1099R from death benefits. Yes. When you inherit something you don't have to pay tax on it so long as the person who died paid tax on it while they were alive. In this case you are inheriting a retirement account that they did not pay tax on so you - as the person inheriting it - will be paying taxes on the money.

Are employee death benefits taxable?

of a death benefit payment that is made up of Roth contri-butions is not taxable. The Roth earnings portion of a death benefit payment is qualified (i.e., paid tax-free) if 5 years have passed since January 1 of the year the participant made his or her first Roth contribution. Note: All death benefit payments will be disbursed pro rata

Can death benefits be taxed?

The death benefits paid on life insurance policies can be subject to an estate tax in two situations. The whole amount of the death benefit is included in the estate and subject to estate tax if the estate is named as beneficiary. Most people name individuals as beneficiaries, so the death benefit doesn't become part of their estate.

Are death benefits taxable income?

It could also cater to other goals including a luxurious holiday or safeguarding ones’ financial independence by securing a supplementary income that allows one ... Accidental Death Benefit Rider and Premium Waiver Rider. Also, it allows customers ...

Is Survivor Annuity taxable?

Q. Are survivor annuities paid to surviving spouse taxable? Distribution code on 1099-R is 4-Death Benefit and no federal income taxes were withheld. A. Yes, they are. However, if there are any...

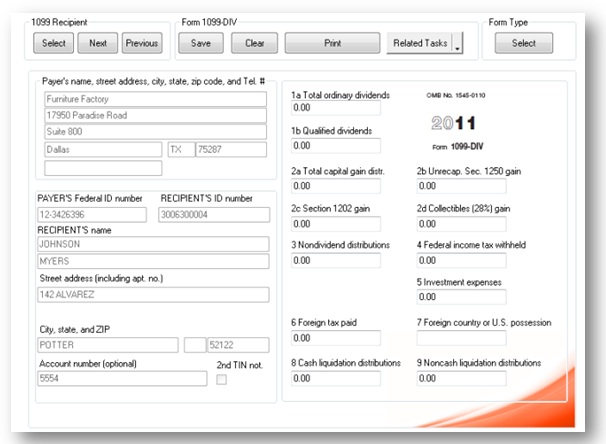

What is the death benefit exclusion on 1099-R?

If the client is the beneficiary of a deceased employee's pension and has received a death benefit exclusion, enter the exclusion amount in Screen 1099R, in the Retirement folder, in the Death benefit exclusion field (in the Pension/Annuity Information section).

Are death benefits taxable income?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Do beneficiaries get a 1099?

This means that when the beneficiary withdraws those monies from the accounts, the beneficiary will receive a 1099 from the company administering the plan and must report that income on their income tax return (and must pay income taxes on the sum).

Is a lump sum death benefit taxable?

While some forms of death benefits, such as life insurance payments, are not subject to income tax, the IMRF lump sum death benefit is taxable. Payments from insurance are not subject to income tax because the member paid the premiums on the policy using previously taxed money.

Do you get a 1099-R for life insurance proceeds?

Do you get a 1099 for life insurance proceeds? You won't receive a 1099 for life insurance proceeds because the IRS doesn't typically consider the death benefit to count as income.

Are widow survivor benefits taxable?

If your combined taxable income is less than $32,000, you won't have to pay taxes on your spousal benefits. If your income is between $32,000 and $44,000, you would have to pay taxes on up to 50% of your benefits. If your household income is greater than $44,000, up to 85% of your benefits may be taxed.

Who claims death benefit on tax return?

A death benefit is income of either the estate or the beneficiary who receives it. Up to $10,000 of the total of all death benefits paid (other than CPP or QPP death benefits) is not taxable. If the beneficiary received the death benefit, see line 13000 in the Federal Income Tax and Benefit Guide.

Do beneficiaries pay taxes on life insurance policies?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received. See Topic 403 for more information about interest.

Are funeral expenses tax deductible 2021?

Individual taxpayers cannot deduct funeral expenses on their tax return. While the IRS allows deductions for medical expenses, funeral costs are not included. Qualified medical expenses must be used to prevent or treat a medical illness or condition.

How do I report a death benefit on my taxes?

Death benefits from nonqualified deferred compensation plans or section 457 plans paid to the estate or beneficiary of a deceased employee are reportable on Form 1099-MISC. Do not report these death benefits on Form 1099-R. However, if the benefits are from a qualified plan, report them on Form 1099-R.

Is a one time death benefit taxable?

Death Benefit Only Plans Payments are still taxed as ordinary income.

What is the death benefit exclusion?

Death benefit exclusion. If you are the beneficiary of a deceased employee (or former employee) who died before August 21, 1996, you may qualify for a death benefit exclusion of up to $5,000. The beneficiary of a deceased employee who died after August 20, 1996, won't qualify for the death benefit exclusion.

What is a 1099R?

A 1099R reports income which was a distribution from a retirement plan. Basically and principal put in the retirement pre-tax, plus any increased value is taxed.#N#Other death benefits may taxed differently.

Is a 1099R taxable?

I believe a 1099R is a distribution from a retirement plan so it is most likely taxable when paid as a death benefit. It will not be subject to penalty.#N#The exception to the taxable part is any amount that represents a return of the decedent's basis. For example, if the decedent made non-deductible IRA contributions.

What is a 1099-R?

File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans , IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, pensions, insurance contracts, survivor income benefit plans, permanent and total disability payments under life insurance contracts, charitable gift annuities, etc.

Who must file 1099-R?

The payer, trustee, or plan administrator must file Form 1099-R using the same name and employer identification number (EIN) used to deposit any tax withheld and to file Form 945, Annual Return of Withheld Federal#N#Income Tax.

What box is the gross distribution on a 1099-R?

If a rollover contribution is made to a traditional or Roth IRA that later is revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

What is the 10% early distribution tax?

The distribution could be subject to the 10% early distribution tax under section 72 (t). If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that later is revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R.

Do you file a separate 1099-R for a distribution?

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.

Do you report death benefits on 1099-R?

Also, report on Form 1099-R death benefit payments made by employers that are not made as part of a pension, profit-sharing, or retirement plan. See Box 1, later. Payments of reportable death benefits in accordance with final regulations published under section 6050Y must be reported on Form 1099-R.

What is a 1099-R?

File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs),

Who must file 1099-R?

The payer, trustee, or plan administrator must file Form 1099-R using the same name and employer identification number (EIN) used to deposit any tax withheld and to file Form 945, Annual Return of Withheld FederalIncome Tax.

Do you need to file a 1099-R for surrender of an annuity?

However, you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. If you are reporting the surrender of a life insurance contract, see

Do I need to furnish a 1099-R?

If you are required to file Form 1099-R, you must furnish a statement to the recipient. For more information about the requirement to furnish a statement to each recipient, see part M in the 2021 General Instructions for Certain Information Returns.

pmacduff

I did a search but can't find this particular question. I have also been through both the General instructions for forms 1099 and the specific 1099-R instructions.

Kimberly S

How would you have completed the form if the benefit had gone to a survivin spouse? It should be the same.

pmacduff

Believe it or not, every surviving spouse I have had rolled the benefit, so the taxable amount was always $0.00. I thought that there was an amount (for example $10,000) of death benefit up to which there isn't any taxation.

Bird

My instincts tell me that the taxable amount in this case is the $3,500 and that whoever files the decedent's tax return for 2007 will do the reporting accordingly.

Just used Free Tax USA for the first time! So happy

So I've used a combination of other tax sites over the years (Turbo, Slayer, Credit Karma) and finally decided to move over to the free option. As a single thirty something with a pretty straight forward tax situation, using Free Tax USA ended up being fantastic.

My employer handed me a 1099-NEC form but I'm an employee

For context, I am a Full time nanny, I sent my W4 and I9 to my boss but he gave me some BS reason why he couldn't hand me the W2.

Child Tax Credit Question

My ex claimed our kids in 2020, and received the 2021 tax credit advance all 6 months. His tax guy says if I claim them this year we will both get audited, and I won’t get the full credit. He went ahead and claimed them again this year before we could really talk about it, says he will give me a part of his return.

A friend of mine and I were going to start a business, he ran away with my money. I sued and the rule claimed it was a bad debt and it's unrecoverable: he flew the country. Can I deduct it as a bad debt in my taxes? It's a lot of money

In 2017 a friend and I were starting a business, although we had the paper work ready, he ran away with my ~100K before signing and started the business without me. I have the texts and emails asking for the money back, he said no or didn't reply.