Tax Benefits of Giving

- A gift to a qualified charitable organization may entitle you to a charitable contribution deduction against your income tax if you itemize deductions. ...

- A contribution is deductible in the year in which it is paid. ...

- Most, but not all, charitable organizations qualify for a charitable contribution deduction. ...

- Charitable organization deductions. ...

How do charitable donations affect my taxes?

Things to remember about tax deductible donations

- Donate to a qualifying organization Your charitable giving will qualify for a tax deduction only if it goes to a tax-exempt organization, as defined by section 501 (c) (3) ...

- Document your contributions Keep track of your tax deductible donations, no matter the amount. ...

- Don’t miss out on tax deductions for volunteering

How does the new tax law affect charitable donations?

- Make sure the non-profit organization is a 501 (c) (3) public charity or private foundation.

- Keep a record of the contribution (usually the tax receipt from the charity).

- If it's a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you're claiming.

How much tax return do you get on charitable donations?

What triggers tax audits?

- Making math errors.

- Failing to report some income.

- Claiming too many charitable donations.

- Reporting too many losses on a Schedule C.

- Deducting too many business expenses.

What is the tax treatment of charitable contributions?

Note.

- The deduction for charitable contributions.

- The dividends-received deduction.

- The deduction allowed under section 249 of the Internal Revenue Code for bond premium.

- Any domestic production activities deduction.

- Any net operating loss carryback to the tax year.

- Any capital loss carryback to the tax year.

:max_bytes(150000):strip_icc()/shutterstock_71295430-5bfc3d07c9e77c005148553a.jpg)

How much do charitable donations reduce taxes 2021?

$300For the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. The 2021 deduction for married couples who take the standard deduction has increased; they can deduct up to $600 of cash contributions.

How much do charitable donations reduce taxes 2020?

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come ...

Is it worth it to claim charitable donations?

Charitable giving can help those in need or support a worthy cause; it can also lower your income tax expense. Eligible donations of cash, as well as items, are tax deductible, but be sure that the recipient is a 503(c)(3) charitable organization and keep donation receipts.

How much do you get back on taxes for donating?

In 2020, you can deduct up to $300 of qualified charitable cash contributions per tax return as an adjustment to adjusted gross income without itemizing your deductions. In 2021, this amount stays at $300 for most filers but increases to $600 for married filing joint tax returns.

Which donation is eligible for 100% deduction?

(C) Donations U/s 80G to the following are eligible for 100% Deduction subject to Qualifying Limit: Donation to Government or any approved local authority, institution or association to be utilised for promoting family planning. the sponsorship of sports and games, in India.

How much do you have to give to charity to get a tax deduction?

There's no charity tax deduction minimum donation amount required to claim a charitable deduction. However, you can only claim certain itemized deductions if they're more than 2% of your adjusted gross income (AGI).

Does giving to charity reduce tax?

A gift to a qualified charitable organization may entitle you to a charitable contribution deduction against your income tax if you itemize deductions. You must itemize in order to take a charitable deduction. Make sure that if you itemize, your total deductions are greater than the standard deduction.

How does giving to charity affect your tax return?

If your employer has a payroll giving scheme, such as CAF Give As You Earn, you can give directly to charity from your pay – before tax is deducted. This means you get tax relief, depending on the rate of tax you pay.

How much charitable donations will trigger an audit?

Non-Cash Contributions Donating non-cash items to a charity will raise an audit flag if the value exceeds the $500 threshold for Form 8283, which the IRS always puts under close scrutiny. If you fail to value the donated item correctly, the IRS may deny your entire deduction, even if you underestimate the value.

Are church tithes deductible in 2020?

If so, is tithing tax deductible in its entirety? Charitable donations are tax deductible and the IRS considers church tithing tax deductible as well. To deduct the amount you tithe to your church or place of worship report the amount you donate to qualified charitable organizations, such as churches, on Schedule A.

How much can you claim in charitable donations without receipts 2021?

$300More In Help However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments.

How much can you deduct from a T-shirt donation?

The deduction is limited to the amount of the contribution that exceeds the fair market value of the shirt. For example, if the contribution is $40, and the fair market value of the T-shirt is $20, then the deductible amount is only $20 ($40 donation minus the shirt’s $20 value).

What are the limits on charitable contributions for 2020?

For C corporations, contribution limits are increased for cash donations from 10% to 25% of taxable income (with some adjustments). Special rules apply for businesses’ contributions of food inventory. The cap on such contributions generally is increased from 15% of net income for owners of pass-through businesses and from 15% of taxable income for C corporations to 25% in each case. 11

What is the charitable contribution ceiling for 2020?

For 2020, the ceiling on deduction for charitable contributions of cash is increased. Previously, the deduction for cash contributions to qualifying organizations was limited to 60% of an individual taxpayer’s contribution base, which is generally equal to a taxpayer’s adjusted gross income, or AGI (calculated without any net operating loss carrybacks). For this one year, taxpayers may deduct the amount of their cash charitable contributions in excess of their allowable noncash charitable contributions, up to the full amount of their AGI. This higher ceiling will enable some taxpayers to eliminate all of their taxable income. If a taxpayer’s contributions exceed the ceiling, then the unused amount may be carried forward for up to five years.

What is the $300 deduction for 2020?

For 2020, some taxpayers, particularly those at low- and middle-income levels with modest charitable contribution totals, may find that the special $300 deduction negates any benefit from grouping two or more years of charitable gifts.

How much is the 2020 tax deduction?

The 2020 standard deduction is set at $24,800 for joint returns and $12,400 for unmarried individuals, with an added $1,300 for each married individual over age 65 or blind, or $1,650 for unmarried individuals . State and local tax deductions are capped at $10,000 ($5,000 if married and filing separately). 5.

Can you deduct charitable contributions on your taxes for 2020?

Except for a special benefit available only in 2020, charitable contributions must be claimed as itemized deductions on Schedule A . For 2020, taxpayers who claim the standard deduction on their tax returns are entitled to deduct up to $300 of charitable contributions made in cash “ above-the-line ”—that is, in calculating their adjusted gross ...

Can you deduct charitable donations?

The Charitable Contributions Deduction allows taxpayers to deduct contributions of cash and property to charitable organizations, subject to certain limitations. For a charitable contribution to be deductible, the recipient charity must be a qualified organization under the tax law. Annual caps limit the total amount of charitable contribution ...

Gifts of cash

The most straightforward way to donate is by giving cash to a charitable organization. The simplicity of this approach is appealing to many people, and most charities even accept donations via credit card on their websites or allow you to donate via text. The simplicity of cash gifts, however, can come at a tradeoff for some people.

Gifts of things

When donating items of value to a charity, you can generally deduct the fair market value of the gifts on your income tax return (if you itemize), resulting in a lower tax bill. The law allows us to take an income tax deduction for the donation of many types of property, including but not limited to the following:

Gifts of appreciated stock or other capital gains assets

One of the most attractive things to donate from a tax perspective is appreciated investments that you have owned for more than one year. When you donate appreciated investments, you get to deduct the value of the investment on the date of the gift, and you don’t have to pay any tax on the underlying gain.

Be strategic and mind the tax details

There are a few things to consider when assessing the tax benefits of a donation. First, the dollar value of the charitable deduction may be limited by your adjusted gross income (AGI) and/or by the type of charity you’re giving to.

Aligning your giving with your values

While there are clearly tax advantages to charitable donations, some of the largest benefits can be more personal. Giving to charity allows you to have a direct impact on causes that you believe in deeply. While much has changed since the start of the pandemic, it’s helpful to remember that some things will never change.

How to deduct charitable donations?

1. Donate to a qualifying organization 1 Your charitable giving will qualify for a tax deduction only if it goes to a tax-exempt organization, as defined by section 501 (c) (3) of the Internal Revenue Code. Examples of qualified institutions include religious organizations, the Red Cross, nonprofit educational agencies, museums, volunteer fire companies and organizations that maintain public parks. 2 An organization can be nonprofit without 501 (c) (3) status, which can make it tricky to ensure your charity of choice counts. 3 You can verify an organization’s status with the IRS Exempt Organizations Select Check tool. 4 Before you donate, ask the charity how much of your contribution will be tax-deductible.

What is tax deductible donation?

Tax deductible donations are contributions of money or goods to a tax-exempt organization such as a charity. Tax deductible donations can reduce taxable income. To claim tax deductible donations on your taxes, you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. For the 2020 tax year, there's a twist: you can deduct ...

What documentation is needed to deduct a donation?

If you made a monetary contribution, qualifying documentation includes a bank statement, a credit card statement and a receipt from the charity (including date, amount and name of the organization) or a cancelled check.

How long can you deduct donations on your taxes?

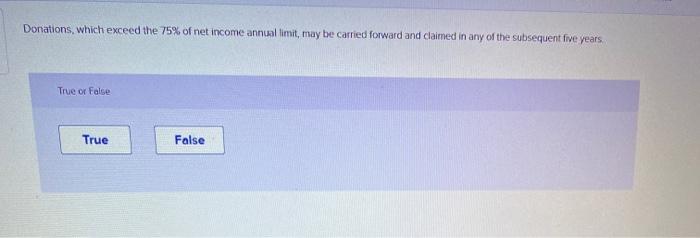

Contributions that exceed the limit can often be deducted on your tax returns over the next five years — or until they’re gone — through a process called a carryover.

How to make your tax year sweeter?

Here’s how to make your tax year a little sweeter. 1. Donate to a qualifying organization. Your char itable giving will qualify for a tax deduction only if it goes to a tax-exempt organization, as defined by section 501 (c) (3) of the Internal Revenue Code.

Can you take the standard deduction if you abandon itemizing?

Plus, if your standard deduction is more than the sum of your itemized deductions, it might be worth it to abandon itemizing and take the standard deduction instead. If you abandon itemizing, however, you abandon taking the deduction for what you donated. Here are the standard deduction amounts by filing status.

Do you need to itemize your tax return?

In general, itemize at tax time. When you file your tax return every year, you'll need to itemize your deductions in order to claim tax deductible donations to charity. That means filling out Schedule A along with the rest of your tax return.

Can you claim charity donations on a tax return?

Yes, here’s how it works: When a taxpayer reports a charitable donation on their tax return, they get to claim a tax credit. A tax credit differs from a tax deduction. A deduction, like a contribution to a registered retirement savings plan ( RRSP ), reduces taxable income on which tax is calculated.

How donating to charity lower taxes

The first $200 of charitable donations generally results in tax savings equal to the lowest marginal tax rate. And donations in excess are at or close to the top tax rate, depending on the province or territory where a taxpayer lives.

How much can you donate?

There is a limit for claiming large donations in a year equal to 75% of a taxpayer’s net income. In the year of death, this limit is increased to 100%. You would generally only carry forward donations if they exceeded the 75% net income limit or if you had no tax payable to reduce with the non-refundable tax credit.

Donating money, but not in the form of cash

Investments: If you donate stocks, mutual funds, exchange traded funds or other eligible capital assets that have appreciated in value, you can get a donation receipt for the fair market value of the donation. You will not have to pay tax on any capital gains, though. Many charities accept a transfer of securities as a donation.

What types of charities and organizations are tax deductible

A registered charity is an organization, public foundation or private foundation that is registered with the Canada Revenue Agency ( CRA ). Other qualified donees include:

Where to claim charitable donations on your return

You use Schedule 9—Donations and Gifts—to calculate the eligible amount of your charitable donations. The tax credit is then claimed on line 34900 of your tax return.

Worth your time and money

Giving to charity is a good thing to do for those who can afford it. The tax reduction is a nice bonus from the CRA and in many cases can cut the net cost of giving in half. Taxpayers who keep these donation guidelines in mind can help maximize their charitable tax savings.

How does charitable giving affect your taxes?

Because charitable giving becomes a tax deduction, you might be able to lower your overall taxable income—possibly allowing you to enter a lower tax bracket. Deductions generally rely on three factors: 1 The recipient (qualified charities are the only ones that can receive a donation that is tax-deductible, so gifting to your family will not give you a tax break) 2 How you structure your donations 3 The form in which you donate

Why is it important to keep a record of donations?

Accurate record-keeping is important. As you make contributions throughout the year, you must keep records to prove the types of donations are you making. Regardless of the amount you donate, you will need a record if you choose to make any deductions.

Can you deduct volunteer time?

Volunteering is a worthwhile donation. Although you cannot deduct the time you spend volunteering, you can deduct the transportation costs and other expenses related to your charitable work. Generally, the full fair market value can be deducted from appreciated long-term assets.

Is charitable giving a tax deduction?

Because charitable giving becomes a tax deduction, you might be able to lower your overall taxable income—possibly allowing you to enter a lower tax bracket. Deductions generally rely on three factors:

Is charitable giving important during the holidays?

Charitable giving during the holiday season is a recognized tradition all over the world. From donating to your favorite charity to volunteering at a soup kitchen, charitable giving is every bit as important to the holiday season as spending time with friends and family. From a financial planning standpoint, charitable giving should be on your mind ...

Can I donate stocks to charity?

However, the deduction is limited to 30% of your adjusted gross income (AGI) compared to the 50% limit for donating cash to charities. Donating your stocks directly to a charity can offer more tax benefits and can lower your income tax bracket.

Do charitable donations have tax breaks?

Some types of charitable giving have different tax breaks than others and some may receive different types of deductions. No matter what types of charitable giving you prefer, it’s important to know the tax implications of your choices—so that you can plan your donations and budget for them while knowing how your taxes will be affected.

Tax Benefits of Charitable Giving

Donating to nonprofit organizations is a win-win proposition. Not only can you help improve the world by supporting your favorite charity, you can reduce your own tax burden in the process.

Can I Deduct Charitable Donations?

First thing’s first: You can typically only claim charitable donations if you are itemizing your taxes. Most Americans will only itemize their taxes if the anticipated total of all itemizations is more than the standard deduction. Typically, the standard deduction will increase year over year.

How Do I Deduct Charitable Giving?

First, you’ll need to ensure the organization receiving your gift is a 501 (c) (3) charity. Only donations made to these organizations qualify for tax deductions. Contributions to political organizations, political campaigns, and organizations that seek to influence legislation typically cannot be deducted.

What Can I Deduct?

While you can probably deduct most of your charitable giving, there are some exceptions. First, you can usually only deduct 60% of your adjusted gross income. However, the amount you can deduct will vary depending on the type of organization you give to.

Donations That Are NOT Tax-Deductible

Currently, the IRS does not allow you to deduct the value of your time or service. However, you can deduct expenses related to volunteering. Such expenses could include mileage to drive to and from an event or supplies purchased to help with a project.

How Does My Income Impact Deductions?

Your overall tax burden is calculated based on your total income. In the United States, tax brackets are progressively tiered, so you only pay the increased rate on income over a specific threshold. For instance, if you are married and filing jointly, and you make $175,000 annually, your tax burden would be as follows:

The CARES Act and Charitable Giving for 2021

The Coronavirus Aid, Relief, and Economic Security (CARES) Act passed in 2020 included charitable giving incentives designed to alleviate the economic strain caused by the pandemic. Donors who take the standard deduction can still claim up to $600 of eligible donations.

How much can you deduct from charitable donations?

Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Tax Exempt Organization Search uses deductibility status codes to identify these ...

What percentage of charitable contributions can you deduct on Schedule A?

In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (AGI). Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent ...

How much can I deduct for food inventory?

There is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage (usually 15 percent) of the taxpayer’s aggregate net income or taxable income. For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made or up to 25 percent of their taxable income.

How much of your food inventory can you deduct in 2020?

For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made or up to 25 percent of their taxable income.

What is tax exempt organization search?

The organizations listed in Tax Exempt Organization Search with foreign addresses are generally not foreign organizations but are domestically formed organizations carrying on activities in foreign countries. These organizations are treated the same as any other domestic organization with regard to deductibility limitations.

Can you deduct a donation of cash?

Deductible Amounts. If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, some adjustments may have to be made.

Can I deduct contributions to a Canadian organization?

A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax return, as described in Publication 597 PDF. Except as indicated above, contributions to a foreign organization are not deductible.