We’ll reduce your Social Security benefits by two-thirds of your government pension. In other words, if you get a monthly civil service pension of $600, two-thirds of that, or $400, must be deducted from your Social Security benefits. For example, if you’re eligible for a $500 spouses, widows, or widowers benefit from Social Security, you’ll get $100 a month from Social Security ($500 – $400 = $100). If two-thirds of your government pension is more than your Social Security benefit, your benefit could be reduced to zero.

Will collecting a public pension reduce your social security?

When you retire, you'll get your public pension, but don't count on getting your full Social Security benefit. Under federal law, any Social Security benefits you earned will be reduced if you were a federal, state or local government employee who earned a pension on wages that were not covered by Social Security.

Will my pension cut my Social Security payments?

So, the answer to your question is yes, your Social Security benefit will be reduced as a result of your LA state pension and WEP (your LA retirement benefit won’t be affected).

Does my pension reduce my Social Security benefits?

Working for the government can reduce both your Social Security benefits and your family's. The windfall elimination provision (WEP) may reduce your benefits if you receive a pension from a government entity or another organization that didn't withhold Social Security taxes from your paychecks.

Why does social security pay so little in retirement?

- If you were born on January 1 st, you should refer to the previous year.

- If you were born on the 1 st of the month, we figure your benefit (and your full retirement age) as if your birthday was in the previous month. ...

- You must be at least 62 for the entire month to receive benefits.

- Percentages are approximate due to rounding.

How much will my Social Security be reduced if I have a state pension?

We'll reduce your Social Security benefits by two-thirds of your government pension. In other words, if you get a monthly civil service pension of $600, two-thirds of that, or $400, must be deducted from your Social Security benefits.

What income reduces Social Security benefits?

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

What types of pensions affect Social Security benefits?

Your Government Pension May Affect Social Security Benefits (En español) The Government Pension Offset, or GPO, affects spouses, widows, and widowers with pensions from a federal, state, or local government job. It reduces their Social Security benefits in some cases.

What income is counted against Social Security?

People can earn $50,520 before reaching full retirement age without affecting their benefits. And the amount of reduction is also just $1 for every $3 earned over the cap. In addition, income only counts against the cap until the month before full retirement age is reached.

At what age is Social Security not affected by income?

You can earn any amount and not be affected by the Social Security earnings test once you reach full retirement age, or FRA. That's 66 and 2 months if you were born in 1955, 66 and 4 months for people born in 1956, and gradually increasing to 67 for people born in 1960 and later.

Does a pension count as earned income?

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Will my private pension affect my benefits?

money you take out of your pension will be considered as income or capital when working out your eligibility for benefits - the more you take the more it will affect your entitlement. if you already get means tested benefits they could be reduced or stopped if you take a lump sum from your pension pot.

Is Social Security getting a $200 raise in 2021?

Social Security beneficiaries will see a 5.9% increase in their monthly checks in 2022. This is much more than the 1.3% adjustment made for 2021, a...

Do you get less Social Security if you have a pension?

Does a pension reduce my Social Security benefits? In the vast majority of cases, no. If the pension comes from an employer who withheld FICA taxes...

Is pension the same as retirement?

A pension plan (also known as a defined benefit plan) is a retirement account sponsored and funded by your employer. ... Over the years, your emplo...

Can you collect a pension and Social Security when you retire?

Yes. There is nothing stopping you from getting both a pension and Social Security benefits. But there are some types of pensions that can reduce S...

Do pensions count as earned income?

Income from pension products does not count as relevant UK income. Individual, employer, and third-party contributions count for the annual benefit...

What income reduces Social Security benefits?

For 2021, it’s $ 18,960. Once the annual income reaches the maximum amount, for every $ 2 that a retired Social Security beneficiary earns working,...

Do you get less Social Security if you have a pension?

Does a pension reduce my Social Security benefits? In the vast majority of cases, no. If the pension comes from an employer who withheld FICA taxes from your paychecks, like almost everyone else, it won’t affect your Social Security retirement benefits.

Is pension the same as retirement?

A pension plan (also known as a defined benefit plan) is a retirement account sponsored and funded by your employer. … Over the years, your employer makes contributions on your behalf and promises to make you regular, default payments each month when you retire.

Can you collect a pension and Social Security when you retire?

Yes. There is nothing stopping you from getting both a pension and Social Security benefits. But there are some types of pensions that can reduce Social Security payments.

Do pensions count as earned income?

Income from pension products does not count as relevant UK income. Individual, employer, and third-party contributions count for the annual benefit, MPAA, and the reduced annual benefit.

What income reduces Social Security benefits?

For 2021, it’s $ 18,960. Once the annual income reaches the maximum amount, for every $ 2 that a retired Social Security beneficiary earns working, the total annual benefit is reduced by $ 1.

How much does WEP reduce Social Security?

In certain situations, the WEP reduces your Social Security benefits by up to half of your pension. Simply put, if you qualify for a pension of $900 monthly, the WEP may cut your Social Security benefits by up to $450. Image Source: Getty Images.

How does Social Security work?

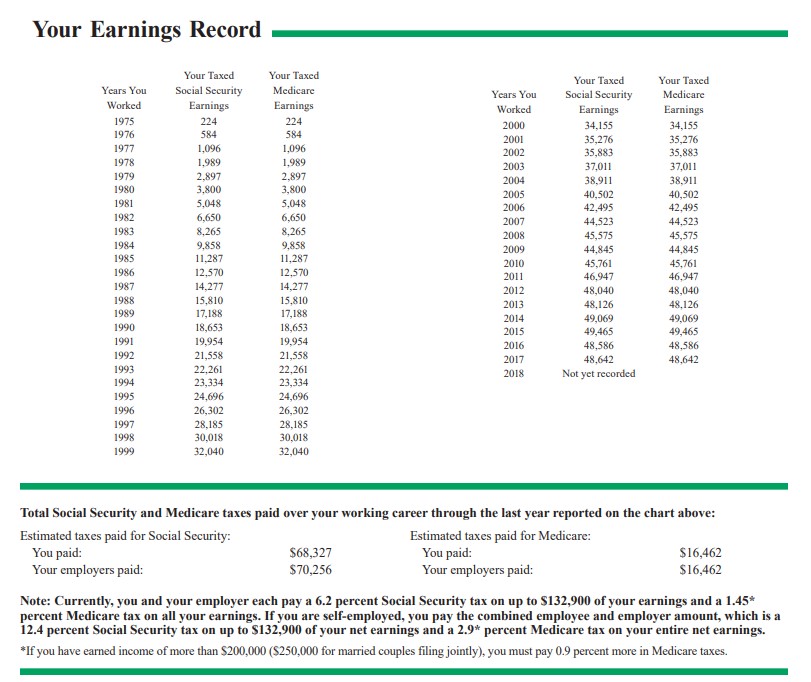

How Social Security benefits work. Your Social Security benefits are based on your income from your covered jobs. The standard benefits formula uses an average of your inflation-adjusted earnings in the 35 years during which you made the most money.

What does WEP mean on Social Security?

The WEP comes into play when you've worked in "covered" jobs where you paid Social Security payroll taxes and "noncovered" jobs where you didn't pay Social Security payroll taxes, earning a pension instead. In certain situations, the WEP reduces your Social Security benefits by up to half of your pension. Simply put, if you qualify for a pension of $900 monthly, the WEP may cut your Social Security benefits by up to $450.

How much does 40% Social Security mean?

If you paid Social Security taxes for less than 21 years, you'll see the biggest impact to your Social Security benefits. The normal 90% drops down to 40%. Using the same monthly earnings of $1,500, the 40% equation translates to benefits of $554.08, or 40% of $926 plus 32% of $574.

What is the percentage of your monthly income for 2019?

In 2019, your benefits would be the total of: 90% of the first $926 of your monthly earnings, plus. 32% of any earnings over $926 but less than $5,583, plus. 15% of any earnings over $5,583. You can see that a lower monthly earnings amount gets a higher percentage of benefits. If your monthly earning number is $900, ...

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens to Social Security after you reach full retirement age?

After you reach full retirement age, Social Security will recalculate your benefit and increase it to account for the benefits that it withheld earlier. 7 .

What happens if you start collecting Social Security benefits earlier?

However, once you reach full retirement age, Social Security will recalculate your benefit to make up for the money it withheld earlier.

How much can I deduct from my Social Security if I earn more than $50,520?

If you earn more than $50,520, it deducts $1 for every $3 you earn—but only during the months before you reach full retirement age. Once you reach full retirement age, you can earn any amount of money, and it won't reduce your monthly benefits. 3 . Note, however, that this money is not permanently lost. After you reach full retirement age, Social ...

How much can I deduct from my Social Security?

If you haven't reached full retirement age, Social Security will deduct $1 from your benefits for every $2 or $3 you earn above a certain amount. After you reach full retirement age, Social Security will increase your benefits to account ...

What is the full retirement age?

What Is Full Retirement Age? For Social Security purposes, your full or "normal" retirement age is between age 65 and 67, depending on the year you were born. If, for example, your full retirement age is 67, you can start taking benefits as early as age 62, but your benefit will be 30% less than if you wait until age 67. 4 . ...

How many Social Security credits will I get in 2021?

In 2021, you get one credit for each $1,470 of earnings, up to a maximum of four credits per year. That amount goes up slightly each year as average earnings increase. 3 . Social Security calculates your benefit amount based on your earnings over the years, whether you were self-employed or worked for another employer.

How many hours can I work to reduce my Social Security?

If you are younger than full retirement age, Social Security will reduce your benefits for every month you work more than 45 hours in a job (or self-employment) that's not subject to U.S. Social Security taxes. That applies regardless of how much money you earn.