Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age. There is some variation at the state level, though, so make sure to check the laws for the state where you live.

Should you wait until age 70 to collect Social Security?

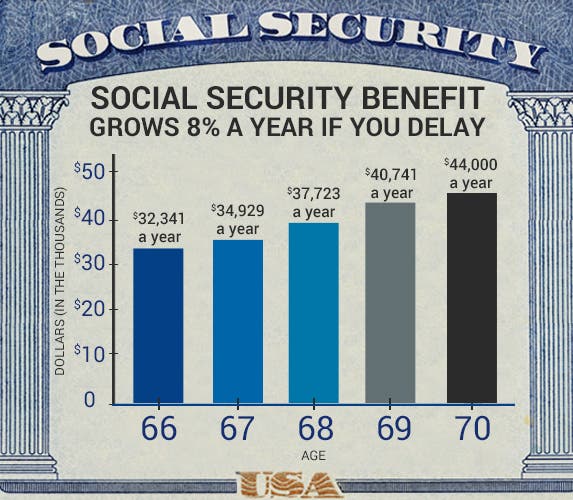

Your first step in maximizing your Social Security benefits should be to visit the Social Security Administration (SSA) website. (between 66 and 67), and age 70. Remember that you don't have to start taking your benefits at those milestone ages; you and your spouse can start collecting anytime between ages 62 and 70. Who's the higher earner?

Should you take Social Security at age 62 or 70?

You can start taking it as early as age 62 (or earlier if you are a survivor of another Social Security claimant or on disability), wait until you've reached full retirement age or even until age 70.

Should you delay taking Social Security until 70?

The single best reason to claim Social Security well before age 70 is if your claim for benefits enables a higher earning spouse to delay their claim for benefits. Say you're married and you and your spouse want to retire, but you need some money from Social Security to make that happen.

Do you pay taxes on social security after age 70?

Turning 70 alone does not change the Social Security tax due on your wages since your filing status and income determine that. If your only income comes from your Social Security benefits, you likely don't have to pay taxes on that money. Under the Federal Insurance Contributions Act, your employer takes Social Security taxes out of your paycheck.

At what age is Social Security not taxable?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much of your Social Security is taxable after full retirement age?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How much can a 70 year old make while on Social Security?

The Social Security earnings limit is $1,630 per month or $19,560 per year in 2022 for someone who has not reached full retirement age. If you earn more than this amount, you can expect to have $1 withheld from your Social Security benefit for every $2 earned above the limit.

Do you pay federal income tax on Social Security?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

How much of Social Security is taxable?

Usually only 50 percent of your benefits are taxable, but for some taxpayers it's 85 percent. Regardless of age, you add the taxable benefits to your other income and apply the same tax rate. There's no special rate for your Social Security checks.

Does turning 70 affect your taxes?

Whether you're working and paying Social Security tax on your earnings, drawing Social Security benefits, or both, turning 70 won't, in itself, affect the taxes you pay.

Can you use the current tax year for lump sum payments?

While you can usually use the current tax year's income for figuring out taxable parts of all benefits received that year, you can also figure out the taxable aspect of prior year lump-sum payments separately by using that year's income information.

Is SSA 1099 taxable?

If you receive a lump-sum payment including benefits for any years before 1983, it is shown in box 3 of these forms. either Form SSA-1099 or Form RRB-1099. Payments for years prior to 1984 are not taxable. Note: This does not involve lump-sum Social Security death benefits, which are not taxable.

Do you pay taxes on Social Security if you only earn money?

It's possible that continuing to earn money in retirement will increase your benefits. If your only income is Social Security benefits, you probably don't have to pay income tax on them. The Social Security Administration says that about one-third of recipients do pay tax on their benefits, because they have other taxable income.

Does Social Security increase your income?

The Social Security Administration says as long as you're earning an income, you keep paying the tax. Neither your age nor receiving retirement benefits changes that. It's possible that continuing to earn money in retirement will increase your benefits.

Is Social Security taxable after 70?

Do Taxes on Social Security Change After Age 70? Is Social Security Taxable in California? Turning 70 is a landmark, but not as far as the Social Security Administration is concerned. Whether you're working and paying Social Security tax on your earnings, drawing Social Security benefits, or both, turning 70 won't, in itself, ...

Is Supplemental Security Income taxable?

Supplemental Security Income — monthly cash assistance for low-income disabled, blind and older people that is administered but not funded by Social Security — is not taxable.

Do Social Security benefits change as you get older?

The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”.

What is the average Social Security benefit per month?

Social Security offers a monthly check to many types of beneficiaries. As of August 2021, the average allowance is $ 1,437.55, according to the Social Security Administration, but that amount can vary dramatically depending on the type of recipient. In fact, retirees typically earn more than the overall average.

Will I lose my SSI if I inherit money?

SSI is different from Social Security and Social Security Disability Income (SSDI.) … However, receiving an inheritance will not affect your Social Security and SSDI benefits. SSI is a federal program that provides benefits to adults over the age of 65 and children with limited income and resources who are blind or disabled.

Does your Social Security count as income?

Since 1935, the US Social Security Administration has provided benefits to retired or disabled people and their families. … Although Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine whether benefits are taxable.

At what age do seniors stop paying taxes?

As long as you are at least 65 and your income from sources other than Social Security is not high, the senior or disabled tax credit can reduce your tax burden on a dollar-for-dollar basis.

Do I have to pay taxes on my Social Security check?

Some of you have to pay federal income taxes on your Social Security benefits. between $ 25,000 and $ 34,000, you may have to pay income tax up to 50 percent of your benefits. … more than $ 34,000, up to 85 percent of your benefits may be taxable.

What Is Social Security Tax?

It is a tax charged on the employer and the employee to fund the social security program. It is collected in the form of self-employment tax or payroll tax. Employers usually withhold the tax from the employee’s paycheck and remit it to the relevant government authority. This amount is used to pay retirees and people who have various disabilities.

Social Security Tax Rate

Employers used a rate of 12.4% in 2017, where the employee contributes half (i.e. 6.2% and the employer pays the other half). The tax is assessed on all types of income: wages, salaries, and bonuses with an income limit of $127,000.

Social Security Benefits

SS benefits are paid monthly to retirees and their spouses after attaining the full retirement age if, during their working years, they paid the social security tax. Some people, however, prefer taking early retirement where social security deducts different amounts of income until the subjects attain the full retirement age.

When Should Seniors File Returns?

Taxes on social security benefits are based on the retiree’s income. If social security benefits are the only source of income for the senior, then there is no need of filing a tax return. As of 2017, retirees without spouses and have attained the required 65 years should file an income tax return if the gross earnings are more than $11,850.

The Taxable Amount of Social Security Benefits

Additional incomes from other sources affect the taxable amount of your social security benefits. The amount ranges from 0–85% based on your combined income. The IRS calculates this figure by adding half of the annual social security benefit, any non-taxable interest, and the federal adjusted gross income.

How to Pay Taxes on Social Security Benefits

The state requires payments for taxes on social security benefits to be made on April 15. Retirees can make estimates for the tax payments throughout the year or ask the Social Security Administration (SSA) to withhold the taxes from their monthly checks.

How to Reduce Taxes on Social Security Benefits

Seniors with incomes that exceed the set limit are liable to pay tax. However, they can reduce the taxable amount through tax credits for the elderly and disabled as long as they have reached 65 and income from other sources does not exceed the set limit. Tax credits are more helpful to people who owe tax to the IRS.

How to have taxes withheld from Social Security?

It is possible to have taxes withheld from Social Security benefit payments by filling out IRS Form W-4V or requesting a Voluntary Withholding Request Form online. 5 6 There are currently 13 states in which your Social Security benefits may also be taxable at the state level, at least to some beneficiaries.

What is the income threshold for Social Security?

For singles, those income thresholds are between $25,000 and $34,000 for 50%, and more than $34,000 for 85%. Some states will also tax Social Security income separate from what the IRS demands.

Do I have to pay taxes on my Social Security?

Whether or not you need to pay taxes on your Social Security benefits, however, depends on your modified adjusted gross income (MAGI). If your MAGI is above a certain threshold for your filing status (e.g. single or married filing jointly), then your benefits would be taxable. Up to 85% of a taxpayer’s Social Security benefits are taxable.

Does continuing to work lower Social Security?

Continuing to work, however, may lower current payments, if any, taken during the year full retirement age is reached, according to a Social Security Administration limit, which changes every year. 2

Can you contribute to Social Security if you are working past retirement age?

Everyone must make applicable Social Security contributions on income, even those working past full retirement age. 1 Working past full retirement age may also increase Social Security benefits in the future because Social Security contributions continue to be paid in. 2 .