What is the maximum unemployment benefit for Mississippi?

- You must be unemployed through no fault of your own. ...

- You must be physically and mentally able to work. ...

- You must be available for work and seeking full-time work. ...

- You must have earned at least $780 during the highest quarter of your Base Period to monetarily qualify for benefits.

- You must have worked at least two quarters during your Base Period

How many weeks of unemployment can you collect in Mississippi?

This will detail the amount of weekly benefits you can receive. In Mississippi, this is between $30 and $235 and is based on the amount of wages you earned during your Base Period. You can collect benefits for up to 26 weeks if you continue to meet all eligibility requirements. Know how and when you will be paid.

Why is unemployment high in Mississippi?

“We know the factors that cause people not to be in the labor force, and we know there are more of those in Mississippi than in other states,” he said. “Disability is one of them. We know Mississippi has lower rates of high school and college attainment degree than the nation as a whole, so that’s probably attributing to it.

What states pay the highest unemployment?

- Connecticut: $649 max normal a week, up to $749 with dependents

- Illinois: $484 max normal a week, up to $667 with dependents

- Massachusetts: $823 max normal a week, up to $1,234 with dependents

- Ohio: $480 max normal a week, up to $647 with dependents

- Pennsylvania: $572 max normal a week, up to $580 with dependents

What are the eligibility requirements for unemployment benefits in Mississippi?

See full answerTo be eligible for UI benefits, one must:1. Must be unemployed through no fault of your own.2. File a weekly claim as required - Claims filed late may be denied.3. Be able to work - You must be mentally and physically able to work your normal work week.4. Be available for work - You must be ready to go to work. You must be willing to accept full-time work. You must have transportation and have made necessary childcare arrangements. You cannot have barriers or conditions, which prevent you from accepting work immediately.5. Be actively seeking work - To meet availability requirements you must make a "good faith" effort to find work. An active work search effort is required.

How long is the unemployment benefit waiting period in Mississippi?

If it is determined that you are eligible for benefits, the first eligible week that you file a claim will serve as your waiting period week. You will not be paid for this week.

What if I go back to work full-time after unemployment in Mississippi?

Advise the MDES Call Center of the date you will return to work, or provide the date when filing your weekly claim form..

What are my rights if I disagree with an eligibility decision for unemployment benefits in Mississippi?

Whether you are an employer, or a claimant, you have the right to file an appeal and receive a hearing.

How can I correct wrong information on my 'Monetary Determination' in Mississippi?

Once you file a claim for benefits, you will receive a Monetary Determination. The Monetary Determination shows the wages reported by your employer(s) during each quarter of your base period. Study the notice carefully. Be sure that it includes all wages paid during the quarters shown. If you believe that some wages you earned are not shown, you should contact the MDES Call Center and file a request for re-determination.

Where can I get information on unemployment benefits appeal in Mississippi?

You may call the Appeals department in the state office at (601) 321-6294.

What is unemployment in Mississippi?

In Mississippi, unemployment benefits are administered through the Mississippi Department of Employment Security (MDES). Unemployment insurance benefits are provided to individuals who are unemployed through no fault of their own , and are designed to ease the economic burden of a job loss on a temporary basis .

How long do you have to collect unemployment in Mississippi?

In Mississippi, this is between $30 and $235 and is based on the amount of wages you earned during your Base Period. You can collect benefits for up to 26 weeks if you continue to meet all eligibility requirements. Know how and when you will be paid. You will be paid after you you’re your second weekly claim.

How much will I be paid?

In Mississippi, the maximum Weekly Benefit Amount (WBA) IS $235. The minimum WBA is $30. The amount you receive for your WBA is based on the total wages in the highest quarter of your Base Period divided by 26. The Base Period of a claim includes the first four of the last five completed calendar quarters immediately preceding the effective date that you filed your claim.

What if I am denied benefits?

If you are denied unemployment insurance benefits, you have the right to appeal that decision and receive a hearing. To file an appeal, within 14 days of the mailing date of your decision, you may file by mailing an appeal request to:

What information do I need to file unemployment in Mississippi?

You will need: Your Social Security number. Your current mailing address. Your phone number.

What happens after you file for unemployment?

After you file an initial claim for benefits, you will receive a Monetary Determination. This will show the amount of wages reported by your employer during each quarter of your base period. Verify that it is accurate and contact the MDES Call Center if you find any errors.

What is the maximum WBA in Mississippi?

Weekly Benefit Amount (WBA) - The weekly amount payable to an individual based on a valid claim. In Mississippi, the maximum WBA is $235 and the minimum WBA is $30.

How much is unemployment in Mississippi?

The maximum Weekly Benefit Amount (WBA) allowed in Mississippi at this time is $235.00. Your WBA for unemployment insurance benefits is based on the total wages in the highest quarter of your Base Period and by dividing that amount by 26. The base period of a claim includes the first four (4) of the last five (5) completed calendar quarters immediately preceding the effective date of the claim. The minimum WBA in Mississippi is $30.00. To estimate your WBA you must first determine what your wages are for the highest quarter during your Base Period. You may find this amount on the Benefit Chart in column A., and your estimated weekly benefit amount will be shown in column B.

How much do you have to work to qualify for unemployment?

Must have earned at least $780.00 in the highest quarter of your base period. Must have earned 40 times your weekly benefit amount in your base period.

What is the maximum WBA in Mississippi?

Benefit Eligibility Requirements. The maximum Weekly Benefit Amount (WBA) allowed in Mississippi at this time is $235.00. Your WBA for unemployment insurance benefits is based on the total wages in the highest quarter of your Base Period and by dividing that amount by 26.

What is the base period for unemployment?

The base period is always the first 4 of the last 5 completed calendar quarters immediately preceding the effective date of the claim.

How to appeal unemployment in Mississippi?

You'll receive a determination in the mail telling you if you qualify for benefits. If you don't, you can file an appeal by contacting the Mississippi Department of Employment Security by phone or by mailing a written appeal request. You must do this within 14 days of receiving your determination.

How long can I collect unemployment benefits?

However, the CARES Act extends that period by 13 weeks, allowing you to collect unemployment benefits for up to 39 weeks.

What if my unemployment claim is denied?

You'll receive a determination in the mail telling you if you qualify for benefits. If you don't, you can file an appeal by contacting the Mississippi Department of Employment Security by phone or by mailing a written appeal request. You must do this within 14 days of receiving your determination.

When does Mississippi suspend the work search requirement?

Your past income must meet the state's minimum standards. Mississippi has suspended the work-search requirement until June 27, but you still need to meet the other two requirements. The state looks at your past earnings during a base period -- the first four of the last five completed quarters.

Can Mississippi workers turn to unemployment?

Image source: Getty Images. Many Mississippi workers can turn to unemployment for assistance during these uncertain times. Many Mississippi workers can turn to unemployment for assistance during these uncertain times . Mississippi is feeling the effects of the COVID-19 pandemic, just like every other state. Thousands of workers must stay ...

Do I qualify for unemployment benefits?

Mississippi workers must meet the following requirements to qualify for unemployment benefits:

What is the expanded unemployment benefit?

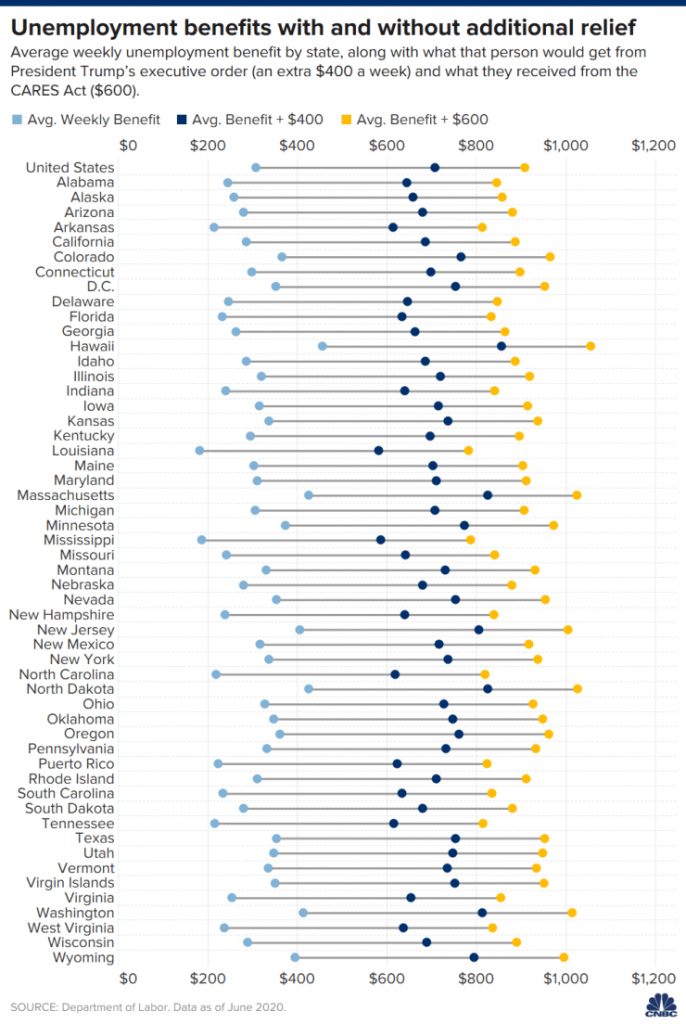

Expanded Unemployment Benefits Under the CARES Act. The Coronavirus Aid, Relief, and Economic Security (CARES) Act included a section that expanded unemployment benefits by an additional $600 per week on top of the benefit offered by states. This provision is being rolled out on a state by state basis, however, ...

When will the 600 unemployment benefit be rolled out?

This provision is being rolled out on a state by state basis, however, the benefit is retroactive to April 5, 2020. The additional $600 weekly benefit brings the state and federal unemployment benefits up to an average of the median weekly wage in the United States.

How many weeks of unemployment benefits are there in 2020?

It adds an additional 13 weeks of benefits through December 31, 2020. Most states currently offer 26 weeks of unemployment benefits (see the unemployment benefits by state section below). it expands benefits for part-time, seasonal, self-employed, and contract workers (such as those in the gig economy). Offers to reimburse the cost ...

How long do you have to wait to apply for unemployment?

You should apply for unemployment compensation as soon as you are unemployed. Most states will make you wait for one week before you are able to apply for unemployment benefits. However, this is currently waived due to the coronavirus outbreak.

When will the 600 dollars be available for unemployment?

It provides an additional $600 per week in benefits and payments through July 31, 2020.

Do all workers get maximum unemployment?

Additionally, this table lists the maximum unemployment insurance benefits you can receive. Not all workers will receive the maximum benefit. Benefits are often based on your previous salary, if or when you previously claimed unemployment compensation, and how long you have been working. Each state may also have additional rules regarding whether or not you are out of work through no fault of your own, whether or not you receive any additional income from employment or side gigs, or whether or not you receive additional income from a pension or retirement benefits.

Is unemployment taxable income?

Be aware that unemployment insurance benefits are considered taxable income . However, most states do not automatically withhold any taxes from your unemployment benefits. You may opt to do so, which will save you from a large tax bill down the road.

How is Missouri unemployment calculated?

Your Weekly Benefit Amount in Missouri is determined by dividing your average wages in your two highest recent quarters by 25. If you collect wages while on UI benefits, the state will disregard an amount equal to 20% of your WBA or $20, whichever is greater.

How To Apply For Unemployment Benefits?

You can file for unemployment benefits online, by phone, or by visiting your nearest unemployment office. Visit your Department Of Labor website to know more about applying for unemployment benefits in your state.

Why The Benefit Amount Varies From One State To Another?

The major reason for variation in the benefit amount from one state to another is the UI replacement rate. UI replacement rate is nothing but the percentage of your previously earned income replaced by the unemployment benefits. For instance, in 2019, D.C. average UI replacement was 21%, whereas Hawaii’s replacement rate was 55%.

How much is your weekly benefit in Illinois?

Your Weekly Benefit Amount in Illinois would be 47% of your average weekly wages in the two highest quarters of your base period. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/2 of your WBA.

How is Hawaii's weekly benefit determined?

Your Weekly Benefit Amount in Hawaii is determined by dividing your earnings in the highest quarter of your base period by 21. If you collect wages while on UI benefits, the state will disregard $150.

How to determine weekly benefits in Georgia?

Your Weekly Benefit Amount in Georgia is determined by dividing your two highest earning quarters by 42, or your earnings in your highest earning quarter by 21. If you collect wages while on UI benefits, the state will disregard $50.

How is the weekly benefit amount determined in Connecticut?

Your Weekly Benefit Amount in Connecticut is determined by dividing your average earnings in your two highest latest quarters by 26. If you collect wages while on UI benefits, the state will disregard 1/3rd of your weekly earnings.

How long does it take to get unemployment benefits?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How Long Will I Receive Benefits?

Usually, most states permit an individual to obtain unemployment for a maximum of 26 weeks or half the benefit year. A benefit year is a period when your claim is established, and it will remain open for one year (52 weeks).

How to Claim for a Benefits Extension?

If you are presently filing weekly claims for unemployment benefits, carry on filing your weekly claim if you are jobless or are working reduced hours. Thye will inform you by mail if you are eligible for the added benefits.

How to File An Initial Claim in Your State?

If you have been separated from work, you can file your initial claim during your first week of total or partial unemployment.

How to File Your Weekly Claim?

Through the Internet – You can file your weekly claim online. You must have a User ID and PIN to file your weekly claim online.

What happens if you work temporarily and get unemployment?

If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced. Ensure that you contact your state unemployment insurance department once you are unemployed.