How much tax youre going to pay on your unemployment benefits depends on the federal and state tax rate. While the federal tax rate for unemployment benefits is 10%, the state one varies from 4% to 10%. In some states, youll only have to pay the federal tax.

How much tax do you pay on unemployment benefits?

- Taxable social security benefits (Instructions for Form 1040 or 1040-SR, Social Security Benefits Worksheet)

- IRA deduction (Instructions for Form 1040 or 1040-SR, IRA Deduction Worksheet)

- Student loan interest deduction (Instructions for Form 1040 or 1040-SR, Student Loan Interest Deduction Worksheet)

How does collecting unemployment affect your taxes?

Unemployment compensation is not subject to FICA taxes, the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working. You'll still pay significantly less in FICA taxes than you would have if you'd been working if you collected unemployment through a significant part of the year.

What percentage is unemployment taxed?

you can file Form W-4V to request withholdings to pay for income taxes. Unemployment withholdings have a standardized rate of 10%. What counts as unemployment benefits? In most cases, you will ...

How to obtain my W2 from unemployment?

Where to find your 1099-G info

- eServices. Sign in to your eServices account and click on the 1099 tab.

- Mail. We mail the 1099-G to the address we have on record as of mid-January, when the forms are printed. The U.S. ...

- Automated claims line. You’ll need your Personal Identification Number (PIN) to access your 1099-G info through the automated claims line.

How are unemployment benefits taxable?

Is the stimulus payment taxable?

Do you have to pay taxes on unemployment in 2020?

Can you file a W-4V with unemployment?

Is unemployment taxable in 2020?

Does the $10,200 unemployment tax apply to 2020?

See more

About this website

How To Handle Taxes If You Received Unemployment in 2021

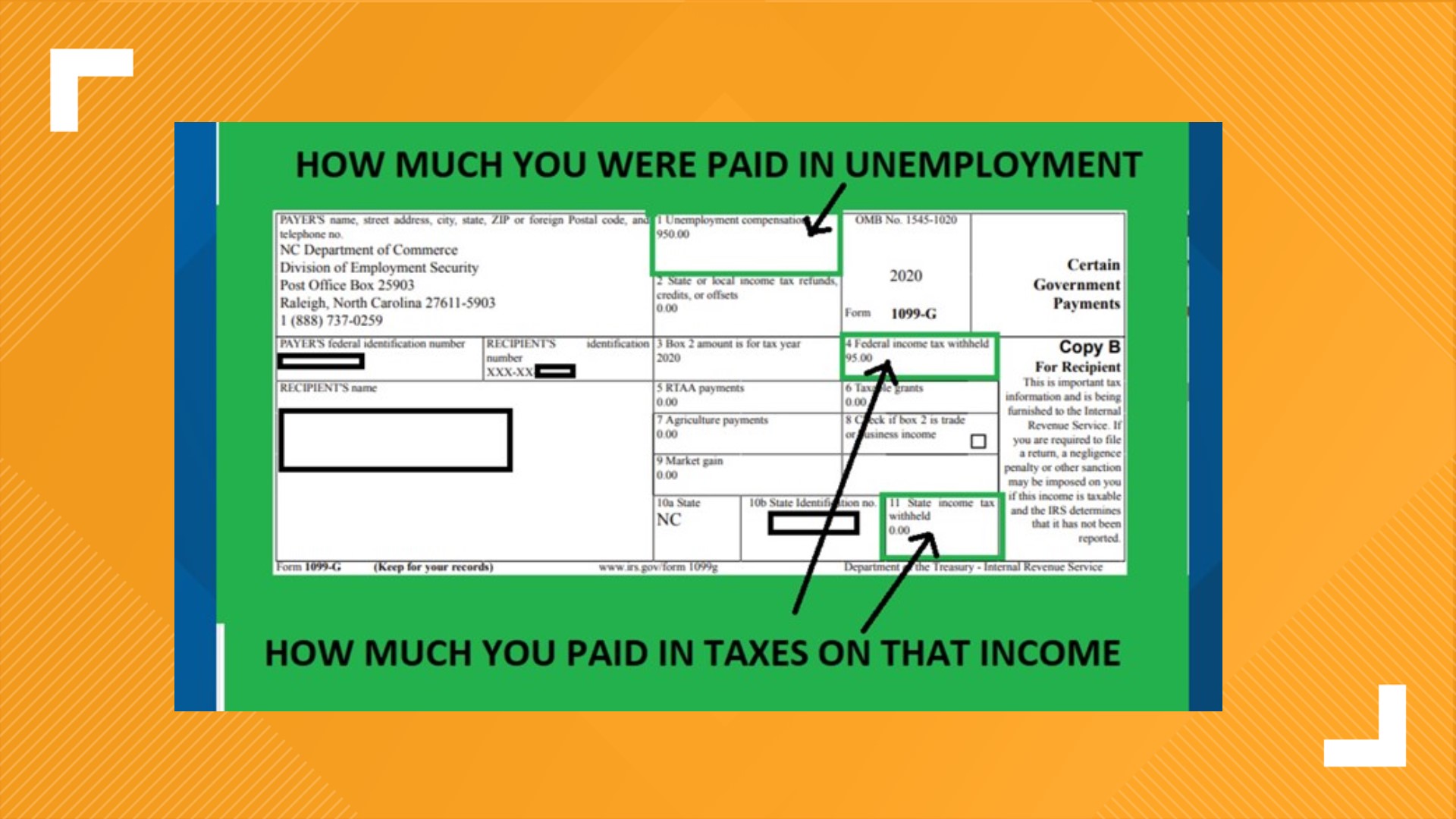

How Taxes on Unemployment Benefits Work . You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. The full amount of your benefits should appear in box 1 of the form. The IRS will receive a copy of your Form 1099-G as well, so it will know how much you received.

Did You Receive Unemployment in 2021? You May Owe the IRS Money

Dori Zinn loves helping people learn and understand money. She's been covering personal finance for a decade and her writing has appeared in Wirecutter, Credit Karma, Huffington Post and more.

No, a tax break on 2021 unemployment benefits isn’t available

Tax season is fast approaching — and recipients of unemployment benefits in 2021 don't appear to be getting a tax break like they did for 2020.

Unemployment Tax Break 2022: A new unemployment income tax ... - MARCA

The Internal Revenue Service (IRS) has started issuing tax refunds to those who received unemployment benefits in 2020, with around 1.5 million refunds sent out, adding to almost n

Is Unemployment Compensation Going To Be Tax-Free For 2021?

If you collected any unemployment benefits in 2021 that were meant for 2020, meaning any late accrued payments, you will need to include this on your 2021 tax return during the 2022 filing season.

The Answer Might Surprise You

More than 7.9 million Americans were unemployed at the end of 2015, according to the Bureau of Labor Statistics, and many of those received unemployment compensation. As tax time approaches, one thing that many unemployed workers don’t realize is that they might have to pay taxes on the money they receive in unemployment benefits.

Are Unemployment Benefits Taxable

Your unemployment qualifies as taxable income subject to federal and state taxes, depending on where you live. In some states like Florida, Alaska, Nevada, South Dakota, Wyoming, Texas and Washington, residents do not have state income taxes.

Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

Repayment Of Employment Benefits

For the 2020 tax year, if you received EI payments and your net income was greater than $67,750, the Canada Revenue Agency requires you to repay 30 percent of your net income over the threshold.

How To Have Taxes Withheld From Unemployment Benefits

It is tempting to forgo paying taxes on unemployment benefits until it comes time to file. However, doing this could leave you with a serious tax liability. States allow you to have taxes withheld for federal and state when you receive approval for benefits.

How To Pay Taxes On Unemployment

The three most common ways to pay those taxes include: paying them when you file your tax return, making estimated payments during the year, or having them automatically withheld which experts say is often the best option.

Unemployment Benefits Are Taxable

The United States has a pay-as-you-go tax system, which means you must pay income tax as you earn income during the year. And while it may feel like unemployment benefits are not considered earned income, they actually are.

How to withhold taxes from unemployment in 2022?

Tax Withholding in 2022: If you think you will still receive unemployment benefits in 2022, start and estimate your 2022 Income Tax Return first and factor in the unemployment benefit payments or income . If you see a result of large tax refund, you should start withholding taxes from your unemployment benefit payments or other income you might have (e.g. W-2, 1099 income, etc.). Based on the estimated tax return results, you might want to have 10% withheld for IRS or Federal taxes. To do so, complete the Voluntary Tax Withholding Request Form W-4V and submit to your state tax agency (click your state below and scroll to the bottom for the state agency address). The state agency will then withhold federal income taxes from your unemployment benefit payments. Alternatively, you can also submit Form 1040-ES with quarterly tax estimate payments - FileIT - or pay your IRS taxes online.

When will the IRS refund unemployment?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021.

How long will unemployment be extended in 2021?

Monitor here to see how your state (s) will handle the unemployment compensation exclusion in response to the ARPA. 2020 Unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020.

How many people filed for unemployment in 2020?

Over 23 million individuals had filed for unemployment during 2020. For the first time, some self-employed workers qualified for unemployment benefits. Get the details on the third stimulus payment.

How long will unemployment benefits be extended?

Enhanced 2020 unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020. However, many states ended this earlier than the September date. The unemployment benefits have increased by $300 per week as a result of the December 2020 second stimulus payment package. It is not too late to claim the first or second stimulus payment on your 2020 Tax Return if you never received them! See how to claim the Recovery Rebate Credit on your 2020 Return by filing a previous year return.

How long does unemployment last?

In most states, unemployment benefits are paid weekly for 26 weeks after the unemployment application and approval process. Some states offer different maximum weeks for unemployment compensation, such as Montana at 28 weeks or Florida at 12 weeks (see table below).

When will the IRS refund unemployment benefits in 2021?

n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021. The IRS will issue these payments in two phases: first to individual taxpayers affected, then to married filing joint taxpayers and/or those with more complicated returns.

What happens if you don't pay taxes on unemployment?

If you didn’t pay taxes on your unemployment checks as you received them, your tax refund may be used to pay for the taxes that you owe, resulting in a smaller refund.

How much unemployment tax is exempt from 2020 taxes?

For paper filers, the IRS published instructions on how to claim the unemployment tax break: New Exclusion of up to $10,200 of Unemployment Compensation. For online filers, the IRS has stated that tax software companies have updated their systems to reflect the unemployment federal tax break. If you file your taxes online and haven’t filed for 2020 yet, you may want to make sure your tax software is updated before filing your tax return.

How to avoid having a large tax bill?

The following options can help you avoid having a large bill at tax time. 1. Request your state employment agency to withhold your federal taxes. Withholding your taxes means that a flat 10 percent of each of your unemployment checks will be used to pay federal taxes, similar to withholding taxes on a regular paycheck.

How to get your refund from Code for America?

Code for America’s Get Your Refund website: Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

What is a low income tax clinic?

Low-Income Taxpayer Clinics (LITCs): LITCs are programs at law schools, accounting schools, or legal services offices that provide assistance and legal representation to lower-income taxpayers who are in disputes with the IRS.

What is a volunteer tax aid?

Volunteer Income Tax Assistance (VITA) and Tax-Aide sites: VITA and Tax-Aide sites are IRS-sponsored programs that provide free tax preparation for those who earn less than about $56,000.

Where to report unemployment benefits?

Check with your state’s Department of Revenue and relevant county and local government tax agency for instructions on how to report your unemployment benefits at the state and local level.

How much unemployment is excluded from 2021?

The American Rescue Plan Act of 2021 excluded up to $10,200 in unemployment compensation per taxpayer from taxable income paid in 2020. Taxpayers should not have been taxed on up to $10,200 of the unemployment compensation. This is not the amount of the refund taxpayers will receive.

When is the 2021 tax tip?

COVID Tax Tip 2021-87, June 17, 2021. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. For eligible taxpayers, this could result in a refund, a reduced balance due or no change to tax.

Can the IRS adjust taxes for single people with no children?

The IRS can adjust tax returns for those who are single with no children and who become eligible for EITC. The IRS also can adjust tax returns where EITC was claimed and qualifying children identified.

Who pays the federal unemployment tax?

However, "unemployment taxes" could also refer to taxes imposed by the Federal Unemployment Tax Act (FUTA). FUTA taxes are paid by employers .

How much can you pay off your taxes?

You can ask for an installment agreement and pay off your tax debt on balances of up to $50,000 over 72 months, according to Capelli. 11

What is the 10% cap on withholding?

This 10% withholding cap prevents you from having extra money withheld now to try to compensate for not having anything withheld earlier in the year. 10 You can ask for extra withholding from your paychecks, however, if you return to work.

What would happen if unemployment was high?

A period of persistently high unemployment could be expected to reduce the amount of money the government collects in taxes. Of course, national taxation is a complex system that's always subject to shifts in political winds and economic forces. If a government wasn't collecting enough revenue, it could theoretically change the tax code as needed to make up for those losses.

What box do you put the amount withheld from your taxes?

The amount that was withheld will appear in Box 4 if you asked to have income tax withheld from your benefits.

Where is the unemployment line on a 1040?

Unemployment compensation has its own line (Line 7) on Schedule 1 , which accompanies your 1040 tax return. You’ll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1, and then the withholding amount (if any) in Box 4 of the 1099-G goes directly onto your 1040 tax return on Line 25b.

Does ARPA apply to unemployment?

The ARPA applies only to federal taxes, the return you'll file with the IRS in 2021. Several states have indicated that they're still going to tax unemployment benefits, so check with your state to find out how it plans to proceed.

How to calculate total unemployment benefits?

The Total Benefit Amount is the amount of unemployment benefits you are eligible to receive during your benefit year, if it is determined that you are eligible to receive unemployment insurance benefits. Divide your total benefit amount by your weekly benefit amount to calculate the approximate number of weeks of unemployment benefits available to you.

What percentage of federal withholding is required for unemployment?

Although you may be receiving a reduced weekly benefit amount, the withholding amount will be 3.5 percent of your weekly benefit amount for state withholding and 10 percent for federal withholding if you have completed both forms.

What does it mean to get a debit card for unemployment?

Getting a debit card does not guarantee that you will continue to qualify for unemployment benefits and payments. You should continue to file a weekly claim. If you have any questions, visit GetKansasBenefits.gov for more information on your claim.

How long do you have to work to get unemployment?

To be eligible for unemployment benefits, an individual must have worked sufficiently within the last 18 months. The individual can apply for benefits, and KDOL will determine whether they have sufficient earnings during that time period to be entitled to benefits.

How much tax do you withhold on your Kansas unemployment?

For example, if your weekly benefit amount is $200 we will withhold $7 for Kansas income taxes and $20 for federal taxes.

When will unemployment be issued in 2021?

Important Notice: Starting July 20, 2021, unemployment benefits will be issued on the new U.S. Bank ReliaCard®. Any remaining funds on the Bank of America debit card will not be transferable to the new ReliaCard.

How long is a disability benefit good for?

The Benefit Year begins when your claim is effective. Your claim is good for one year starting with this date.

Employer Liability For Unemployment Taxes

In order to fund unemployment compensation benefit programs, employers are subject to federal and state unemployment taxes depending on several factors. These factors include the sums employers pay their employees, the unemployment claims filed against the business, and the type & age of the business.

Employers Of Agricultural Employees

Employers must pay Federal unemployment taxes if: they pay wages to employees of $20,000, or more, in any calendar quarter or, in each of 20 different calendar weeks in the current or preceding calendar year, there was at least 1 day in which they had 10 or more employees performing service in agricultural labor.

How Much Are Unemployment Taxes

Both federal and state unemployment taxes are based on employee wages.

Contact Your State Representative Or Senator

As a last ditch effort, Harris reached out to her state senators office, and says she was told they would send an inquiry on her behalf. About two weeks later, in late September, Harris received back pay totaling $10,000. Harris believes she is still owed additional benefits, and is unclear on how to ensure continued benefits.

Does An Employer Have To Pay For Unemployment When An Employee Is Laid Off

In most cases, when you are laid off, the employer who terminated your position does not directly have to pay for your unemployment benefits these checks come from the state’s unemployment fund.

What Additional Benefits Are Available During Economic Downturns

Three types of programs can potentially provide extra weeks of benefits to workers in states where unemployment has increased significantly: temporary federal programs that Congress generally establishes during national economic downturns the permanent federal-state Extended Benefits program, which is available to hard-hit states even when the national economy is not performing poorly and additional temporary or permanent programs that states sometimes put in place.

Unemployment Insurance As Economic Stimulus

Unemployment benefits are designed first to relieve distress for jobless workers and their families. In recessions and the early stages of recoveries, however, they provide an additional benefit: stimulating economic activity and job creation.

How are unemployment benefits taxable?

How Unemployment Benefits Are Usually Taxed. Unemployment benefits are usually taxable as income – and are still subject to federal income taxes above the exclusion, or if you earned more than $150,000 in 2020. Depending on the maximum benefit size in your state and the amount of time you were receiving unemployment benefits, ...

Is the stimulus payment taxable?

Those payments were considered a refundable income tax credit and were never taxable. The stimulus payments were technically an advanced payment of a special 2020 tax credit, based on your 2018 or 2019 income (your most recent tax return on file when they calculated the stimulus payments).

Do you have to pay taxes on unemployment in 2020?

Millions of people received unemployment benefits in 2020, and many are in tax limbo now. The federal government usually taxes unemployment benefits as ordinary income (like wages), although you don't have to pay Social Security and Medicare taxes on this income.

Can you file a W-4V with unemployment?

You can ask to have taxes withheld from your payments when you apply for benefits, or you can file IRS Form W-4V, Voluntary Withholding with your state unemployment office . You can only request that 10% of each payment be withheld from your unemployment benefits for federal income taxes.

Is unemployment taxable in 2020?

Unemployment benefits are usually taxable, although a new law excludes some payments for 2020 – and complicates tax filing this year.

Does the $10,200 unemployment tax apply to 2020?

The $10,200 exclusion only applies to unemployment benefits paid in 2020, but the rules could change. "It does appear to be the type of provision that Congress may include in the next round of tax legislation later this year for 2021," says Luscombe. [.