Financials First

- Banks. Rising rates tend to point to a strong economy. And that health usually means that borrowers have an easier time making loan payments and banks have fewer non-performing assets.

- Brokers. On the broker front, companies like E*TRADE Financial Corp., Charles Schwab Corp. ...

- Insurers. Insurance stocks can flourish as rates rise. ...

What is the relationship between stocks and interest rates?

The argument suggests that when interest rates are high, fixed income investments such as bonds are more competitive and therefore this diminishes stock values. Conversely, when interest rates are low, fixed income is less competitive and therefore stock valuations will rise.

Should you own bonds in a rising rate environment?

The best bond funds for rising rates are not guarantees of positive returns in that kind of economy. But these types of bond funds do have lower interest-rate risk than most other types of bond funds. What is a bond? A bond is a security that usually pays a fixed interest rate. It represents a loan to a government entity or a corporation.

What are rate sensitive stocks?

Market participants can use the analysis on market dynamics to plan effective growth strategies and prepare for future challenges beforehand. Each trend of the global Pressure-Sensitive Detection Mat market is carefully analyzed and researched about by the market analysts.

What are interest rate sensitive stocks?

- Morgan Stanley ( NYSE: MS)

- Royal Bank of Canada (NYSE: RY)

- BlackRock (NYSE: BLK)

- Blackstone (NYSE: BX)

- Nike (NYSE: NKE)

- Caterpillar (NYSE: CAT)

- Walmart (NYSE: WMT)

Who benefits from interest rates increasing?

Cash-rich companies benefit from rising interest rates, because they earn more on their cash reserves.

Do higher interest rates help stocks?

Investor interest in how higher interest rates will affect stocks is high.

How will interest rate hikes affect the stock market?

As a general rule of thumb, when the Federal Reserve cuts interest rates, it causes the stock market to go up; when the Federal Reserve raises interest rates, it causes the stock market to go down.

Why are stocks rising?

A slew of earnings results and economic data has boosted optimism among investors in recent sessions, helping pull major indexes away from their lows of the year. A broad-based rally, with all 11 of the S&P 500's groups rising, helped the index break a seven-week losing streak.

How do financials benefit from higher interest rates?

Financials benefit from higher rates through increased profit margins. Brokerages often see an uptick in trading activity when the economy improves and higher interest income when rates move higher. Industrials, consumer names, and retailers can also outperform when the economy improves and interest rates move higher. 1:27.

Why are insurance stocks good for the economy?

A healthy economy sees more investment activity and brokerage firms also benefit from increased interest income when rates move higher. Insurance stocks can flourish as rates rise. In fact, the relationship between interest rates and insurance companies is linear, meaning the higher the rate, the greater the growth.

Why do interest rates rise and fall in 2021?

Updated Jun 15, 2021. Interest rates rise and fall as the economy moves through periods of growth and stagnation. The Federal Reserve is an important driver for rates, as Fed officials often lower rates when economic growth slows and then raise rates to cool the economy when inflation becomes a concern. 1.

Why are discretionary stocks a bump?

Consumer discretionary stocks also can see a bump because improving employment, coupled with a healthier housing market, makes consumers more likely to splurge on purchases outside of the realm of consumer staples (food, beverages, and hygiene goods).

Which sector is most sensitive to interest rates?

The financial sector has historically been among the most sensitive to changes in interest rates. With profit margins that actually expand as rates climb, entities like banks, insurance companies, brokerage firms, and money managers generally benefit from higher interest rates.

Why do insurers have a dividend?

Insurers, which have steady cash flows, are compelled to hold lots of safe debt to back the insurance policies they write. In addition, the economic health dividend also applies to insurers. Improving consumer sentiment means more car purchasing and improving home sales, which means more policy-writing.

What to do when interest rates are rising?

A balanced approach when interest rates are rising is to stay invested and take advantage of late-stage positive momentum. But you should also prepare for harder times that are lurking around the corner. Take a look at the best stock funds and stock sectors for rising interest rates.

When is the best time to invest in growth stocks?

The best time to invest in growth stocks is most often when times are good, during the latter (mature) stages of an economic cycle. Times of rapid growth often occur at the same time as rising interest rates. Momentum investing takes advantage of this.

Why is inflation a concern?

This is because the Federal Reserve raises rates when the economy appears to be growing too fast. Thus, inflation becomes a concern. 1. Those who aim to time the market with sectors will have the goal of catching positive returns on the upside.

What asset type is used during economic slowdown?

Gold: When traders expect an economic slowdown, they tend to move into funds that invest in real, physical asset types. These may include assets such as gold funds and ETFs. Gold is not a sector, but it is an asset that can do well in uncertain times and falling markets.

Is timing a good idea for investing?

Even though you are striving to make smart purchases, you must still use caution. Be aware that market timing is not a good idea for most investors. However, you can still use some of these ideas when constructing your portfolio to help you diversify.

Does the balance provide tax?

The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors.

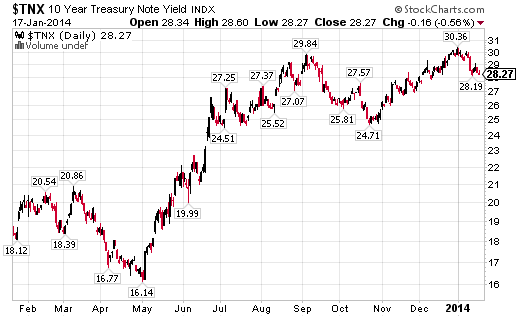

The Current Interest Rate Environment

Financials First

- The financial sector has historically been among the most sensitive to changes in interest rates. With profit margins that actually expand as rates climb, entities like banks, insurance companies, brokerage firms, and money managersgenerally benefit from higher interest rates.

Beyond Financials

- Financials aren’t the only star performers in a rising rate environment. Consumer discretionary stocks also can see a bump because improving employment, coupled with a healthier housing market, makes consumers more likely to splurge on purchases outside of the realm of consumer staples(food, beverages, and hygiene goods). Manufacturers and sellerso...

The Bottom Line

- You've adjusted your fixed-income portfolio to account for rising rates. Now is the time to adjust your equity investments to favor companies that benefit from the economic health dividend indicated by rising rates. Again, an excellent place to start is the financial sector. From there, as consumer confidencepicks up and housing follows suit, consider manufacturers of durable goo…