Social Security Benefits Taxable After Age 65

- Taxation for Individuals. If you’re filing your tax return as an individual and your combined income tops $25,000 per year, the IRS taxes 50 percent of your Social Security benefits.

- Taxation for Married Couples. If you’re married, your spouse’s earnings are calculated as part of your total annual income for tax purposes.

- Paying Taxes. ...

- Considerations. ...

What is the current Social Security tax rate?

West Virginia has been gradually phasing out its tax on Social Security benefits, and by 2022, those taxes will be history. For 2021, however, taxpayers will still have to pay state income tax on 35% of Social Security benefits.

How to calculate taxable Social Security income?

- Less than $25,000 single/$32,000 joint: 0% taxable.

- $25,000 to $34,000 single/$32,000 to $44,000 joint: up to 50% taxable.

- Greater than $34,000 single/$44,000 joint: up to 85% taxable.

When does the earnings limit end for Social Security?

Social Security Survivor Benefits for Spouses

- A surviving spouse can get reduced benefits as early as age 60. ...

- A surviving spouse who has a disability can collect benefits as early as age 50. ...

- Surviving spouses can get benefits at any age if they take care of their spouse’s child who is under age 16 or disabled and receives Social Security benefits.

How much of my social security benefit may be taxed?

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Do seniors pay taxes on Social Security income?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

How much of Social Security is taxable?

Up to 50% of Social Security income is taxable for individuals with a total gross income including Social Security of at least $25,000 or couples filing jointly with a combined gross income of at least $32,000. Retirees who have little income other than Social Security generally won't be taxed on their benefits.

Do you pay taxes on Social Security after 66?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Does Social Security benefits count as income?

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

How much can you make without paying taxes over 65?

For retirees 65 and older, here's when you can stop filing taxes: Single retirees who earn less than $14,250. Married retirees filing jointly, who earn less than $26,450 if one spouse is 65 or older or who earn less than $27,800 if both spouses are age 65 or older.

Does IRS tax Social Security?

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable.

How much can a retired person earn without paying taxes in 2020?

For retirees 65 and older, here's when you can stop filing taxes: Single retirees who earn less than $14,250. Married retirees filing jointly, who earn less than $26,450 if one spouse is 65 or older or who earn less than $27,800 if both spouses are age 65 or older.

Is Social Security ever tax free?

From a couple of Treasury Department tax rulings in 1938 and another in 1941, social security benefits have been explicitly excluded from federal i...

What is the average Social Security benefit per month?

Social Security offers a monthly check to many types of beneficiaries. As of August 2021, the average allowance is $ 1,437.55, according to the Soc...

Will I lose my SSI if I inherit money?

SSI is different from Social Security and Social Security Disability Income (SSDI.) ... However, receiving an inheritance will not affect your Soci...

Does your Social Security count as income?

Since 1935, the US Social Security Administration has provided benefits to retired or disabled people and their families. ... Although Social Secur...

At what age do seniors stop paying taxes?

As long as you are at least 65 and your income from sources other than Social Security is not high, the senior or disabled tax credit can reduce yo...

Do I have to pay taxes on my Social Security check?

Some of you have to pay federal income taxes on your Social Security benefits. between $ 25,000 and $ 34,000, you may have to pay income tax up to...

Is Supplemental Security Income taxable?

Supplemental Security Income — monthly cash assistance for low-income disabled, blind and older people that is administered but not funded by Social Security — is not taxable.

Do Social Security benefits change as you get older?

The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”.

How to have taxes withheld from Social Security?

It is possible to have taxes withheld from Social Security benefit payments by filling out IRS Form W-4V or requesting a Voluntary Withholding Request Form online. 5 6 There are currently 13 states in which your Social Security benefits may also be taxable at the state level, at least to some beneficiaries.

What is the income threshold for Social Security?

For singles, those income thresholds are between $25,000 and $34,000 for 50%, and more than $34,000 for 85%. Some states will also tax Social Security income separate from what the IRS demands.

Do I have to pay taxes on my Social Security?

Whether or not you need to pay taxes on your Social Security benefits, however, depends on your modified adjusted gross income (MAGI). If your MAGI is above a certain threshold for your filing status (e.g. single or married filing jointly), then your benefits would be taxable. Up to 85% of a taxpayer’s Social Security benefits are taxable.

Does continuing to work lower Social Security?

Continuing to work, however, may lower current payments, if any, taken during the year full retirement age is reached, according to a Social Security Administration limit, which changes every year. 2

Can you contribute to Social Security if you are working past retirement age?

Everyone must make applicable Social Security contributions on income, even those working past full retirement age. 1 Working past full retirement age may also increase Social Security benefits in the future because Social Security contributions continue to be paid in. 2 .

What Is Social Security Tax?

It is a tax charged on the employer and the employee to fund the social security program. It is collected in the form of self-employment tax or payroll tax. Employers usually withhold the tax from the employee’s paycheck and remit it to the relevant government authority. This amount is used to pay retirees and people who have various disabilities.

Social Security Tax Rate

Employers used a rate of 12.4% in 2017, where the employee contributes half (i.e. 6.2% and the employer pays the other half). The tax is assessed on all types of income: wages, salaries, and bonuses with an income limit of $127,000.

Social Security Benefits

SS benefits are paid monthly to retirees and their spouses after attaining the full retirement age if, during their working years, they paid the social security tax. Some people, however, prefer taking early retirement where social security deducts different amounts of income until the subjects attain the full retirement age.

When Should Seniors File Returns?

Taxes on social security benefits are based on the retiree’s income. If social security benefits are the only source of income for the senior, then there is no need of filing a tax return. As of 2017, retirees without spouses and have attained the required 65 years should file an income tax return if the gross earnings are more than $11,850.

The Taxable Amount of Social Security Benefits

Additional incomes from other sources affect the taxable amount of your social security benefits. The amount ranges from 0–85% based on your combined income. The IRS calculates this figure by adding half of the annual social security benefit, any non-taxable interest, and the federal adjusted gross income.

How to Pay Taxes on Social Security Benefits

The state requires payments for taxes on social security benefits to be made on April 15. Retirees can make estimates for the tax payments throughout the year or ask the Social Security Administration (SSA) to withhold the taxes from their monthly checks.

How to Reduce Taxes on Social Security Benefits

Seniors with incomes that exceed the set limit are liable to pay tax. However, they can reduce the taxable amount through tax credits for the elderly and disabled as long as they have reached 65 and income from other sources does not exceed the set limit. Tax credits are more helpful to people who owe tax to the IRS.

What is the average Social Security benefit per month?

Social Security offers a monthly check to many types of beneficiaries. As of August 2021, the average allowance is $ 1,437.55, according to the Social Security Administration, but that amount can vary dramatically depending on the type of recipient. In fact, retirees typically earn more than the overall average.

Will I lose my SSI if I inherit money?

SSI is different from Social Security and Social Security Disability Income (SSDI.) … However, receiving an inheritance will not affect your Social Security and SSDI benefits. SSI is a federal program that provides benefits to adults over the age of 65 and children with limited income and resources who are blind or disabled.

Does your Social Security count as income?

Since 1935, the US Social Security Administration has provided benefits to retired or disabled people and their families. … Although Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine whether benefits are taxable.

At what age do seniors stop paying taxes?

As long as you are at least 65 and your income from sources other than Social Security is not high, the senior or disabled tax credit can reduce your tax burden on a dollar-for-dollar basis.

Do I have to pay taxes on my Social Security check?

Some of you have to pay federal income taxes on your Social Security benefits. between $ 25,000 and $ 34,000, you may have to pay income tax up to 50 percent of your benefits. … more than $ 34,000, up to 85 percent of your benefits may be taxable.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

Is Social Security taxable if married filing jointly?

If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable .

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

Does Social Security count as ordinary income?

For individual filers, there is no tax on the first $ 25,000. For combined incomes between $ 25,000 and $ 34,000, up to 50 percent of Social Security benefits may be subject to normal income taxes. For income over $ 34,000, up to 85 percent of benefits may be taxed. For jointly filed marriage, no tax is charged on the first $ 32,000.

How much of Social Security is counted as income?

You must claim at least 50 per cent of your Social Security benefits, and you may have to pay income taxes on them. If your income exceeds $ 44,000 and you are married and jointly filing, 85 percent of your benefits may be taxable.

Can I live on 5000 a month in retirement?

It depends on your age and how much money you need to maintain your lifestyle. Normally, you can generate at least $ 5,000 a month in retirement income, which is guaranteed for the rest of your life. This does not include Social Security Benefits.

What does the average retiree live on per month?

According to Bureau of Labor Statistics data, “softer households” as defined by those aged 65 and over spend an average of $ 45,756 a year, or about $ 3,800 a month. I don’t know about you, but you seem to spend $ 45,756 after tax a year in retirement!

Is there a property tax break for senior citizens?

Property tax exemption program for the elderly and disabled. Available to: Taxpayers who meet one of the following requirements as at 31 December of the year before taxes fall due: at least 61 years of age or older.

Are school taxes frozen at 65 in Texas?

Homestead exemptions are available to all homeowners in Texas to reduce their property tax, while those over the age of 65 are better exempt. The over-65s house exemption permanently freezes the amount paid for school property taxes.

Are Social Security benefits taxed after age 66?

When you reach full retirement age, Social Security benefits will not be reduced no matter how much you earn. However, Social Security benefits are taxable. … If your combined income is more than $ 44,000, as much as 85% of your benefits may be subject to income tax.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How much does Social Security withhold?

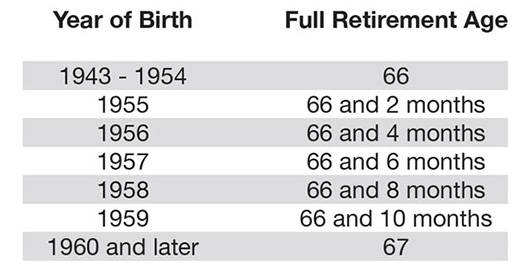

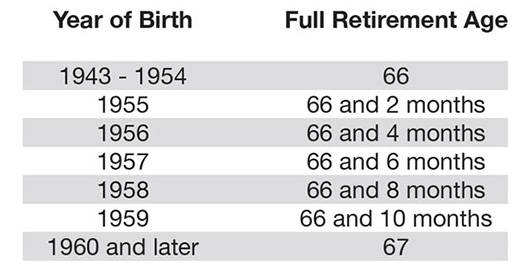

Social Security withholds your monthly checks to cover the penalty. The year you reach full retirement age, the calculations change. You may earn $37,680 that year without penalty. A penalty of $1 for every $3 you earn applies to that year you reach full retirement age. If you are 65 and reach full retirement age at 66, ...

What is the full retirement age?

Social Security uses full retirement age to calculate 100 percent of your benefit amount. For individuals born in 1942 or earlier, full retirement age is 65. Individuals born from 1943 to 1954 reach full retirement age at 66. Persons born after 1960 reach full retirement age at 67, and a birth date between 1955 ...

How old is a person born in 1956?

An individual born in 1955 reaches full retirement age at 66 years and 2 months; 1956 is 66 years and 4 months.

Does Social Security base on your work history?

Unearned Income & Social Security. Learn More →. Social Security bases benefits on your work history, not your present income or your personal wealth. Individuals who have amassed a fortune collect Social Security, along with those who need Social Security benefits to pay for food. Early retirement has a penalty for earned income, ...

Income and Taxation of Benefits

Taxpayer Bracket

- However, taking Social Security benefits while continuing to work may have the unexpected negative consequence of bumping a taxpayer into a higher tax bracket. Most people forget that a certain percentage of Social Security benefits may be taxed—up to 85%—depending on filing status and combined income, including half of Social Security benefits.1 Some states also tax S…

How to Lower Your Social Security Taxes

- There are several remedies available for those who are taxed on their Social Security benefits. Perhaps the most obvious solution is to reduce or eliminate the interest and dividendsthat are used in the provisional income formula. Therefore, the solution could be to convert the reportable investment income into tax-deferred income, such as from an annuity, which will not show up o…

The Bottom Line

- If you continue to work after the retirement age, you will need to contribute to Social Security. When you start receiving Social Security benefits, you may also be taxed on them, depending on your income. It is possible to be taxed on either 50% or 85% of your benefits.1There are plenty of strategies to avoid being taxed, such as reducing your inc...