Are survivor benefits considered income?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit — retirement, disability, survivors or spouse benefits are all considered taxable income.

Are Social Security survivors benefits taxable?

Supplemental Security Income payments, however, are not taxable. You could have to pay taxes on 50% of your Social Security benefits if the total income for an individual, including pensions, wages, dividends and capital gains plus Social Security benefits total between $25,000 and $34,000.

When are Social Security survivor benefits taxable?

As for paying taxes on your Social Security benefits ... Here's what you need to know about Social Security survivors benefits If you are over age 60 but not yet full retirement age, and if you apply for your survivors benefit now, it will be permanently ...

Are pension survivor benefits taxable?

Previously, Nebraska excluded only a portion of military retirement from income taxes. However, survivors receiving SBP payments will still have to pay taxes on their payments. North Carolina also passed legislation joining the list of states that no longer will tax military retirees, with the new rule becoming effective Jan. 1, 2022.

Do I have to pay taxes on my deceased husband's pension?

Pension and Annuity Death benefits bought under a pension or an annuity work much the same as life insurance. They're not taxable unless they exceed the value of the contract. If the death benefit is more than that, then the IRS gets a cut.

Do you pay taxes on Widows pension?

If your combined taxable income is less than $32,000, you won't have to pay taxes on your spousal benefits. If your income is between $32,000 and $44,000, you would have to pay taxes on up to 50% of your benefits. If your household income is greater than $44,000, up to 85% of your benefits may be taxed.

Do beneficiaries pay taxes on pensions?

With a pension, people pay income taxes when they withdraw the money in retirement or their heirs pay income taxes when they inherit it. The income tax rates that apply are those that apply at the time of the withdrawal or inheritance.

Are death benefits paid to a survivor beneficiary taxable?

These retirement contributions the deceased employee (made bi-weekly via payroll deduction to the FERS Retirement and Disability Fund) were made with after-taxed dollars. If a FERS spousal survivor annuity is also paid, then all of the special death benefit is taxable.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Do survivor benefits count as income?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

How do I avoid tax on an inherited pension?

To avoid taxes on inheritance, you can use a deferred annuity or a life insurance policy. Annuities offer enhanced death benefits that allow beneficiaries to offset taxes or spread the tax burden over time.

How are pensions paid to beneficiaries?

The pension payout How your beneficiary is paid depends on your plan. For example, some plans may pay out a single lump sum, while others will issue payments over a set period of time (such as five or 10 years), or an annuity with monthly lifetime payments.

How much of a survivor's income is taxable?

6 . If the person has any additional income but it’s below $25,000, benefits won’t be taxed. 7 If they earn between $25,000 and $34,000, 50 percent of the survivor benefit is taxable.

What happens if neither spouse claims benefits?

If neither spouse has claimed benefits, and the surviving spouse works, he or she will receive theirs or the deceased spouses —generally whichever is larger. If one was claiming benefits and one was not, the surviving spouse will need help figuring out how to maximize their benefits. 4 .

What percentage of Social Security benefits are lost to a deceased parent?

If the family earnings are more than 150 percent to 180 percent of the deceased parent’s earnings, Social Security will reduce the benefits proportionally for everybody except the surviving parent until the total reaches the total maximum amount. 13 .

How many children can you get from a deceased parent?

According to Social Security, 98 of every 100 children could get benefits. 9 If the deceased parent’s child is under the age of 18, or 19 if they’re attending elementary or secondary school full time, he or she qualifies for survivor benefits. 2

When do widows get full benefits?

Widow or Widower. If a spouse passes away, the surviving spouse may receive full benefits once they reach their full retirement age or reduced benefits as early as age 60. If the spouse is disabled, benefits begin as early as age 50. They can also get benefits at any age if they take care of a child who is younger than age 16 or disabled, ...

Do children pay taxes on survivor benefits?

Survivor benefits to children are taxable under certain circumstances but in most cases, children will not pay taxes. If the survivor benefits are the only income the child earns, they won’t pay any taxes on the benefits. If the child earns income through a job or other means, some calculating has to take place.

Do you pay taxes on surviving spouse?

If you are the surviving spouse and your child receives survivor benefits, that money is for them and has no bearing on your taxes. You do not pay taxes for the child’s earnings and no part of your Social Security status will have an effect on their ability to collect benefits if they are eligible. 11 12

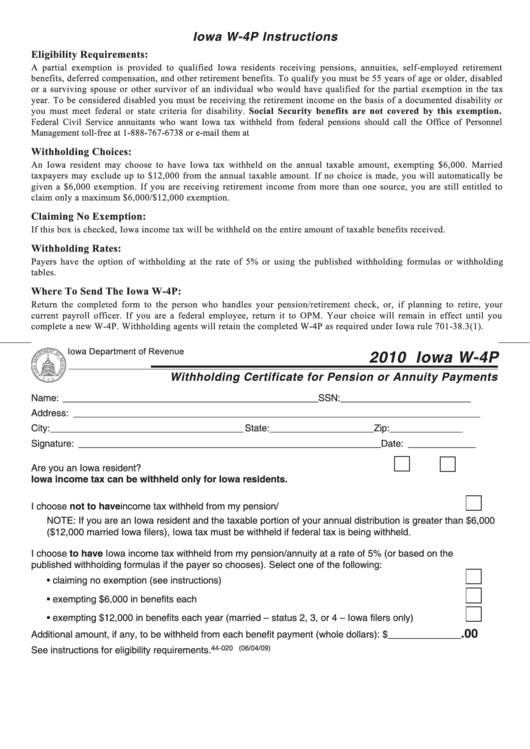

Survivors Pension

The Survivors Pension benefit, which may also be referred to as Death Pension, is a tax-free monetary benefit payable to a low-income, un-remarried surviving spouse and/or unmarried child (ren) of a deceased Veteran with wartime service.

Eligibility

The deceased Veteran must have met the following service requirements:

How to Apply

To apply for Survivors Pension, download and complete VA Form 21P-534EZ, “Application for DIC, Death Pension, and/or Accrued Benefits” and mail it to the Pension Management Center (PMC) that serves your state. You may also visit your local regional benefit office and turn in your application for processing.

How long does it take to roll over an IRA to a deceased spouse?

If a surviving spouse receives a distribution from his or her deceased spouse's IRA, it can be rolled over into an IRA of the surviving spouse within the 60-day time limit, as long as the distribution is not a required distribution, even if the surviving spouse is not the sole beneficiary of his or her deceased spouse's IRA.

Who is a beneficiary of an IRA?

A beneficiary can be any person or entity the owner chooses to receive the benefits of a retirement account or an IRA after he or she dies. Beneficiaries of a retirement account or traditional IRA must include in their gross income any taxable distributions they receive.

Can a beneficiary transfer an IRA to a trustee?

However, the beneficiary can make a trustee-to-trustee transfer as long as the IRA into which amounts are being moved is set up and maintained in the name of the deceased IRA owner for the benefit of the beneficiary.

Can a beneficiary of an inherited IRA make contributions to the IRA?

This means that the beneficiary cannot make any contributions to the IRA or roll over any amounts into or out of the inherited IRA.

Can a beneficiary receive an annuity on death of employee?

If the beneficiary is entitled to receive a survivor annuity on the death of an employee, the beneficiary can exclude part of each annuity payment as a tax-free recovery of the employee's investment in the contract. The beneficiary must figure the tax-free part of each payment using the method that applies as if he or she were the employee.

What percentage of your pension will you receive if you choose a survivor?

Sometimes you have a choice of whether the surviving spouse will receive 50% or 75% of your benefit. There may be other choices. If so, make sure you understand what they are. If you choose the survivor’s benefit, it means that you will receive lower monthly benefits than the monthly benefits based on the pension-earner’s lifetime alone. ...

How much does a spouse's annuity pay if they die?

It would stop if/when your spouse dies. Under a joint and survivor annuity, the benefit might be $1,300 a month while your spouse is alive. However, if/when your spouse dies, your benefit would be $650 a month for as long as you live.

What is single life benefit?

This Fact Sheet focuses on two types of benefits: Single Life Benefit: monthly payments based only on the pension-earner’s expected lifetime, which means the benefits stop when that person dies. Joint and Survivor Benefit: monthly payments based on you and your spouse’s lifetime.

What is defined benefit pension?

A defined benefit pension plan is a pension plan that promises a certain benefit at retirement, usually calculated through a formula based on a combination of years of service and amount of pay. The following information will help you understand the choices and how they will affect your retirement benefit payments.

What happens if you are married and you retire?

If you are married when you retire, and either you or your spouse has a traditional defined-benefit pension, you will face some choices when you retire and apply for benefits.

Does the federal pension waiver cover state pensions?

Unfortunately, the law does not cover state and local government pensions. Be sure to read this form carefully. It can be confusing.

Do spouses receive survivor benefits if they die first?

This means that should the pension-earner die first, the spouse will continue to receive survivor’s benefits from your spouse’s pension. The monthly payments are typically lower than a single life benefit but they are guaranteed to continue for the surviving spouse.

What is pension plan?

Pension plans are a type of retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker's future benefit. The pool of funds is invested on the employee's behalf, and the earnings on the investments generate income to the worker upon retirement. Pension plan options typically offer a lump-sum ...

What are the different types of pension plans?

Types of Pensions. There are two main types of pension plans: defined-benefit and defined-contribution . A defined-benefit plan is what people normally think of as a "pension.". It is an employer-sponsored retirement plan in which employee benefits are computed using a formula that considers several factors, such as length ...

How to notify a spouse of a death?

"When a plan participant dies, the surviving spouse should contact the deceased spouse’s employer or the plan’s administrator to make a claim for any available benefits. The plan will likely request a copy of the death certificate. Depending upon the type of plan, and whether the participant died before or after retirement payments had started, the plan will notify the surviving spouse as to: 1 the amount and form of benefits (in other words, lump sum or installment payments under an annuity); 2 whether death benefit payments from the plan may be rolled over into another retirement plan; and 3 if a rollover is possible, the method and time period in which the rollover must be made." 3

What is a period certain annuity?

Period Certain Annuity. A period certain annuity option allows the customer to choose how long to receive payments. This method allows beneficiaries to later receive the benefit if the period has not expired at the date of the member's death.

Why is defined benefit called defined benefit?

It is called "defined benefit" because employees and employers know the formula for calculating retirement benefits ahead of time, and they use it to set the benefit paid out. The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferred account.

Can a pension plan allow a non-spouse beneficiary?

Typically, pension plans allow for only the member—or the member and their surviving spouse—to receive benefit payments. However, in limited instances, some may allow for a non-spouse beneficiary, such as a child.

Do I need to notarize my spouse's survivor benefits?

The spouse would need to certify in writing via a spousal consent or spousal waiver form that they are choosing not to receive survivor benefits. 4 5 It may need to be notarized. If done properly, this allows the member to designate another beneficiary, such as a child.

What happens to a military pension after husband dies?

Military Pension After Husband Death. Unlike other pensions, a military retiree’s pension ends upon his death. To take care of survivors, the military offers a form of insurance called a Survivor Benefit Plan, which issues a monthly payment to survivors in the event of a member’s death.

What happens to widow pension after remarrying?

One thing to consider after you start receiving a widow pension is how remarriage will affect those benefits. This can vary from one plan to another, but some retirement plans specifically state that if the widow remarries, the survivor’s benefits end.

What happens when a spouse dies?

In some cases, a spouse dies while still employed, with that pension serving as a promise for a retirement that will never come. When that happens, the surviving spouse will be issued those benefits, either as a lump sum or as a bridge pension that ends when your husband would have reached his 65 th birthday.

What is a survivor pension?

The survivor receives a cost-of-living adjustment on payments from one year to the next. Survivors of wartime veterans may also be eligible for something called a VA Survivor’s Pension, which is a tax-free benefit to surviving spouses and ex-spouses who never remarried.

When a person signs up for a pension, does it come with guidelines?

When a person signs up for a pension, it comes with guidelines and restrictions for claiming that pension at the time of retirement. That fine print can vary from one employer to the next and also depends whether the employer was a private company, government agency or the military. At the time of signup, the employee should be asked ...

Can a spouse contribute to a 401(k) after death?

Many employers have replaced pension plans with 401 (k) options, which they either contribute to or leave completely up to the employee to fund. When checking into a pension after death of husband, you may find that this type of plan was in place. Spouses are entitled to a person’s 401 (k) account after death, ...

Does SBP protect against inflation?

In addition to providing a pension to a spouse and/or children after death, the SBP also protects pensions against increases in inflation.

When is a survivor annuity payable?

For both CSRS and FERS, a survivor annuity may still be payable if the employee's death occurred before 9 months if the death was accidental or there was a child born of your marriage to the employee. If a former spouse was awarded part of the total survivor CSRS or FERS annuity, you'll receive the remainder.

What is the maximum survivor benefit?

If you retire under the Civil Service Retirement System (CSRS), the maximum survivor benefit payable is 55 percent of your unreduced annual benefit. If you retire under the Federal Employees Retirement System (FERS), the maximum survivor benefit payable is 50 percent of your unreduced annual benefit .

What are the types of benefits payable?

The types of benefits payable are: Current spouse survivor annuity. Former spouse annuity that is voluntarily elected or awarded by a court order in divorces granted on or after May 7, 1985. A one-time lump sum benefit.

What happens if you don't pay an annuity upon death?

If no survivor annuity is payable upon the retiree's death, any remaining portion, representing either the remaining annuity and/ or retirement contributions not paid to the retiree, is payable to the person (s) eligible under the order of precedence.

What is a partial annuity?

A full or partial annuity for a spouse. A full or partial annuity for a former spouse. A combination of a full or partial annuity for a spouse and for a former spouse. Here are things you should consider when making an election: Your spouse's future retirement benefits based on his or her own employment. Other sources of income.

How long after annuity can you increase your spouse's health insurance?

Your spouse's need for continued coverage under the Federal Employees Health Benefit program. There's an opportunity to increase survivor benefits within 18 months after the annuity begins. However, this election may be more expensive than the one you make at retirement.

How much is the reduction for insurable interest?

Here's how the reduction to provide an insurable interest benefit is calculated: If the person named is older, the same age, or less than 5 years younger than the retiree, the reduction is 10 percent. If the person named is 5 but less than 10 years younger than the retiree, the reduction is 15 percent.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

How to report a death to the funeral home?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778 ). You can speak to a Social Security representative between 8:00 am – 5:30 pm. Monday through Friday.

Can I apply for survivors benefits now?

You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later. For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

When can I switch to my own Social Security?

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62 .

Can a widow get a divorce if she dies?

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more. Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.