What age must you be to get unemployment benefits?

Typical State Unemployment Benefit Requirements. No matter how old you are, each state's unemployment program will have its own list of criteria you must meet. For example, you usually must not have done something to get yourself fired, and you need to have the physical ability and the desire to perform work again.

Can you still do taxes when you collected unemployment?

Unemployment benefits are taxable income, so recipients must file a Federal tax return and pay taxes on those benefits. Depending on your circumstances, you may receive a tax refund even if your only income for the year was from unemployment. To receive a refund or lower your tax burden, make sure you either have taxes withheld or make estimated tax payments.

How long does it take to receive my unemployment benefits?

With the DUA debit card, you can:

- Get quicker access to your benefits

- Avoid overdraft fees

- Pay for items everywhere that MasterCard® debit cards are accepted at no charge, including: In stores Online By phone

- Get cash and check your balance at any Bank of America or Allpoint ATM at no charge Charges may apply if you don’t access your money at one of these ...

Do employers pay unemployment benefits when they fire someone?

Yes, in most cases. If you are fired, apply for unemployment compensation immediately. Your employer does NOT pay unemployment benefits. What they pay is unemployment INSURANCE, a percentage of your pay that is based on claims, or the amount that the employers company has caused your State Unemployment Insurance (SUI) to pay out.

Is the 600 unemployment extended in Texas?

TWC: State Unemployment Benefits to Continue But $600 Federal Payment Ends July 25. AUSTIN – The Texas Workforce Commission reminds claimants that the Federal Pandemic Unemployment Compensation ( FPUC ) ends the week of July 25, 2020.

What is the waiting period for unemployment in Washington state?

The first week you are eligible for unemployment benefits is called your waiting week. You do not get paid for your waiting week. You must meet the eligibility requirements and submit a weekly claim to receive credit for your waiting week.

How long after certifying for unemployment will I get paid California?

It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers. When your first benefit payment is available, you will receive a debit card in the mail. Once you activate the card you can track, use, and transfer your benefit payments.

How will I know if I'm approved for unemployment in Texas?

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there.

Why haven't I received my unemployment this week?

Your state is overwhelmed with new jobless benefits applications. The most likely reason why you haven't yet received your unemployment check is probably also the most frustrating: State unemployment agencies have been inundated with new filings and are hard-pressed to process them in a timely manner.

What do I do if I haven't received my unemployment?

Please wait at least three weeks before reaching out because your payment may still be in process. If you do not receive your payment, you can let us know by sending a message through the secure messaging system in your online account or by calling us at 888-209-8124.

How long does it take to get paid after certifying?

If you submit your certification by phone, your payment will generally be deposited on to your EDD Debit CardSM within 24 hours. Note: If you submitted your certification by mail and/or requested your benefit payments by check, allow 10 days for processing.

Why is my EDD payment pending so long?

If you have a Pending status for any weeks on your UI OnlineSM Claim History, we may need to determine your eligibility or verify your identify. If we need to verify your identity, you'll receive a notice to provide additional documentation. For more information, visit Respond to Your Request for Identity Verification.

Why are my EDD payments pending?

This pending status occurs for many reasons, such as a claimant's answer to a biweekly certification question that triggered the need for an eligibility interview. “We know many claimants who cleared fraud filters and verified identity have been waiting too long for payment,” said EDD Director Rita Saenz.

What time does unemployment direct deposit hit your account in Texas?

Your payment should be in your direct-deposit or debit-card account within three days of TWC processing your payment. If you request payment online after 6 p.m., allow two additional business days for processing.

Why does my unemployment claim say $0 Texas?

If your claim shows a determination of “0-0” while it is pending, this means we are still processing your claim, and there is nothing more you need to do. If you received a confirmation number, rest assured your claim is in process, and you will receive the full amount to which you are entitled.

What happens if employer does not respond to unemployment claim in Texas?

If an employer does not respond at all and the employee receives benefits, the employer receives a “Notice of Maximum Potential Chargeback.” Employers must then decide if they wish to challenge the decision to award unemployment benefits to the former employee.

How long do you have to work to get unemployment?

Earnings Requirements: To receive unemployment compensation, workers must meet the unemployment eligibility requirements for wages earned or time worked during an established (usually one year) period of time.

How is unemployment determined?

Eligibility for unemployment insurance, the amount of unemployment compensation you will receive, and the length of time benefits are available are determined by state law. Each state has its unemployment agency dedicated to overseeing employment and unemployment based matters.

What are the requirements to qualify for unemployment?

However, according to the U.S. Department of Labor, there are two main criteria that must be met in order to qualify: 2 . 1. You must be unemployed through no fault of your own.

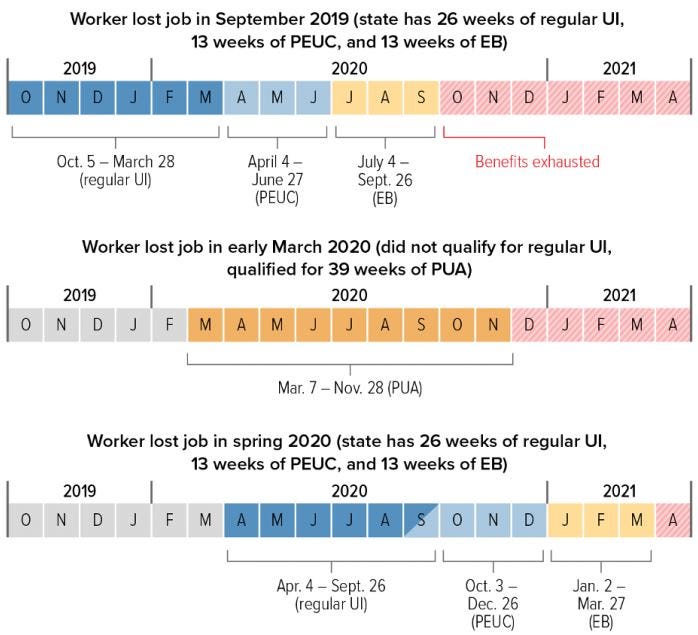

What is extended unemployment?

Enhanced and Extended Unemployment Benefits: Extended unemployment benefits for workers who have used all state benefits, as well as a temporary supplemental weekly benefit for all recipients may be available in your state.

Can you collect unemployment if you are fired?

Unemployment Eligibility When You're Fired: If you were fired from your job, you might be eligible for unemployment, depending on the circumstances. There are a variety of factors that will determine whether you can collect benefits.

Can you get unemployment if you quit?

If you quit or are fired for some form of misconduct, you are unlikely to be eligible for unemployment. However, if you were wrongly terminated from your position, or forced to quit, you may qualify for unemployment.

Do you have to register for unemployment?

Registering with the state job service and actively seeking work is a requirement while collecting unemployment in some locations. You must be ready, willing, available, and able to work. The job service may require job seekers to apply for jobs, submit resumes, and not turn down a position if it meets certain standards.

What is the base period for unemployment?

Unemployed workers must meet the state requirements for wages earned or time worked during a set period of time referred to as a "base period.". Your benefits will be calculated on your earnings during that time. The guidelines vary based on location. 1.

What is the emotional fallout of unemployment?

Unemployment Eligibility Guidelines. The emotional fallout can take some time to process, but your first priority is to make a plan to survive financially until you secure your next position. Among other things, that means figuring out whether you're eligible for unemployment insurance .

How much do you have to be paid to file a claim in 2020?

For claims filed in 2020, you must have been paid at least $2,600 in one calendar quarter. (This amount increases to $2,700 for claims filed in 2021.) The total wages paid to you must be at least 1.5 times the amount paid to you in your high quarter. Most other states have similar formulas to determine eligibility.

Can you get unemployment if you lost your job?

In addition, if you lost your job due to the pandemic, you are likely eligible for unemployment benefits through the Coronavirus Aid, Relief, and Economic Security (CARES) Act . These benefits are available to workers who wouldn’t be covered under traditional unemployment insurance, including self-employed workers, independent contractors, ...

Historic expansion

When the coronavirus pandemic first took hold in the US and upended the economy about 18 months ago, Congress passed an unprecedented expansion of unemployment benefits. It was designed to give people a financial cushion that allowed them to stay home amid state-ordered lock downs that cost millions their jobs.

Losing benefits

More than 2 million laid-off Americans stopped receiving unemployment benefits and another 1 million-plus people saw their weekly payments shrink by $300 in the states that ended the programs in June.

Businesses having trouble hiring

Still, there are lots of anecdotal reports that people are opting to stay home rather than take jobs. Multiple employers have said they are having a difficult time filling jobs -- even if they offer better pay, signing bonuses and other incentives.

A decrease in spending

While the early termination of benefits may not have had much influence on job growth, it likely had a bigger impact on spending.

What to look for while you are unemployed?

While you are unemployed, you will look for a job similar to your last job in terms of commute, job duties, and salary. The longer you stay unemployed, the more flexible you'll have to be in terms of accepting a new job.

What happens if you refuse a job?

If you refuse the job, you may be denied benefits for the week in which you refuse the job and for the next three weeks. Because people's experience and circumstances are different, the definition of a " suitable job " varies. It depends on your skills, where you live, and your past salary.

Can you get PUA if you have unemployment?

If your need to provide care to a loved one is related to COVID-19, and your earnings or employment history do not qualify you or Family Leave During Unemployment, or you exhausted your regular unemployment benefit entitlement, you may qualify for Pandemic Unemployment Assistance (PUA).

Can you get PUA if you have a disability?

If your illness, injury, or disability is related to COVID-19, and your earnings or employment history do not qualify you for Disability During Unemployment, or you exhausted your regular unemployment benefits, you may qualify for Pandemic Unemployment Assistance (PUA).

How Many Weeks of Regular State Unemployment Benefits Are Available?

"The period for collecting unemployment benefits varies by state but the maximum period for getting such benefits is 26 weeks," says David Clark, a lawyer and partner at the Clark Law Office, which has offices in Lansing and Okemos, Michigan.

What Federal Unemployment Benefits Are Available?

There are three federal unemployment benefit programs available – but not for long. They're set to end on Sept. 6. It has been estimated that approximately 7.5 million Americans are at risk for losing federal unemployment benefits.

What if I Need Unemployment Benefits After 26 Weeks? Do I Have Options?

After Sept. 6, your options may be pretty limited, other than finding employment. Of course, regular unemployment benefits will continue, and so if you became unemployed, for instance, on Aug. 20, you'd have a couple weeks of receiving extended benefits – and then you would continue receiving your regular state's unemployment benefits.

How long can you collect unemployment?

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available. Regardless of how much you make, you never can collect more than ...

How long do you get unemployment if you are laid off?

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum. State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits ...

What percentage of unemployment is taxed?

Some states withhold a percentage of your unemployment benefits to cover taxes—typically 10%. If the option to have taxes withheld is available, you will be notified when you sign up for unemployment.

What does it mean to be ineligible for unemployment?

It typically means you are ineligible if you quit—although there are exceptions, like if you quit because of impossible work conditions. If you are fired for cause, you also are likely ineligible. You also have to have been employed for a minimum amount of time or have earned a minimum amount in compensation.

Is unemployment taxable income?

Taxes on Unemployment. Unemployment benefits are considered taxable income, and the unemployment compensation you receive must be reported when you file your federal and state tax returns. 2 . Both state unemployment benefits and federally funded extended benefits are considered income and must be reported when you file your federal ...

How long does it take to get unemployment?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim. In general, it takes approximately 3 weeks to process a claim; however, you will still need to claim benefits every week. The information you need before filing a claim:

How long does unemployment last?

This is beneficial for those that are out of work for a long period. The maximum benefits duration has increased from 26 to 99 weeks in some states.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

What happens if you work while receiving unemployment?

In case you earn an income while receiving benefits, they would reduce the amount of benefits that you receive. If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced.

How to file a weekly claim?

You can file your weekly claim: Through the Internet – You can file your weekly claim online. You must have a User ID and PIN in order to file your weekly claim online. By phone – You must call the number given to you during the registration process.

Do higher wages get a larger benefit check?

In a way, this would be up to a cap that is tied to the average earnings in that state. So the employees with a higher wage would receive a larger benefits check but it is still a percentage of what they used to earn. The amount that an employee would receive differs from each state.

Can I file unemployment if I received severance pay?

Have your entire information ready before filing your claim. If you have received severance pay upon your separation from work, you may still be eligible for unemployment benefits. So it is still important to call and file your initial claim during your first week of total or partial unemployment.

1. You will file an Initial Claim

If you file online, you'll receive a confirmation page at the end of the online application AND a confirmation email that includes the date that you will file your "continued claim" or "biweekly claim." No matter which day you submit your initial (new) claim (Sunday through Saturday) it will be effective on Sunday and will remain active for one year with anywhere between 18 and 26 full weeks of benefit payments available..

2. You will receive your Claim Confirmation Letter in the Mail

Keep this letter in a safe place! It will have your four-digit Personal Identification Number (PIN) that you will need to access your account AND file your biweekly claims.

3. File your Biweekly Claim

Similar to working for two weeks and getting a paycheck a couple weeks later, UC is similar.

4. You will receive your Financial Determination Letter

Keep this letter in a safe place! It states your financial eligibility.

5. If You have Claim Issues

If there is an issue with your claim, you will be asked to contact our team by the system; however, please due so via email at [email protected] and send only one email to prevent delays.