Key Takeaways

- Your Social Security benefits are based on the income you earned during your working years.

- Your benefits are permanently reduced if you take Social Security before you reach your full retirement age,

- Your benefit amount drops if you decide to work during retirement.

- You may collect unemployment and Social Security benefits simultaneously but you can't...

How are Social Security benefits affected by your income?

Key Points

- Your marital status could affect Social Security benefits.

- Divorce can sometimes leave you with a reduced Social Security check.

- Eligibility for spousal benefits and survivor benefits can depend how long you were married.

How do I estimate my Social Security benefits?

- Currently receiving benefits on your own Social Security record.

- Waiting for a decision about your application for benefits or Medicare.

- Age 62 or older and receiving benefits on another Social Security record.

- Eligible for a Pension Based on Work Not Covered By Social Security.

How do you determine Social Security benefits?

Then calculate your total retirement income based on Social Security plus IRA and 401(k) withdrawals, plus pensions and investment income. Unlike your other retirement investments, if you don’t use your Social Security benefits, you will lose them.

How to estimate your Social Security benefit?

Your Social Security benefit is decided based on your lifetime earnings and the age when you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation.

Is Social Security income based on gross or net income?

gross incomeWhen reporting your wages, Social Security requires that you report your gross income — the amount you've earned before any deductions were taken from your paycheck. Social Security looks at gross income to determine whether you're meeting or exceeding substantial gainful activity (SGA).

How much do you have to earn to get maximum Social Security?

2 To be eligible to receive the maximum benefit, you need to earn Social Security's maximum taxable income for 35 years. The cap, which is the amount of earnings subject to Social Security tax, is $147,000 in 2022, up from $142,800 in 2021.

Is Social Security determined by income?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings.

Is Social Security based on the last 5 years of work?

No, your Social Security benefits do not depend on the last three or five years of work.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much will I get from Social Security if I make $30000?

0:362:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

Is Social Security based on your highest earning years?

Social Security replaces a percentage of your pre-retirement income based on their lifetime earnings. The portion of your pre-retirement wages that Social Security replaces is based on your highest 35 years of earnings and varies depending on how much you earn and when you choose to start benefits.

How much Social Security will I get if I make $40000 a year?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

How many credits do you need to collect Social Security?

40 SocialYou must earn at least 40 Social Security credits to qualify for Social Security benefits. You earn credits when you work and pay Social Security taxes. The number of credits does not affect the amount of benefits you receive.

How many years of work to receive Social Security?

10 yearsAlthough you need 10 years of work, or 40 credits, to qualify for Social Security retirement benefits, we base the amount of your benefit on your highest 35 years of earnings.

How many years of Social Security is based on?

35 yearsCalculate your average indexed monthly earnings during the 35 years in which you earned the most. Apply a formula to these earnings and arrive at your basic benefit, or “primary insurance amount.” This is how much you would receive at your full retirement age — 65 or older, depending on your date of birth.

Why Is Income Important in The SSI Program?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot...

What Income Does Not Count For Ssi?

Examples of payments or services we do not count as income for the SSI program include but are not limited to:the first $20 of most income received...

How Does Your Income Affect Your SSI Benefit?

Step 1: We subtract any income that we do not count from your total gross income. The remaining amount is your "countable income".Step 2: We subtra...

Example A – SSI Federal Benefit With only Unearned Income

Total monthly income = $300 (Social Security benefit)1) $300 (Social Security benefit) -20 (Not counted) =$280 (Countable income)2) $750 (SSI Feder...

Example B – SSI Federal Benefit With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) =$232 divided by 1/2 =$116 (Countable income)

Example C – SSI Federal Benefit and State Supplement With only Unearned Income

The facts are the same as example A, but with federally administered State supplementation.1) $300 (Social Security benefit) -20 (Not counted) =$28...

Example D – SSI Federal Benefit and State Supplement With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) $232 divided by 1/2 =$116 (Countable income...

How Will Windfall Offset Affect My Benefit?

Windfall offset occurs when we reduce your retroactive Social Security benefits if you are eligible for Social Security and SSI benefits for the sa...

When Does Deemed Income Apply?

When a person who is eligible for SSI benefits lives with a spouse who is not eligible for SSI benefits, we may count some of the spouse's income i...

When Does Deemed Income Not Apply?

When you no longer live with a spouse or parent.When a disabled or blind child attains age 18. When an alien's sponsorship ends.

What is income in SSI?

Income is any item an individual receives in cash or in-kind that can be used to meet his or her need for food or shelter. Income includes, for the purposes of SSI, the receipt of any item which can be applied, either directly or by sale or conversion, to meet basic needs of food or shelter. Earned Income is wages, net earnings from ...

What are some examples of payments or services that do not count as income for the SSI program?

Examples of payments or services we do not count as income for the SSI program include but are not limited to: the first $20 of most income received in a month; the first $65 of earnings and one–half of earnings over $65 received in a month; the value of Supplemental Nutrition Assistance Program (food stamps) received;

What is considered in-kind income?

In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value. Deemed Income is the part of the income of your spouse with whom you live, your parent (s) with whom you live, or your sponsor (if you are an alien), which we use to compute your SSI benefit amount.

What is unearned income?

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives. In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

Can I get SSI if my income is over the limit?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot receive SSI benefits. Some of your income may not count as income for the SSI program.

What is SSI for disabled people?

We are with those who need a helping hand. The Supplemental Security Income (SSI) program provides support to disabled adults and children who have limited income and resources, as well as people age 65 and older who are not disabled but have limited income and resources.

Why do we pay disability benefits to people who can't work?

We pay disability benefits to those who can’t work because they have a medical condition that’s expected to last at least one year or result in death. Find out how Social Security can help you and how you can manage your benefits. LEARN MORE.

What is the age limit for Medicare?

Medicare. Medicare is our country’s health insurance program for people 65 or older. Certain people younger than age 65 can qualify for Medicare too, including those with disabilities and those who have permanent kidney failure. Social Security works with the Centers for Medicare and Medicaid Services to ensure the public receives ...

How much can I deduct from my Social Security?

If you haven't reached full retirement age, Social Security will deduct $1 from your benefits for every $2 or $3 you earn above a certain amount. After you reach full retirement age, Social Security will increase your benefits to account ...

How much can I deduct from my Social Security if I earn more than $50,520?

If you earn more than $50,520, it deducts $1 for every $3 you earn—but only during the months before you reach full retirement age. Once you reach full retirement age, you can earn any amount of money, and it won't reduce your monthly benefits. 3 . Note, however, that this money is not permanently lost. After you reach full retirement age, Social ...

What happens if you start collecting Social Security benefits earlier?

However, once you reach full retirement age, Social Security will recalculate your benefit to make up for the money it withheld earlier.

What happens to Social Security after you reach full retirement age?

After you reach full retirement age, Social Security will recalculate your benefit and increase it to account for the benefits that it withheld earlier. 7 .

What is the full retirement age?

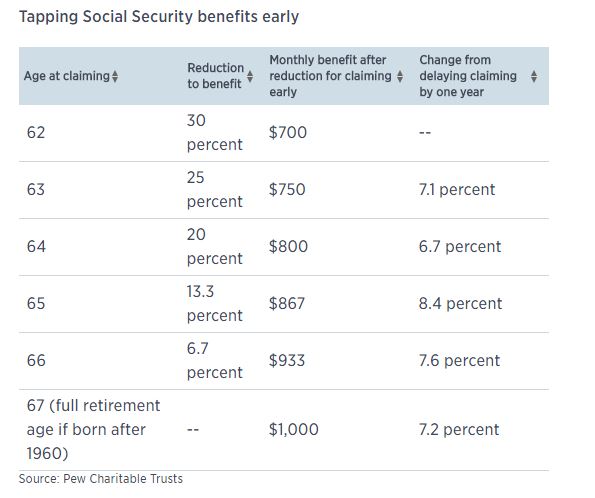

What Is Full Retirement Age? For Social Security purposes, your full or "normal" retirement age is between age 65 and 67, depending on the year you were born. If, for example, your full retirement age is 67, you can start taking benefits as early as age 62, but your benefit will be 30% less than if you wait until age 67. 4 . ...

How many Social Security credits will I get in 2021?

In 2021, you get one credit for each $1,470 of earnings, up to a maximum of four credits per year. That amount goes up slightly each year as average earnings increase. 3 . Social Security calculates your benefit amount based on your earnings over the years, whether you were self-employed or worked for another employer.

How many hours can I work to reduce my Social Security?

If you are younger than full retirement age, Social Security will reduce your benefits for every month you work more than 45 hours in a job (or self-employment) that's not subject to U.S. Social Security taxes. That applies regardless of how much money you earn.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

What is the effect of Social Security on lower income earners?

The effect of these calculations is that a Social Security benefit "replaces" more of the income of lower-wage earners than it does for higher-wage earners. The effect is to help level the playing field in retirement between workers of different income levels.

What percentage of a spouse's Social Security benefit is a PIA?

If you're married, the PIA will also figure in any benefit amount that your spouse would be due, generally 50 percent of your PIA if the spouse turns on the tap at full retirement age. The PIA is also the basis of a survivor's benefit and a child's benefit.

How many years of work do you have to work to get Social Security?

It starts with Social Security examining your earnings history — with an emphasis on the money you earned during your 35 highest-paid years. That means that if you worked 40 years, Social Security would use your highest-paid 35 years in its calculations and ignore the other five.

What is PIA in Social Security?

The next step is to calculate your all-important primary insurance amount (PIA).

Why do I get my unemployment benefits early?

The reason: If you start early, you will get more payments for a longer period of time, but with smaller amounts of money in each payment .

Is Social Security an earned benefit?

The first is that a Social Security benefit is an earned benefit. It's not a freebie. We Americans earn our benefits by working for many years and paying the Social Security tax in each of those years. That tax is 6.2 percent of your wages up to a ceiling ($127,200 in 2017).

Is there a limit to how high a salary can go on Social Security?

There are limits to how high it can go, however, because wages above the ceiling aren't subject to Social Security tax and aren't counted in your benefit calculation. OK, now that we know the rules of the retirement road, let's see how Social Security figures out the dollars and cents that become your monthly benefit.