PUA extended unemployment benefits to eligible workers, including:

- Freelancers and independent contractors

- Workers seeking part-time work

- Workers who don’t have a work history long enough to qualify for state unemployment insurance benefits

- Workers who otherwise wouldn’t qualify for benefits under state or federal law

How do I know if I am eligible for Pua?

- You have been diagnosed with or are experiencing symptoms of COVID and are seeking a medical diagnosis.

- A member of your household has been diagnosed with COVID.

- You are providing care for a family member or a member of your household who has been diagnosed COVID.

Is Pua considered earned income?

Unemployment compensation is considered taxable income by the IRS and most states, thus you are required to report all unemployment income as reported on Form 1099-G on your income tax return. You should be mailed a Form 1099-G before January 31, 2022 for Tax Year 2021 stating exactly how much in taxable unemployment benefits you received.

Who is eligible for pandemic Unemployment Assistance (PUA)?

Who Was Eligible to Receive Pandemic Unemployment Assistance (PUA)? PUA was intended to support workers who didn't otherwise qualify for unemployment insurance. Examples of the types of workers targeted by the PUA program included freelancers, part-time gig workers, and self-employed individuals.

What is Pua unemployment benefits?

PUA was the federal program created in March 2020, as COVID-19 quickly surged. It was designed to help those who worked in jobs that traditionally did not qualify for regular unemployment benefits. About 2.9 million Californians benefited from the program.

This guide has everything you need to know about Pandemic Unemployment Assistance: what is PUA, who is eligible, how to get it - literally everything!

The CARES Act, which was passed in March 2020, established an emergency jobless benefits programme known as Pandemic Unemployment Assistance (PUA). Unemployed workers who are not qualified for regular state unemployment benefits or who have exhausted their state unemployment benefits are eligible for PUA.

What is PUA?

The term “Pandemic Unemployment Assistance” (PUA) refers to a programme that temporarily extended unemployment insurance (UI) eligibility to people who were self-employed or employed at some point during the calendar year preceding and up to the start of your PUA claim.

Understanding PUA

You must submit proof of employment or self-employment even though PUA benefits have ended in order to avoid the potential of having to repay benefits received or wouldn’t otherwise qualify.

Who is eligible to receive PUA?

You had to self-certify that you were able to work and that you were available for a job but were unemployed, partially employed, unable to work, or unable for employment due to one of the below mentioned COVID-19-related situations.

Unemployment programs under the CARES Act

People who received unemployment insurance, including those who received a partial unemployment benefit check, were given a flat amount called FPUC. It was for persons who received benefits under the PUA and PEUC programmes.

Special considerations

States had a lot of leeway under federal legislation to change their laws to grant unemployment insurance benefits in a variety of COVID-19-related situations. States, for example, were able to provide benefits when:

Who was Pandemic Unemployment Assistance (PUA) created for?

PUA was created to help workers who might otherwise be ineligible for unemployment benefits. Freelancers, part-time gig workers, and self-employed persons were among the workers targeted by the PUA initiative.

Who is eligible for PUA?

PUA Eligibility for students on work study. An individual participating in work study who is not eligible for regular UC, whose worksite closed as a direct result of COVID-19, and who has suffered a loss of income, may be eligible for PUA.

What is PUA eligibility?

PUA Eligibility For individuals who continue to make some income. A person who has been accepted into the PUA program may be able to earn some income in a given week. Each state has different policies on weekly income reporting & benefit amount reductions.

How do I qualify for unemployment?

According to the U.S. Department of Labor. Each state sets its own unemployment insurance benefits eligibility guidelines, but you usually qualify if you: 1 Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work. 2 Meet work and wage requirements. You must meet your state’s requirements for wages earned or time worked during an established period of time referred to as a "base period." (In most states, this is usually the first four out of the last five completed calendar quarters before the time that your claim is filed.) 3 Meet any additional state requirements. Find details of your own state’s program.

What is a good example of a PUA?

pua eligibility for self-employed individuals who work from home and have lost income. A good example of this is an author who works from home but has lost considerable income because of the COVID-19 pandemic. According to the U.S. Department of Labor, a freelance worker, for example, who has experienced a significant diminution ...

What is a child in the household for which the individual has primary caregiving responsibility is unable to attend school or

a child or other person in the household for which the individual has primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 public health emergency and such school or facility care is required for the individual ;

Can I qualify for PUA?

You may qualify for PUA. The CARES Act does provide PUA to an individual who is the “primary caregiver” of a child who is at home due to a forced school closure that directly results from the COVID-19 public health emergency.

Can I get PUA if I am unemployed?

Additionally, if the individual is currently unemployed, partially unemployed or unable or unavailable to work because of at least one of the COVID-19 related reasons , then the individual may be eligible for PUA.

Who is eligible for PUA?

Pandemic Unemployment Assistance (PUA) extends unemployment benefits to eligible self-employed workers, including: 2. Freelancers and independent contractors. Workers seeking part-time work. Workers who don't have a work history long enough to qualify for state unemployment insurance benefits. Workers who otherwise wouldn't qualify ...

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) is a program that temporarily expands unemployment insurance (UI) eligibility to self-employed workers, freelancers, independent contractors, and part-time workers impacted by the coronavirus pandemic. PUA is one of the programs originally established by the Coronavirus Aid, Relief, ...

What are the new programs under the Cares Act?

In addition to the PUA program, the CARES Act extended unemployment benefits through two other initiatives: the Pandemic Emergency Unemployment Compensation (PEUC) program and the Federal Pandemic Unemployment Compensation (FPUC) program.

When was PUA created?

PUA is one of the programs originally established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion coronavirus emergency stimulus package that President Donald Trump signed into law on March 27, 2020. The act expanded states' ability to provide unemployment insurance to many workers affected by COVID-19, ...

What is the FPUC?

FPUC is a flat amount given to people who receive unemployment insurance, including those who get a partial unemployment benefit check. It applies to people who receive benefits under PUA and PEUC. The original amount of $600 was reduced to $300 per week after the program was extended in August 2020.

How long does it take to get unemployment benefits after being exhausted?

Extends benefits up to an extra 53 weeks after regular unemployment compensation benefits are exhausted. Federal Pandemic Unemployment Compensation (FPUC) Provides a federal benefit of $300 a week through Sept. 6, 2021. Provided $600 a week through July 31, 2020.

What are some examples of PUA?

Examples of the types of workers targeted by the PUA program include freelancers, part-time “gig workers,” and those who are self-employed. To qualify, workers must certify they are unable to work due to one or several conditions related to COVID-19.

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) Program. This is a newly available emergency unemployment assistance program under the federal CARES Act. PUA provides assistance for unemployed or partially unemployed individuals who are not eligible for regular unemployment insurance and who are unable or unavailable to work due to COVID-19 related ...

How much is PUA in 2020?

If you qualify for PUA the initial payments you will receive are as follows: $167.00 per week, for each week from February 2, 2020 to March 28, 2020 that you were unemployed due to a COVID-19 related reason . AND.

How often do you have to backdate your PUA?

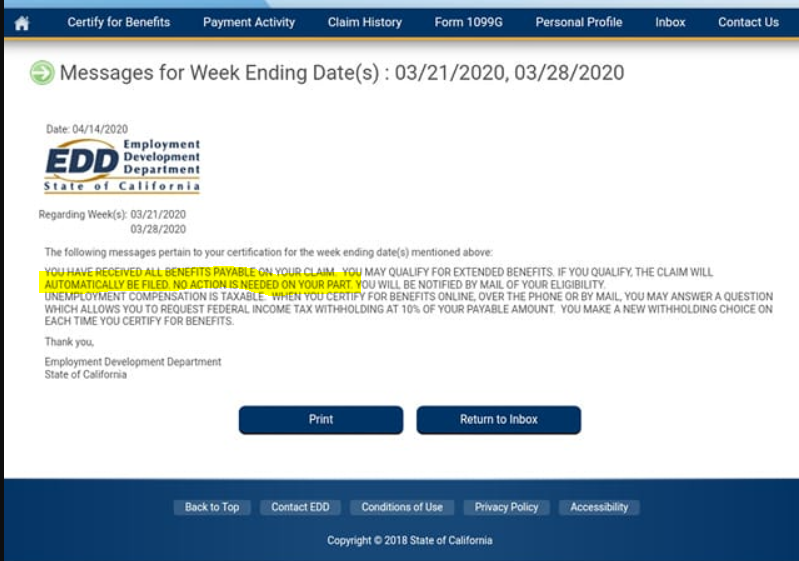

If you qualify for your claim to be backdated to an earlier PUA effective date based on your last day of work, you could receive payment for prior weeks you were unemployed due to COVID-19. You will be required to provide the EDD eligibility information every two weeks. This is known as certifying for benefits.

When does PUA end?

Similarly, the PUA program has a legislative end date of 12/31/20, but for most Californians the last full week of benefits will end on 12/26/20. 1.

How much is unemployment in 2020?

AND. $167.00 per week, for each week from July 26, 2020 to December 26, 2020, that you are unemployed due to a COVID-19 related reason, up to a total of 39 weeks (minus any weeks of regular UI and certain extended UI benefits that you have received).

When does the $600 CARES Act end?

Last week is week ending December 26, 2020.**. ** Under the CARES Act of 2020, the $600 additional benefits are available through 07/31/20. However, the U.S. DOL has issued guidance to clarify that, for most Californians, the last full week of benefits will end on 07/25/20. Similarly, the PUA program has a legislative end date of 12/31/20, ...

How much is the minimum weekly benefit?

Amount of Benefits. Minimum weekly benefit amount of $167 (but weekly amount may be higher and equal the amount provided under regular UI, depending on proof of prior earnings) PLUS $600 for weeks between March 29, 2020 to July 25, 2020 .**. When Benefits Start.

When does the PUA end?

The PUA program provides up to 39 weeks of benefits, which are available retroactively starting with weeks of unemployment beginning on or after January 27, 2020, and ending on or before December 31, 2020.

What is suitable employment?

Typically, suitable employment is connected to the previous job’s wage level, type of work, and the claimant’s skills. Refusing an offer of suitable employment (as defined in state law) without good cause will often disqualify individuals from continued eligibility for unemployment compensation.

What is UIPL 20-20?

UIPL 20-20: Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 - Operating, Financial, and Reporting Instructions for Section 2105: Temporary Full Federal Funding of the First Week of Compensable Regular Unemployment for States with No Waiting Week. UIPL 18-20: Coronavirus Aid, Relief, and Economic Security (CARE S) ...

Does the Cares Act apply to unemployment?

Yes, depending on how your state chooses to implement the CARES Act. The new law creates the Federal Pandemic Unemployment Compensation program (FPUC), which provides an additional $600 per week to individuals who are collecting regular UC (including Unemployment Compensation for Federal Employees (UCFE) and Unemployment Compensation for Ex-Servicemembers (UCX), PEUC, PUA, Extended Benefits (EB), Short Time Compensation (STC), Trade Readjustment Allowances (TRA), Disaster Unemployment Assistance (DUA), and payments under the Self Employment Assistance (SEA) program). This benefit is available for weeks of unemployment beginning after the date on which your state entered into an agreement with the U.S. Department of Labor and ending with weeks of unemployment ending on or before July 31, 2020.

Can I get PUA if I am a gig economy worker?

You may be eligible for PUA, depending on your personal circumstances. A gig economy worker, such as a driver for a ride-sharing service, is eligible for PUA provided that he or she is unemployed, partially employed, or unable or unavailable to work for one or more of the qualifying reasons provided for by the CARES Act. For example, a driver for a ride-sharing service may be forced to quit his or her job if he or she was diagnosed with COVID-19 by a qualified medical professional, and although the driver no longer has COVID-19, the illness caused health complications that render the driver objectively unable to perform his or her essential job functions, with or without a reasonable accommodation. Similarly, under an additional eligibility criterion established by the Secretary of Labor pursuant to 2102 (a) (3) (A) (ii) (I) (kk), a driver who receives an IRS Form 1099 from the ride-sharing service may qualify for PUA benefits if he or she has been forced to suspend operations as a direct result of the COVID-19 public health emergency, such as if an emergency state or municipal order restricting movement makes continued operations unsustainable. Relatedly, widespread social distancing undertaken in response to guidance from federal, state, or local governments may so severely reduce customer demand for a driver’s services as to force him or her to suspend operations, and thus make the driver eligible for PUA.

Can you get PUA if you are not eligible for the Cares Act?

Under the CARES Act, you may be eligible for benefits if you meet one of the circumstances listed in the Act, but none include the scenario described. On these facts, you are not eligible for Pandemic Unemployment Assistance (PUA) because you do not meet any of the qualifying circumstances.

Overview

In March of 2020, the federal government created Pandemic Unemployment Assistance (or PUA), a program that provided support for Americans who were unable to work due to the Coronavirus pandemic but did not qualify for traditional Unemployment Insurance (UI). The Continued Assistance Act (CAA) was signed into law on December 27, 2020.

Frequently Asked Questions

Q) When must I provide my proof of employment, self-employment, or proof of the planned beginning of employment or self-employment?

How long is the waiting period for PUA?

Normally, states will not pay out unemployment benefits while it processes your application and there is a waiting period of one week. This waiting period was effectively waived by the CARES Act so you will immediately begin receiving benefits.

What is the eligibility for unemployment?

Eligibility is based on the state in which you are claiming unemployment insurance benefits and each state has slightly different rules. The main two rules are that you are unemployed through no fault of your own and that you met the work and wage requirements for the “base period,” in which you earned eligibility.

How much is the Cares Act benefit?

As many Americans look towards the next round of stimulus, with the first action being the House of Representatives voting on the HEROES Act last Friday, there’s at tendency to forget that the CARES Act created a $2,400 per month benefit for many Americans. With official unemployment figures at 14.7%, millions of Americans are out ...

How much is the extra 600 for unemployment?

It’s known as Pandemic Unemployment Assistance and it provides for up to an additional $600 per week ($2,400 for a four-week month) of benefits on top of your state’s unemployment compensation structured through two programs: Federal Pandemic Unemployment Compensation (FPUC) is effective from March 29th, 2020 through July 31st, 2020, ...