How to Get Your Ex’s Social Security in 5 Easy Steps

- Make Sure You Can Answer ‘Yes’ to These Questions. To qualify for an ex’s Social Security benefits, you need to be able to answer “yes” to these four questions.

- Gather Your Ex’s Information. You’re going to need some information to prove to Social Security that you’re eligible for your ex’s benefits.

- Resist the Urge to Tell Them. ...

Can ex wife collect her ex husbands social security?

In general, a divorced spouse is entitled to a Social Security benefit that’s equivalent to 50% of the ex-spouse’s retirement benefit even if the ex-spouse has remarried. If the spouse is deceased, the former partner may be eligible for a survivor’s benefit of up to 100% of that amount. In either case, the divorced spouse must have reached full retirement age in order to receive the full (50% or 100%) benefit.

Can I collect my ex husbands social security?

Your ex-spouse qualifies for Social Security benefits. You can even begin drawing benefits before your ex has retired, as long as they qualify and you’ve been divorced at least two years. How Much Can I Receive?

Can you get Social Security for your ex husband?

To claim on behalf of an ex-spouse, he or she needs to be eligible for Social Security. That means they must be at least 62 and have at least 40 work credits, which translates to 10 years of full-time work. You also need to be at least 62, regardless of whose record you're using.

Can my ex-spouse collect on my social security?

Ex-spouses are free to start their checks whenever they are ready. If you were still married, your spouse would not be able to claim spousal benefits until after you had already filed for your own Social Security retirement income. But if you divorced at least two years ago, then this rule no longer applies.

How much Social Security does a divorced spouse get?

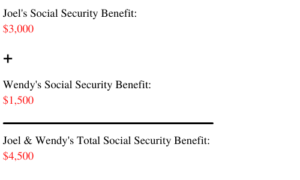

If they qualify, your ex-spouse, spouse, or child may receive a monthly payment of up to one-half of your retirement benefit amount. These Social Security payments to family members will not decrease the amount of your retirement benefit.

Can a divorced woman claim her ex husband's Social Security?

Thus, divorced women receive Social Security benefits either as retired workers, divorced spouses, or surviving divorced spouses. They can also receive widow benefits from a prior marriage that ended in widowhood.

When can I collect my ex husband's Social Security benefits?

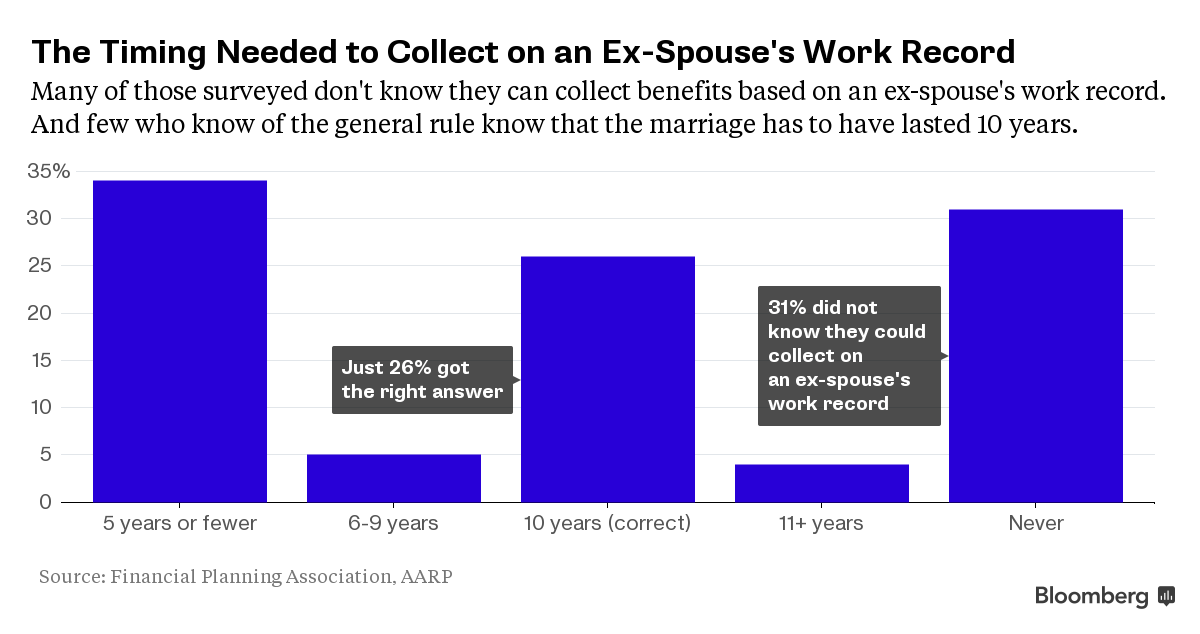

To be eligible, you must have been married to your ex-spouse for 10 years or more. If you have since remarried, you can't collect benefits on your former spouse's record unless your later marriage ended by annulment, divorce, or death.

Can a woman collect her ex husband's Social Security?

you're eligible for some of your ex's Social Security That means most divorced women collect their own Social Security while the ex is alive, but can apply for higher widow's rates when he dies.

How does Social Security work for divorced spouses?

A divorced spouse may be eligible to collect Social Security benefits based on the former spouse's work record. The marriage must have lasted for at least 10 years, and the divorced spouse must be at least 62 years old.

Can you collect 1/2 of spouse's Social Security and then your full amount?

Your full spouse's benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to begin receiving spouse's benefits before you reach full retirement age, your benefit amount will be permanently reduced.

Can I collect ex spousal benefits and wait until I am 70 to collect my own Social Security?

You can only collect spousal benefits and wait until 70 to claim your retirement benefit if both of the following are true: You were born before Jan. 2, 1954. Your spouse is collecting his or her own Social Security retirement benefit.

What is a second wife entitled to Social Security?

Eligible spouses and ex-spouses can receive up to 100 percent of the late beneficiary's monthly Social Security payment, if they have reached full retirement age, or FRA. For people claiming survivor benefits, FRA is currently 66.

Is my ex wife entitled to my Social Security if she remarries?

Can I collect Social Security as a divorced spouse if my ex-spouse remarries? Yes. When it comes to ex-spouse benefits, Social Security doesn't care about the marital status of your former spouse; it only cares about your marital status.

Does my Social Security get reduced if my ex wife collect?

Does my divorced-spouse benefit decrease what my ex gets from Social Security? No. Receiving benefits on the earnings record of your ex-spouse will not change what that person can receive from Social Security. They'll collect the benefit they're entitled to, regardless of whether you claim an ex-spousal benefit.

How old do you have to be to claim your ex-spouse?

However, if this is the case, the divorce must be at least two years old. (There is no such requirement if your ex is already receiving benefits.)

How long do you have to be married to collect spousal benefits?

You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as: The marriage lasted at least 10 years. You have not remarried. You are at least 62 years of age. Your ex-spouse is entitled to collect Social Security retirement or disability benefits . Your former spouse doesn't have to be collecting ...

How old do you have to be to get a disability?

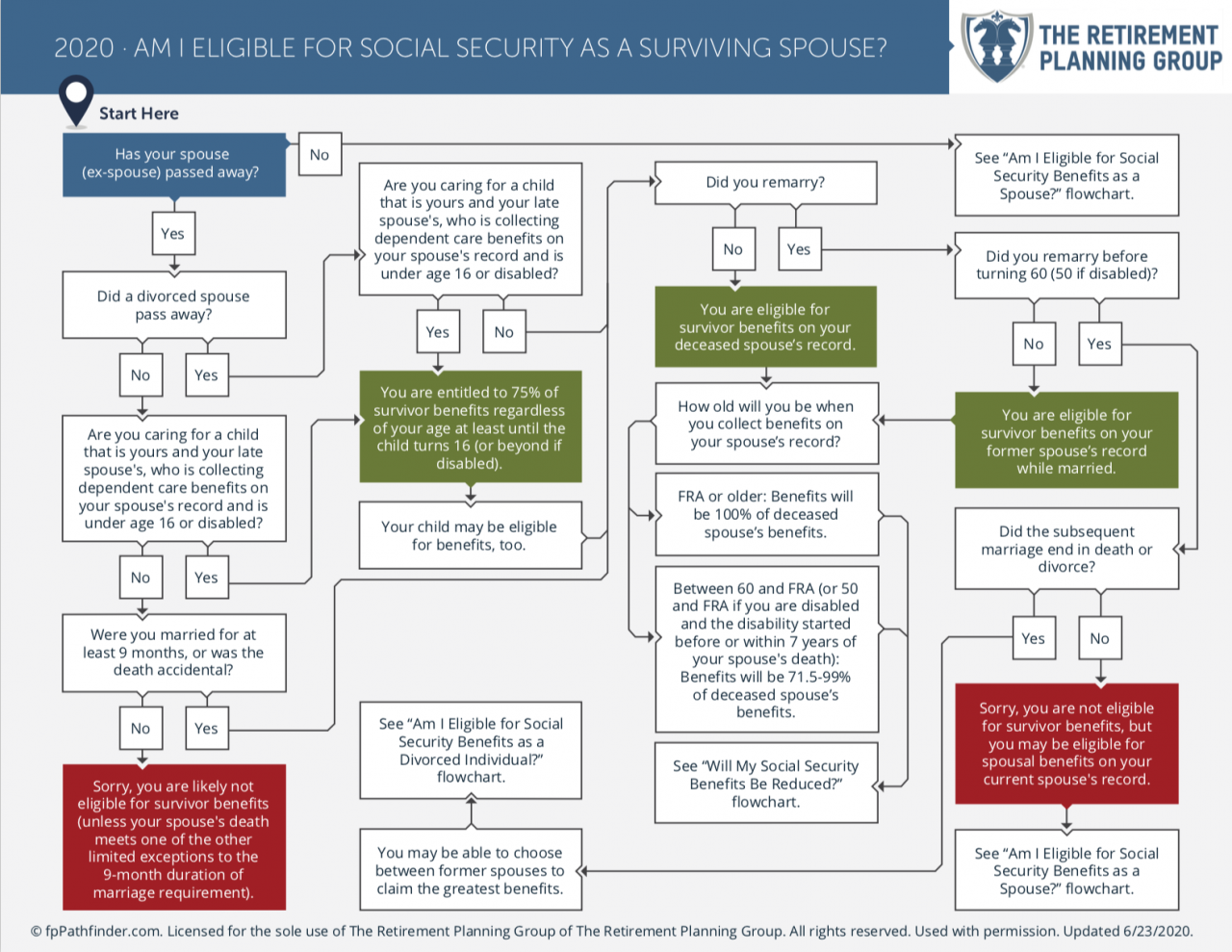

If you are disabled, and your ex-spouse has died, you can begin receiving survivors benefits if you're between the ages of 50 and 59. Your disability also must have started before or within seven years of your ex's death. The rules vary slightly when it comes to children. If you are caring for a child who is under age 16 or disabled, ...

How much do you get if you are 60?

If you are age 60 or older but not yet of full retirement age, you would receive 71.5% to 99%. If are 50 to 59 years old and disabled, you would receive 71.5%. If you are caring for your ex-spouse's child who is disabled or under the age of 16, you would receive 75%, no matter your age. 6 7.

Can you receive your own retirement at age 70?

That way, you receive only the ex-spousal benefit. You can let your own benefit amount continue racking up delayed retirement credits until you reach age 70. When you reach age 70, you can switch to your own benefit amount if that's larger than the ex-spousal amount.

How much of my ex's Social Security benefits are used?

If your own benefit is less than 50% of your ex's, Social Security uses your benefit and then taps your former spouse's record to make up the difference. You can contact your local Social Security office to find out how much you could get based on their record.

What happens if you claim Social Security at 62?

Keep in mind that if you claim Social Security at 62, you'll reduce your monthly benefit no matter whose earnings it's based on. To get the maximum payment -- 50% of theirs or 100% of your own -- you'll have to wait until you've reached your FRA. Claim before that and you'll get less than half their benefit.

How old do you have to be to claim Social Security?

Both of you must be at least 62. To claim on behalf of an ex-spouse, he or she needs to be eligible for Social Security. That means they must be at least 62 and have at least 40 work credits, which translates to 10 years of full-time work. You also need to be at least 62, regardless of whose record you're using.

Can you double dip Social Security?

Social Security doesn't allow for double dipping. Essentially, you'll get whichever is higher -- 100% of your own retirement benefit or 50% of their benefit, but not both. If the amount you qualify for based on your own work record is more than what you'd get from 50% of your former spouse's full retirement, Social Security gives you your benefit, ...

How much of Social Security benefits are available if you have been married multiple times?

You’ll only be eligible 50% of their full benefit as well. And if you’ve been married and divorced multiple times? Social Security will use whichever ex-spouse’s record gives you the biggest benefit. Remember, though: Only marriages that lasted 10 years or more will count.

What is the maximum amount of retirement benefits?

The maximum benefit you can get based on the record of a spouse — whether you’re currently married or divorced — is 50% of their full retirement age benefit. Full retirement age is the age at which you qualify for 100% of your benefit. It’s 66 or 67, depending on when you were born.

How old do you have to be to get a survivor's check?

If your ex-spouse is deceased, you can qualify for survivors benefits at age 60, or age 50 if you’re disabled.

Do spouses contribute to Social Security?

The philosophy is that both spouses often contribute economically during the marriage , even if only one person was employed. The Social Security rules protect those who spent most of their working years raising a family or playing a supportive role to their spouse and may have no retirement savings of their own.

What happens if my ex-wife gets Social Security at 62?

If the ex-wife claims Social Security at 62, before FRA, it is reduced from her FRA amount. Not only that, “she’s going to get a spousal reduction top-up [as well],” says Mantell.

Will she get 50% of her FRA?

In other words, she’ll get half of what his benefit would be at full retirement age, says Chris Chen, head of Financial Strategists in Newton, Massachusetts. “She doesn’t have to wait until he claims at a later age. She will only get 50% of his benefit at his FRA,” he says.

Can a divorced spouse claim Social Security?

Even in the best of times, Social Security is a maze of complicated rules and notable exceptions. For a divorced spouse who wants to claim benefits on their ex’s record, it can get even trickier.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You should also have your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.

What happens if my ex-spouse gets reduced Social Security?

If your late ex-spouse took reduced benefits by filing for Social Security early, you may qualify for the highest possible share of those benefits — that is , the highest possible survivor benefit — before your own FRA. If this is your situation, contact Social Security to see how it will affect your survivor benefit.

What happens if you claim survivor benefits before you reach full retirement age?

Claiming survivor benefits before you reach full retirement age reduces the amount of your benefit, except as noted below . If you are caring for a child from the marriage who is under the age of 16 or is disabled, you will receive 75 percent of the deceased ex-spouse’s benefit. If you have already claimed Social Security on your own, ...

What happens to survivor benefits when you retire?

Claiming survivor benefits before you reach full retirement age reduces the amount of your benefit, except as noted below. If you are caring for a child from the marriage who is under the age of 16 or is disabled, you will receive 75 percent of the deceased ex-spouse’s benefit.

Does Survivor Benefits affect late beneficiaries?

Survivor benefits paid to you as a divorced spouse do not affect payments to the late beneficiary’s widow or widower or to other former spouses. Updated May 6, 2021.

Who Is Eligible?

Social Security Benefits

- The maximum amount of Social Security benefits you can receive based on an ex-spouse's record is 50% of what your ex-spouse would get at their full retirement age. This varies based on their year of birth. The spousal benefit amount is further decreased if you file before you reach your own full retirement age.3 If you have an idea of what your ex-...

Survivors Benefits Explained

- If your ex-spouse has died, you may collect survivor's benefits. These follow different rules than those for a living ex-spouse. You can apply for benefits as early as age 60. If you remarry after you reach age 60, or age 50 if you are disabled, you will still be able to claim these benefits. If you are disabled, and your ex-spouse has died, you can begin receiving survivors benefits if you're betwe…

What About Unmarried Children?

- An unmarried child of the deceased may be able to receive benefits if one of the following applies: 1. They are younger than 18 years of age; or, they are up to age 19, if they are a full-time student in an elementary or secondary school. 2. They are age 18 or older with a disability that began before the age of 22.8