How does 529 plan affect my taxes?

When the Form 1099-Q is issued to the 529 plan beneficiary, any taxable amount of the distribution will be reported on the beneficiary’s income tax return. This typically results in a lower tax obligation than if the Form 1099-Q is issued to the parent or 529 plan account owner.

Are there any tax advantages with California 529 plans?

Like most 529 plans, California’s ScholarShare 529 plan has state tax benefits that mirror the federal tax benefits: Contributions are eligible for the annual gift tax exclusion of $15,000 ($30,000 for a couple giving jointly) Contributions beyond the annual gift tax exclusion are eligible for 5-year gift tax averaging, permitting lump sum contributions of up to $75,000 ($150,000 for a couple giving jointly) without incurring gift taxes; Earnings accumulate on a tax-deferred basis

How does 529 affect taxes?

- 529 plan accounts are investment vehicles

- 529 plan accounts grow tax-free

- There are no federal 529 tax deductions

- Many states have 529 tax deductions for contributions

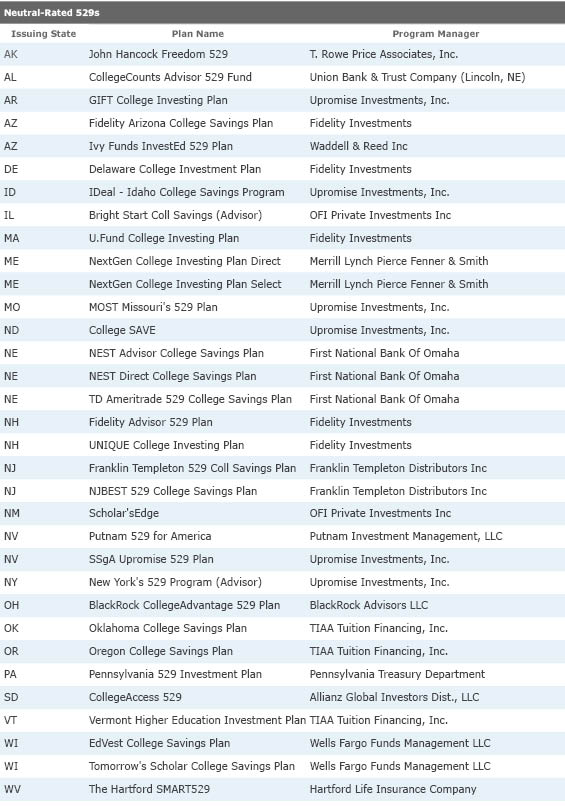

- You can shop for 529 plans outside your state

- You should plan for 529 contribution limits

Can you get a 529 plan tax deduction?

While no federal tax break exists for deducting 529 plan contributions, you may be able to claim a deduction or tax credit at the state level. Here’s more on how a 529 plan deduction works and when you may be able to claim one on your taxes.

How much can you gift to a 529?

This allows someone to be able to gift up to $14,000 to a 529 account of any beneficiary without incurring federal gift tax. Additionally, married spouses filing jointly can engage in gift splitting and fund the account with $28,000 a year per beneficiary.

What is the power of a 529?

The real power behind a 529 comes from the tax-deferred growth and tax-free withdrawals it can provide. First, 529 plans can be invested in a wide range of investment options; some offer guaranteed returns while others are more like traditional mutual fund and stock market investments.

Is a 529 plan a state tax deduction?

While the state tax benefits of using a 529 plan vary from state to state, they are often enhanced or dependent on funding an in-state 529 plan. However, a few states (i.e., Arizona, Kansas, Maine, Missouri, Montana, and Pennsylvania), ...

Is a 529 plan subject to federal taxes?

The earnings generated in a 529 plan are not subject to federal income taxes, allowing the investments to grow without being depleted annually by taxes. Additionally, when the money is used for qualified education expenses, the distributions from the 529 plan are not subject to federal or state income taxes.

Can a 529 be taxable?

For instance, contributions to a 529 plan count as a present interest taxable gift to the beneficiary of the account. However, you can offset this tax issue by applying the annual federal gift tax exclusion amount to the gift.

What are the benefits of a 529 plan?

529 plan state income tax benefits. Many states offer incentives to encourage residents to save for college. Studies show that children who have even a small amount saved for college are more likely to attend and graduate. Having a highly educated workforce can help drive economic growth and development in the state.

What is the state tax deduction for 529?

Nebraska offers married taxpayers a state tax deduction for 529 plan contributions to a 529 plan of up to $10,000 per year. Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to $4,000 per year for each beneficiary.

How does a 529 plan work?

However, each state has its own rules regarding the type of tax benefit and the amount of 529 plan contributions that are eligible for a state tax deduction or credit each year.

How much is a 529 plan contribution for K-12?

529 plan contributions for K-12 tuition. The Tax Cuts and Jobs Act of 2017 expanded the definition of 529 plan qualified expenses to include up to $10,000 in K-12 tuition per year, per beneficiary. However, some states have not conformed with the federal law and consider K-12 tuition a non-qualified 529 plan expense.

Which states offer 529 deductions?

Pennsylvania. The most common benefit offered is a state income tax deduction for 529 plan contributions. However, Indiana, Utah and Vermont offer a state income tax credit for 529 plan contributions and Minnesota offers a state income tax deduction or tax credit, depending on the taxpayer’s adjusted gross income.

Can you rollover a 529 plan?

529 plan rollovers. Parents may consider rolling funds from an out-of-state 529 plan to their home state’s 529 plan and claiming a state income tax deduction or credit. Families may also consider switching 529 plans if they move to another state. However, some states do not allow taxpayers to claim a state income tax benefit for rollover ...

Can you carryforward a 529 plan in Ohio?

Carryforward of excess 529 plan contributions. Ohio is also one of 12 states that allow taxpayers to carryforward excess 529 plan contributions to deduct in future tax years. That means if the grandparents want to contribute more than Ohio’s annual limit of $4,000 per beneficiary, they may deduct the excess in future years in increments ...

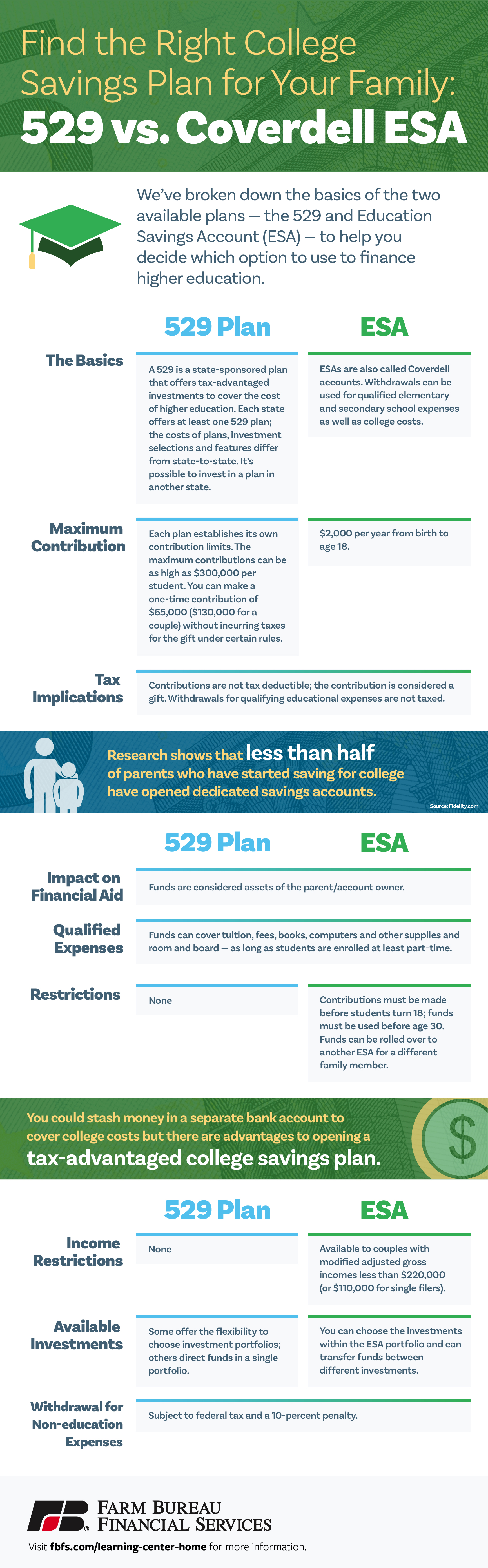

What is a 529 plan?

A 529 plan is a very hands-off way to save for education -to enroll,simply visit our Best 529 Plans page and select the plan you like best or contact your financial advisor. Most plans allow you to ‘set it and forget it’ with automatic investments that link to your bank account or payroll deduction plans.

What is the maximum amount you can contribute to a 529 plan?

Unlike Roth IRAs and Coverdell Education Savings Accounts, 529 plans have no income limits, age limits or annual contribution limits. There are lifetime contribution limits, which vary by plan, ranging from $235,000 – $529,000.

How often can you change your 529 plan?

You can change your 529 plan investment options twice per calendar year. You can rollover your funds into another 529 plan one time in a 12-month period. Hint: There is no federal limit on the frequency of these changes if you replace the account beneficiary with another qualifying family member at the same time. 7.

Can you choose a 529 plan if your state doesn't offer benefits?

If your state doesn’t offer benefits for residents, you can choose any other state’s plan. 3. You, the donor, stay in control of the account. With few exceptions, the named beneficiary has no legal rights to the funds in a 529 account, so you can assure the money will be used for its intended purpose.

Do 529 contributions have to be reported on taxes?

Simplified tax reporting. Contributions to a 529 plan do not have to be reported on your federal tax return. You won’t receive a Form 1099 to report taxable or nontaxable earnings until the year you make withdrawals.

Is a 529 plan tax deductible?

1. 529 plans offer unsurpassed income tax breaks. Although contributions are not deductible, earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college.

Can you claim 529 contributions on your taxes?

In addition to the federal tax savings, over 30 states currently offer a full or partial tax deduction or credit for 529 plan contributions. You can generally claim state tax benefits each year you contribute to your 529 plan, so it’s a smart idea to continue keep making deposits until you’ve paid your last tuition bill.

Is a 529 a good plan?

529s are a great option for education-minded savers, but the benefits of these plans don't stop there. In fact, there are sizable tax advantages within the 529 rules that can go a long way toward wealth transfer and estate planning, among other common concerns. Here are a few of the major tax-related advantages that 529 plans offer.

Can you withdraw from a 529?

529s may not get the same kind of attention or interest from investors as other high profile vehicles, but 529 may lack in pizzaz they make up in steady returns and unparalleled tax flexibility. Most states offer self-directed and managed plans, making it easy to manage your own money or leave it to a financial professional. And for as long as your account is active and funded, you can make withdrawals for qualifying expenses—even if they're not explicitly aimed at college-related expenses.

How to claim 529 contributions?

If you’re interested in deducting 529 plan contributions on your taxes, the first step is determining whether you live in a state that allows it. If you do, the next step is estimating how much of your contributions you can get deduct.

What is a 529 college account?

A 529 college savings account is a tax-advantaged way to set aside money for education expenses. All 50 states offer at least one 529 savings plan, though some may offer multiple options. You don’t have to be a resident of a particular state to contribute to that state’s plan. The money you save in a 529 account is allowed to grow on ...

What states allow 529 contributions?

State tax laws may be more favorable when it comes to getting a deduction for 529 plan contributions. More than 30 states offer some type of tax break in the form of a deduction or credit for 529 plan savers. Currently, the only states that don’t allow some type of tax incentive for contributing to a college savings account include: 1 Alaska 2 California 3 Delaware 4 Florida 5 Hawaii 6 Kentucky 7 Maine 8 Nevada 9 New Hampshire 10 New Jersey 11 North Carolina 12 South Dakota 13 Tennessee 14 Texas 15 Washington 16 Wyoming

What are qualified withdrawals for 529?

Qualified withdrawals include things like tuition, fees and room and board paid to a school that’s eligible to participate in federal student aid programs. In terms of how much you can contribute to a 529 plan, there are two thresholds to keep in mind. The first is the annual gift tax exclusion limit.

How much can you gift someone without triggering the gift tax?

The first is the annual gift tax exclusion limit. This limit says that you can gift someone up to a certain amount of money without triggering the gift tax. For 2021, that limit is $15,000 but if you’re married and file a joint return, you and your spouse can split your gift and contribute up to $30,000 to a 529 savings plan per child.

What are the benefits of the American Opportunity Credit?

The American Opportunity Credit and the Lifetime Learning Credit can also help reduce your tax liability if you paid out-of-pocket higher education costs. While a tax deduction reduces your taxable income for the year, tax credits reduce what you owe in taxes on a dollar-for-dollar basis.

Which states allow 529 deductions?

South Dakota. Tennessee. Texas. Washington. Wyoming. Whether you can get a 529 tax deduction or a tax credit depends on where you live and which state’s plan you contribute. Some states, for example, allow you to claim a tax deduction or credit, regardless of which state’s plan you’re enrolled in.