| Year | COLAa | Eligible individual |

|---|---|---|

| 2018 | 2.0% | 750.00 |

| 2019 | 2.8% | 771.00 |

| 2020 | 1.6% | 783.00 |

| 2021 | 1.3% | 794.00 |

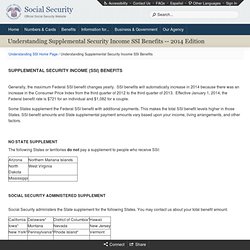

Which states offer supplemental benefits to federal SSI?

- California (individuals: $954.72/month; couples: $1,598.14/month)

- Delaware (individuals: $794/month; couples: $1,191/month)

- Hawaii (individuals: $794/month; couples: $1,191/month)

- Iowa (individuals: $794/month; couples: $1,191/month)

- Michigan (individuals: $794/month; couples: $1,191/month)

- Montana (individuals: $794/month; couples: $1,191/month)

Who is eligible for Supplemental Security Income (SSI)?

Unlike Social Security, children, themselves, who are blind or deaf are eligible to receive SSI benefits. To receive Social Security benefits a person has to have " worked long enough and paid Social Security taxes " in order be " insured " so that the benefits be paid to you or "certain members of your family."

How much you will get from Social Security?

The maximum possible Social Security benefit for someone who retires at full retirement age is $3,148 in 2021. However, a worker would need to earn the maximum taxable amount, currently $142,800 for 2021, over a 35-year career to get this Social Security payment.

Can you get Social Security retirement benefits and SSDI?

You may not collect Social Security disability and retirement benefits at the same time. 2. SSDI may convert to retirement benefits at age 65, 66 or 67. Only people born before 1937 receive full Social Security retirement benefits upon turning 65.

What to do if you are out of work?

What is the maximum retirement income for 2020?

What is the maximum Social Security benefit for 2020?

When can I claim Social Security?

Is Social Security tax free?

See more

About this website

What is the max amount of SSI you can get?

Social Security The latest such increase, 5.9 percent, becomes effective January 2022. The monthly maximum Federal amounts for 2022 are $841 for an eligible individual, $1,261 for an eligible individual with an eligible spouse, and $421 for an essential person.

How much do SSI get a month?

California pays the average highest supplement, making the average payment there $729 per month....SSI Payment Amounts by State.California$729Georgia$603Illinois$614Michigan$615New York$6166 more rows

What state has the highest SSI payment?

States That Pay out the Most in SSI BenefitsNew Jersey: $1,689 per month.Connecticut: $1,685 per month.Delaware: $1,659 per month.New Hampshire: $1,644 per month.Maryland: $1,624 per month.

How can I increase my SSI benefits?

How to increase your Social Security payments:Work for at least 35 years.Earn more.Work until your full retirement age.Delay claiming until age 70.Claim spousal payments.Include family.Don't earn too much in retirement.Minimize Social Security taxes.More items...•

Claiming Social Security in 2022? Here's Your Max Benefit at Full ...

Knowing the maximum benefit at full retirement age, and at age 70, is helpful to get an idea of what Social Security can provide. But since chances are good your benefits will be below this amount ...

What Is the Social Security Income Limit for 2022?

The financial options available to help pay for senior care is dependent on, among other things, the type of care that is required. If you are just beginning the research process on how to pay for long-term care, it is helpful to have an idea about the type of care you or your loved one currently requires, as well as to anticipate future needs.

What Is the Maximum Social Security Retirement Benefit?

The maximum Social Security retirement benefit in 2022 is $4,194 for those who qualify and delay claiming until age 70.

The Maximum Social Security Benefit Explained - AARP

The maximum Social Security benefit changes each year and you are eligible if you earned a maximum taxable income for at least 35 years. Learn more here.

What to do if you are out of work?

On the other hand, if you find yourself out of work and looking for money to get by, look for alternatives. Give the economy time to recover from the coronavirus pandemic so that you can go back to work. Exhaust all stimulus checks, unemployment, severance, or even unused vacation pay that may be at your disposal.

What is the maximum retirement income for 2020?

For 2020, the limit is $48,600 . The good news is only the earnings before the month in which you reach your full retirement age will be counted. There is no reduction in benefits once you reach full retirement age, regardless of how much or little you earned.

What is the maximum Social Security benefit for 2020?

At age 70, the maximum Social Security benefit is $3,790, per month, in 2020. For those who have a comprehensive retirement plan, that will provide a base income that you cannot outlive. Again, if you have earned the revenue required to get the maximum Social Security benefit at age 70, that will still not be enough for you to maintain your ...

When can I claim Social Security?

Even for those fortunate enough to not need the money, they will be forced to claim Social Security at age 70. If you are still working, claim Social Security at age 70, and use the money to top off your retirement contributions. That is an excellent problem to have. I bet a few of you are rolling your eyes, but I know quite a few people who are ...

Is Social Security tax free?

Not everyone should wait until age 70 to claim benefits. For those with other retirement income, Social Security is not a tax-free benefit.

What is the income limit for SSI?

The income exclusion amount for students receiving SSI is now $1,900 per month (up to an annual limit of $7,670).

How much do you have to make to qualify for SSDI?

An applicant for disability benefits through the Social Security disability insurance (SSDI) or SSI programs must be making less than $1,260 per month (up from $1,220 per month in 2019) to qualify for benefits.

What are the benefits of Social Security?

While exact Social Security retirement and disability benefit amounts depend on the lifetime earnings of the recipient, here are the average benefit amounts anticipated for 2020: 1 average retirement benefit: $1,503 (an increase of $24) 2 average disability benefit: $1,258 (an increase of $20) 3 average widow's or widower's benefit: $1,422 (an increase of $22).

How much is the new SSI?

The new SSI federal base amount is $783 per month for an individual and $1,175 per month for a couple. The SSI payment amounts are higher in states that pay a supplementary SSI payment. While exact Social Security retirement and disability benefit amounts depend on the lifetime earnings of the recipient, here are the average benefit amounts ...

How much is the average Social Security disability?

average disability benefit: $1,258 (an increase of $20) average widow's or widower's benefit: $1,422 (an increase of $22). The maximum Social Security retirement benefit that can be collected at full retirement age is $3,011 per month in 2019, though few people are able to collect this amount.

When will Social Security increase?

Increased payments to Social Security recipients begin January 1, 2020, while increased payments to SSI recipients begin on December 27, 2019. Other numbers regarding eligibility for disability and average benefits have also changed for 2020.

How much is Social Security taxed?

The maximum amount of earnings that is subject to the Social Security tax is $137,700, up from $132,900 in 2019. There is no limit to the amount of income subject to the Medicare tax.

What is the maximum SSI benefit in 2021?

SUPPLEMENTAL SECURITY INCOME (SSI) BENEFITS. Generally, the maximum Federal SSI benefit changes yearly. SSI benefits increased in 2021 because there was an increase in the Consumer Price Index from the third quarter of 2019 to the third quarter of 2020. Effective January 1, 2021 the Federal benefit rate is $794 for an individual ...

What is the federal SSI rate for 2021?

Effective January 1, 2021 the Federal benefit rate is $794 for an individual and $1,191 for a couple. Some States supplement the Federal SSI benefit with additional payments. This makes the total SSI benefit levels higher in those States.

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How is SSI payment reduced?

Payment reduction. The monthly amount is reduced by subtracting monthly countable income. In the case of an eligible individual with an eligible spouse, the amount payable is further divided equally between the two spouses. Some States supplement SSI benefits.

What is the maximum federal income tax for 2021?

The latest such increase, 1.3 percent, becomes effective January 2021. The monthly maximum Federal amounts for 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person.

Who Is Eligible for SSI?

People who receive SSI benefits are generally older or have a disability that prevents them from working. Beneficiaries receive funds from the government to help them pay for their basic living expenses, such as food, clothing, and shelter.

Income and Asset Limits for SSI Benefits

There is both an income and asset limit that beneficiaries cannot breach in order to get or retain their SSI benefits. For 2022, an individual beneficiary cannot earn more than $1,767 per month in wages or have more than $2,000 in assets. 1 2

Further SSI Income and Asset Limit Considerations

Individuals can receive a maximum monthly federal SSI payment of $841 as of 2022, or $1,261 for a couple. And again, the income limit for an individual is $1,767, or $2,607 for a couple—if that income comes from wages. 1 Those numbers change annually too.

What Happens If I'm Over the Limit?

The SSA will calculate a beneficiary’s countable income when determining eligibility for, or potential changes to, SSI benefits. As for what happens when you’re over the limit? There are a lot of factors to consider, such as whether your income was earned or not, and if your SSI benefits are being supplemented by your state.

How to Use ABLE Accounts as a Workaround

Both Haddad and Ehlert point to ABLE accounts as a potential way for beneficiaries to work around the income and asset limits for SSI benefits.

Can I Get SSI Benefits for My Disabled Child?

If you want to get benefits for a disabled child, the same eligibility rules (income and asset limits) apply to the child’s parents, up until the child turns 18. 7 “At 18, if the child has a disability, they become eligible on their own,” says Haddad.

Will My State Supplement My SSI Benefits?

Most states supplement federal SSI payments. The only states that do not are Arizona, Mississippi, North Dakota, and West Virginia, along with the Northern Mariana Islands. 8 Some states pay and administer their own supplement payments as well.

What to do if you are out of work?

On the other hand, if you find yourself out of work and looking for money to get by, look for alternatives. Give the economy time to recover from the coronavirus pandemic so that you can go back to work. Exhaust all stimulus checks, unemployment, severance, or even unused vacation pay that may be at your disposal.

What is the maximum retirement income for 2020?

For 2020, the limit is $48,600 . The good news is only the earnings before the month in which you reach your full retirement age will be counted. There is no reduction in benefits once you reach full retirement age, regardless of how much or little you earned.

What is the maximum Social Security benefit for 2020?

At age 70, the maximum Social Security benefit is $3,790, per month, in 2020. For those who have a comprehensive retirement plan, that will provide a base income that you cannot outlive. Again, if you have earned the revenue required to get the maximum Social Security benefit at age 70, that will still not be enough for you to maintain your ...

When can I claim Social Security?

Even for those fortunate enough to not need the money, they will be forced to claim Social Security at age 70. If you are still working, claim Social Security at age 70, and use the money to top off your retirement contributions. That is an excellent problem to have. I bet a few of you are rolling your eyes, but I know quite a few people who are ...

Is Social Security tax free?

Not everyone should wait until age 70 to claim benefits. For those with other retirement income, Social Security is not a tax-free benefit.

Social Security and SSI Benefit Amounts

- The new SSI federal base amount is $783 per month for an individual and $1,175 per month for a couple. The SSI payment amounts are higher in states that pay a supplementary SSI payment. While exact Social Security retirement and disability benefit amounts depend on the lifetime earnings of the recipient, here are the average benefit amounts anticipated for 2020: 1. average retirement benefit: $1,503 (an increase of $24) 2. average disa…

Eligibility For Disability and Working

- An applicant for disability benefits through the Social Security disability insurance (SSDI) or SSI programs must be making less than $1,260 per month (up from $1,220 per month in 2019) to qualify for benefits. (Blind applicants can make up to $2,110 per month). Anyone working above those limits is considered to be doing "substantial gainful activity" (SGA). However, people who are currently receiving SSDI who attempt to return to work can mak…

Early Retirement and Working

- Those who collect early retirement benefits but continue to work have their benefits reduced when they make over $18,240 per year ($1,520 per month). But in the year a recipient reaches full retirement age, he or she can make up to $4,050 per month without having retirement benefits taken away. (After the worker reaches full retirement age, benefits aren't reduced at all, regardless of the amount of work or earnings.) Any early retirement benefits deduc…

Amount of Social Security Taxes Withheld

- The maximum amount of earnings that is subject to the Social Security tax is $137,700, up from $132,900 in 2019. There is no limit to the amount of income subject to the Medicare tax. The Social Security figures and limits for 2019 can be found in the 2019 update. Effective date: Jan 01, 2020