Is long term care insurance a good investment?

Long-term care insurance can help you pay for the costs associated with your care as you get older and need help with everyday activities — such as bathing, dressing and eating — or care ...

What are the benefits of long term care?

- A drug and alcohol-free environment for an extended period of time

- Time to break the cycle of relapse and dependence

- Time for the body to heal physically

- Structured daily schedule

- Supervision and support

- Sober peers and accountability

- Family treatment and education programs

- Consistent monitoring to track progress and modify the treatment plan as needed

How to fund Long Term Care?

- You can tell us about news and ask us about our journalism by emailing [email protected] or by calling 425-339-3428.

- If you have an opinion you wish to share for publication, send a letter to the editor to [email protected] or by regular mail to The Daily Herald, Letters, P.O. ...

- More contact information is here.

When to buy long term care insurance?

“When care is needed, people want to remain in their own home, something the long-term care insurance industry has known for decades,” Slome admits. “But everything associated with the product category focuses on skilled care with home care listed as a secondary benefit that is included.

In which case are long-term care benefits taxable?

If payments exceed the greater of $360 per day (adjusted annually for inflation) or the actual amount of qualified long-term care expenses incurred, the excess payment amounts are taxable as income when benefits are paid.

Are long-term care insurance benefits taxable income?

In general, the income from a long-term care insurance policy is non-taxable, and the premiums paid to buy the insurance are tax deductible.

Do I need to report 1099 LTC?

Do I have to report benefits from a Long-Term Care Insurance policy to the IRS? Generally, no. Tax-qualified Long-Term Care Insurance benefits come to you tax-free. Insurance companies that pay long-term care insurance benefits are required by the Internal Revenue Service (IRS) to provide claimants with a 1099 LTC.

Is long-term care a tax deduction?

Long-term-care costs. You can deduct unreimbursed costs for long-term care as a medical expense if certain requirements are met. This includes eligible expenses for in-home, assisted living and nursing-home services. First, the long-term care must be medically necessary.

How do I report a 1099 LTC on my tax return?

If unchecked, the payments should be reported as Other Income in Schedule 1 (Form 1040) notated "LTC". Box 5 "Chronically ill" or "Terminally ill" may be checked, along with the date certified.

Where do I put long-term care insurance on my tax return?

Qualified long-term care premiums, up to the amounts shown below, can be included as medical expenses on Form 1040, Schedule A, Itemized Deductions or in calculating the self-employed health insurance deduction: Age 40 or under: $450.

How do I enter a 1099 LTC in Turbotax?

How do I enter a 1099-LTCFrom the top, select tab Federal Taxes.Wages and Income /Scroll down to Less Common Income section.Choose Miscellaneous Income, 1099-A, 1099-C / Start.Scroll down to Long-term care account distributions (Form 1099-LTC) , continue to follow the prompts.

Is long-term care and accelerated death benefits taxable?

Accelerated death benefits for individuals certified as chronically ill are generally excludable from income, just as they would be if paid under a qualified LTC insurance contract. Your 1099-LTC may list a large amount of benefits for which you may not necessarily owe taxes (a "tax-qualified policy").

Where do I enter CCH 1099 LTC?

How do I enter IRS-1099LTC information in a 1040 return using worksheet view in CCH Axcess™ Tax and CCH® ProSystem fx® Tax?Go to Income/Deductions > Medical Savings Accounts. Select Section 3 - LTC Insured Information. In Lines 1-4, enter the applicable information. ... Calculate the return.

Are long-term care benefits taxable 2022?

2022 Tax Year Remember, benefits paid under a qualified Long-Term Care Insurance policy are generally excluded from taxable income.

Are long-term care premiums tax deductible in 2021?

Premiums for "qualified" long-term care insurance policies (see explanation below) are tax deductible to the extent that they, along with other unreimbursed medical expenses (including Medicare premiums), exceed 7.5 percent of the insured's adjusted gross income in 2021.

Are long-term care premiums tax deductible in 2020?

The Internal Revenue Service just announced the increased limits for tax deductibility of long-term care insurance premiums. According to IRS Revenue Procedure 2019-44, a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as $10,860 in 2020.

What is tax qualified long term care insurance?

A tax-qualified Long-Term Care Insurance contract qualifies for favorable federal income tax treatment. If the policy only pays benefits that reimburse you for qualified long-term care expenses you will not owe federal income tax on these benefits. 2. If Box 3 is marked "Reimbursed Amount" and you have a Non-Tax Qualified Contract, ...

How to get 1099 LTC?

If you are preparing your own taxes make sure you order or download the Instructions for Form 1099-LTC from the Internal Revenue Service. You can request free tax forms and guides by calling the IRS at 1-800-TAX-Form or 1-800-829-3676. Otherwise, your tax preparer should have access to this form.

What is the box in a health insurance claim?

Box 1. Gross benefits paid by the insurance company. Box 2. Does not apply to long-term care insurance. Box 3. This indicates benefits paid (as reflected in Box 1) as either on a Per Diem (Indemnity) basis or as a Reimbursement for actual long-term care expenses incurred. Box 4: This is an optional field that indicates if benefits were paid ...

When will insurance companies issue 1099?

The insurance companies typically will issue these special 1099 forms in January for the previous tax year. All payments which were made directly to you, as well as those that were paid to a third party on your behalf, will be reflected on the Form 1099-LTC.

Is per diem insurance taxable?

Because benefits were paid on a per diem (indemnity) basis , without regard to the actual long-term care expenses incurred, the amount of benefits that may be excluded from income is subject to a daily maximum amount. If this per diem (indemnity) limitation is exceeded, part of the benefits received may be taxable.

Is long term care insurance tax deductible?

Usually, the benefits from a Long-Term Care Insurance policy are tax-free and, in some cases, premiums can be tax-deductible. All tax-qualified Long-Term Care Insurance benefits will come to you tax-free in most cases. The insurance companies that pay these benefits are required by the Internal Revenue Service ...

Is Box 3 taxable?

If Box 3 is marked "Reimbursed Amount" and you have a Non-Tax Qualified Contract, then some or all of your benefits may be taxable. Again, the insurance company can tell you if your policy is considered a Non-Tax Qualified policy. A Non-Tax Qualified policy may result in a tax liability. You should consult a tax-advisor.

What is the floor for medical expenses?

The federal tax code has a 7.5 percent floor governing medical expenses deductions taken on Schedule A (Form 1040), meaning that the premium expense is deductible to the extent that it exceeds 7.5 percent of the individual’s Adjusted Gross Income. There are other considerations with regard to the policyholder’s age.

Can nursing home expenses be deducted?

The costs of care in a nursing home or similar institution, as well as the wages and other amounts paid for nursing services at home, can be included as medical expenses deductions. In such cases the services provided must be connected with the individual’s chronic illness.

Is long term care insurance taxable?

In general, the income from a long-term care insurance policy is non-taxable, and the premiums paid to buy the insurance are tax deductible. Similar tax advantages exist at the state level, but each state treats the subject differently. The fact that there are tax benefits to purchasing long-term care coverage testifies to ...

Is a medical conference tax deductible?

Medical conference costs are deductible if the conference is primarily for and necessary to the medical care of you, your spouse or dependent. Expenses for prescribed drugs and medicines are tax deductible. Q.

How much can you exclude from your income?

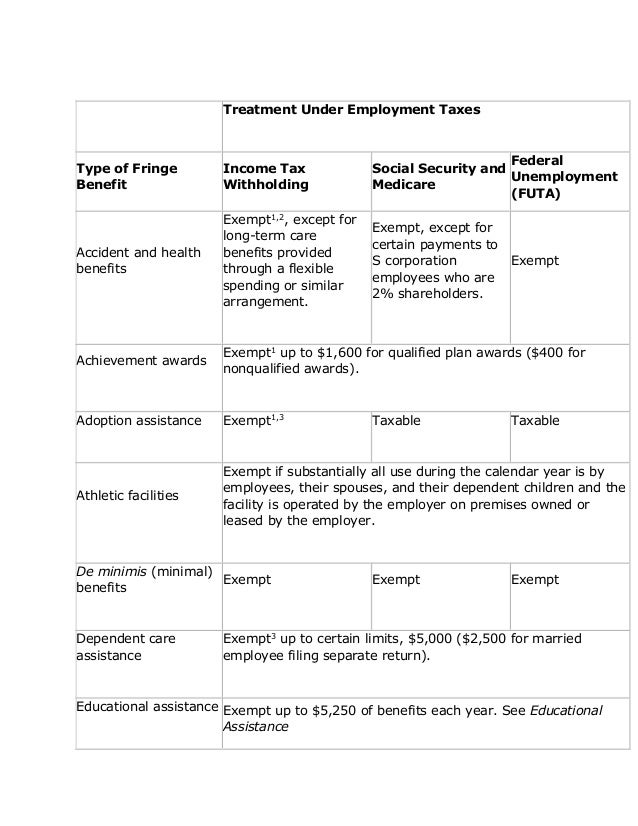

However, the amount you can exclude is limited to your employer's cost and can’t be more than $1,600 ($400 for awards that aren’t qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that don’t create a significant likelihood of it being disguised pay.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

What is included in gross income?

In most cases, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

Is emergency financial aid included in gross income?

The amounts of these are not included in the gross income of the eligible self-employed individual. Emergency financial aid grants. Certain emergency financial aid grants under the CARES Act are excluded from the income of college and university students, effective for grants made after 3/26/2020.

Does the Cares Act include EIDL?

Other loan forgiveness under the CARES Act. Gross income does not include any amount arising from the forgiveness of certain loans, emergency Economic Injury Disaster Loan (EIDL) grants, and certain loan repayment assistance, each as provided by the CARES Act, effective for tax years ending after 3/27/2020.

How does long term care affect taxes?

How does long-term care insurance affect my taxes? If you’re already covered by long-term care (LTC) insurance, you may be eligible to deduct some or even all of your LTC premiums. Or, if you’re receiving payments from a LTC insurance plan, you could exclude from your taxable income any payments made to you.

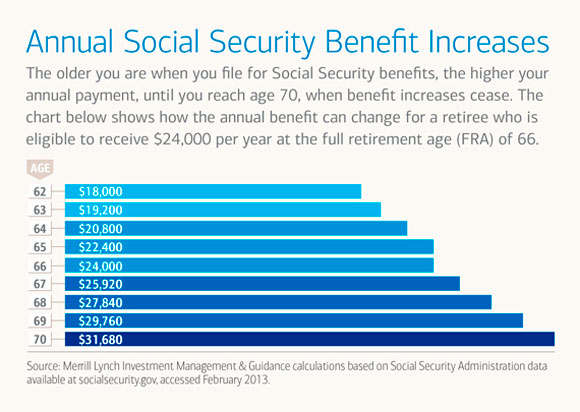

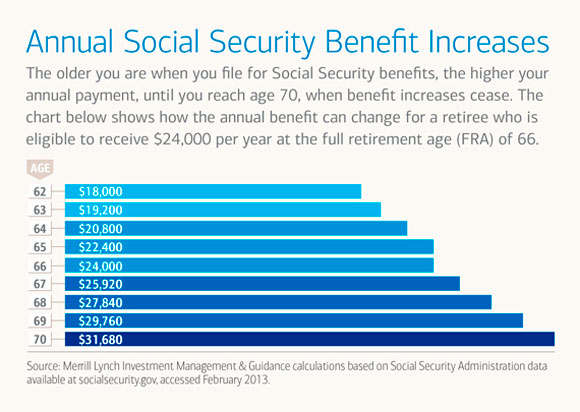

How much can you pay for per diem in 2020?

However, if payments are made regardless of expenses paid, then there’s a limit. If you’re receiving payments on a periodic or per diem basis, the limit is $380 for each day for the 2020 tax year.

Can I deduct LTC premiums?

You may deduct LTC insurance premiums as a medical expense. As with all deductible medical expenses, you’ll need to meet the percentage of AGI floor requirement first. See Deducting Medical Expenses. You can deduct premiums up to a certain limit based on your age.

Can you exclude long term care from your taxable income?

To exclude payments from your taxable income, your plan must meet a few requirements: You, your spouse, or dependent receiving care must be considered chronically ill by a licensed health care practitioner. Your plan must only provide coverage for long-term care and must be renewable.

Does a long term care plan have to be renewable?

Your plan must only provide coverage for long-term care and must be renewable. Your plan must not provide cash or have a surrender value or money that is pledged, assigned, or borrowed. Check with your HR department or LTC provider to make sure your plan meets these requirements.

Is LTC insurance taxable?

Payments from a LTC insurance plan are considered taxable income, but you may be able to exclude that income from your return. But: If your employer makes any contributions toward your LTC premiums, the contributions must be reported as income on your return.

What is group long term disability?

Group long-term disability insurance: Group long-term provides coverage to a group of employees through your employer. It provides disability coverage for years and normally a health exam is not needed to qualify. That’s a nice plus.

Is long term disability insurance taxable?

Are Long-Term Disability Insurance Benefits Taxed? The answer is mainly no, but it depends and there are exceptions to every rule. For both individual and group long-term disability policies, the benefits may not be taxable. If the premiums are paid with after-tax dollars (they usually are), then your long-term disability benefits are not taxed.

Is long term disability insurance considered medical?

The fact is the IRS does not view your long-term disability insurance premiums as a medical expense. Technically they are not incorrect. You are receiving replacement income in the event you become disabled, ill or injured. You are not, however receiving payment for medical care.

Can you deduct long term disability insurance premiums?

No, the IRS still does not allow you to deduct your long-term disability insurance premiums from your federal taxes. They don’t deem your disability premiums as a medical expense, no matter how you slice the pie.

What is a tax qualified long term care contract?

A tax-qualified long term care insurance contract qualifies for favorable federal income tax treatment. If the policy only pays benefits that reimburse you for qualified long-term care expenses you will not owe federal income tax on these benefits. 2. If Box 3 is marked "Reimbursed Amount" and you have a Non-Tax Qualified Contract, ...

When do you need a 1099 for long term care?

Insurance companies usually issue these 1099 LTC Forms in January for the prior tax year.

What is the box in a health insurance claim?

Box 1. Gross benefits paid by the insurance company. Box 2. Does not apply to long-term care insurance. Box 3. This indicates benefits paid (as reflected in Box 1) as either on a Per Diem (Indemnity) basis or as a Reimbursement for actual long-term care expenses incurred. Box 4: This is an optional field that indicates if benefits were paid ...

Is per diem insurance taxable?

Because benefits were paid on a per diem (indemnity) basis, without regard to the actual long-term care expenses incurred; the amount of benefits that may be excluded from income is subject to a daily maximum amount. If this per diem (indemnity) limitation is exceeded, part of the benefits received may be taxable.

Is Box 3 taxable?

If Box 3 is marked "Reimbursed Amount" and you have a Non-Tax Qualified Contract, then some or all of your benefits may be taxable. Again, the insurance company can tell you if your policy is considered a Non-Tax Qualified policy. A Non-Tax Qualified policy may result in a tax liability. You should consult a tax-advisor.

Is Box 3 a tax qualified policy?

If Box 3 is marked "Reimbursed Amount" and the policy is categorized as a Tax-Qualified Contract, then the amount of money received can generally be excluded from the income being reported. The insurance company can tell you if your policy is considered a Tax-Qualified policy. A tax-qualified long term care insurance contract qualifies ...

Do I need a 1099 for LTC?

It causes policyholders to wonder about the tax implications of their LTC benefit, however the 1099 forms are required simply to show the IRS you received tax-free benefits from your long-term care insurance policy. It does not necessarily mean that the amount is taxable income to you.

What is a qualified long term care contract?

A qualified long-term care insurance contract is treated as an accident and health insurance contract. Thus, amounts (other than dividends or premium refunds) received under such a contract are treated as amounts received for personal injuries and sickness and are treated as reimbursement for expenses actually incurred for medical care. ...

What is the box 4 on a 1099 LTC?

Box 4 may be checked to indicate the benefits were from a qualified long-term care contract.

Is per diem taxable?

Notably, this “ per diem” rule will not apply, regardless of payment size, if the payments are fully allocable to the reimbursement of the insured’s long-term care insurance expenses. However, payments in excess of reimbursements may become taxable to the extent they exceed the per diem limitation as calculated above. 2.

Is medical excess taxable income?

If the amount reimbursed exceeds the total amount of medical expenses paid, then the excess would be taxable income regardless of whether they are transferred into another long term care insurance policy.

Is long term care insurance considered income?

When is long term care insurance reimbursement considered income? Yes, when entering your medical expenses you would only enter the amount that you paid over and above the reimbursed amount ($15,000 for your example). Or, enter the full amount ($40,000) and also the reimbursement ($25,000).

Is long term care insurance taxable?

Since amounts received for personal injuries and sickness are generally not includable in gross income, benefits received under qualified long-term care insurance are generally not taxable. But there is a limit on the amount of qualified long-term care benefits that may be excluded from income. Generally, if the total periodic payments received ...

Is LTC reimbursement taxable?

Generally, your LTC reimbursement is only taxable if they exceed your medical expenses. Be sure to answer the TurboTax follow-up questions in the 1099-LTC interview. It may be best to answer having read the below info first. If you have additional questions or details regarding this, please feel free to post in the comments for further ...

What About The Tax Paperwork?

- People might think long-term care benefits are taxable because of how the paperwork goes out. When you receive benefits, the insurance company sends you a 1099-LTC tax form showing what they paid, which may lead you to believe you owe taxes. However, the 1099-LTC form helps with …

Are There Any Exceptions?

- If you receive cash on a per diem basis, there is a limit to how much of it can be tax-free. As of 2021, the maximum is up to $400 per day. This is true even if your daily long-term care expenses are under $400. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. For example, if you receive $450 a day and your e…

How Can You Prepare For Taxes?

- You should ask your insurer whether your long-term care insurance policy is tax-qualified or nonqualified. These days, most policies are qualified, but if yours is nonqualified, you may want to prepare by saving for potential taxes. Alternatively, you could explore converting your policy into a qualified one. If your policy offers a per diem benefit, you could also ask your insurer whether it'…