Full Answer

Does my employer get notified when I apply for unemployment?

No, but Unemployment knows if you are working. It differs by state, but in some states employers are required to inform the Department of Labor when they hire someone, and those records are cross checked with unemployment records.

Can you still do taxes when you collected unemployment?

Unemployment benefits are taxable income, so recipients must file a Federal tax return and pay taxes on those benefits. Depending on your circumstances, you may receive a tax refund even if your only income for the year was from unemployment. To receive a refund or lower your tax burden, make sure you either have taxes withheld or make estimated tax payments.

What to do when your unemployment claim is denied?

- You voluntarily quit your job. You may still be eligible for unemployment benefits if you quit your last job, as long as you had a good reason (as defined by ...

- You were fired for misconduct. Being fired from your job doesn't necessarily disqualify you from unemployment benefits. ...

- You don't have sufficient earnings or work during the base period. ...

Can you turn down a job when collecting unemployment?

When you are collecting unemployment benefits, you are allowed to decline a job offer if it is not considered to be suitable for you. Jobs that are not suitable include those that pay too little money in relation to your prior job experience or those that require too demanding of physical requirements for your condition.

What happens if you forgot to file unemployment on Sunday in NY?

If you miss claiming benefits for a week during which you were unemployed, you can request credit for this week by secure message, fax or regular mail. Do not call the Telephone Claims Center to request back credit for a week.

What day are NC unemployment benefits paid?

When will I receive payment? After you file your claim for unemployment insurance, your last employer is given, by law, 10 days to respond to DES about your claim. No payment will be released until after this 10-day period. Your claim may be identified as 'pending' during this period.

How soon will I get my unemployment benefits in New Jersey?

We normally transfer funds to your bank account within two full business days after you certify for benefits. Payments will not be transmitted on bank holidays or weekends. It is your responsibility to verify that your benefits have cleared your bank account before writing checks or making debits against that account.

What is the maximum time for which I can receive unemployment benefits in New Jersey 2021?

Per federal regulations, on April 17, 2021, NJ state extended unemployment benefits were reduced from up to 20 weeks to up to 13 weeks because New Jersey's unemployment rate went down.

Why haven't I received my unemployment this week?

Your state is overwhelmed with new jobless benefits applications. The most likely reason why you haven't yet received your unemployment check is probably also the most frustrating: State unemployment agencies have been inundated with new filings and are hard-pressed to process them in a timely manner.

What happens if you forget to file your weekly unemployment?

If you miss a week, you will be able to file for the current week and the prior week (the one you missed filing for) only. If you miss filing your weekly claims for more than two weeks, the weekly claim filing system will no longer recognize you.

How do I claim my weekly unemployment benefits in NJ?

You may apply for unemployment benefits on the Internet, 24 hours a day, seven (7) days a week at www.njuifile.net or you may telephone a Reemployment Call Center. The Reemployment Call Centers are open during regular business hours, Monday through Friday, excluding holidays.

What happens if you forget to file your weekly unemployment claim in NJ?

If you miss your certification window, the department provides a “catch-all” window at the end of the day, it said. “If you miss both your scheduled time slot and the catch-all time slot, you may certify for two weeks of benefits at your scheduled date/time the following week,” the department said.

How do I get my unemployment back pay in NJ?

Usually, your claim is dated the Sunday of the week you filed. If you believe your claim should be backdated, you'll need to tell us that over the phone, even if you submit your application online. We will then schedule a fact-finding interview to determine if your claim can be backdated.

Are they extending unemployment?

About the PEUC Extension Pandemic Emergency Unemployment Compensation (PEUC) provided up to 53 additional weeks of payments if you've used all of your available unemployment benefits. The first 13 weeks were available from March 29, 2020 to September 4, 2021.

Can I work part time and collect unemployment in NJ?

Yes, a claimant may be eligible for partial unemployment benefits while working part time due to lack of work. However, the worker's weekly benefit amount will be reduced dollar-for-dollar for all earnings in excess of 20% of the worker's full weekly benefit rate.

What is the highest amount of unemployment?

The majority of U.S. states offer unemployment benefits for up to 26 weeks. Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823.

COVID-19 Unemployment Benefits

COVID-19 extended unemployment benefits from the federal government have ended. But you may still qualify for unemployment benefits from your state...

How to Apply for Unemployment Benefits

There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unem...

Continuation of Health Coverage: COBRA

Learn how you can continue your health care coverage through COBRA.What is COBRA?COBRA is the Consolidated Omnibus Budget Reconciliation Act. COBRA...

Short-Term and Long-Term Disability Insurance

If you can't work because you are sick or injured, disability insurance will pay part of your income. You may be able to get insurance through your...

Workers' Compensation for Illness or Injury on the Job

Workers' compensation laws protect employees who get hurt on the job or sick from it. The laws establish workers’ comp, a form of insurance that em...

Wrongful Discharge/Termination of Employment

If you feel that you have been wrongfully fired from a job or let go from an employment situation, you may wish to learn more about your state's wr...

Welfare or Temporary Assistance for Needy Families (TANF)

Temporary Assistance for Needy Families (TANF) is a federally funded, state-run benefits program. Also known as welfare, TANF helps families achiev...

How often do you have to request unemployment benefits?

To stay eligible, you must make a request for benefits each week you are unemployed. You must request benefits every week you want a payment, even if your application or appeal is pending. You may request benefits for the prior week at any time beginning Sunday through Saturday of the current week. Request weekly benefits online.

Can I get unemployment if I don't certify my eligibility?

No payment will be issued for any week that you fail to certify your eligibility. Once you have applied for Unemployment Insurance (UI) benefits , you must request benefits for each week during which you are in partial or total unemployment.

How long does unemployment last?

Extended unemployment insurance benefits last for 13 weeks. You can apply for extended benefits only once you've run out of regular benefits. Check with your state; not everyone qualifies. You must report unemployment benefits as income on your tax return.

What is the extension for unemployment in 2021?

The American Rescue Plan Act of 2021 temporarily authorized: An extension for people already receiving unemployment benefits. Automatic, additional payments of $300 per week to everyone qualified for unemployment benefits. Extension of the Pandemic Unemployment Assistance (PUA) program for self-employed or gig workers.

What to do if you are terminated by an employer?

If you are an employer seeking information about legal termination of employees, you may wish to contact both the Equal Employment Opportunity Commission (EEOC) and your State Labor Office to ensure you do not violate any federal or state labor laws. You may wish to consult with a licensed attorney.

What is workers comp?

Workers' compensation laws protect employees who get hurt on the job or sick from it. The laws establish workers’ comp, a form of insurance that employers pay for. These laws vary from state to state and for federal employees.

How long does a disability policy last?

Types of Disability Policies. There are two types of disability policies. Short-term policies may pay for up to two years. Most last for a few months to a year. Long-term policies may pay benefits for a few years or until the disability ends.

What to do if you lose your job?

Apply for Unemployment Benefits. There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unemployment insurance benefits, job training, and finding a job. Open All +.

How often do you have to submit unemployment claim?

How and when to submit a weekly claim. After you apply for unemployment benefits, you must submit a weekly claim the next week in order to begin receiving benefits. Then, you must submit a claim each week until you want your benefits to stop.

What time do you submit a claim?

When to submit. If submitting online, anytime between 12:00 a.m. on Sunday, and 11:59 p.m. on Saturday. If submitting by phone, use the automated system ( 12 a.m. Sunday – 4 p.m. Friday, unless Friday is a holiday) or speak with a claims agent. For current claims center contact information and hours go to: ...

When will the unpaid waiting week end?

On May 7, 2021, a new rule is going into effect to waive the unpaid waiting week for anyone with a waiting week that ended Jan. 9, 2021 or later . The new rule to waive the unpaid waiting week will stay in effect until further notice.

When will the waiting week end in 2021?

On May 7, 2021, a new rule waives the waiting week for anyone with an unpaid waiting week ending Jan. 9, 2021 or later. In the week following May 7, anyone whose waiting week was unpaid for Jan. 9, 2021 or later will get a supplemental payment for week the same way they’ve been paid for other weeks.

Do you get paid for the first week of unemployment?

Typically, you do not get paid for the first week you are eligible for unemployment benefits. This is called the waiting week . However, under the CARES Act, the federal government is reimbursing states so the first week you are eligible for unemployment insurance will now be paid.

Do you get paid for waiting week?

Waiting week waiver under the CARES Act. The first week you are eligible for unemployment benefits is called your waiting week. Typically, you do not get paid for your waiting week. However, under the CARES Act, the federal government is reimbursing states so the first week you are eligible for unemployment insurance will now be paid.

Is unemployment paid for waiting week?

In most cases, the first weekly claim will be counted as your "waiting week.". No unemployment benefits are paid for your waiting week. Then, your second and subsequent weekly claims may trigger benefit payment if you are eligible for payment.

What is weekly claim?

Filing a weekly claim involves answering questions about whether you worked, earned any income and whether you were able, available and looking for work. As of April 18, 2021, the weekly job search requirement must be completed each claim week, in addition to certifying each week. Both tasks ensure that you are paid accurately and timely.

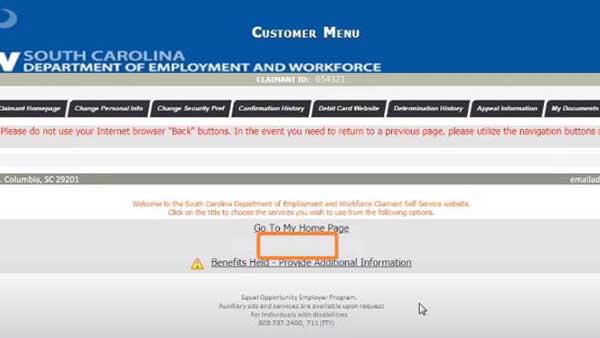

How to check my DEW payment status?

In order to check your payment status, simply log into your MyBenefits portal and go to the portal homepage. Payments issued by DEW will be easily listed on the homepage under the payment header. You can also call 1-866-831-1724 | Relay 711 to speak with a TelClaim representative.

What is the phone number for the unemployment claim?

You can send us a secure message or call the Telephone Claims Center toll-free at (888) 209-8124 during the hours of operation: Monday through Friday, 8 am to 6 pm.

How to change your address on unemployment?

Click the "Claim Weekly Benefits" button, which brings you to the Benefit Payments page. Click the "Continue" button at the bottom of that page, which will bring you to the Claim Weekly Benefits page. Click the "Change Address/Telephone Number" button to change your address and/or phone number.

What does "certify for benefits" mean?

Also, what does “certify for benefits” mean? Both "claim weekly benefits" and "certify for benefits" refer to the way you tell the Department of Labor that you are still unemployed, ready and able to work, looking for a job, and in need of Unemployment Insurance benefits.

Can I estimate my weekly unemployment benefits?

Can I estimate my weekly Unemployment Insurance benefit amount? Yes, you can use the benefit rate calculator on our website. Please note that the tool gives an estimate only. It does not guarantee that you will be eligible for benefits or a specific amount of benefits.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How long does it take to get unemployment?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim. In general, it takes approximately 3 weeks to process a claim; however, you will still need to claim benefits every week. The information you need before filing a claim:

What happens if you work while receiving unemployment?

In case you earn an income while receiving benefits, they would reduce the amount of benefits that you receive. If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced.

How long does unemployment last?

This is beneficial for those that are out of work for a long period. The maximum benefits duration has increased from 26 to 99 weeks in some states.

How to file a weekly claim?

You can file your weekly claim: Through the Internet – You can file your weekly claim online. You must have a User ID and PIN in order to file your weekly claim online. By phone – You must call the number given to you during the registration process.

Do higher wages get a larger benefit check?

In a way, this would be up to a cap that is tied to the average earnings in that state. So the employees with a higher wage would receive a larger benefits check but it is still a percentage of what they used to earn. The amount that an employee would receive differs from each state.

Can I file unemployment if I received severance pay?

Have your entire information ready before filing your claim. If you have received severance pay upon your separation from work, you may still be eligible for unemployment benefits. So it is still important to call and file your initial claim during your first week of total or partial unemployment.

What is the maximum amount you can receive in unemployment?

Your maximum benefit amount ( MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

How long can you be out of work for APB?

You may be able to use an alternate base period ( APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

What is the base period for TWC?

Your base period is the first four of the last five completed calendar quarters before the effective date of your initial claim. We do not use the quarter in which you file or the quarter before that; we use the one-year period before those two quarters. The effective date is the Sunday of the week in which you apply. The chart below can help you determine your base period. If you do not have enough wages from employment in the base period, TWC cannot pay you benefits.

Can you use the TWC unemployment estimate?

You may use the TWC Benefits Estimator to estimate your potential benefit amounts. The estimator cannot tell you whether you qualify for unemployment benefits. Your benefit amounts are based on your past wages. How we calculate benefits is explained below.