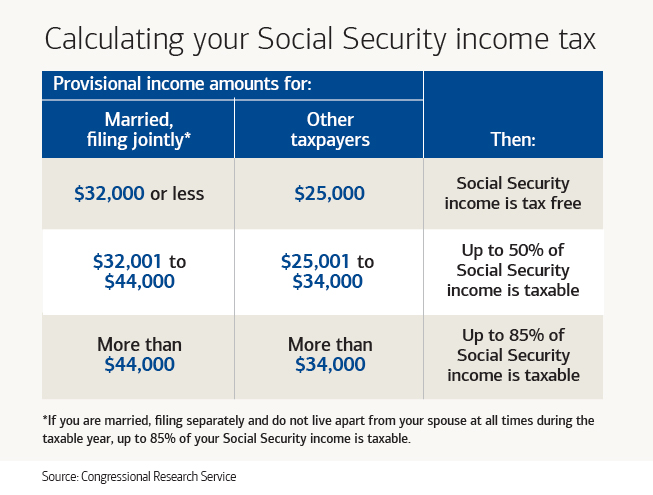

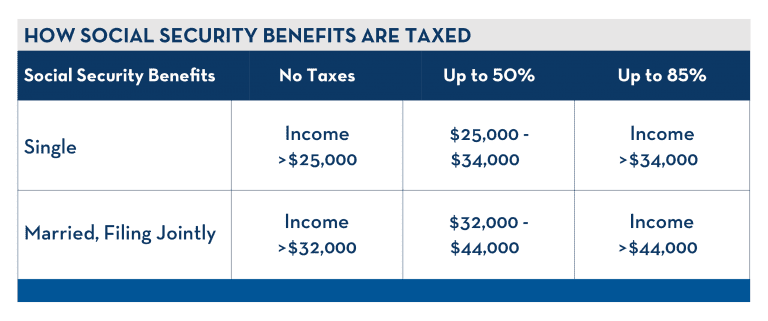

It is typical for Social Security benefits to be 85% taxable, especially for clients with higher income sources in retirement. But the benefit subject to taxation can be lower. Depending on income levels, taxable Social Security can be 0%, 50%, or 85% taxable.

How do you calculate taxable social security benefits?

- $25,000 if you’re filing single, head of household, or married filing separately (living apart all year)

- $32,000 if you’re married filing jointly

- $0 if you’re married filing separately and lived together with your spouse at any point in the year

How much of your Social Security benefit is taxable?

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules. If you: between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How to determine if your Social Security benefits are taxable?

- $25,000 – if taxpayers are single, head of household, qualifying widow or widower with a dependent child or married filing separately and lived apart from their spouse for all of ...

- $32,000 – if they are married filing jointly

- $0 – if they are married filing separately and lived with their spouse at any time during the year

How to calculate tax on Social Security benefits?

- Less than $25,000 single/$32,000 joint: 0% taxable.

- $25,000 to $34,000 single/$32,000 to $44,000 joint: up to 50% taxable.

- Greater than $34,000 single/$44,000 joint: up to 85% taxable.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much of your unemployment benefits are taxable?

more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. more than $44,000, up to 85 percent of your benefits may be taxable.

How to get a replacement SSA-1099?

To get your replacement Form SSA-1099 or SSA-1042S, select the "Replacement Documents" tab to get the form.

Do you pay taxes on your benefits if you are married?

are married and file a separate tax return, you probably will pay taxes on your benefits.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

Is Social Security taxable if you are single?

If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

What percentage of Social Security recipients owe income tax?

The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. For purposes of determining how the Internal Revenue Service treats your Social Security payments, “income” means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits.

How many states tax Social Security?

All of the above concerns federal taxes; 13 states also tax Social Security to varying degrees. If you live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont, Utah or West Virginia, contact your state tax agency for details on how benefits are taxed.

Is unemployment taxable in Colorado?

Some follow the federal rules for determining if benefits are taxable, others have their own sets of deductions and exemptions based on age or income, and Colorado, Nebraska and West Virginia are phasing out taxation of benefits entirely for most or all residents. Contact your state tax agency for details on how benefits are taxed.

Is Social Security income taxable?

Supplemental Security Income (SSI) is never taxable. If you do have to pay taxes on your benefits, you have a choice as to how: You can file quarterly estimated tax returns with the IRS or ask Social Security to withhold federal taxes from your benefit payment. Updated June 30, 2021.

What is the tax rate on Social Security?

The tax rate on Social Security for most people: 0%. For the majority of taxpayers, Social Security benefits end up being free of tax. That's because you're allowed to have up to a certain amount of income before you have to include any of your Social Security on your tax return. Image source: Getty Images.

How much of Social Security is taxable?

Only if your countable income is above those threshold numbers do things get complicated. The general rules that apply to Social Security taxation are as follows: 1 For single filers with countable incomes between $25,000 and $34,000 and joint filers with incomes between $32,000 and $44,000, up to half of your benefits can be included in taxable income. 2 For single filers with countable incomes above $34,000 and joint filers with incomes above $44,000, up to 85% of benefits can get treated as taxable income.

How much is countable income for Social Security?

The general rules that apply to Social Security taxation are as follows: For single filers with countable incomes between $25,000 and $34,000 and joint filers with incomes between $32,000 and $44,000, up to half of your benefits can be included in taxable ...

What is the highest tax rate for seniors?

The highest rate that you'll pay in federal income taxes on your benefits is 31.45%. That rate applies if you're in the top 37% income tax bracket, and the maximum 85% of benefits gets included as taxable income. It's common for seniors who have incomes that are not too far above the thresholds to be in the 12% tax bracket.

What percentage of Social Security income is taxable?

First, the actual percentage of your Social Security that you have to include in taxable income can vary widely, and while it can't exceed 50% or 85% for the respective categories above, it can be quite a bit below that. For instance, if you're single and your countable income was $25,002, then only $1 of your Social Security income would be ...

Can you apply tax brackets to Social Security?

Applying tax brackets to Social Security income . It's impossible to come up with a single rule that will cover every situation involving income taxes and Social Security benefits. However, you can come up with some general observations that can provide some color to the question. For instance:

Can you cut your Social Security taxes?

There are a few ways you can affect how much tax you pay on Social Security, most of which tie into decisions about taking retirement plan withdrawals as taxable income. Apart from that, though, most older Americans don't have much flexibility with their tax planning. For them, knowing what tax rate will apply can simply help them prepare for what they'll have to pay the IRS at tax time.

How Much of Your Social Security Income Is Taxable?

Social Security payments have been subject to taxation above certain income limits since 1983. 1 No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

How Do I Determine If My Social Security Is Taxable?

Add up your gross income for the year, including Social Security. If you have little or no income in addition to your Social Security, then you won’t owe taxes on it. If you’re an individual filer and had at least $25,000 in gross income including Social Security for the year, then up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more (or a couple’s income is $44,000 or more), then up to 85% may be taxable.

Do I Have to Pay State Taxes on Social Security?

Thirty-seven states do not impose taxes on Social Security benefits. The other 13 tax some recipients under some circumstances.

Why are survivor benefits not taxed?

Survivor benefits paid to children are rarely taxed because few children have other income that reaches the taxable ranges. The parents or guardians who receive the benefits on behalf of the children do not have to report the benefits as income. 4

What is included in Social Security income?

That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and any other taxable income. Then, any tax-exempt interest is added.

How to keep Social Security benefits free from taxes?

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income so low it falls below the thresholds to pay tax. However, few choose to live in poverty just to minimize their taxes. A more realistic goal is to limit how much tax you owe.

Can you make quarterly estimated taxes on Social Security?

If you owe taxes on your Social Security benefits , you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

What is the federal tax rate for Social Security?

Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2020. 3 You're limited to these exact percentages—you can't opt for another percentage or a flat dollar amount.

How much do married couples pay on Social Security?

Married couples who lived apart from each other throughout the entire year can use the same base amount as single filers, $25,000. 1 .

What is the income threshold for married couples filing separately?

The income thresholds for married couples filing together are $32,000 for the base amount and $44,000 for an additional amount. 2 . For married couples who file separate tax returns, it all depends on whether they spent any part of the year living together.

How to figure out your tax liability?

To figure out your tax liability, you must first calculate your "combined income," then compare it to the base amounts in the chart below. Your combined income is your total income from all other sources, including tax-exempt interest, plus half your Social Security benefits. 1

What does it mean to cross the 50% threshold?

Crossing the base amount threshold doesn't mean you'll be taxed at a rate of 50%. It means that you'll have to report and pay income tax on 50% of your Social Security income. Your tax rate will be determined by your income tax bracket. If your combined income were to cross that additional amount threshold of $34,000, ...

How much can a married couple use for single filers?

Married couples who lived apart from each other throughout the entire year can use the same base amount as single filers, $25,000. 1

Can you make adjustments to your income to avoid crossing the threshold?

You can potentially make some adjustments to your income to avoid crossing that threshold. For example, you might want to give up that one-day-a-week job if it looks like your investment income and half your benefits are going to nudge you up against that provisional income threshold.