Since a defined benefit plan is a "tax qualified" retirement plan, contributions are tax deductible and earnings "build up" tax deferred. When distributions commence, since none of the funds were ever taxed, the distribution amounts are 100% taxable. The other statements about defined benefit plans are true.

What are the requirements for a defined benefit plan?

A defined benefit plan requires the employer to fund the plan each year for an amount equal to the pension expense. 18.

Which type of Pension Plan provides for future retirement income?

A pension plan provides for future retirement income based on the employee's earnings and length of service with the company. This type of pension plan is termed a A. contributory plan B. defined contribution plan C. noncontributory plan D. defined benefit plan 14.

Are defined benefit retirement plans tax deductible?

Since a defined benefit plan is a "tax qualified" retirement plan, contributions are tax deductible and earnings "build up" tax deferred. When distributions commence, since none of the funds were ever taxed, the distribution amounts are 100% taxable. The other statements about defined benefit plans are true.

What is the smallest contribution to a defined benefit plan?

The smallest benefits are owed to low salary employees far away from retirement, so these are the smallest contributions. Since a defined benefit plan is a "tax qualified" retirement plan, contributions are tax deductible and earnings "build up" tax deferred.

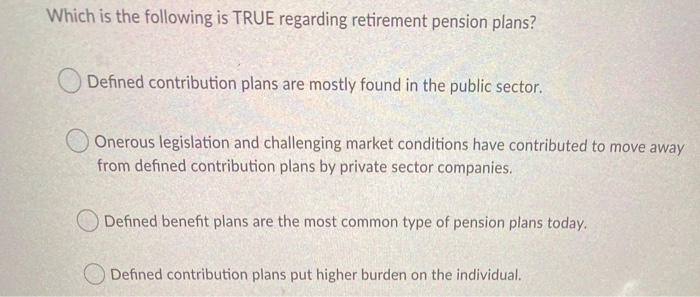

What is true about a defined benefit plan?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

What is the purpose of a defined benefit pension plan?

A defined benefit plan, more commonly known as a pension plan, offers guaranteed retirement benefits for employees. Defined benefit plans are largely funded by employers, with retirement payouts based on a set formula that considers an employee's salary, age and tenure with the company.

Which statement characterizes defined benefit plan?

Which statement characterizes defined benefit plan? * Defined benefit plans are comparatively simple in construction and raise few accounting issues for employers. Retirement benefits are based on the plan's benefit formula.

What are the rules for a defined benefit plan?

Defined Benefit Plan rules require that employers provide a meaningful benefit to at least 40% of nonexcludable employees. However, the requirement is capped at 50 employees. Additionally, if there are fewer than three employees, all employees must receive a meaningful benefit.

Which statement is true regarding a defined benefit plan quizlet?

Which statement is true regarding a defined benefit pension plan? A defined benefit plan defines the annual amount of cash that an employer must deposit to fulfill its pension obligation to employees.

What is a defined benefit plan quizlet?

Defined Benefit Plan. An employer-sponsored retirement plan where employee benefits are sorted out based on a formula using factors such as salary history and duration of employment.

What is a defined benefit obligation?

What are Defined Benefit Plan Obligations? A defined benefit plan is a type of post-employment-benefit that guarantees a pension to employees in retirement. The plan rules state the post-retirement compensation, which is often a percentage of the retiring employee's final salary.

What is defined benefit and defined contribution?

A defined benefit plan (APERS) specifies exactly how much retirement income employees will get once they retire. A defined contribution plan only specifies what each party – the employer and employee – contributes to an employee's retirement account.

Is a defined benefit pension plan good?

Easier to plan for retirement – defined benefit plans provide predictable income, making retirement planning much more straightforward. The predictability of these plans takes the guesswork out of how much income you will have at retirement.

Who benefits most from a defined benefit plan quizlet?

Who benefits more from a defined contribution plan? -Younger employees have longer for the money to grow. contributions may be deductible depending on income limits. -Contributions are not deductible, they are made with after tax dollars and may continue past 72 if still working.

Which of the following is typically a characteristic of a defined contribution plan?

Which of the following is a characteristic of a defined contribution pension plan? The benefit of gain or the risk of loss from the assets contributed to the pension fund are borne by the employee.

What is defined benefit plan?

TRUE. 2. The defined benefit plan is a type of plan in which the employer's contribution into the pension fund is based on a formula. False.

When did John Company adopt a defined benefit pension plan?

John Company adopted a defined benefit pension plan on January 1, 2014, and prior service credit was granted to employees. The present value of that prior service obligation as of January 1, 2014 was $1,400,000 and is being amortized by the straight-line method over the remaining 20-year service life of the company's active employees.

How much did Gage Pension contribute in 2014?

Gage began a defined benefit pension plan on January 1, 2014. During 2014, the service cost was $450,000 . Gage contributed $450,000 to the pension plan for 2014. The actuary said the projected benefit obligation at December 31, 2014 was $450,000.

What is an unfunded pension?

An unfunded pension liability means that expected payments from the retirement plan are in excess of the expected future assets in the plan. It is common for defined benefit pension plans to be underfunded, but the plan trustee is responsible to ensure that future funding is adequate as needed.

Does Erisa cover public sector retirement plans?

PLAY. ERISA rules cover private retirement plans to protect employees from employer mismanagement of pension funds. It does not cover public sector retirement plans, such as federal government and state government plans, since these are funded from tax collections and are closely regulated. Nice work!

Is a non-tax qualified retirement plan taxable?

Funds paid into "non-tax qualified" retirement plans are not tax deductible . Any earnings build up tax deferred. When distributions are taken, the portion that represents the return of original after tax investment is not taxed; while the portion that represents the tax deferred earnings buildup is taxable.

Is a retirement plan taxable?

Funds paid into "tax qualified" retirement plans were never subject to tax, since the contribution amount was deductible from income at the time it was made. Earnings build up tax deferred in the plan. When distributions are taken, since all of the dollars in the plan were never taxed, all of the distribution is taxable.