What age is best to start taking social security?

There are many factors that can influence the best time for you:

- Are you married or single?

- What is the age difference between you and spouse, if married.

- What is the income difference between you and your spouse, if married.

- Do you have children age 18 or younger?

- Are you widowed?

- Are you still working or fully retired?

What happens if you work after starting Social Security?

If you start a new job after you begin receiving Social Security benefits ... How Much Can You Earn While Receiving Social Security? If you opt to work while receiving Social Security before your full retirement age, you will only be able to receive ...

When is the best time to collect Social Security?

There is no definitive answer as to when you should take your Social Security benefits. Factors ranging from your health, your current retirement savings, your life goals and your future retirement date all play a role in helping determine when the best age is to maximize your benefits.

When you should file early for Social Security?

Key Takeaways

- You can collect Social Security as early as age 62, but your benefits will be permanently reduced. ...

- The longer you can afford to wait after age 62 (up to 70), the larger the monthly benefit. ...

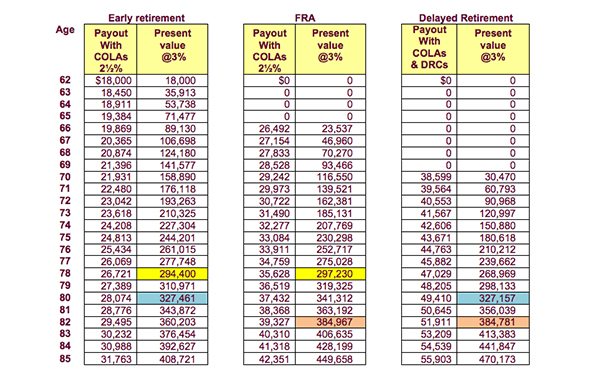

- Doing a breakeven analysis can help you determine when you would come out ahead by delaying benefits.

What is the best age to start collecting Social Security benefits?

When it comes to calculating the best age for starting to collect your Social Security benefits, there's no one-size-fits all answer. As a rule, it's best to delay if you can. If you're in good health and don't need supplemental income, wait until age 70.

Is it better to collect Social Security at 66 or 70?

If you start receiving retirement benefits at age: 67, you'll get 108 percent of the monthly benefit because you delayed getting benefits for 12 months. 70, you'll get 132 percent of the monthly benefit because you delayed getting benefits for 48 months.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Can I draw Social Security at 62 and still work full time?

Can You Collect Social Security at 62 and Still Work? You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily reduced until you reach full retirement age.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much money can you have in the bank on Social Security retirement?

$2,000You can have up to $2,000 in cash or in the bank and still qualify for, or collect, SSI (Supplemental Security Income).

How do I retire at 62 with health insurance?

If you retire at 62, you'll need to make sure you can afford health insurance until age 65 when your Medicare benefits begin. 5 (If you have a disability, you can qualify early.) With the Affordable Care Act, you are guaranteed to get coverage even if you have a pre-existing condition.

How much will I get from Social Security if I make $30000?

0:362:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

Do you pay taxes on Social Security?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

Is Social Security based on the last 5 years of work?

Social Security calculates your retirement benefit by: Taking your highest 35 years of earnings from work in which you paid Social Security taxes. Adjusting those income numbers for historical changes in U.S. wages. Deriving a figure for your monthly average income.

What happens if you stop working at 62 but don't collect until full retirement age?

What happens if you stop working at 62 but don't collect until full retirement age? You will receive the full retirement age benefit based on your top 35 working years — adjusted for COLA.

How much money can you make and collect Social Security at age 62?

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits. Beginning in August 2022, when you reach full retirement age, you would receive your full benefit ($800 per month), no matter how much you earn.

What does it mean to delay retirement benefits?

If you are the higher earner, delaying starting your retirement benefit means higher monthly benefits for the rest of your life and higher survivor protection for your spouse, if you die first.

Is it important to decide when to start receiving Social Security?

Choosing when to start receiving your Social Security retirement benefits is an important decision that affects your monthly benefit amount for the rest of your life. Your monthly retirement benefit will be higher if you delay claiming it.

When can I apply for Social Security?

You can apply once you reach 61 years and 9 months of age. However, Social Security reduces your payment if you start collecting before your full retirement age, or FRA. (FRA is currently 66 and 2 months and is gradually rising to 67 for people born in 1960 or later.)

What age can I start receiving Social Security?

The starting age can differ for other types of Social Security benefits: Spousal benefits can begin at 62, as long as the spouse on whose work record you are claiming them is receiving retirement benefits.

When can I start receiving AARP benefits?

The earliest you can start receiving retirement benefits is age 62. The soonest you can apply is when you reach 61 years and 9 months of age. Skip to content. Stay connected to all things AARP — and earn up to 750 AARP Rewards points. Install AARP Perks™.

Is there an age limit for Social Security Disability?

There is no minimum age requirement for Social Security Disability Insurance . You may qualify for disability benefits with less time in the workforce than you need to collect retirement benefits, but you must also demonstrate that your medical condition meets Social Security’s strict definition of disability and show evidence ...

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

While you can start collecting benefits at age 62, should you collect early or delay?

Select’s editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

The basics of Social Security

First off, every eligible worker can begin receiving Social Security benefits at age 62, but you’ll get a reduced monthly payment if you don’t wait until you’re at full retirement age.

What is the break even point and why is it important?

Whenever you wait until age 70 to collect benefits, you’ll be missing out on the years you weren’t receiving payments. If you’re deciding when to collect, you might consider calculating your break even point.

What other factors should you consider when deciding to collect Social Security?

Before you decide to collect Social Security based on your break even point, you should also consider how collecting early or delaying could impact the benefit your spouse receives.

Supplementing your Social Security income

For many retirees, the income they receive from Social Security is not enough to live off of: According to AARP, the estimated average Social Security monthly benefit in 2022 is $1,657.

Bottom line

It’s important to understand how collecting at different ages can influence how much money you’ll receive from Social Security. You should consider how collecting early or delaying your benefits impacts how much your spouse receives too.

Apply for Retirement Benefits

Starting your Social Security retirement benefits is a major step on your retirement journey. This page will guide you through the process of applying for retirement benefits when you’re ready to take that step. Our online application is a convenient way to apply on your own schedule, without an appointment.

Ready To Retire?

Before you apply, take time to review the basics, understand the process, and gather the documents you’ll need to complete an application.