When will my Child Tax Benefit be paid out?

The dates for the child tax benefit payment is usually near the end of the month, around the 20th. If you select direct deposit, your money will be paid out on that date.

When will the last child tax credit check be deposited?

After that, the sixth and final check is scheduled to be deposited on December 15. The future of the expanded Child Tax Credit program remains in limbo amid negotiations over scaling back President Joe Biden's $3.5 trillion social spending plan, which included an extension of the CTC through 2025.

When do I get my Child Tax Credit advance payments?

Some advance payments of the Child Tax Credit were sent by mail in August instead of direct deposit. Check your bank account in September for direct deposits of the payment. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

What are the payment dates for Canada Child Benefit?

Canada child benefit payment dates. The CRA makes Canada child benefit (CCB) payments on the following dates: 2021. May 20, 2021. June 18, 2021. July 20, 2021. August 20, 2021. September 20, 2021. October 20, 2021.

What time do tax refunds get deposited?

Normally they sent to your bank between 12am and 1am. That does not mean it will go directly into your bank account. You bank can take up to 5 days to deposit it but normally it only takes a few hours.

What day of the week does the Child Tax Credit get deposited?

The sixth — and potentially final — payment from the Child Tax Credit program is set to hit U.S. parents' bank accounts on Wednesday. Unless lawmakers renew the benefit, parents of 61 million children won't receive additional monthly checks in 2022.

What time does the IRS deposit refunds 2020?

If you file your tax return electronically, the IRS will generally process direct deposit refunds within 7-10 days of receiving your tax return, and process paper checks within about two weeks. Filing a paper tax return may delay your refund by up to several weeks.

Will there be a Child Tax Credit in December 2021?

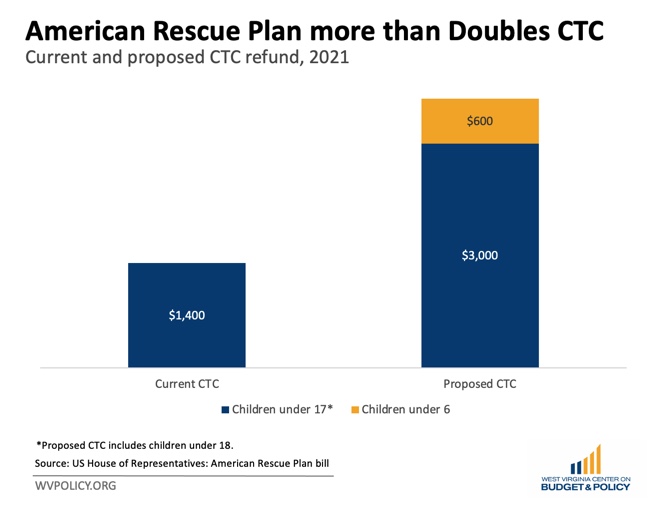

Specifically, the Child Tax Credit was revised in the following ways for 2021: The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

Can I track my Child Tax Credit check?

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal.

Will there be a Child Tax Credit in 2021?

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families. It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6. For each child ages 6 to 16, it's increased from $2,000 to $3,000.

Does direct deposit hit midnight?

However, employers will generally initiate the ACH transfer far enough in advance to ensure that the money shows up in the employee's bank account on payday. Many employees can expect payroll direct deposit to arrive in their account at midnight the day before the pay date.

What time in the morning does direct deposit go through?

In short, you can expect a direct deposit to arrive in your bank account between 12 a.m. and 6 a.m. on the day your employer sends them out.

Will my refund be deposited on the day it says?

Those direct deposits are not always sent early in the day, sometimes, it's late in the day. The IRS gave you a direct deposit date, but they also gave you a second date that if you haven't received the refund by, then you should contact the bank and if they are not able to help you then you need to contact the IRS.

How much was the 3rd stimulus check?

$1,400 per personHow much are the payments worth? The third round of stimulus payments is worth up to $1,400 per person. A married couple with two children, for example, can receive a maximum of $5,600. Families are allowed to receive up to $1,400 for each dependent of any age.

Will there be a Child Tax Credit in January 2022?

Yes. In January 2022, the IRS sent Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021.

Will there be another Child Tax Credit 2022?

This year the Child Tax Credit will revert back to the program offered by the IRS before the American Rescue Plan expanded it in 2021. For 2022 the credit will be worth up to $2,000 per child, with the money to be distributed in the form of a single end of year tax credit.