- Gold Stocks. Investors turn to safe haven investments such as gold stocks when they see high inflation in the economy.

- Oil Stocks. There is a positive correlation between the price of oil and inflation. ...

- Consumer Staples. When there is high inflation, companies will pass these costs onto the consumers. ...

- Utilities. Utilities are defensive stocks as people will need utilities even in a high inflation environment. ...

- Healthcare. Defensive stock such as healthcare are considered safer investments as people will always need healthcare even when consumer budgets are tight.

- Material Stocks. Inflation may also mean the economy is heating up and more goods are manufactured and sold. Companies can begin to sell more goods and services at increased prices.

- Chubb Limited (NYSE:CB)

- Colgate-Palmolive Company (NYSE:CL)

- Devon Energy Corporation (NYSE:DVN)

- Chevron Corporation (NYSE:CVX)

- Eli Lilly and Company (NYSE:LLY)

What are the best stocks to invest during the inflation?

Wells Fargo: Here's The Best Asset To Own When Inflation Strikes

- Top Assets During Inflation. If you want to know what to own during inflation, know one word: Oil. ...

- Drilling Into Stocks, In The S&P 500 And Out. What does inflation do to S&P 500 stocks and others? ...

- The Bottom Line: Be Inflation Smart. Don't let the risk of inflation chase you out of S&P 500 stocks. ...

- Best And Worst Assets During Inflation

What is the best investment to hedge inflation?

“Hard assets generally make the best inflation hedges. Investments like gold, silver, and real estate can hold up very well in inflationary environments. Commodity producers can also perform very well, but may face temporary headwinds if there is a recession in the United States.

Which equity sectors can combat higher inflation?

Will Bradwell, portfolio manager in the Franklin UK Equity team, picked insurance firm Phoenix Group. Although most would traditionally associate inflation and interest rates with banks, he said the lagging insurance sector could also work as play against higher prices.

Do stocks rise with inflation?

While stocks, in general, fare better than bonds during periods of high inflation, our theme of Inflation Stocks includes companies from the banking, insurance, consumer staples, and energy sector that could be more likely to benefit from high inflation and possibly higher interest rates.

What stocks do best during inflation?

7 stocks that are good inflation investments:Baker Hughes Co. (BKR)BorgWarner Inc. (BWA)Newmont Corp. (NEM)Corning Inc. (GLW)American Tower Corp. (AMT)KLA Corp. (KLAC)Eastman Chemical Co. (EMN)

Are stocks good during inflation?

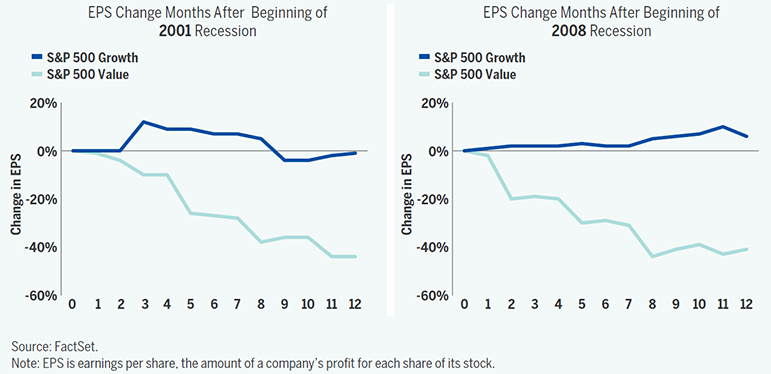

Key Takeaways. Rising inflation can be costly for consumers, stocks and the economy. Value stocks perform better in high inflation periods and growth stocks perform better when inflation is low. Stocks tend to be more volatile when inflation is elevated.

What stocks make money during inflation?

Value stocks Some research has shown that value stocks tend to do better than growth stocks during periods of inflation. Value stocks are companies that have strong earnings relative to their current share price. They are also known to have robust cash flows, which investors typically value when prices are rising.

Where should I invest in rising inflation?

Here's where experts recommend you should put your money during an inflation surgeTIPS. TIPS stands for Treasury Inflation-Protected Securities. ... Cash. Cash is often overlooked as an inflation hedge, says Arnott. ... Short-term bonds. ... Stocks. ... Real estate. ... Gold. ... Commodities. ... Cryptocurrency.

What should you stock up on before inflation?

If you are wondering what food to buy before inflation hits more, some of the best food items to stockpile include:Peanut butter.Pasta.Canned tomatoes.Baking goods – flour, sugar, yeast, etc.Cooking oils.Canned vegetables and fruits.Applesauce.

How to get rich off inflation?

Inflation Proof InvestmentsKeep Cash in Money Market Funds or TIPS.Inflation Is Usually Kind to Real Estate.Avoid Long-Term Fixed-Income Investments.Emphasize Growth in Equity Investments.Commodities Tend to Shine During Periods of Inflation.Convert Adjustable-Rate Debt to Fixed-Rate.

What should I buy before hyperinflation hits 2021?

Storing the Basics Before HyperinflationDry Goods Shortages of dry goods, like pasta, rice, beans, and spices, cropped up during the early days of the Covid-19 pandemic. ... Canned foods, including vegetables, fruit, and meats are easy to store and useable in a variety of ways.More items...•

What does well during inflation?

Value stocks that are in the consumer staples space like food and energy do well during inflation because demand for staples are inelastic and that gives these companies higher pricing power as they are able to increase their prices with inflation better than other industries.”

What is the inflation rate for 2021?

Last week, the Federal Reserve raised its 2021 inflation forecast, known as the personal consumption expenditures price index, from 2.4% to 3.4% – well above its long-term target of 2%. In May, the Consumer Price Index gained 5% year over year, its highest jump since 2008. The Fed has said elevated inflation levels are "transitory" as the U.S. economy opens back up to full capacity. But investors who worry that inflation is here to stay should consider these nine dividend stocks that could outperform in an inflationary environment, according to Bank of America.

Is Morgan Stanley a good investment bank?

Morgan Stanley is one of the world's largest investment banks. Analyst Michael Carrier says Morgan Stanley has healthy organic growth, is hitting its financial targets, has strong capitalization ratios and is benefiting from elevated financial market activity around the world. Looking ahead, Carrier says there is room for earnings multiple expansion if Morgan Stanley can generate at least 3% organic growth. Demand for new products has been high, and Morgan Stanley has international expansion opportunities as well. The stock pays a 1.6% dividend. Bank of America has a "buy" rating and a $105 price target for MS stock.

Is inflation a transitory level?

The Fed has said elevated inflation levels are "transitory" as the U.S. economy opens back up to full capacity. But investors who worry that inflation is here to stay should consider these nine dividend stocks that could outperform in an inflationary environment, according to Bank of America.