How to estimate Railroad Retirement?

- Round the result to the nearest lower ten cents.

- Apply a cost-of-living increase (if needed) for each year between the first year of eligibility and the year of retirement.

- Round the result to the nearest lower ten cents.

Do you have to pay taxes on Railroad Retirement?

Railroad retirement annuities are not taxable by states in accordance with section 14 of the Railroad Retirement Act (45 U.S.C. § 231m). The RRB will not withhold state income taxes from railroad retirement payments. Purpose of Form RRB W- 4P. Form RRB W-4P is used by United States citizens or legal residents for U.S. tax purposes.

What part of Railroad Retirement is taxable?

The SSEB portion of Tier I – the part of a Railroad Retirement annuity equivalent to a Social Security benefit based on comparable earnings and included on Form RRB-1099 (or Form RRB-1042S for nonresident aliens) – must be reported on an individual’s federal income tax return, and is treated for tax purposes the same way as a Social Security benefit. The amount of these benefits that may be subject to federal income tax, if any, depends on the beneficiary’s income.

What are Tier 1 Railroad Retirement Benefits?

Tier 1 Railroad Benefits

- Retirement. Retirement benefits are calculated the same way as Social Security retirement benefits, but the eligibility requirements differ.

- Disability Benefits. The RRB follows the same definition of disability as the SSA. ...

- Spousal Benefits. ...

- Children's Benefits. ...

- Survivors Benefits. ...

How much of railroad retirement is taxable?

If the sum of a recipient's adjusted gross income, tax-exempt interest, and half of either Social Security benefits or Social Security-equivalent Tier I Railroad Retirement benefits exceeds $25,000 for single taxpayers or $32,000 for couples who file jointly, up to 50 percent of the benefits are taxable.

At what age is railroad retirement no longer taxed?

This is age 60 with 30 or more years of railroad service or age 62 with less than 30 years of railroad service. beginning date. Partition payments are not subject to tax-free calculations using the EEC amount. Note - The RRB does not provide or compute the tax-free amount of railroad retirement annuities.

What is the difference between tier1 and Tier 2 railroad retirement?

Tier 1 benefits are adjusted for the cost of living by the same percentage as Social Security benefits. Tier 2 benefits are based on the employee's service in the rail- road industry and are payable in addition to the tier 1 benefit amount.

Are tier 1 and Tier 2 railroad retirement benefits taxed in California?

Question 988: Does California's income tax apply to my Railroad Retirement benefit? Answer: Most of Tier 1 is treated like Social Security benefits, so it should be excluded from State income tax. The remainder of Tier 1, all of Tier 2, is treated like a private pension, so it should be fully taxable.

What is a railroad Tier 1 benefit?

Tier 1 Railroad Benefits. Tier 1 benefits include retirement, disability, spousal, and survivors benefits.

What is railroad tier1 compensation?

What is Tier I Compensation? Tier I is the railroad retirement equivalent of social security wages and benefit amounts. Employees and employers pay taxes based on the employee's earnings.

What is tier1 tax?

The tier 1 tax rate is 7.65 percent (6.2 percent for railroad retirement and 1.45 percent for Medicare). Tier 1 uses the same annual contribution and benefit base as the social security wage base for earnings subject to the 6.2 percent rate.

Can you collect social security and railroad retirement at the same time?

Answer: Yes, you can apply for and receive both benefits, but the Tier 1 portion of your Railroad Retirement Annuity will be reduced by the amount of your Social Security benefit, so you may not receive more in total benefits.

Can I get my social security and my husbands railroad retirement?

Yes. The tier I portion of a spouse annuity is reduced for any social security entitlement, regardless of whether the social security benefit is based on the spouse's own earnings, the employee's earnings or the earnings of another person.

Are tier 1 railroad retirement benefits taxable to California?

Retirement Benefits ** Railroad benefits paid by individual railroads are taxable by California. These benefits are reported on federal Form 1099-R.

Does California tax railroad retirement income?

California does not tax Social Security or Railroad Retirement benefits, but does tax all other retirement income such as pensions and IRA distributions.

What part of RRB 1099-R is taxable?

Amounts shown on Form RRB-1099-R are treated like private pensions and taxed either as contributory pension amounts or as noncontributory pension amounts. The NSSEB portion of tier I and tier II (shown as the contributory amount paid on the statement) are contributory pension amounts.

Where does the RRB withhold taxes?

The individual resides outside the 50 United States, Washington D.C., Guam, and the Commonwealth of the Northern Mariana Islands. If the "No" box is completed, the RRB will withhold taxes as if married and claiming three allowances. Item 7. Marital Status: Enter your marital status for tax withholding purposes.

Is a tier 1 annuity taxable?

The non-social security equivalent benefit (NSSEB) portion of tier 1 benefits, tier 2 benefits, vested dual benefits, and supplemental annuity payments are considered taxable income regardless of the amount of any other income you may have. These portions of your annuity are subject to Federal income tax withholding.

Is Social Security income taxable?

If your taxable income and tax-exempt interest income, plus one-half of the amount of your social security equivalent benefits, is more than your base amount, some of your benefits may be taxable. You can choose to have taxes withheld from the SSEB portion of your railroad retirement annuity by filing IRS Form W-4V.

Is Railroad Retirement annuity taxable?

The portions of a railroad retirement annuity that are taxable the same as Social Security benefits are generally referred to as social security equivalent benefits (SSEB).

Does RRB W-4P include accrual?

Each payment you receive will be taxed based on what you claim on your RRB W- 4P. This includes accrual payments. If what you claimed on your RRB W-4P along with item 10 (additional amount) is more than the accrual payment we will also withhold the entire accrual payment. Even, if the tax withholding amount calculated is more than the accrual payment, we cannot withhold any portion of your SSEB, unless IRS Form W- 4V is filed with the RRB.

Is SSEB taxable?

The SSEB portion of tier I is similar to a social security benefit and is treated as a social security benefit for Federal income tax purposes. To determine if your SSEB portion of tier I and/or social security benefits are taxable, refer to the Social Security Benefits worksheet in the IRS booklet 1040 Instructions.

Is railroad retirement annuity taxable?

The NSSEB portion of tier I and the tier II portion of a railroad retirement annuity are treated like contributory pensions for Federal income tax purposes. Only the amount of the contributory pension that exceeds the amount of contributions made by the wage earner is taxable.

What should every railroader know about taxes?

What Every Railroader Should Know About Taxes and Railroad Retirement. Tier 1 Tier 2 Retirement Financial Planning Taxes. A hard earned benefit to all railroad employees is the retirement annuities that are administered by the Railroad Retirement Board. However, as the expression goes, “ there is no free lunch”.

What is the 6.20% retirement rate for railroad employees?

The math breakdowns is as follows: 6.20% for railroad retirement and 1.45% goes to Medicare. The employer pays the same amount for each employee. Once the employee earnings reach $132,900 in 2019, the 6.20% will stop being collected for the Tier 1 portion. However the 1.45% for Medicare continues with no earnings limit.

What is a tier 1 annuity?

Lets’ start with the taxation of Tier 1 annuity benefits. The taxation of Tier 1 benefits is a function of two amounts: The total amount of Tier 1 benefits received, and. The amount of you other income. The higher amount of Tier 1 benefits received during the tax year and the higher the income from other sources (including tax exempt income), ...

How is railroad retirement annuity funded?

The two tiers of the railroad retirement annuity are funded by payroll taxes that are collected from the employees and the employer. Regarding Tier 1, employees have 7.65% of their pay deducted from each paycheck that funds Tier 1. The math breakdowns is as follows: 6.20% for railroad retirement and 1.45% goes to Medicare.

What is the difference between a Tier 1 and Tier 2 annuity?

The Age and Service annuity consists of two parts, Tier 1 and Tier 2. Tier 1 is identical to Social Security for the most part and Tier 2 acts much more like a traditional annuity.

Does Highball Advisors offer tax advice?

Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. Highball Advisors encourages you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation.

Do you pay taxes on railroad retirement?

Well now that you have paid taxes your whole career for the Railroad Retirement Annuity, it is only right that the federal government has decided it will also tax your benefits you will be receiving in retirement. The tax payments will be distinct for Tier 1 and Tier 2.

Get Your Social Security Form 1099 or 1042S Online

Avoid mail delays and get your Form SSA-1099 or SSA-1042S, Social Security Benefit Statement, online at the Social Security Administration.

Nontaxable Benefits

Other income is taken into account in determining whether your benefits are taxable. Your benefits won't be taxable unless the sum of your modified adjusted gross income (MAGI) plus one half of your benefits received in the tax year is more than the base amount for your filing status.

How Do I Know if My Benefits Are Taxable?

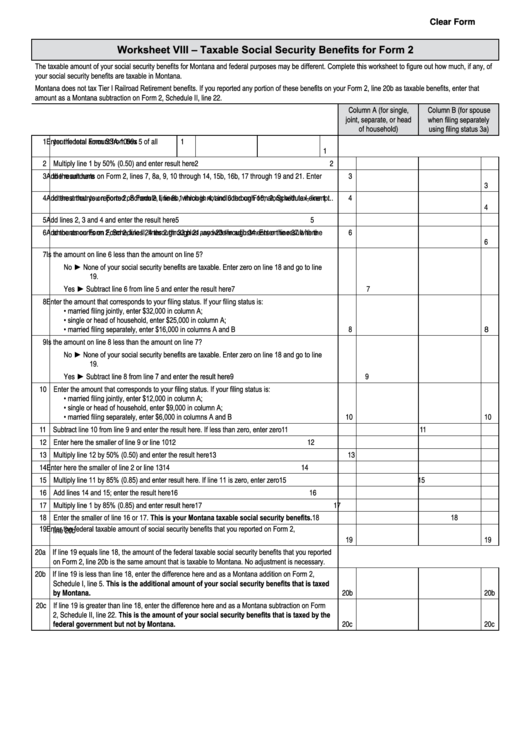

Review Are My Social Security or Railroad Retirement Tier I Benefits Taxable? or Worksheet 1 in Publication 915, Social Security and Equivalent Railroad Retirement Benefits to figure if your benefits are taxable, or complete a worksheet in the Instructions for Form 1040 (and Form 1040-SR) PDF to figure your taxable benefits and MAGI.

Lump-Sum Payments

If you received benefits in the current tax year that were for a prior year, see Publication 915 for rules on a special lump-sum election that you can make. This election may reduce the amount of your taxable benefits.

Determining Who Is Taxed

If any of the benefits are taxable, the person with the legal right to receive the benefits must include them in gross income. For example, if you and your child received benefits, you must use only your own portion of the benefits in figuring if any part is taxable to you, even if the check for your child was made out in your name.

How Benefits Are Reported to You

You should receive your Form SSA-1099, Social Security Benefit Statement or Form RRB-1099, Payments by the Railroad Retirement Board by early February for the benefits paid in the prior calendar year. The form will show benefits paid to the person who has the legal right to receive them, and the amount of any benefits repaid.

Reporting Taxable Benefits

Report your taxable benefits on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.