What is the difference between benefits and compensation?

Main Differences Between Compensation and Benefits

- Compensation consists of all the monetary and non-monetary forms of remuneration due to an employee from the employer. ...

- Benefits are solely non-monetary forms of value.

- Compensation can be direct or indirect. ...

- Monetary compensation is divided into basic pay and variable pay.

What is compensation and benefits in HRM objectives, examples?

What are different types of compensation?

- Base Pay

- Commissions

- Overtime Pay

- Bonuses, Profit Sharing, Merit Pay

- Stock Options

- Travel/Meal/Housing Allowance

- Benefits including: dental, insurance, medical, vacation, leaves, retirement, taxes ...

What are the 5 types of state workers compensation benefits?

Workers’ compensation insurance benefits usually help employees by covering:

- Medical treatments

- Disability benefits

- Vocational rehabilitation

- Death and funeral services

What are non - salary benefits?

There is a regulatory definition, however, and it states administrative duties are exempt when they:

- Connect directly to the general business operations, employer's customers, or management

- Include the use of discretion and independent judgment regarding important matters

- Are work responsibilities accomplished in an office or are not manual

Is compensation and benefits the same?

What is the difference between compensation and benefits? Put simply, compensation covers people's direct pay, their salary. Benefits cover employees' indirect pay, things like health insurance and stock options but also social benefits such as parental leave.

Is salary a benefit or compensation?

Key Takeaways. Annual compensation, in the simplest terms, is the combination of your base salary and the value of any financial benefits your employer provides. Annual salary is the amount of money your employer pays you over the course of a year in exchange for the work you perform.

Are employee benefits part of employee compensation?

Benefits are a part of the employee compensation package, and they're usually worth a great deal to employees. Benefits are any perks that companies offer to employees in addition to salary.

What is considered as compensation?

Compensation is the total cash and non-cash payments that you give to an employee in exchange for the work they do for your business. It's typically one of the biggest expenses for businesses with employees. Compensation is more than an employee's regular paid wages.

What are the 4 types of compensation?

The Four Major Types of Direct Compensation: Hourly, Salary, Commission, Bonuses. When asking about compensation, most people want to know about direct compensation, particularly base pay and variable pay.

How do you define compensation and benefits?

Compensation and benefits refers to the compensation/salary and other monetary and non-monetary benefits passed on by a firm to its employees. Compensation and benefits is an important aspect of HRM as it helps to keep the workforce motivated.

What are some examples of compensation?

Compensation may also be used as a reward for exceptional job performance. Examples of such plans include: bonuses, commissions, stock, profit sharing, gain sharing.

What is included in compensation of employees?

Compensation describes the cash rewards paid to employees in exchange for the services they provide. It may include base salary, wages, incentives and/or commission. Total compensation includes cash rewards as well as any other company benefits.

Which is not a direct compensation?

Direct compensation can be in the form of wages, salaries, commissions and bonuses that an employer provides regularly and consistently. Compensation that isn't considered direct includes benefits, retirement plans, leaves, employee services and education.

What determines compensation?

Essentially, it's a combination of the value of your pay, vacation, bonuses, health insurance, and any other perk you may receive, such as free lunches, free events, and parking. These components are encompassed when you define compensation.

What is the difference between compensation and benefits?

Meaning. Compensation is defined as the financial remuneration given to employees in return to the services they provide to the organization. On the other hand, benefits is defined as the non-financial forms of rewards given to employees in addition to their cash salary for ...

Why is compensation important?

An employee essentially works to meet the expenses of living. Compensation also serves as a key factor when taking decisions on recruitment of new employees. If a company is seeking to hire a competent workforce, they need to offer an attractive compensation package.

Why is it important to formulate a benefit package carefully?

It is important to formulate the benefit package carefully because when the benefits are inadequate, employees can suffer from low motivation ...

What is fringe benefit?

Benefits are essentially the extra rewards given to employees apart from their stipulated compensation. These benefits are also called fringe benefits and are provided to employees in addition to the cash payments with the aim of enhancing the welfare of the employees and also motivating them.

What factors determine an employee's compensation?

There are various factors that determine an employee’s compensation, including their educational background, nature of work, previous work experience, skills, etc. An individual’s compensation increases when they perform well and when move ahead in the organizational hierarchy.

What is piece rate compensation?

Piece-rate compensation: Employees are sometimes paid compensation on the basis of piece-rate plans, where a base salary is not paid; rather, their pay depends on their output. This is also referred to as commission-based compensation, where employees are paid a given percentage of the total sales they produce each day.

What is the term for the different forms of payments made to employees because of the tasks they perform for the organization?

The different forms of payments made to employees because of the tasks they perform for the organization are known as compensation. Compensation is typically provided in monetary terms. It is essentially the financial payment made to employees for carrying out the tasks and responsibilities assigned to them within an organization.

Why are compensation and benefits important?

A competent approach towards compensation and benefits in the workplace goes a long way to ensuring that a company’s employees are satisfied. Some other reasons why compensation and benefits are important are listed below:

What are the ways to calculate compensation and benefits?

While governments ensure that everyone that chooses to work gets paid a minimum wage, companies often adhere to an industry-wide standard when determining what they pay their employees. There are various ways to do that:

What are the parts of the overall reward system?

This model says that the overall rewards for an employee are made up of five parts: compensation, well-being, benefits, development, and recognition.

What is fixed pay?

Fixed pay is the minimum amount of money an employer pays to their employee, excluding any bonuses or overtime. An employee is paid a fixed pay monthly rather than on an hourly basis. Factors contributing towards setting this amount are minimum wage, the role of the employee, cost of living, industry standard of pay, etc.

What does it mean when a company has more talented workers?

The more talented a company’s workers are, the better its output and its bottom line.

Should managers be paid more?

However, if we are looking to build an organization that pays its employees fairly, then the manager with more team members and the analyst with specialized knowledge of financial technology should be paid more.

Do stocks vest in compensation?

This allows employees to gain a share of the overall profits of the company, apart from their salary and non-monetary benefits. These stocks form a part of an employee’s compensation package as equity pay. However, usually, these stocks vest only after an employee has spent a fixed amount of time with the company.

What is compensation and benefits?

The key difference between compensation and benefits is that compensation is referred to as the financial payments paid to an employee in return for their contribution to the organization performing a designated job whereas benefits are non-financial forms of value provided in addition to compensation to the employee in return for their contribution to the organization.

What is the difference between Compensation and Benefits?

Benefits are non-financial forms of value provided in addition to compensation to the employee in return for their contribution to the organization.

What are Benefits?

Benefits are non-financial forms of value provided in addition to compensation to the employee in return for their contribution to the organization. Thus, benefits can be explained as a form of non-financial compensation and include all rewards that are not a part of compensation. The number of benefits and the nature of benefits are different from one organization to another and take the following forms.

Why are benefits important?

Benefits are also very important since motivation does not result by financial rewards alone. Similar to compensation, the number of benefits and the nature of the benefits will increase when an employee progresses in ...

What are paid absences?

Paid Absences. Holidays, sick leaves, vacation, educational leave, compensation leave. Benefits also include other aspects that ensure smooth progression of careers where employees are motivated. These are not included in job descriptions or documented remuneration packages; however, they should be present and are a part of performing a job.

Why is compensation important?

Compensation is very important since this is directly linked to cost of living. The main objective of an occupation is to cover the living expenses. Compensation also becomes the deciding factor in recruiting new employees; an attractive compensation should be offered if the company is to attract competent employees.

What are the factors that affect compensation?

Compensation for an employee is subjected to a number of factors such as the educational qualifications, number of years of work experience and the nature of work experience. Compensation increases in value depending on the performance of the employee and when an employee progresses within the organizational hierarchy.

What is compensation for employees?

Employee Compensation Definition: Compensation is the total cash and non-cash payments that you give to an employee in exchange for the work they do for your business. It is typically one of the biggest expenses for businesses with employees. Compensation is more than an employee’s regular paid wages. It also includes many other types of wages and ...

What are the laws for compensation?

Compensation regulations. Compensation is governed by many local, state, and federal tax and employment laws. You need to abide by federal minimum wage laws, which are governed by the Fair Labor Standards Act ( FLSA ). Many states and some cities also have their own minimum wage.

What is gross pay?

Gross pay is the amount an employee earns before taxes and other deductions are subtracted. Net pay is the amount the employee takes home after everything is subtracted. An employee’s base compensation is part of both gross and net wages. But, gross and net wages might include other compensation too, such as overtime wages.

What is base pay rate?

The base pay rate is essentially the minimum amount an employee can expect to receive before taxes and other deductions. Base pay includes an employee’s base salary or hourly wages. It also includes shift differentials and pay for special assignments.

How to determine how much you can spend on employees?

You need to calculate carefully how much you can spend on employees. When determining how much an employee costs, remember the costs of taxes and benefits. Before you offer a job or pay raise, make sure the compensation plan will fit in your budget.

Why is offering desirable benefits important?

By offering desirable benefits, you might be able to offer a lower base pay to employees. You need to know what benefits are the most desirable in your area and industry. Employees often heavily consider employee benefits packages when looking for a job.

Why do you pay more for an employee?

Or, you might pay an employee more if they received more education or advanced training related to their job.

What is disability compensation?

Disability Compensation is a tax free monetary benefit paid to Veterans with disabilities that are the result of a disease or injury incurred or aggravated during active military service. Compensation may also be paid for post-service disabilities that are considered related or secondary to disabilities occurring in service and for disabilities presumed to be related to circumstances of military service, even though they may arise after service. Generally, the degrees of disability specified are also designed to compensate for considerable loss of working time from exacerbations or illnesses. Learn More

What is special monthly compensation?

For Veterans, Special Monthly Compensation is a higher rate of compensation paid due to special circumstances such as the need of aid and attendance by another person or a specific disability , such as loss of use of one hand or leg.

What is dependent and indemnity compensation?

Dependency and Indemnity Compensation (DIC) is a tax free monetary benefit generally payable to a surviving spouse, child, or parent of Servicemembers who died while on active duty, active duty for training, or inactive duty training or survivors of Veterans who died from their service-connected disabilities. DIC for parents is an income based benefit. Learn More

What are the benefits of VA?

Other Benefits: VA provides additional housing and insurance benefits to Veterans with disabilities, including Adapted Housing grants, Service-Disable Veterans' Insurance, and Veterans' Mortgage Life Insurance. Eligibility Requirements. Compensation benefits require that your disability be service-connected.

What is required for disability benefits?

Compensation benefits require that your disability be service-connected. You must also have separated or been discharged from service under other than dishonorable conditions.

Is special monthly compensation tax free?

Special Monthly Compensation Disability compensation recipients may be eligible for this additional tax-free benefit due to the special circumstances of your disability, if you are housebound, or need help performing daily living functions. Learn about special monthly compensation benefit rates

Can disabled veterans get a grant?

If you are a disabled Veteran you may be eligible for a grant to purchase or adapt an automobile.

What are employer provided benefits?

Types of Employer-Provided Benefits and Perks. In addition to benefits required by law, other benefits are provided by companies because they feel socially responsible to their employees and opt to offer them beyond the level required by law. Depending on the company, these benefits may include health insurance ...

Who Gets Employee Benefits?

According to the Bureau of Labor Statistics (BLS), workers in the private sector received an average of 10 paid vacation days after one year of service, while federal government workers received an average of 13 in the same period. 2

What are the benefits of a company?

Depending on the company, these benefits may include health insurance (required to be offered by larger companies), dental insurance, vision care, life insurance, legal insurance, paid vacation leave, personal leave, sick leave, child care, fitness, retirement benefits and planning services, college debt relief, pet insurance, and other optional benefits offered to employees and their families.

How many hours does an employer have to provide health care?

Employers are required to provide health care to employees who work at least 30 hours per week. 4 Some (though not many) part-time workers are covered by employer plans.

What is an employee benefits package?

An employee benefits package includes all the non-wage benefits, such as health insurance and paid time off, provided by an employer. There are some types of employee benefits that are mandated by federal or state law, including minimum wage, overtime, leave under the Family Medical Leave Act, unemployment, and workers' compensation ...

How many non-government employers offer health benefits?

Among non-government employers, 87% offered health benefits according to the BLS. Another 67% offered their employees a pension or retirement program. 3. In addition, more employers are using bonuses, perks, and incentives to recruit and retain employees.

What are the minimum standards for health insurance?

Under the Patient Protection and Affordable Care Act (Obamacare), minimum standards are set for health insurance companies regarding services and coverage. Most employers with 50 or more employees are required to offer healthcare plans or pay a fine.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemplo yment systems , provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee’s wages.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Is benefit funding based on employer contributions?

In the majority of states, benefit funding is based solely on a tax imposed on employers. (Three states require minimal employee contributions.)

Does the employer pay FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee’s wages. The Department of Labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it. In general, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are ...

What is a compensation package?

A compensation package is your base pay plus other benefits. When considering a job offer or a raise, it is critical to take into account not just the base salary, but the entire compensation package that is offered.

What is base pay?

Base pay is expressed in terms of an hourly rate, or a monthly or yearly salary. In other words, a job ad that promises a base pay of $20 per hour means that the employee would earn a salary of $20 per hour worked, or $160 for an 8 hour day. Base salary does not include any extra lump sum compensation, including overtime pay or bonuses, ...

What happens when you get a job offer?

When you receive a job offer, the employer will present you with a compensation package that includes a base salary and potentially other benefits. You may choose to negotiate for a better compensation package if you believe that the offer is not in line with your skillset, education, career level or other strengths.

Why do employers ask about salary history?

First, keep in mind that the reason that employers ask about salary history is to determine your potential market value and to make sure that your salary expectations are in line with the budget for the role.

What to do if you feel uncomfortable sharing your salary history?

If you feel uncomfortable sharing your salary history or would like to avoid the discussion until the negotiation phase, you may politely decline by explaining that you would rather learn more about the role and its responsibilities before moving to a discussion of salary expectations.

Why are salaries higher in some regions?

In addition to your skills and qualifications, other factors can shape your base salary. Specifically, some regions are more expensive to live in than others. Salaries are often higher in more expensive locations so that employees can cover the higher cost of living.

What are the factors that affect the average salary?

Other factors of variation in base salary include education, skillset, cost of living, level of experience and seasonality.

Who Pays for Your Policy?

If your insurance does more than just reimburse you – for example, if you receive financial benefits when you are temporarily disabled or sick, for instance – these benefits might indeed be taxable. The primary factor decided who the tax burden falls on at this point is who is currently paying your premiums.

Is medical reimbursement taxable?

Personal Medical Expense Reimbursement. If your benefits do nothing but pay for doctor bills, prescriptions and hospital stays, then don't worry – those payments are not taxable. Even though your health insurance is essentially paying for these critical services, this will in no way be considered part of your annual income.

Is health insurance considered income?

Are Health Insurance Benefits Considered Income by the IRS? Health insurance is not taxable income, even if your employer pays for it. Under the Affordable Care Act, the amount your employer spends on your premiums appears on your W-2s, but it should in no way be classified as income.

Is insurance tax free?

The primary factor decided who the tax burden falls on at this point is who is currently paying your premiums. When you pay for the insurance policy, your benefits are tax-free. When your employer pays, the benefits are taxable.

Is 60 percent of your health insurance premiums taxable?

If it's a split – your employer pays 60 percent of the premiums, for example – then 60 percent of the benefits are taxable. Your employer should factor that into your withholding.

Is long term care insurance taxable?

If your disability or other health problems require long-term care, money you get from a long-term care insurance policy is usually tax-free. If there's a cash surrender value on the policy, your benefits are taxable.

Is adult child coverage taxable?

In that case, your coverage is a fringe benefit and part of your taxable income. One effect of the Affordable Care Act is that if you cover an adult child younger than 27, the coverage isn't subject to tax.

What Are Compensation and Benefits in The Workplace?

Why Are Compensation and Benefits Important?

- Human resources are the most important aspect of a company. The more talented a company’s workers are, the better its output and its bottom line. A competent approach toward compensation and benefits in the workplace goes a long way to ensuring that a company’s employees are satisfied. Some other reasons why compensation and benefits are important are …

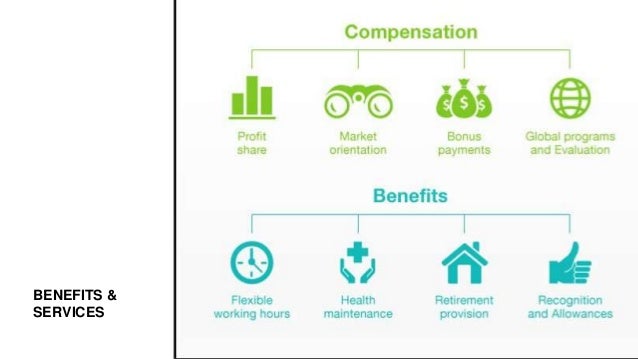

What Are The Key Components of Compensation and Benefits?

- As mentioned earlier, compensation and benefits can be divided into various elements such as salary, time off, healthcare, and well-being policies. However, compensation and benefits have three main components:

Sample Compensation and Benefits Package

- Each compensation and benefits program will look slightly different. On top of the standard offerings, this should reflect your company culture and core values. Also keep in mind any local laws and the roles each package covers. And consider what you will offer salaried full-time employees compared to part-time or contingent workers. When putting together a compensatio…

How Can You Maintain Compensation Fairness?

- Compensation fairness, essentially, ensures that everyone at a company is paid in accordance with the industry standard and their individual needs. In a scenario where all things are equal, every employee in the same position at a company would be paid an equal compensation package. However, in the real world, all things are rarely equal. And “when it comes to pay, fair d…

How to Calculate Compensation and Benefits

- While governments ensure that everyone that chooses to work gets paid a minimum wage, companies often adhere to an industry-wide standard when determining what they pay their employees. There are various ways to do that:

How Do Compensation and Benefits Ensure The Success of A Business?

- There are many parts that determine an employee’s compensation and benefits package at a company. It is important for an HR professional to establish that their company offers competitive compensation and benefits packages and communicate this to current and potential hires. Having clear guidelines around compensation and benefits provide two distinct advantages to a …

Key Difference – Compensation vs Benefits

What Is Compensation?

- Compensation is referred to as the financial payments paid to an employee in return for their contribution to the organization performing a designated job. Compensation includes the following factors. 1. Equitable wages and salariesincluding bonuses 2. Commissions 3. Cost of living increases (salary increase in line with inflation) Compensation is very important since this …

What Are Benefits?

- Benefits are non-financial forms of value provided in addition to compensation to the employee in return for their contribution to the organization. Thus, benefits can be explained as a form of non-financial compensation and include all rewards that are not a part of compensation. The number of benefits and the nature of benefits are different from...

Summary – Compensation vs Benefits

- The difference between compensation and benefits can be identified based on whether it is financial or non-financial. While compensation is the most important part of the remuneration package, benefits are also vital and should not be ignored. Every employee has his or her own set of needs and motivators. As a result, it is wrong to assume that everyone shares the same motiv…