Where can I find a Summary of Benefits and Coverage? You’ll find a link to the SBC on each plan page when you preview plans and prices before logging in, and when you've finished your application and are comparing plans. You can ask for a copy from your insurance company or group health plan any time.

How do I get the summary of benefits and coverage?

You'll get the "Summary of Benefits and Coverage" (SBC) when you shop for coverage on your own or through your job, renew or change coverage, or request an SBC from the health insurance company. Back to Glossary Index

Where can I find the plan documents for my coverage?

This is only a summary of coverage. For more information, log in to your account at bcbsm.com. You’ll find detailed plan documents under the My Coverage section. This is only a summary of coverage.

How do I find the SBC for my health insurance plan?

If you have trouble finding the SBC for your current health insurance plan (or a plan that you’re considering) call your plan’s provider. If you receive your insurance through your job, you can also ask your human resources department. What’s Up Top?

When will I receive my health insurance summary?

People will receive the summary when shopping for coverage, enrolling in coverage, at each new plan year, and within seven business days of requesting a copy from their health insurance issuer or group health plan.

What is a summary of benefits of coverage?

The SBC is a snapshot of a health plan's costs, benefits, covered health care services, and other features that are important to consumers. SBCs also explain health plans' unique features like cost sharing rules and include significant limits and exceptions to coverage in easy-to- understand terms.

Where can I get Anthem Blue Cross summary of benefits and coverage?

To view the SBCs and glossary online, visit www.calpers.ca.gov* on the Plans & Rates page (subsection Health Plans), or visit any of the health plan websites below. To request a free paper copy of the SBC and glossary, contact each health plan directly.

What is a coverage summary?

It will summarize the key features of the plan or coverage, such as the covered benefits, cost-sharing provisions, and coverage limitations and exceptions.

How do I find out my health benefits?

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you'll be directed to your state's health insurance marketplace website. Marketplaces, prices, subsidies, programs, and plans vary by state. Contact the Marketplace Call Center.

What is a SBC form?

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan. would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided. separately.

Is Blue Cross Blue Shield the same as Anthem?

Blue Cross Blue Shield is a subsidiary of Anthem, but the two entities each sell health insurance in different areas of the country, and each company provides Medicare health benefits and prescription drug coverage to beneficiaries in those areas.

How can I check my health insurance coverage?

Here's how you can Check your Health Insurance Claim StatusVisit the Health Insurance Company's official website.Click on the 'Register a Claim' icon on their website.Now Select 'Track Claim Status'It will redirect you to a new page where you provide your Customer ID, Policy Number, Claim Number, and date of birth.More items...

What is the difference between coverage and benefits?

For example, your car insurance pays you the value of your car if it's totaled in a crash, and your health insurance covers the cost of your hospital stay if you're injured in that crash. In an insurance plan, the insurer carries the risk. A benefit plan, on the other hand, is only set up to cover certain costs.

How do I get my 1095 a form?

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2021 application — not your 2022 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

What is PPO insurance?

A type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan's network.

What are the benefits of health insurance?

Health insurance protects you from unexpected, high medical costs. You pay less for covered in-network health care, even before you meet your deductible. You get free preventive care, like vaccines, screenings, and some check-ups, even before you meet your deductible.

What is summary of benefits and coverage?

Summary of Benefits and Coverage. Under the law, insurance companies and group health plans will provide consumers with a concise document detailing, in plain language, simple and consistent information about health plan benefits and coverage. This summary of benefits and coverage document will help consumers better understand ...

What are coverage examples?

The coverage examples would illustrate how a health insurance policy or plan would cover care for common benefits scenarios. Using clear standards and guidelines provided by the Center for Consumer Information and Insurance Oversight (CCIIO), plans and issuers will simulate claims processing for each scenario so consumers can see an illustration of the coverage they get for their premium dollar under a plan. The examples will help consumers see how valuable the health plan will be at times when they may need the coverage.

How many Americans have private health insurance?

Under the Affordable Care Act, health insurers and group health plans will provide the 180 million Americans who have private insurance with clear, consistent and comparable information about their health plan benefits and coverage.

Why do health plans require SBC?

All health plan companies are required to provide an SBC for each of their different plans. When you’re making decisions about buying a plan or using your benefits, an SBC can be a useful tool to help you compare costs and understand coverage options. Using an SBC to compare and shop for plans. The SBC was created to make it easier to compare ...

What is SBC in health insurance?

Maybe you’ve heard the term, Summary of Benefits and Coverage — also called “SBC.”. It’s often talked about when it comes to choosing health plans and learning about costs. That’s because it’s basically a document that outlines what’s covered — and not covered — under a health plan. All health plan companies are required to provide an SBC ...

How many pages are in a SBC?

Every SBC is created with four double-sided pages and 12-point type. Here’s a step-by-step look at what information is in an SBC: An overview of what’s covered. An explanation of what’s not covered and/or the limits on coverage. Information on costs you might have to pay — like deductibles, coinsurance and copayments.

What is SBC information?

Information on costs you might have to pay — like deductibles, coinsurance and copayments. Coverage examples, including how coverage works in the case of a pregnancy or a minor injury. A reminder that the SBC is only a summary. To get all the details, you’ll want to look at complete health plan documents.

The basics

A summary of benefits and coverage (SBC) is a document that all insurance companies are required to provide. It details the coverage and costs for any Affordable Care Act-compliant health plan. No matter the insurance provider, all SBCs outline the same basic information. This is meant to help you compare your options and understand your coverage.

Why trust us

Talia Lowery is a licensed health insurance agent and supports social impact efforts at GoodRx. Prior to joining GoodRx, she worked in the healthcare sector in a number of other capacities ranging from helping employers, families, and individuals understand their health coverage options to coordinating patient care.

Where to find your SBC

If you’re shopping for a health plan through HealthCare.gov, the site will provide you with access to documentation for each potential plan before you make your choice. If you are looking at plans through your employer, it should be presented to you when you enroll.

The purpose of an SBC

SBCs can help you determine which plan is best for you when shopping for health coverage. Many people don’t review these documents carefully until after they’re enrolled in a plan. When you don’t know the details of your coverage, you could end up surprised by a bill or the cost of an unexpected service.

A sample SBC

Let’s take a look at this SBC from Anthem Blue Cross of California. You’ll know it’s the plan for the current year based on the date in the upper right corner. Calendar year plans will always roll over in January, and policy year plans restart on the anniversary of when your coverage originally began.

Deductible

Your deductible is the amount you are expected to pay out of pocket before your insurance provider will start paying for certain benefits.

Out-of-pocket limit

The out-of-pocket limit listed is the maximum amount you can expect to pay in a year for your portion of provider services. If you think of your deductible as the lowest amount you’ll be expected to pay out of pocket, then the limit is the highest amount.

What is the important question section in a health insurance plan?

The Important Questions section explains your financial obligations under the plan. The basic information that you need for budgeting will be addressed on the first page of the Summary of Benefits.

What is SBC in health insurance?

A Summary of Benefits and Coverage (also called an SBC) is a tool that was created in 2010 as part of the Affordable Care Act. A basic Summary of Benefits and Coverage is designed to help you understand what’s covered by your health plan. Since SBCs present information in a uniform way, you can also use them to directly compare insurance plans.

What is deductible in SBC?

The deductible is how much you’ll pay on your own each year before the plan begins paying for your covered services. Usually an SBC will include an individual and a family deductible. This corresponds to the “Coverage for” listed in the top header of the SBC. There may also be separate deductibles for in-network and out-of-network services.

Why are SBCs important?

SBCs were implemented to serve as a window into what was previously a muddy and complex system. Understanding your health policy and how it works is the first step in becoming an educated healthcare consumer. This tool will help you compare available health services, and how they will affect you financially.

What is the most common type of health insurance?

All Affordable Care Act-compliant plans (the most common type of coverage) will cover 10 essential health benefits that most Americans would expect to be a part of their insurance policy. There will almost always be incidental services, like medical care in foreign countries, that a plan doesn’t cover.

What is the common medical events section?

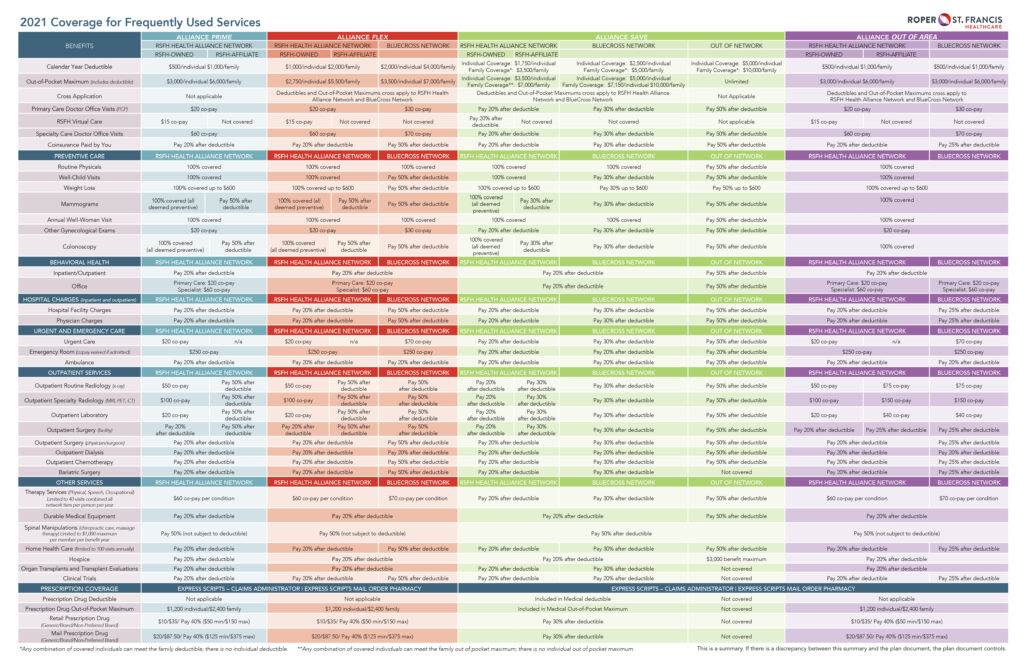

This section will help you prepare for the unexpected. The Common Medical Events section walks you through the costs of likely ways your plan will be used. Charges for office visits, diagnostic tests, pregnancy, and more are broken down in detail.

Does Obamacare have a summary of benefits?

Every Obamacare health insurance plan will provide members with a Summary of Benefits. If you have trouble finding the SBC for your current health insurance plan (or a plan that you’re considering) call your plan’s provider. If you receive your insurance through your job, you can also ask your human resources department.

What is summary of benefits and coverage?

A summary of benefits and coverage explains things like what a health insurance plan covers, what it doesn't cover, and what your share of costs will be. These documents also show your estimated costs for two sample medical events: having a baby and managing diabetes. The examples are meant to help you understand what you might pay, ...

Is health insurance based on actual prices?

Keep in mind they aren't based on actual prices. If you're not familiar with the health insurance terms used on a summary of benefits and coverage, here's a Glossary of Health Coverage and Medical Terms. Questions? Please call 1-888-288-2738 and we'll help.

Summary of Benefits and Coverage

- Under the law, insurance companies and group health plans will provide consumers with a concise document detailing, in plain language, simple and consistent information about health plan benefits and coverage. This summary of benefits and coverage document will help consumers better understand the coverage they have and, for the first time, allow t...

Uniform Glossary of Terms

- Thanks to the Affordable Care Act, consumers will also have a new resource to help them understand some of the most common but confusing jargon used in health insurance. Insurance companies and group health plans will be required to make available upon request a uniform glossary of terms commonly used in health insurance coverage such as “deductible” and “co-pa…

Additional Resources