3 Sectors That Could Benefit From Rising Interest Rates

- Consumer discretionary. . Companies such as automakers, casinos, homebuilders, apparel retailers and cruise lines...

- Technology. . Technology stocks have boasted strong dividend growth in recent years. ... He adds: "Intel and Microsoft...

- Get ready for volatility. . As the Federal Reserve readies for interest rates...

Which sectors do well when interest rates rise?

There are some sectors that do well when interest rates rise including: Healthcare: People need healthcare no matter what’s going on. That makes healthcare a sector worth considering, especially during a period of rising interest rates.

How do banks benefit from rising interest rates?

Banks can actually get a nice boost from rising interest rates. Part of this has to do with the fact that higher rates mean they can charge more interest on loan products. If a bank can charge you a higher interest rate on a mortgage or a credit card, it can make more money.

Do rising interest rates impact sector returns?

Nick Kalivas: Yes, rising rates tend to signal stronger economic conditions and can impact sector returns. Higher rates are usually consistent with stronger economic growth and inflationary pressures, and sector performance can be influenced by trends in growth and inflation.

How will rising interest rates affect the manufacturing sector?

Finally, there’s a good chance that some manufacturers, particularly those related to homebuilding, are likely to see improvements as interest rates move higher. Think truck part manufacturers who see an increase in demand as building ramps up or appliance manufacturers who need to outfit new homes.

Who benefits from an increase in interest rates?

One sector that tends to benefit the most is the financial industry. Banks, brokerages, mortgage companies, and insurance companies' earnings often increase—as interest rates move higher—because they can charge more for lending.

What sectors do well in inflation?

Which Are The Sectors That Benefit From Inflation?Wine. When inflation rises and purchasing power decreases, many investors turn to real assets for an inflation hedge. ... Real estate. ... Energy. ... Bonds. ... Financial Companies. ... Commodities. ... Healthcare. ... Consumer staples.

What happens when interest rates rise?

When the Fed raises the federal funds target rate, the goal is to increase the cost of credit throughout the economy. Higher interest rates make loans more expensive for both businesses and consumers, and everyone ends up spending more on interest payments.

What should you invest in when inflation is rising?

Those looking for the best inflation investments can find them in a number of asset classes – equities, sure, but also real estate, commodities and, to a certain extent given the Federal Reserve's recent hawkishness, bonds.

Where should I invest in rising inflation?

Here are some of the top ways to hedge against inflation:Gold. Gold has often been considered a hedge against inflation. ... Commodities. ... A 60/40 Stock/Bond Portfolio. ... Real Estate Investment Trusts (REITs) ... The S&P 500. ... Real Estate Income. ... The Bloomberg Aggregate Bond Index. ... Leveraged Loans.More items...

Does raising interest rates help inflation?

But how do higher interest rates reel in inflation? They help by slowing down the economy, according to the experts. “The Fed uses interest rates as either a gas pedal or a brake on the economy when needed,” said Greg McBride, chief financial analyst at Bankrate.

Why is raising interest rates good for inflation?

The idea is that if someone is spending more on their mortgage or credit card payment, they won't have as much money to spend on luxury good and items. In theory that lowers demand, increases supply, and brings prices down.

Is high interest rate good or bad?

Raising interest rates makes borrowing money more expensive, which can hurt individuals and businesses. Generally, raising interest rates slows down the economy by discouraging people from spending money. Homes cost more to buy for individuals and borrowing money to finance business operations becomes more costly.

What sectors do well when interest rates rise?

There are some sectors that do well when interest rates rise including: Healthcare: People need healthcare no matter what’s going on. That makes healthcare a sector worth considering, especially during a period of rising interest rates.

Who benefits from rising interest rates?

In general, while banks and insurers benefit from rising interest rates, there are consumers who can benefit as well.

What happens when stocks are publicly listed?

Publicly Listed Companies — If rates are rising to slow inflation, businesses have to borrow at higher rates, which can eat into their profit margins. When that happens, their stock prices can fall, prompting investors to sell.

Why are interest rates rising?

Rising interest rates are often connected to economic growth. When the economy is improving and people are able to spend more money, inflation can be a driver of higher interest rates.

What are the factors that affect the risk of investing?

In general, there are four main factors that impact the risk in your portfolio: Market risk: The risk presented by the stock market in general. Interest rate risk: How rising or falling interest rates impact stock performance.

Why does the Federal Reserve raise interest rates?

The Federal Reserve often drives rates, as they can raise or lower rates to stimulate economic growth. While rising interest rates can often mean an increase in things like mortgage rates, there can be opportunities for investors looking to expand their equities.

Why are consumer goods stocks stable?

That’s why consumer goods stocks are often stable, as people will still need to buy groceries during a recession. Financials: As we mentioned earlier, financial stocks often benefit the most from rising interest rates because of their connection to products like mortgages and loans.

What to do when interest rates are rising?

A balanced approach when interest rates are rising is to stay invested and take advantage of late-stage positive momentum. But you should also prepare for harder times that are lurking around the corner. Take a look at the best stock funds and stock sectors for rising interest rates.

How does interest rate affect stock prices?

This affects stock prices because the cost of lending goes up, which drives down business growth and expansion. It also drives investors toward investments with lower interest rates and a guarantee of delivering returns, which reduces demand for stocks and pushes prices down.

Why is inflation a concern?

This is because the Federal Reserve raises rates when the economy appears to be growing too fast. Thus, inflation becomes a concern. 1. Those who aim to time the market with sectors will have the goal of catching positive returns on the upside.

What was the economy like in 2007?

For instance, in 2007, the economy was growing fast, and most market indexes had reached all-time highs. It was at this time that growth stocks dominated across all capitalization—large-cap stocks, mid-cap stocks, and small-cap stocks. Note that 2007 was the year prior to The Great Recession of 2008, which ended the cycle.

What asset type is used during economic slowdown?

Gold: When traders expect an economic slowdown, they tend to move into funds that invest in real, physical asset types. These may include assets such as gold funds and ETFs. Gold is not a sector, but it is an asset that can do well in uncertain times and falling markets.

Why do we time the market?

Those who aim to time the market with sectors will have the goal of catching positive returns on the upside. At the same time, they'll want to prepare for harder declines when the market turns down.

When is the best time to invest in growth stocks?

The best time to invest in growth stocks is most often when times are good, during the latter (mature) stages of an economic cycle. Times of rapid growth often occur at the same time as rising interest rates. Momentum investing takes advantage of this.

Highlights

While interest rate hikes are largely feared because of the rising cost of borrowing, they can also be beneficial in some way.

Financial sector

The financial sector has long been considered a direct beneficiary of rising interest rates. One should understand that each financial transaction has two facets to it, one side receives the money, and the other gives it.

Consumer discretionary sector

Often, a rising interest rate environment is linked with a strengthening economy. In the current context, this could mean that the economy is more likely to get back on its feet faster following interest rate hikes. This increased confidence could be predominantly seen across consumer discretionary products.

Healthcare

Healthcare products and services are essential for survival and cannot be compromised in household spending. The healthcare industry is currently facing strenuous circumstances due to the pandemic.

Four-Factor Risk Model

At Sapient Investments, we use a proprietary risk model to measure the risks of a stock, bond, fund, or portfolio. It is described more fully in an article on our website entitled “ How Much Risk is in My Portfolio? ” The four risk factors are:

10 Major Sectors

In the graph below, we show the LTB betas of the 10 major economic sectors into which U.S. stocks are generally grouped.

Industries Most Affected

The graph below shows some of the industries that have unusually extreme LTB betas, either positive or negative.

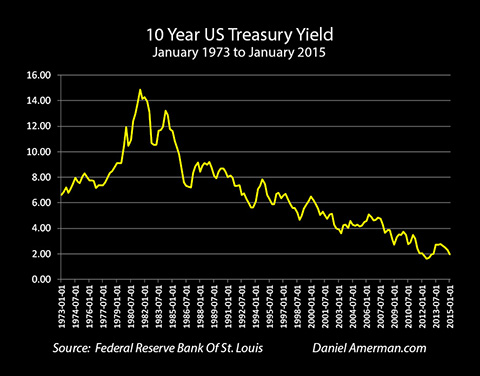

Will Rates Keep Rising?

The graph below depicts the history of the 10-Year Treasury Bond Yield since 1979. It had been on a downtrend since 1981 when it peaked at 15.8%. Last summer, the yield hit an all-time low of .5%. Since then, the yield has increased over 1%, to 1.7%.

How are interest rates affected by the economy?

Other industries on the right side are sensitive to changes in interest rates through the economics of how their businesses operate. For example, the demand for real estate and home construction is strongly influenced by mortgage interest rates—when rates move up, demand falls. Similarly, gold miners are affected by the price of gold, which in turn is affected by interest rates because gold does not provide any interest or dividend income, and when interest rates rise, the opportunity cost of owning gold increases, making it a less attractive store of value.

What are the sector recommendations?

Sector recommendations are to buy financials (XLF) and energy (XLE) and avoid/sell technology (XLK). Interest rates are notoriously difficult to forecast. However, if you believe that rates will continue to rise (as I do), it may be helpful to know which market sectors are likely to be most affected, for good or ill.

Why did the 10-year Treasury yield move up?

The Fed has maintained its unprecedentedly easy money approach, holding short-term rates close to zero and buying huge amounts of longer-term bonds to try to push rates lower all along the yield curve. It appears that the “bond market vigilantes” are back. If bond market participants fear that inflation will devalue their investments, they will naturally sell . They may not wait for the Fed to tighten to stave off inflation or trust that it will, and in fact, given the mindset of the current Fed, the central bank appears much more willing to tolerate much more inflation than would have been the case even a few years ago, in the interest of fostering “full employment.”

Which asset has the most positive sensitivity to LTB changes?

Assets with the most positive sensitivity to LTB changes are in orange —they will go down in price if interest rates rise, just like bonds. When trying to understand the effects of LTB risk on various sectors, it is helpful to understand why interest rates might be changing.

What are the risks of current monetary and fiscal policies?

Current monetary and fiscal policies risk an overheated and inflationary economy.

What industries will be on the right side in 2020?

The industries on the right side are a varied lot. Some are clearly associated with the “winners” in 2020, especially software, medical equipment, and solar. These are all growth industries in which a large portion of the expected cash flows are many years down the road.

What are the left side industries?

Those on the left side could be described as economic recovery industries . They typically suffered poor returns in 2020 and are only recently seeing their stock prices recover. They are also most often considered value industries as opposed to growth industries.

Which sectors have the strongest correlations to interest rates?

Cyclical sectors like energy, industrials, information technology and materials have historically shown the strongest correlations to interest rates. This makes sense given that inflationary pressures and higher interest rates often come on the heels of strong economic growth—the same growth that benefits economically sensitive sectors.

What is higher rate?

Higher rates are usually consistent with stronger economic growth and inflationary pressures, and sector performance can be influenced by trends in growth and inflation. For example, Industrials, financials and cyclical names can benefit.

When did the Fed start raising rates?

It’s possible that there’s a period of hiccup and dislocation as the Fed starts to raise rates—this occurred in the 1994 period. However, usually, stocks perform well through much of the rate-hike cycle. The start and end can be riskier.

Is interest rate going to rise?

Interest rates are still historically low in the U.S., but they are bound to rise—at least according to signals from the Federal Reserve. When they do begin to rise, different economic sectors will react in different ways because they display various correlations to rates.

Is nominal GDP growth low?

Nominal GDP growth has been unusually low in the post-crisis period and has been a factor leading to unusually low rates. Nominal GDP has been below 5 percent post-crisis, and was well over 5 percent in most periods after World War II. Stronger growth will improve the outlook for cyclical names.

Do consumer discretionary shares gain?

Consumer discretionary shares have also gained during periods of rising interest rates , although the correlation is not nearly as strong as with financials.

What is the best inflation indicator?

Perhaps the best inflation indicator of all is a market-based indicator. In other words, it tells you what real investors believe about future inflation, as measured by how they are actually investing their money right now.

Why are stocks valued based on discounted cash flow?

The discount rate used in this equation is prevailing interest rates, which are still near record lows, but rising fast. If inflation continues to accelerate, then you can bet interest rates will follow.

What happens if inflation continues to accelerate?

If inflation continues to accelerate, then you can bet interest rates will follow. And higher interest rates (i.e. a higher discount rate) could mean lower stock market values. For stock investors who have grown accustomed to the market’s big gains over the past year, higher inflation is a wake-up call.

Is oil a cyclical sector?

Both are cyclical sectors tied to natural resources. And companies that produce them (think oil & gas companies, or miners) have pricing power in an inflationary climate as commodity prices rise.

Is inflation a problem for the stock market?

Suddenly, it seems, inflation could be a problem for the stock market. Perhaps it is hard to believe that inflation could be the thing that finally spoils this stock market party. After all, since the early 2000s, and especially since the global financial crisis in 2008, deflation has been the bigger fear—as in too little economic growth ...

What happens if interest rates rise again?

If rates rise again soon, there could be some vulnerability for investors overexposed to certain types of bonds.

What industries will suffer from the debt crisis?

Says Kenton: "Capital and debt-intensive industries such as telecoms, manufacturing, shipping and construction will suffer."

When interest hikes compel would-be homebuyers to hunker down, do they take on?

When interest hikes compel would-be homebuyers to hunker down, they take on home improvement as a consolation prize – a good thing for Lowe's Cos. (ticker: L) and Home Depot ( HD ).

Is rising interest rates good news?

No matter how much some consumers may grumble, rising interest rates mean good news on at least one front.

Is the banking sector vulnerable to interest rate hikes?

Yet while this sector is sensitive to interest rate hikes, it isn't necessarily vulnerable. In large part, any potential hurt depends on how much rates rise.

Who is the author of the Association between Federal Reserve Policy and Sector Returns?

As co-author of "The Association Between Federal Reserve Policy and Sector Returns," Bob Johnson notes that energy is among the best performers when interest rates move up – finishing ahead of other winners such as consumer goods, utilities and food.

Do low mortgage rates make you stay in your house?

"Homeowners with a low mortgage rate are far more likely to stay in their homes and spend to improve them than pursue a new house ... with a higher mortgage rate" Dhanyamraju says.

The Four-Factor Risk Model

Industries Most Affected by Interest Rates

What to Invest in When Interest Rates Rise

Who Benefits from An Interest Rate Rise?

Who’s at Risk from An Interest Rate Rise?

- When it comes to sectors affected by interest rates, you’re likely to see the biggest sensitivity with financial-related companies. For example:

Will Rates Keep Rising?

- As you consider sectors affected by interest rates, it’s a good idea to see if it makes sense to change your strategy. Be mindful of your individual needs; it might make sense to consult with a professional before making changes to your portfolio. Here are some ideas of what to invest in when interest rates rise:

The Bottom Line

- In general, while banks and insurers benefit from rising interest rates, there are consumers who can benefit as well. 1. Regular Investors — If rates rise at a manageable pace and are a manifestation of economic growth, regular investors can benefit.With an increased interest in the stock market and investing, it’s possible to see gains in your por...