Step 1: Calculate Your Monthly Earnings

- Calculate Your Monthly Earnings Your Social Security benefit calculation starts by looking at how long you worked and how much you made each year. ...

- Calculate Your Primary Insurance Amount (PIA) Once you have calculated your Average Indexed Monthly Earnings (AIME), you'll plug that number into a formula to determine your Primary Insurance ...

- Adjust Your PIA for the Age You Will Begin Benefits

How do you determine your Social Security benefit amount?

- For earnings that fall within the first band, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall within the second band, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

How do you estimate your Social Security benefit?

Key Points

- Social Security benefits may not be as high as you think.

- The average benefit is going up in 2022.

- Your benefit could be above or below average, depending on your wages over your career.

How to calculate your projected Social Security benefit?

- For every dollar of average indexed monthly earnings up to $926, you’ll get 90 cents per month in benefits.

- For every dollar of average indexed monthly earnings between $927 and $5,583 you’ll get $.32 cents per month in benefits.

- For every dollar of average indexed monthly earnings beyond $5,583 you’ll get $.15 cents per month in benefits.

What is the formula to determine social security?

With that in mind, the 2019 formula is:

- % of the first $926 of AIME.

- % of AIME greater than $926, but less than $5,583.

- % of AIME greater than $5,583.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

How much do you have to earn to get maximum Social Security?

In 2022, if you're under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

Is Social Security based on highest 40 quarters?

To even be eligible for retirement benefits, you generally need 10 years (40 quarters) of gainful employment. In 2017, you need to earn at least $1,300 in a quarter for it to count as a credit.

How is Social Security calculated if you work less than 35 years?

If you stop work before you start receiving benefits and you have less than 35 years of earnings, your benefit amount is affected. We use a zero for each year without earnings when we calculate the amount of retirement benefits you are due. Years with no earnings reduces your retirement benefit amount.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much Social Security will I get if I make $40000 a year?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

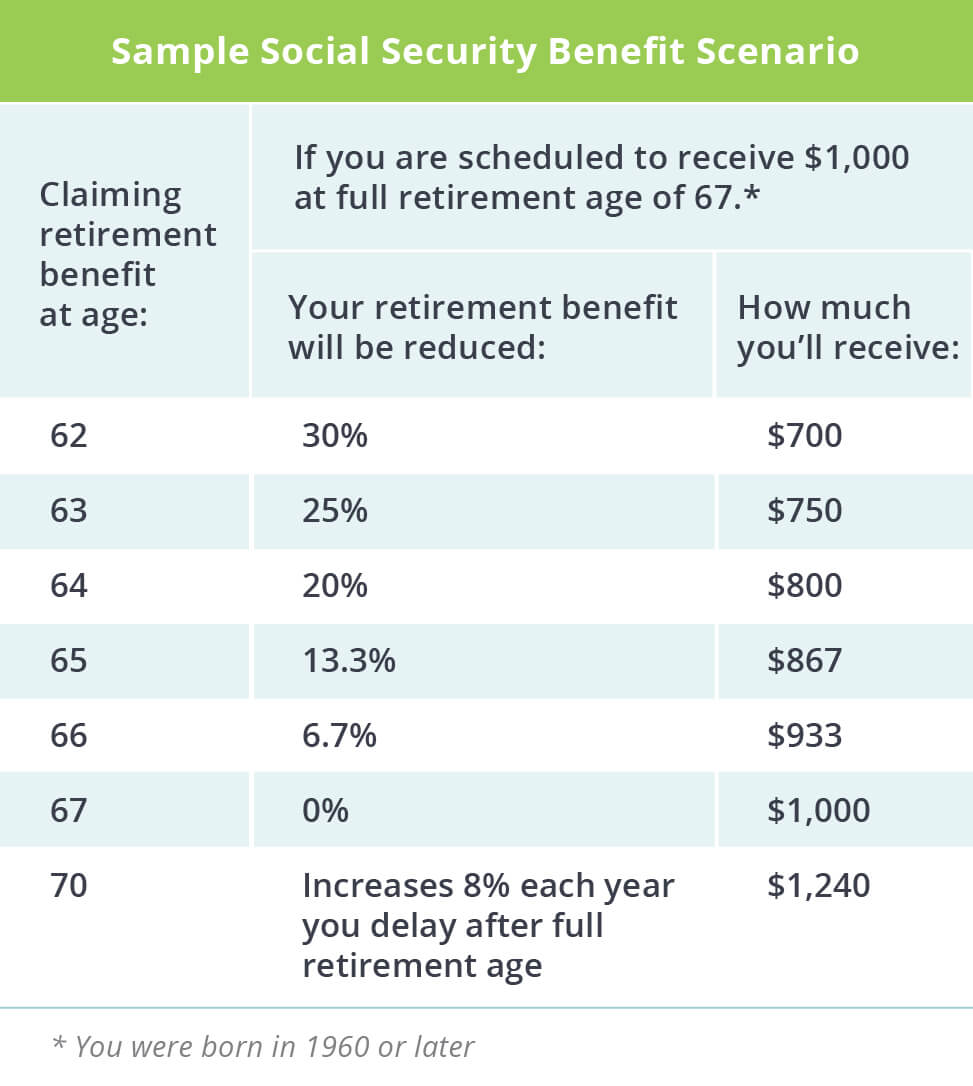

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How many years do you have to work to get maximum Social Security?

35 yearsQualifying for Social Security in the first place requires 40 work credits or approximately 10 years of work. 2 To be eligible to receive the maximum benefit, you need to earn Social Security's maximum taxable income for 35 years.

What does 40 credits mean for Social Security?

The Social Security Administration (SSA) defines “enough work” as earning 40 Social Security credits. More specifically, in 2022, an individual receives one credit for each $1,510 in income, and they can earn a maximum of four credits per year. So, 40 credits are roughly equal to 10 years of work.

Can I get Social Security if I only worked 10 years?

Anyone born in 1929 or later needs 10 years of work (40 credits) to be eligible for retirement benefits.

How do I know if I have 40 credits for Social Security?

Earn 40 credits to become fully insured In 2022, the amount needed to earn one credit is $1,510 . You can work all year to earn four credits, or you can earn enough for all four in a much shorter length of time. If you earn four credits a year, then you will earn 40 credits after 10 years of work.

What percentage of a spouse's Social Security benefit is a PIA?

If you're married, the PIA will also figure in any benefit amount that your spouse would be due, generally 50 percent of your PIA if the spouse turns on the tap at full retirement age. The PIA is also the basis of a survivor's benefit and a child's benefit.

What is the effect of Social Security on lower income earners?

The effect of these calculations is that a Social Security benefit "replaces" more of the income of lower-wage earners than it does for higher-wage earners. The effect is to help level the playing field in retirement between workers of different income levels.

How many years of work do you have to work to get Social Security?

It starts with Social Security examining your earnings history — with an emphasis on the money you earned during your 35 highest-paid years. That means that if you worked 40 years, Social Security would use your highest-paid 35 years in its calculations and ignore the other five.

What is PIA in Social Security?

The next step is to calculate your all-important primary insurance amount (PIA).

Why do I get my unemployment benefits early?

The reason: If you start early, you will get more payments for a longer period of time, but with smaller amounts of money in each payment .

Is Social Security an earned benefit?

The first is that a Social Security benefit is an earned benefit. It's not a freebie. We Americans earn our benefits by working for many years and paying the Social Security tax in each of those years. That tax is 6.2 percent of your wages up to a ceiling ($127,200 in 2017).

Is there a limit to how high a salary can go on Social Security?

There are limits to how high it can go, however, because wages above the ceiling aren't subject to Social Security tax and aren't counted in your benefit calculation. OK, now that we know the rules of the retirement road, let's see how Social Security figures out the dollars and cents that become your monthly benefit.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How to calculate Social Security benefits?

Your Social Security benefit is based on your average indexed monthly earnings (AIME). You can calculate this by looking at your annual income each year. Make sure you only include the portion of your income that was subject to Social Security tax.

How much does the SSA withhold?

If you make more than $45,360 in 2018 after filing a claim for Social Security benefits, SSA withholds $1 in benefits for every $3 you earn in excess of this higher limit.

How many years do you have to work to get Social Security?

Add up your income for the 35 highest years. Social Security benefits are based on your average earnings for 35 years of work. If you haven't worked for at least 35 years, Social Security will average in zeroes for as many years as you are short. If you've worked more than 35 years, choose the 35 years in which you earned the most income.

How much will Social Security be reduced if you retire early?

However, if you claim your benefit before you reach full retirement, your benefits will be reduced by 30 percent.

What is the age of full retirement?

1. Determine your normal retirement age (NRA). Your NRA, also called "full retirement age," is based on the year you were born, but varies generally from 65 to 67. This is the age at which you will receive your full benefit amount. If you file a claim for Social Security benefits before this age, you'll get less money.

Is Social Security taxable if spouse is still working?

This is also true if your spouse is still working, since Social Security benefits are also taxable. Decide whether you plan to keep working. If you don't intend to completely quit working after you file your claim for Social Security benefits, the SSA may withhold some of your benefits.

What is the Social Security wage base?

In 2019, the base is $132,900, an increase of $4,500 from last year. The wage base is the maximum amount of income on which Social Security taxes must be paid. “If a person works (fewer) than 35 years, missing years are filled in with zeros.

What is the foundation of a retirement plan?

Experts often say that the foundation of a retirement plan is like a three-legged stool, with the legs of the stool being Social Security, employer-sponsored retirement benefits and personal savings. Social Security benefits will be a big portion of monthly retirement income for many Americans, and it helps to know how the benefits are calculated.

How many credits do you need to get full retirement?

To qualify for your full benefit, you must have accrued a certain number of credits. If you were born after Jan. 2, 1929, you need 40 credits (or 10 years of work) to receive your full retirement benefit. In 2019, you must earn $1,360 to get one credit. You may earn up to four credits per calendar year.

Can you get a reduced Social Security if you claim early?

You get a reduced benefit if you claim benefits early, and you get a higher benefit if you delay claiming benefits up to age 70. “Claiming Social Security early results in a permanent pay cut from what your benefit would be at full retirement age,” warns Greg McBride, CFA, Bankrate’s chief financial analyst.

When can I claim my Social Security benefits?

You can claim earned benefits as early as age 62, the minimum retirement age. However, if you claim before your full retirement age, your monthly benefits will be lower. If you claim later than full retirement age, your benefits will be higher.

How much does Social Security pay out if only one spouse works?

If only one spouse worked, then the Social Security Administration calculates half of the worker spouse’s PIA and adjusts it (between 32.5% and 50% ) based on the age of the claiming spouse. If both spouses worked, then the Social Security Administration first pays out benefits on one’s own earnings record.

What happens to Social Security benefits if you claim a survivor before your full retirement age?

Moreover, if a survivor claims this benefit before their survivors full retirement age, the benefits are reduced by a percentage based on their birth year. (See the survivors full retirement age by birth year below. Note that survivor benefits have a different full retirement age than other Social Security benefits.)

What is the difference between a higher and lower earning spouse's PIA?

So take as an example a couple where the lower-earning spouse’s PIA is $1,100, and the higher-earning spouse’s PIA is $2,000. Because the $2,000 PIA is greater than half of the lower-earning spouse’s PIA, the lower earning spouse will not receive a spousal benefit.

What is the maximum amount of Social Security benefits in 2020?

The maximum amount of earnings a worker can use toward Social Security changes every year. In 2020, that maximum is $137,700. That 35-year total is divided by 12 to reach the “average indexed monthly earnings” (AIME). That AIME figure is then used in a formula.

What is PIA in Social Security?

Your PIA is what your monthly benefit would be if you started collecting Social Security at your full retirement age (FRA). Your full retirement age is calculated based on your birth year: The other factor that determines your Social Security benefit amount is how old you are when you claim.

How long do you have to work to get Social Security?

The Social Security Administration bases those benefits on the highest 35 years of a worker’s salary history. (If someone worked less than 35 years, all of their working years will be used.)

How long do you have to be a Social Security employee to get full benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born.

How much will Social Security be in 2052?

starting in 2052 at age 66: $48,771. The earliest you can begin receiving benefits is at age 62. Spouse's annual Social Security benefit. The earliest you can begin receiving benefits is at age 62. Social Security Benefits Accounting for Inflation: 1st year of benefits through age 95.

How does Social Security affect retirement?

Social Security benefits in retirement are impacted by three main criteria: the year you were born, the age you plan on electing (begin taking) benefits and your annual income in your working years. First we take your annual income and we adjust it by the Average Wage Index (AWI), to get your indexed earnings.

What age do you have to be to claim Social Security?

If you claim Social Security benefits early and then continue working, you’ll be subject to what’s called the Retirement Earnings Test. If you’re between age 62 and your full retirement age, and you’re claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly.

How long do I have to work to get Social Security?

To get your social security benefits we do a couple things. First we assume that you have or will work for 35 years before electing social security benefits (this is needed to calculate your benefits) We then take your income and we adjust it by the Average Wage Index (AWI), to account for the rise in the standard of living during your working ...

Does Social Security protect against inflation?

That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation. It’s a big perk that doesn’t get a lot of attention.

Is Social Security a tax?

You may hear people grumbling about the Social Security “Earnings Tax”, but it’s not really a tax. It’s a deferment of your benefits designed to keep you from spending too much too soon. And after you hit your full retirement age, you can work to your heart’s content without any reduction in your benefits.

How to figure out my Social Security benefits?

There are four ways to figure out your Social Security benefits: visit a Social Security office to get an estimate; create an account at the official Social Security website and use its calculators; let the SSA calculate your benefits for you; or calculate your benefits yourself. Doing the calculations for yourself involves understanding what AIME, ...

What is the NAWI adjustment factor for Social Security?

To be conservative, use a NAWI adjustment factor of 1.0 in column B for all future years.

How to increase PIA?

There are four ways the starting benefit can be permanently increased or reduced from the PIA calculated at age 62: 1 Starting benefits early – Benefits may begin as soon as age 62, but they are permanently reduced for every month between the onset of benefits and FRA. 18 2 Delaying benefits beyond full retirement age – Delayed retirement credits can permanently increase benefits, and they are awarded for every month between FRA and a later onset of benefits. 20 3 Starting early and continuing to work – If you start benefits before your FRA and keep working, the SSA may deduct the part of your benefits that exceeds a threshold. However, any such deductions are not permanent. When you reach your FRA, the SSA recalculates your benefits and credits back any deductions. 21 4 Continuing to work, period – Even if you don’t start benefits early, you can increase your benefits by continuing to work up to any age. Any year in which your indexed earnings are higher than one of your 35 previous highest years will boost your benefits. 22 However, after age 60 you will not receive wage indexing, and after age 62 you will not receive bend point inflation indexing.

When does index factor change to 1.0000?

Notice that the index factor becomes 1.0000 in 2014, the year in which the worker turns 60, and it remains 1.0000 without changing for any future years of taxable earnings. If you plan to continue working after age 60, just project your taxable earnings in column two and use 1.0000 in column three for all future years.

Is Social Security progressive?

Social Security is designed as a “progressive” social insurance system, which means it replaces a greater part of average monthly pay for low-income workers than it does for high-income workers. The bend points implement this skew relative to each worker’s AIME. 13 .

Is Social Security open by appointment?

Due to the COVID-19 pandemic, Social Security offices are only open by appointment, and to get an appointment you need to be in a “dire need situation.” 6 Most people will have to transact their business online, by phone, or through the mail.

Can you wait until you start receiving Social Security benefits?

You can wait until you decide to start receiving benefits and let the SSA calculate the amount for you. However, this doesn’t help you plan ahead, and while the SSA can usually be counted on to determine benefits accurately, mistakes can be made. 5 .