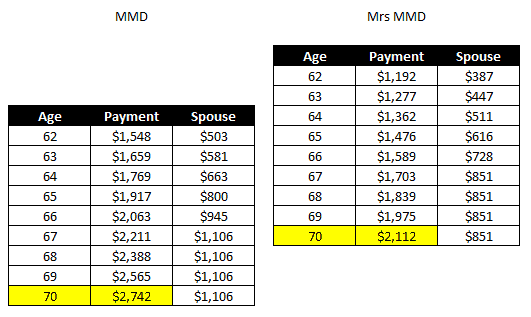

- You can receive up to 50% of your spouse’s Social Security benefit.

- You can apply for benefits if you have been married for at least one year.

- If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

- Starting benefits early may lead to a reduction in payments.

How to maximize Social Security income in retirement?

Use these 6 strategies to increase your household's lifetime benefits

- Don’t Take the SSA’s Advice at Face Value. Going straight to the source seems like a great way to get accurate information about the best time to file for ...

- Withdraw Your Social Security Application. Here’s one opportunity to reverse a claiming decision you regret. ...

- Suspend Your Social Security Benefits. ...

- Maximize Your Household Benefits. ...

Does Social Security still have a minimum benefit?

The benefit amounts are still calculated through both formulas, but with the minimum Social Security benefit provision, the higher of the two benefits is the amount provided to qualified individuals. In 2019, there were 64 million Social Security recipients; about 32,092 of them qualified for the minimum benefit. While it’s not a provision that impacts most people qualifying for Social Security, it’s still an important concept to understand if you want to broaden your full understanding ...

How much do you have to earn to get maximum Social Security?

In 2022, if you're under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $100000 a year?

Based on our calculation of a $2,790 Social Security benefit, this means that someone who averages a $100,000 salary throughout their career can expect Social Security to provide $33,480 in annual income if they claim at full retirement age.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

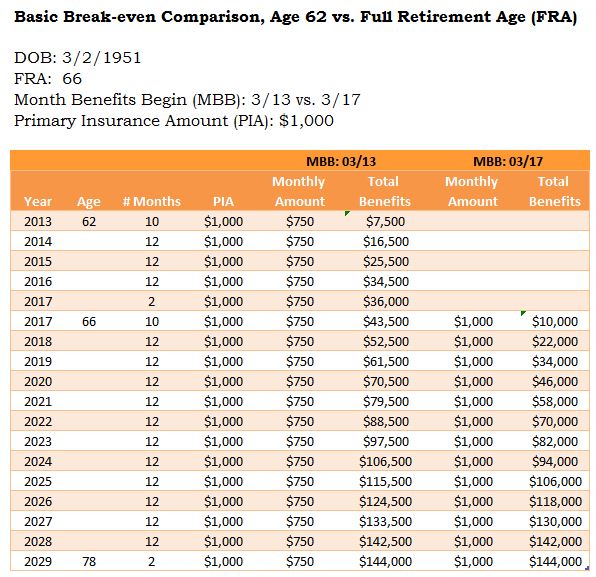

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What is a good monthly retirement income?

According to AARP, a good retirement income is about 80 percent of your pre-tax income prior to leaving the workforce. This is because when you're no longer working, you won't be paying income tax or other job-related expenses.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

Is Social Security based on lifetime earnings?

Social Security replaces a percentage of your pre-retirement income based on their lifetime earnings. The portion of your pre-retirement wages that Social Security replaces is based on your highest 35 years of earnings and varies depending on how much you earn and when you choose to start benefits.

What's the average Social Security check at 62?

According to payout statistics from the Social Security Administration in June 2020, the average Social Security benefit at age 62 is $1,130.16 a month, or $13,561.92 a year.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

What is the average Social Security check at age 65?

At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Can you collect Social Security at 66 and still work full time?

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment.

What is the maximum wage for Social Security in 2021?

The maximum wage taxable by Social Security is $142,800 in 2021. However, the exact amount changes each year and has increased over time. It was $137,700 in 2020 and $106,800 in 2010. Back in 2000, the taxable maximum was just $76,200. Only $39,600 was taxed by Social Security in 1985.

How much do you pay for Social Security?

Workers pay 6.2% of their earnings into the Social Security system, and employers match this amount until their salary exceeds the taxable maximum amount of income for that year. Those who have salaries larger than the taxable maximum do not pay Social Security taxes on that income or have those earnings factored into their future Social Security payments.

How much does a spouse get if they receive Social Security?

So, if one spouse has a Social Security payment of $3,895 per month , the other spouse might qualify for a spousal payment of $1,947.50 monthly. And after you pass away, your spouse could receive a survivor's payment of the full $3,895 per month, which would also be adjusted annually for inflation.

How much will Social Security pay in 2021?

But many retirees receive over $3,000 per month from the Social Security Administration, and payments could be as much as $3,895 in 2021.

Do you have to pay Social Security if you make more than the maximum amount?

If you earn more than the taxable maximum amount in a single year, you won't have to pay Social Security taxes on that income . However, that income also won't be used to calculate your Social Security payments.