What is the difference between fixed cost and variable costs?

Why the Differences Between Fixed and Variable Costs Matter

- Economies of Scale. Understanding the difference between fixed and variable costs can help a business owner identify economies of scale, which occur when a business makes cost reductions as it ...

- Break-Even Analysis. ...

- Operating Leverage. ...

Are salaries fixed or variable costs?

If you pay an employee a salary that isn't dependent on the hours worked, that's a fixed cost. Other types of compensation, such as piecework or commissions are variable. Annual salaries are fixed costs but other types of compensation, such as commissions or overtime, are variable costs.

Is employee salary a fixed cost?

When a firm pays an individual a salary, it is regarded as a fixed cost of doing business. Wages will be a typical cost of doing business and will generally remain fixed over a period of time. A fixed salary is compensation that is paid to an employee in the form of wages earned for work production time.

Are operating expenses fixed or variable?

When you operate a small business, you have two types of costs - fixed costs and variable costs. Fixed costs do not change with the amount of the product that you produce and sell, but variable costs do. A change in your fixed or variable costs affects your net income. It also affects your company's breakeven point.

Are employee salaries a fixed cost?

Salaried Labor is a Fixed Cost Examples include your rent, utilities, accounting expenses and annual staff salaries. Salaries are classified as fixed costs when they do not vary with the number of hours a person works, or with the output rolling off your production line.

Are employee salaries a variable cost?

If a company bills out the time of its employees, and those employees are only paid if they work billable hours, then this is a variable cost. However, if they are paid salaries (where they are paid no matter how many hours they work), then this is a fixed cost.

Is insurance a fixed cost or variable cost?

FixedFixed costs remain the same regardless of production output. Fixed costs may include lease and rental payments, insurance, and interest payments.

Why salaries are a fixed cost?

Employee salaries: Salaries are paid on an annual basis, so they are considered fixed even if you give your employee a raise over time. On the other hand, if you pay sales bonuses or commissions, these are considered to be variable costs because they're tied to production.

Is a manager's salary a fixed cost?

Fixed expenses or costs are those that do not fluctuate with changes in production level or sales volume. They include such expenses as rent, insurance, dues and subscriptions, equipment leases, payments on loans, depreciation, management salaries, and advertising.

Is health insurance a fixed cost?

Your health insurance, car insurance, life insurance, and homeowners or renters insurance are also examples of fixed costs.

What are 5 examples of variable expenses?

Here are some common examples of variable expenses to account for in your monthly budget:Packaging costs.Utilities, like electricity and water.Credit card and bank fees.Hourly wages and direct labor.Shipping costs.Raw materials.Sales commissions.

When does fixed cost become variable cost?

Now, referring to your question on when does a fixed cost become a variable cost? No, fixed cost will not become variable cost...according to the examples above. The only way fixed cost seem to vary is when there is an adjustment on that cost over time. As stated in the rental cost example above, the adjustment to the rental cost is not according to the sales values, by according to the landlord's decision. Even if the fixed cost do change, it only change over a long period...probably annually or once in a few years.

What is fixed cost?

Fixed costs are items of cost that, in total ,do not change at all with volume or quantity. Building rent, property taxes and management salaries are illustrations of fixed costs.There might be an objection that rents are bound to increase in the following year due to inflation, but for the period the rent is not influenced by sales volume or the quantity.

What is semi variable cost?

Moving to semi-variable costs ,semi-variable costs may be defined as those costs which are a combination of fixed-cost and variable cost items.it is to be noted that in this context semi means partly not half.The total amount of a semi-variable cost item varies partly with but not proportionately with volume!

What is the term for the cost that remains the same regardless of the volume produced?

The cost which remains same, regardless of the volume produced, is known as fixed cost . Again Semi Variable Cost also includes some fixed part and variable cost which changes with the change in output.

What is the maxim that higher volume creates higher costs?

If an economic entity enhances the number of goods and services it produces, the amount of resources it uses to produce the increased volume or quantity should also increase. This leads to the maxim that higher volume creates higher costs. In a large number of cases the percentage increase in costs is less than the increase in quantity or volume.

Is FICA a variable cost?

FICA taxes on wages paid to line factory workers are most likely a pure variable cost. Health insurance payments for all employees are more likely fixed. All fringe benefits paid for managerial personnel are probably fixed. Pension payments paid for line factory workers could well be mixed costs, depending on the provisions of the pension contribution plan.

Is FICA a fixed cost?

FICA taxes on wages paid to line factory workers are most likely a pure variable cost. Health insurance payments for all employees are more likely fixed. All fringe benefits p

When creating your benefits package and forecasting costs for your business, it’s helpful to use accurate benchmarking data to?

When creating your benefits package and forecasting costs for your business, it’s helpful to use accurate benchmarking data to guide your decisions. A great place to start is by reviewing the United States Bureau of Statistics to get an idea of what the true cost of employee benefits are across the U.S.

How much does it cost to train an employee?

In addition to this, Training Magazine reports that in 2019, companies spent on average $1,286 dollars per employee to train them on their roles. When you consider that most employees need up to 6 months ...

What happens if you miss enrolling dates?

Missing enrolling dates, not having all proper documentation on file, charging employees the wrong amount for their coverage, and failure to terminate coverage within the proper time frame are all common mistakes in paperwork that can have severe financial penalties and thus impact on your business.

Is it bad to have employees who are not happy?

The costs of benefits can be challenging for your budget; however, having employees who are not happy or healthy can be even more detrimental . The people you hire will make the difference between whether you fail or succeed as a company, so if managed well, your investment will pay off. Bookmark ( 0)

Is healthcare cost going up?

According to Investopedia, healthcare costs are projected to continue rising across the U.S. Beyond government policy, some drivers of these cost increases include:

Can an employee start off with a single health plan?

While an employee may start off their career needing an individual/single health benefits plan, this situation could change as they potentially get married or have kids. This change will increase the cost of their benefits package for the employer.

How to determine if labor costs are fixed or variable?

A good rule of thumb for determining whether a labor cost is variable or fixed is to ask whether you would incur the cost if the business closed operations for the day. Labor costs that would need to be paid such as management salaries are fixed costs.

What are variable labor costs?

Labor costs that would not need to be paid such as commissions, piece workers, hourly rates and overtime wages are variable costs. Maximizing variable labor costs and minimizing fixed labor costs is one way to reduce overhead, and stay profitable during slow-selling periods. References.

What is fixed cost?

A fixed cost is one that stays the same every month regardless of how much you're selling. Examples include your rent, utilities, accounting expenses and annual staff salaries. Salaries are classified as fixed costs when they do not vary with the number of hours a person works, or with the output rolling off your production line. So, a full-time salaried manager earning $40,000 per year is still required to manage and is contractually entitled to receive his $40,000 salary, regardless of how many widgets you're manufacturing. The amount is fixed.

What are fixed expenses?

Examples of so-called fixed expenses include rent, electricity and property taxes. Other costs are variable, which means they go up or down with the volume of sales or production. Labor can be either a fixed or variable cost, depending ...

How much does a full time manager make?

So, a full-time salaried manager earning $40,000 per year is still required to manage and is contractually entitled to receive his $40,000 salary, regardless of how many widgets you're manufacturing. The amount is fixed.

Is labor a fixed or variable cost?

The labor cost is considered a fixed cost. When you pay only for the number of hours worked on an as-needed basis – which is usually the case when hiring temporary or contract laborers or piece-workers – then it is considered a variable cost. It goes up or down with production.

Can hourly rates be fixed?

Hourly Wages Can Be Fixed or Variable Costs. Hourly rate labor may be fixed or variable depending on the circumstances. If the worker is paid an hourly wage but is contractually guaranteed a fixed number of hours each week, and is paid for the fixed number of hours irrespective of his actual working hours, then the worker is effectively ...

Why is it important to classify costs as variable or fixed?

Classifying costs as either variable or fixed is important for companies because by doing so, companies can assemble a financial statement called the Statement/Schedule of Cost of Goods Manufactured (COGM) Cost of Goods Manufactured (COGM) Cost of Goods Manufactured (COGM) is a term used in managerial accounting that refers to a schedule ...

Why are high volumes and low volatility good for machine investment?

High volumes with low volatility favor machine investment, while low volumes and high volatility favor the use of variable labor costs. If sales were low, even though unit labor costs remain high, it would be wiser not to invest in machinery and incur high fixed costs because the high unit labor costs would still be lower than ...

What is the difference between financial accounting and managerial accounting?

While financial accounting is used to prepare financial statements that benefit external users, managerial accounting is used to provide useful information to people within an organization, mainly management, to help them make more informed business decisions.

Is fixed cost related to volume?

Graphically, we can see that fixed costs are not related to the volume of automobiles produced by the company. No matter how high or low sales are, fixed costs remain the same.

Do fixed costs change with increases or decreases in units of production volume?

Fixed costs do not change with increases/decreases in units of production volume, while variable costs fluctuate with the volume of units of production. Fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Analysis of Financial Statements How to perform Analysis ...

What are fixed and variable costs for restaurants?

Fixed and variable costs for restaurants (with examples) Some costs, such as loan payments ( most restaurants get initial funding from loans) and equipment depreciation (all restaurants need expensive equipment to operate) are more likely to apply to restaurants than to other types of businesses.

What is variable cost?

Falling under the category of cost of goods sold (COGS), your total variable cost is the amount of money you spend to produce and sell your products or services. That includes labor costs (direct labor) and raw materials (direct materials).

How do variable costs affect sales?

Variable costs increase in tandem with sales volume and production volume. They’re also tied to revenue—since the more you sell, the more revenue you have coming in. So, if you sell tote bags, and your sales revenue doubles during the holidays, you’ll also see your variable costs—including the cost of wholesale tote bags—increase.

What is fixed cost?

Fixed costs (aka fixed expenses or overhead) Fixed costs stay the same month to month. They aren’t affected by your production volume or sales volume. You can think of them as the price of staying in business: Even if your company isn’t making any sale, you have to pay your fixed costs.

When it's time to cut costs, what are the first places you turn?

When it’s time to cut costs, variable expenses are the first place you turn. The lower your total variable cost, the less it costs you to provide your product or service. So you get to keep more of your revenue as income. Further reading: Variable Costs: A Simple Guide.

Is overhead better or worse for a business?

For some businesses, overhead may make up 90% of monthly expenses, and variable 10%. For others, it may be the other way around. Neither is better or worse.

Do you have to pay for insurance for an event?

Insurance and event licenses. You may be required to pay a minimum amount, increasing with the number of attendees.

What is variable cost?

Variable costs are inventoriable costs – they are allocated to units of production and recorded in inventory accounts, such as cost of goods sold. Fixed costs, on the other hand, are all costs that are not inventoriable costs. All costs that do not fluctuate directly with production volume are fixed costs. Fixed costs include various indirect costs ...

Why do variable costs go up?

Variable costs go up when a production company increases output and decrease when the company slows production. Variable costs are in contrast to fixed costs, which remain relatively constant regardless of the company’s level of production or business activity. This is because the company may still be under contract or agreement with workers ...

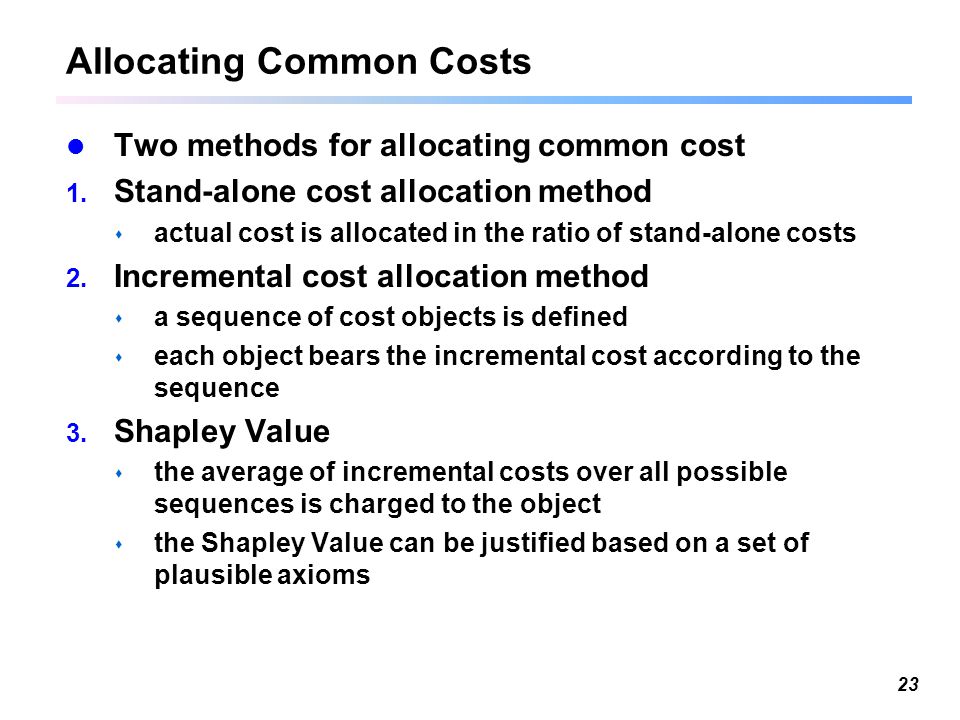

What is common cost?

A common cost is a cost that is not attributable to a specific cost object, such as a product or process. For example, the cost of rent for a production facility is not directly associated with any single unit of production that is manufactured within that facility, and so is considered a common cost.

Do fixed costs change with production?

Although fixed costs do not vary with changes in production or sales volume, they may change over time. Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not.

Is prime cost calculation misleading?

As a result, the prime cost calculation can be misleading if indirect costs are relatively large. A company likely incurs several other expenses that would not be included in the calculation of the prime cost, such as manager salaries or expenses for additional supplies needed to keep the factory running. These other expenses are considered ...

Can direct costs be indirect?

Put another way, a company can avoid the cost if they no longer produce the good or service. Direct costs do not include indirect expenses, such as advertising and administrative costs. It is important to understand the behavior of the different types of expenses as production or sales volume increases.

Is fixed cost relevant to decision?

Since fixed costs will be incurred regardless of the outcome of the decision, those costs are not relevant to the decision. Only costs that will or will not be incurred as a direct result of the decision are considered.

What is variable cost?

A variable cost is one that may increase or decrease over the course of an accounting period. When a firm pays an individual a salary, it is regarded as a fixed cost of doing business. Wages will be a typical cost of doing business and will generally remain fixed over a period of time.

What is fixed salary?

A fixed salary is compensation that is paid to an employee in the form of wages earned for work production time. These costs will remain relatively stable over the course of the month. Here’s an example: A foreman may have a salary of $2,500 per month. He will receive the same salary no matter how many hours he works for his employer in that month.

Do fixed costs change during each accounting period?

When salaries are paid to quality control and sales staff, these are categorized as manufacturing overhead costs. Fixed costs do not change during each accounting period. However, the cost per unit of the product can change as the production amount increases or decreases.

Is salary a fixed cost?

With that said, salaries are generally regarded as a fixed cost!

What Are Variable Costs?

2 As sales go up, so do variable costs. As sales go down, variable costs go down. Variable costs are the costs of labor or raw materials because these items change with sales. One way for a company to save money is to reduce its variable costs.

What Are Fixed Costs?

Fixed costs are the costs associated with your business's products or services that must be paid regardless of the volume you sell. 1 One example of a fixed cost is overhead. Overhead may include rent for the space your company occupies, such as your office space or your factory space. Here are the top five fixed costs in most businesses:

What are the two types of costs that a small business has?

When you operate a small business, you have two types of costs - fixed costs and variable costs.

What is indirect cost?

Indirect costs refer to costs that are not directly associated with the production of goods, such as rent and insurance.

What is an expense in business?

Examples are prepaid expenses, inventory, and fixed assets. An expense is a cost whose utility has been used up. For example, if you buy a van to use in your business, you depreciate it over time.

What are some examples of variable costs?

Here are some examples of variable costs: Direct Materials - the raw materials that go into the production of your product. Production Supplies - the supplies that are necessary for the machinery that help produce your product, such as supplies that help maintain your equipment. Sales Commissions - the part of a worker's salary ...

Can you reduce fixed costs to improve cash flow?

Reducing certain fixed costs to improve your cash flow is possible, but may require decisions like moving to a less expensive workplace or reducing the number of employees. Other fixed costs, like depreciation, on the other hand, won't improve your cash flow but may improve your balance sheet.

Financial Accounting vs. Managerial Accounting

Example 2

- Let’s say that XYZ Company manufactures automobiles and it costs the company $250 to make one steering wheel. In order to run its business, the company incurs $550,000 in rental fees for its factory space. Let’s take a closer look at the company’s costs depending on its level of production. Launch our financial analysis coursesto learn more!

Applications of Variable and Fixed Costs

- Classifying costs as either variable or fixed is important for companies because by doing so, companies can assemble a financial statement called the Statement/Schedule of Cost of Goods Manufactured (COGM). This is a schedule that is used to calculate the cost of producing the company’s products for a set period of time. The COGM is then transferre...

More Accounting Resources

- This has been CFI’s guide to Fixed and Variable Costs. To keep learning and advancing your career, the following resources will be helpful: 1. Analysis of Financial Statements 2. Guide to Financial Modeling 3. The Analyst Trifecta 4. Advanced Excel Formulas