How much tax do you pay on unemployment benefits?

- Taxable social security benefits (Instructions for Form 1040 or 1040-SR, Social Security Benefits Worksheet)

- IRA deduction (Instructions for Form 1040 or 1040-SR, IRA Deduction Worksheet)

- Student loan interest deduction (Instructions for Form 1040 or 1040-SR, Student Loan Interest Deduction Worksheet)

How much unemployment compensation is tax free?

Yet researchers estimate that only 40% of unemployment payments in 2020 had taxes withheld. That’s due, in part, to the fact that while state unemployment agencies are supposed to offer the option to withhold 10% of benefits for income taxes, some states failed to do so.

Do you get taxes back from unemployment?

Unemployment benefits are taxable income, so recipients must file a Federal tax return and pay taxes on those benefits. Depending on your circumstances, you may receive a tax refund even if your only income for the year was from unemployment. To receive a refund or lower your tax burden, make sure you either have taxes withheld or make estimated tax payments.

Is the extra 600 unemployment taxable?

Yes, the $600 additional weekly benefit is taxable, just like your regular unemployment benefits. It is therefore important to make provision for how you are going to pay that tax. Are the $300 Disaster Relief Fund Unemployment Benefits Taxable?

How much of the 600 will be taxed?

The second stimulus check from the $900 billion relief package is not taxable. The $600 stimulus payment is also considered an advance of a tax credit for the 2020 tax year and is not considered part of your taxable income.

Is stimulus unemployment taxable?

Will the unemployment money I receive during the pandemic eventually be taxed? By law, unemployment payments are taxable and must be reported on your federal tax return, according to the IRS. This includes the special unemployment compensation authorized under the COVID-19 relief bills.

Is the $300 stimulus taxable?

Yes. All unemployment benefits (including the extra $300 per week PUC payment) are included in your taxable gross income and Modified Adjusted Gross Income for purposes of eligibility for financial help available through Covered California.

What happens if you don't withhold taxes on unemployment?

If you don't have taxes withheld from your unemployment benefits and you fail to make estimated payments, you'll have to pay any lump sums and penalties by tax day (usually April 15), when your tax return is due.

What are the types of unemployment benefits?

Here are some types of payments taxpayers should check their withholding on: 1 Benefits paid by a state or the District of Columbia from the Federal Unemployment Trust Fund 2 Railroad unemployment compensation benefits 3 Disability benefits paid as a substitute for unemployment compensation 4 Trade readjustment allowances under the Trade Act of 1974 5 Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and 6 Unemployment assistance under the Airline Deregulation Act of 1978 Program

How to get 10% withholding from unemployment?

To do that, fill out Form W-4V, Voluntary Withholding Request PDF, and give it to the agency paying the benefits. Don't send it to the IRS. If the payor has its own withholding request form, use it instead.

When are quarterly estimated taxes due?

The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively.

Is unemployment taxable in 2020?

By law, unemployment compensation is taxable and must be reported on a 2020 federal income tax return. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted this spring. Withholding is voluntary.

Line 7

You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you in 2020. Report this amount on line 7.

Unemployment Compensation Exclusion Worksheet – Schedule 1, Line 8

If you are filing Form 1040 or 1040-SR, enter the total of lines 1 through 7 of Form 1040 or 1040-SR. If you are filing Form 1040-NR, enter the total of lines 1a, 1b, and lines 2 through 7.

Do I Need To File An Amended Return To Claim The Tax Break

How to report the non taxable unemployment benefits on your 2020 return.

What If My 1099

According to the IRS, taxpayers who receive an incorrect Form 1099-G for unemployment benefits they did not receive should contact the issuing state agency to request a revised Form 1099-G showing they did not receive these benefits.

Income Taxes Vs Fica Taxes

Unemployment compensation is not subject to FICA taxes, the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working.

What To Do If You Have Filed Already

If you collected unemployment insurance in 2020 but you already filed your tax return, you are still eligible for the exemption under the American Rescue Plan. You do not need to take any action to claim the money youre owed. Instead, the IRS will automatically refund the money.;

Can I Have Taxes Withheld From Unemployment Payments

Yes. State unemployment agencies allow you to have federal and state taxes taken out of your unemployment checks, and the IRS recommends you do this to avoid surprise tax bills. You can set this up when you first apply for unemployment, or at any point while you are receiving it, by filing Form W-4V.

Preparing Your Tax Return Now

If you are preparing you own tax return, you must determine if you are eligible for the exclusion by considering whether your AGI is less than $150,000. Filing electronically is the easiest way to calculate the correct amount.

Should I Just Submit For An Extension On Filing My Taxes

Spivey said she anticipates “a significant number of people that will not do this year, and then get charged penalties and interest.” Sometimes people then experience a “snowball effect,” she said. “They don’t do one year and then it causes anxiety, and then they just don’t do them for a couple of years.”

How to withhold taxes from unemployment in 2022?

Tax Withholding in 2022: If you think you will still receive unemployment benefits in 2022, start and estimate your 2022 Income Tax Return first and factor in the unemployment benefit payments or income . If you see a result of large tax refund, you should start withholding taxes from your unemployment benefit payments or other income you might have (e.g. W-2, 1099 income, etc.). Based on the estimated tax return results, you might want to have 10% withheld for IRS or Federal taxes. To do so, complete the Voluntary Tax Withholding Request Form W-4V and submit to your state tax agency (click your state below and scroll to the bottom for the state agency address). The state agency will then withhold federal income taxes from your unemployment benefit payments. Alternatively, you can also submit Form 1040-ES with quarterly tax estimate payments - FileIT - or pay your IRS taxes online.

When will the IRS refund unemployment benefits in 2021?

n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021. The IRS will issue these payments in two phases: first to individual taxpayers affected, then to married filing joint taxpayers and/or those with more complicated returns.

How long will unemployment be extended in 2021?

Monitor here to see how your state (s) will handle the unemployment compensation exclusion in response to the ARPA. 2020 Unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020.

How many people filed for unemployment in 2020?

Over 23 million individuals had filed for unemployment during 2020. For the first time, some self-employed workers qualified for unemployment benefits. Get the details on the third stimulus payment.

How long will unemployment benefits be extended?

Enhanced 2020 unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020. However, many states ended this earlier than the September date. The unemployment benefits have increased by $300 per week as a result of the December 2020 second stimulus payment package. It is not too late to claim the first or second stimulus payment on your 2020 Tax Return if you never received them! See how to claim the Recovery Rebate Credit on your 2020 Return by filing a previous year return.

How long does unemployment last?

In most states, unemployment benefits are paid weekly for 26 weeks after the unemployment application and approval process. Some states offer different maximum weeks for unemployment compensation, such as Montana at 28 weeks or Florida at 12 weeks (see table below).

When will the IRS refund unemployment?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021.

How are unemployment benefits taxable?

How Unemployment Benefits Are Usually Taxed. Unemployment benefits are usually taxable as income – and are still subject to federal income taxes above the exclusion, or if you earned more than $150,000 in 2020. Depending on the maximum benefit size in your state and the amount of time you were receiving unemployment benefits, ...

Is the stimulus payment taxable?

Those payments were considered a refundable income tax credit and were never taxable. The stimulus payments were technically an advanced payment of a special 2020 tax credit, based on your 2018 or 2019 income (your most recent tax return on file when they calculated the stimulus payments).

Do you have to pay taxes on unemployment in 2020?

Millions of people received unemployment benefits in 2020, and many are in tax limbo now. The federal government usually taxes unemployment benefits as ordinary income (like wages), although you don't have to pay Social Security and Medicare taxes on this income.

Can you file a W-4V with unemployment?

You can ask to have taxes withheld from your payments when you apply for benefits, or you can file IRS Form W-4V, Voluntary Withholding with your state unemployment office . You can only request that 10% of each payment be withheld from your unemployment benefits for federal income taxes.

Is unemployment taxable in 2020?

Unemployment benefits are usually taxable, although a new law excludes some payments for 2020 – and complicates tax filing this year.

Does the $10,200 unemployment tax apply to 2020?

The $10,200 exclusion only applies to unemployment benefits paid in 2020, but the rules could change. "It does appear to be the type of provision that Congress may include in the next round of tax legislation later this year for 2021," says Luscombe. [.

When will unemployment be tax free?

Unemployment Benefits Were Tax-Free in 2020. Don't Expect That in 2021

Will there be a 2021 unemployment rule?

Those collecting benefits should be aware that so far, no such rule exists for 2021.

Is the tax break on unemployment guaranteed?

Image source: Getty Images. Last year's tax break on unemployment is not guaranteed for this year. Millions of Americans lost their jobs during the pandemic, and the damage was especially devastating in the spring of 2020, when weekly jobless claims were filed in the millions.

Will the IRS refund unemployment in 2020?

The bill also threw the jobless a tax break, exempting up to $10,200 in unemployment benefits from taxes in 2020. A lot of people may have gotten a tax refund this year due to that change. Normally, those collecting unemployment benefits can have taxes withheld up front so they don't owe the IRS money later.

How much unemployment will be exempt from taxes in 2020?

As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the pandemic will find that up to $10,200 of those benefits will be exempt from taxes.

How many people will receive unemployment in 2020?

Brian Galle, a professor at Georgetown Law School, analyzed the impact for The Century Foundation, a progressive think tank, looking at the nearly $580 billion dollars in unemployment benefits sent to more than 40 million Americans in 2020.

What is the unemployment income exemption?

The unemployment income exemption is the result of a compromise between Democrats and Republicans to get the package passed. They agreed to trim extended weekly jobless benefits to $300 from $400, but also to continue the federal boost through Sept. 6 and make the first $10,200 of income tax free for those jobless Americans making under $150,000.

What line do you include unemployment on?

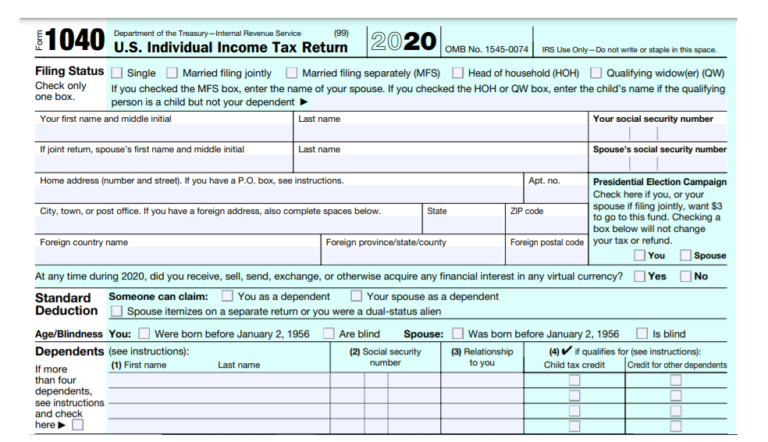

The IRS recommends using that form to fill out the Form 1040, the standard tax worksheet. On Line 7 and 8 of the form, you include how much unemployment insurance you and your spouse received, and add those numbers up. The total number is the amount of "unemployment compensation excluded from your income.".

When is the IRS filing 1099 G?

MORE: IRS delays tax filing deadline to May 17 because of COVID-related changes. Any Americans who received unemployment insurance will receive a 1099-G form that details how much the individual or household received in benefits in the 2020 tax year. The IRS recommends using that form to fill out the Form 1040, the standard tax worksheet.

What is the tax break for 2021?

The tax break is part of the American Rescue Plan, President Joe Biden's $1.9 trillion relief package that also includes direct payments for Americans in 2021. A U.S. Department of the Treasury Internal Revenue Service (IRS) 1040 Individual Income Tax sits with a W-2 wage statement in Tiskilwa, Ill., March 20, 2020.

Is the tax break hotly contested?

Although many of the provisions in the American Rescue plan have been criticized, the tax break is less hotly contested, for example, than the direct payments.