Who pays Social Security taxes for federal employees?

This includes the president, the vice president, and members of Congress. It also includes federal judges and most political appointees. They all pay the same amount of Social Security taxes as people working in the private sector. To learn about your federal benefits or get help with them, contact your agency's personnel or human resources office.

What are employee benefits?

Employee benefits are any kind of tangible or intangible compensation given to employees apart from base wages or base salaries. This employee benefits definition points to examples of job benefits such as insurance (including medical, dental, life), stock options and cell phone plans.

How can the US Department of labor help with pay and benefits?

The U.S. Department of Labor is committed to helping you pay your employees properly and navigate your responsibilities if you provide employee benefits. Please select one of the following questions to learn more about pay and benefits and find out whom to contact if you need more information.

How do employers choose the right benefits for their employees?

Also, some employers pay attention to the demographics of their employee base to give everyone the benefits they need most based on their characteristics. For example, in order to retain and engage millennials, businesses may offer them benefits such as student loan repayment support and co-sign support for auto loans.

How are employee benefits funded?

Simply put, fully-insured health plans work as follows; employers pay an agreed upon annual premium to a carrier, coupled with employee premium contributions per paycheck. In return, the insurance carrier pays all covered benefits.

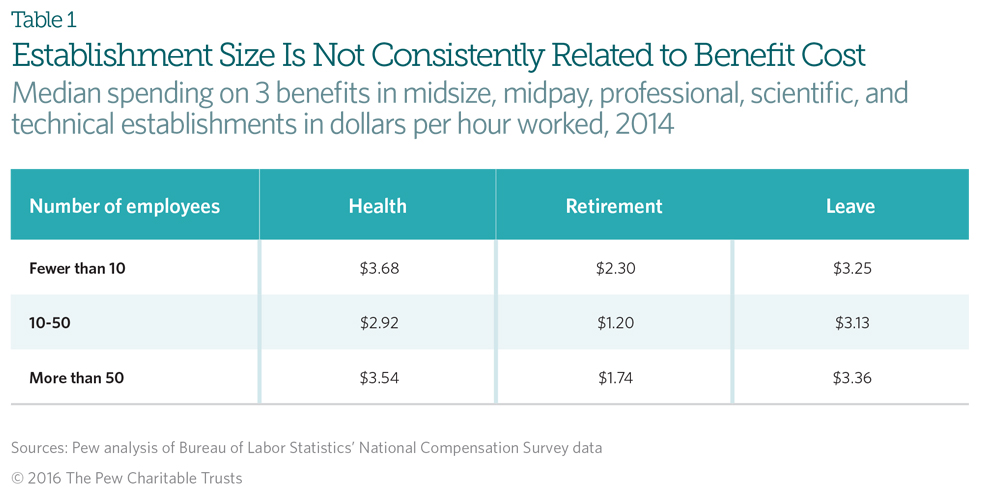

What is the cost of benefits to an employer for an employee?

Total employer compensation costs for private industry workers averaged $38.07 per hour worked in December 2021. Wage and salary costs averaged $26.86 and accounted for 70.5 percent of employer costs, while benefit costs were $11.22 and accounted for 29.5 percent.

Where do employee benefits come from?

In most instances, these plans are funded by both the employees and by the employer(s). The portion paid by employees is deducted from their gross pay before federal and state taxes are applied.

How much do employers pay for benefits in Canada?

Effective January 1, 2022, employees and employers contribute 5.70% up to the maximum (C$3,499.80).

What is the true cost of an employee?

There's a rule of thumb that the cost is typically 1.25 to 1.4 times the salary, depending on certain variables. So, if you pay someone a salary of $35,000, your actual costs likely will range from $43,750 to $49,000.

What is fully loaded cost of employee?

The simplest way to derive the average loaded cost of an employee is to count up your total corporate expenses and divide it by the total number of productive hours worked.

What are employer provided benefits?

45) an employer provided benefit is a benefit an employer provides to, or on behalf of, an employee for the employee's, or in some cases their family's, private use. Example: Employer provided benefits include: cars. school fees.

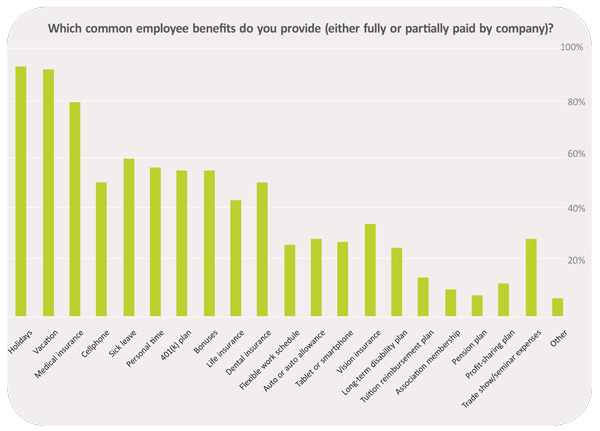

What are the 4 major types of employee benefits?

There are four major types of employee benefits many employers offer: medical insurance, life insurance, disability insurance, and retirement plans. Below, we've loosely categorized these types of employee benefits and given a basic definition of each.

What are benefits given to employees?

Supplementary employee benefits include medical, accident, life, retirement, business travel insurance, and increasingly EAP. Common employee perks offered include vehicle or transport allowance, meal vouchers or subsidized cafeteria, and reimbursement of internet and mobile phone charges.

Do employers pay for health insurance in Canada?

Employers must make contributions for Employment Insurance based on the earnings of all employees. Generally, employers deduct a certain percentage of their employee's wage and also contribute to the employee's premium.

Do employers have to provide benefits Canada?

The mandatory benefits that a Canadian employer must provide as a minimum to employees include annual leave or vacation time off, sick leave, critical illness leave, maternity, paternity, parental leave, Canadian Pension Plan contributions, and employment insurance contributions.

How does employee insurance work in Canada?

An employee benefits package typically includes healthcare insurance, retirement plans, vacation and paid time off. Generally, these packages will cover 80%, and in some cases 100%, of healthcare costs. Both the employer and employee pay the monthly premium on benefits.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemplo yment systems , provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee’s wages.

Is fringe income taxed?

Fringe benefits are generally included in an employee’s gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Does the employer pay FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee’s wages. The Department of Labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it. In general, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are ...

Who pays Social Security taxes?

Federal Employees Pay Social Security Taxes. All federal employees hired in 1984 or later pay Social Security taxes. This includes the president, the vice president, and members of Congress. It also includes federal judges and most political appointees. They all pay the same amount of Social Security taxes as people working in the private sector.

How to find out about federal benefits?

To learn about your federal benefits or get help with them, contact your agency's personnel or human resources office. And visit the Office of Personnel Management (OPM) website. You can also Contact OPM.

What is TSP retirement?

The Thrift Savings Plan (TSP) is a retirement plan for federal government employees and members of the military. Find the basics about participating - Eligibility, contributions, loans, withdrawals, setting up and managing your account. Learn about investment funds - Overview of fund types, fund options, and performance.

Does OPM have access to beneficiary information?

OPM and the Office of Federal Employees' Group Life Insurance (OFEGLI) do not have access to your records and cannot answer questions about coverage or beneficiaries.

Editor's Note

Do you have a point you’d like to make or an issue you feel strongly about? Submit a letter to the editor.

Question of the week

Overnight users will be required to have permits everywhere in Mt. Jefferson, Mt. Washington and Three Sisters wilderness areas. Day use permits will be required at 19 of the 79 trails in those areas.

Employer Liability For Unemployment Taxes

In order to fund unemployment compensation benefit programs, employers are subject to federal and state unemployment taxes depending on several factors. These factors include the sums employers pay their employees, the unemployment claims filed against the business, and the type & age of the business.

Employers Of Agricultural Employees

Employers must pay Federal unemployment taxes if: they pay wages to employees of $20,000, or more, in any calendar quarter or, in each of 20 different calendar weeks in the current or preceding calendar year, there was at least 1 day in which they had 10 or more employees performing service in agricultural labor.

How Much Are Unemployment Taxes

Both federal and state unemployment taxes are based on employee wages.

Contact Your State Representative Or Senator

As a last ditch effort, Harris reached out to her state senators office, and says she was told they would send an inquiry on her behalf. About two weeks later, in late September, Harris received back pay totaling $10,000. Harris believes she is still owed additional benefits, and is unclear on how to ensure continued benefits.

Does An Employer Have To Pay For Unemployment When An Employee Is Laid Off

In most cases, when you are laid off, the employer who terminated your position does not directly have to pay for your unemployment benefits these checks come from the state’s unemployment fund.

What Additional Benefits Are Available During Economic Downturns

Three types of programs can potentially provide extra weeks of benefits to workers in states where unemployment has increased significantly: temporary federal programs that Congress generally establishes during national economic downturns the permanent federal-state Extended Benefits program, which is available to hard-hit states even when the national economy is not performing poorly and additional temporary or permanent programs that states sometimes put in place.

Unemployment Insurance As Economic Stimulus

Unemployment benefits are designed first to relieve distress for jobless workers and their families. In recessions and the early stages of recoveries, however, they provide an additional benefit: stimulating economic activity and job creation.

1. Starbucks

Starbucks is a chain of coffee shops that sell drinks and food to customers. Some benefits they typically offer to employees include:

2. Facebook

Facebook is a social media platform that helps people connect by letting them create profiles and communicate with other members of the platform online through posts and private messages. Here are a few benefits that Facebook offers to its employees:

3. Campbell Soup Company

Campbell Soup Company is a food company that sells products like soups, canned meals, baked goods and beverages. Some of the most attractive benefits that Campbell Soup Company offers to its employees can include:

4. Sage

Sage is a technology company that aims to help small companies grow their businesses and improve their operations with their software products. Here are a few employee benefits that Sage typically provides for its employees:

5. Spotify

Spotify is a music streaming service that allows customers to purchase subscriptions and access an extensive cloud-based music library. Here are some of the most popular benefits that Spotify offers:

6. Costco Wholesale

Costco Wholesale is a retailer that sells memberships that allow customers to visit their warehouses and purchase products, often in bulk quantities. Some particularly attractive benefits that Costco Wholesale offers to its employees can include:

7. Cornerstone OnDemand Inc

Cornerstone OnDemand Inc. is a technology company that sells tools for businesses that can help them improve their training, recruiting and management operations. Here are a few common employee benefits that Cornerstone OnDemand Inc. provides for its employees:

What is unemployment?

Unemployment insurance, also known as unemployment, is a social support precaution designed to help people who lose their jobs due to external circumstances. Unemployment allows eligible applicants to receive a portion of their former wages for a set period of time or until they secure employment again.

How does unemployment work?

Unemployment insurance works by collecting tax from employers each year and redistributing those funds to people who apply for unemployment benefits after losing their job. Individuals fill out forms at their state’s unemployment office and, pending approval, receive 13 to 26 weeks of supplemental pay.

Who pays for unemployment benefits?

Unemployment insurance is funded through a company’s payroll taxes. Each individual state has its own unemployment office that manages applications and payments, with the requirements to qualify for benefits varying from state to state.

What responsibilities do employers have when managing unemployment?

Your company has a few key responsibilities when it comes to setting up employment benefits:

What happens after an employee files an unemployment claim?

As an employer, you may eventually have to deal with unemployment claims from former employees. If one of your former employees files for unemployment, you will receive a notice explaining their claim and giving you a deadline to contest it.

Frequently asked questions about unemployment

Employers can disagree with an unemployment claim and submit evidence that it is not a valid claim, but they themselves do not have the authority to deny an unemployment claim. They have to fill out the proper paperwork and let the unemployment office choose to deny or approve the claim.

How does each state limit the tax you have to pay with respect to any one employee?

However, each state confine the tax you have to pay with respect to any one employee by detailing a maximum wage amount to which the tax applies. Once an employee’s wages for the calendar year surpass that maximum amount, your state tax liability with respect to that employee ends.

What is the premium rate for new non-governmental employers?

All other new employers are allotted a 2.7% new employer premium rate. In the past, mining and construction are the only industries with new employer rates higher than 2.7%.

How much is a FUTA tax?

The FUTA tax is imposed at a single flat rate on the first $7,000 of wages that you give each employee. Once an employee’s wages for the calendar year go beyond $7000, you have no additional FUTA liability for that employee for the year.

What is the liability of an employer for unemployment?

In order to fund unemployment compensation benefit programs, employers are subject to federal and state unemployment taxes depending on several factors. These factors include the sums employers pay their employees, the unemployment claims filed against the business, and the type & age of the business.

How much do you pay in a quarter for a FUTA?

You pay wages totaling at least $1,500 to your employees in any calendar quarter; or. You have at least one employee on any given day in each of 20 different calendar weeks. Once you fulfill either of the tests, you become liable for the FUTA tax for the whole calendar year and for the next calendar year as well.

Why is unemployment tax so high?

When you first open your UI account, your tax rate will be fairly high because you have no track record. If you work for several years without laying off an employee, your tax rate will go down. If you continually lay off employees, your tax rate will increase.

Does a business have to pay unemployment tax?

The Federal Unemployment Tax Act (FUTA) imposes a payroll tax on employers, depending on the wages they pay to their employees. Unlike some other payroll taxes, the business itself has to pay the FUTA tax. You do not hold back the FUTA tax from an employee’s wages.

Fringe Benefits

Unemployment Insurance

- The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee's wages. The Department of Labor provides informat...

Workers' Compensation

- The Department of Labor's Office of Workers' Compensation Programs (OWCP)administers four major disability compensation programs that provide wage replacement benefits, medical treatment, vocational rehabilitation and other benefits to federal workers or their dependents who are injured at work or who acquire an occupational disease. Individuals injured on the job while e…

Health Plans

- If an employer pays the cost of an accident or health insurance plan for his/her employees (including an employee's spouse and dependents), then the employer's payments are not wages and are not subject to social security, Medicare, and FUTA taxes, or federal income tax withholding. Generally, this exclusion also applies to qualified long-term care insurance contract…