The Advantages of Sole Proprietorship Taxation

- Convenience. As a sole proprietor, you report your business income on your personal income tax return, which is...

- Potential Lower Rates. Income from your sole proprietorship is taxed at your individual income tax rate, which may be...

- Umbrella Effect. If you have losses in your sole proprietorship for the year, you can use...

How does sole proprietor pay business taxes?

Sole Proprietorship Taxes Defined

- Federal and State Income Tax. Sole proprietors file need to file two forms to pay federal income tax for the year. ...

- Self-Employment Tax. When you work for an employer, they’re responsible for taking Social Security and Medicare tax out of your pay.

- Federal and State Estimated Taxes. Estimated taxes aren’t a separate class of tax by themselves. ...

- Sales Tax. ...

How do sole proprietors are taxed?

Sole proprietors are responsible for paying:

- Federal income tax.

- State income tax, if this applies in your home state.

- Self-employment tax.

- Federal and state estimated taxes.

- Sales tax, if applicable.

Which businesses are best suitable for sole proprietorship?

Some advantages of a sole proprietorship include:

- It’s easy and inexpensive to form. As an unincorporated business, you may not need to formally register to establish a sole proprietorship. ...

- You will report profits and losses on your personal income tax return. ...

- You avoid double taxation. ...

- You have complete control of your business. ...

What are the pros and cons of sole proprietorship?

PROS OF A SOLE PROPRIETORSHIP

- Easy setup or formation. A sole proprietorship is very easy to form, which most likely explains why it is the oldest type of business structure known to man.

- Management flexibility. The reason why many individuals go into business is because they want to “be their own boss”. ...

- Less government control. ...

- Tax advantages. ...

- Least amount of recordkeeping. ...

Do you pay more taxes as a sole proprietor?

Sole proprietors must pay the entire amount themselves (although they can deduct half of the cost). The self-employment tax rate is 15.3%, which consists of 12.4% for Social Security up to an annual income ceiling (above which no tax applies) and 2.9% for Medicare with no income limit or ceiling.

How do sole proprietors reduce taxes?

For tax purposes, a sole proprietorship is a pass-through entity. Business income “passes through” to the business owner, who reports it on their personal income tax return. This can reduce the paperwork required for annual tax filing.

What taxes do sole proprietors pay?

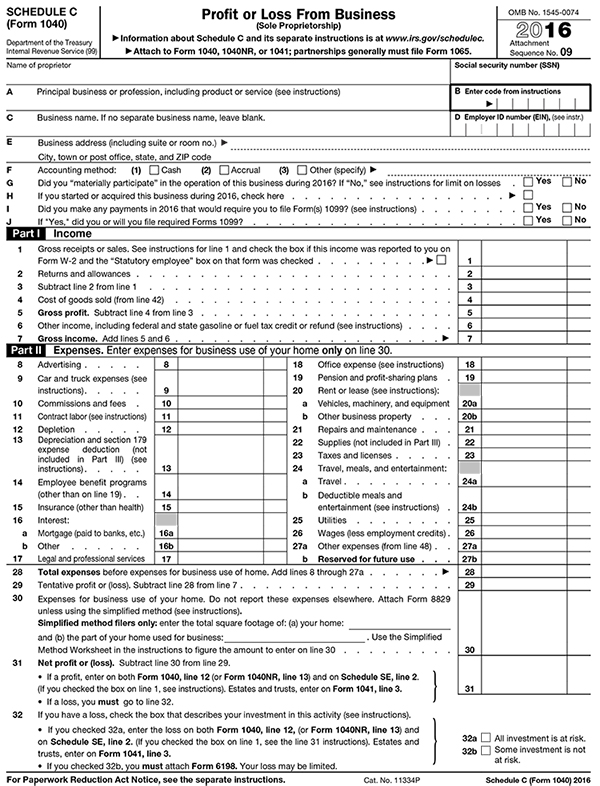

Sole proprietorships are subject to pass-through taxation, meaning the business owner reports income or loss from their business on their personal tax return, but the business itself is not taxed separately. A sole proprietor will submit a Schedule C with their personal 1040 tax return on an annual basis.

What is better LLC or sole proprietorship?

A sole proprietorship is useful for small scale, low-profit, and low-risk businesses. A sole proprietorship doesn't protect your personal assets. An LLC is the best choice for most small business owners because LLCs can protect your personal assets.

How many years can a sole proprietor claim a loss?

The IRS will only allow you to claim losses on your business for three out of five tax years. If you don't show that your business is starting to make a profit, then the IRS can prohibit you from claiming your business losses on your taxes.

Can a sole proprietor get a tax refund?

Sole proprietors are entitled to tax refunds when the estimated tax payments they have made throughout the year exceed their tax liability based on the company's overall profit and loss.

Will I get a tax refund if my business loses money?

A common business accounting question that tax practitioners often hear from small-business clients is “Why doesn't my business get a tax refund?” Taxpayers, in general, receive a refund only when they have paid more tax than was due on their return. The same is essentially true of businesses.

How much should I set aside for taxes as a sole proprietor?

To cover your federal taxes, saving 30% of your business income is a solid rule of thumb. According to John Hewitt, founder of Liberty Tax Service, the total amount you should set aside to cover both federal and state taxes should be 30-40% of what you earn.

What is the tax rate for sole proprietorship?

Income from your sole proprietorship is taxed at your individual income tax rate, which may be lower than the corporate tax rates. For example, if the corporate tax bracket is 39 percent and your individual income rate is 28 percent, you'll save on the tax difference.

How long can you carry back a sole proprietorship loss?

Instead, you can carry it back for the prior two years or carry forward the loss for the next 20 years to offset your future gains. For example, say you have a $10,000 loss in the first year and no other income to offset.

How often is a C corporation taxed?

Corporate income from a C Corporation is taxed in the year it's earned on the corporate return and then taxed a second time when the income is distributed to the owners. With a sole proprietorship, you only pay individual income taxes on it once -- when you earn it.

What happens if you make a profit of $90,000 in the second year?

When you make a profit of $90,000 in the second year, you can carry that loss forward to bring your taxable income down to $80,000 in the second year. Mark Kennan is a writer based in the Kansas City area, specializing in personal finance and business topics.

What are the advantages of sole proprietorship?

The advantages of a sole proprietorship include easy setup and complete control over business decisions. Depending on the state you live and do business in, you may form a sole proprietorship without a special license. It also runs more simply if you’re the only employee and don’t manage payroll for others.

What form do sole proprietors file to pay federal taxes?

Federal and State Income Tax. Sole proprietors file need to file two forms to pay federal income tax for the year. Firstly, there’s Form 1040 , which is the individual tax return.

How much is self employed tax?

Here’s how the self-employment taxbreaks down for 2019: 12.4% goes t0ward Social Security tax, on up to the first $132,900 of your income. 2.9% goes toward Medicare tax.

Is a sole proprietorship a pass through entity?

For tax purposes, a sole proprietorship is a pass-through entity. Business income “passes through” to the business owner, who reports it on their personal income tax return. This can reduce the paperwork required for annual tax filing. But it’s important to understand which sole proprietorship taxes you’ll pay.

Do you have to pay sales tax if you sell a product?

If you sell products or services in your business, you may have to collect and pay sales tax. How you pay and collect this tax depends on your home state. Your state’s department of revenue can tell you if and when you pay and file taxes. Tax Deductions for Sole Proprietorships.

What are the advantages of sole proprietorship?

What Are the Main Advantages of a Sole Proprietorship? Sole proprietorships are inexpensive to form and give you more freedom and control, but they come with some significant drawbacks. by Boni Peluso. updated August 02, 2021 · 2 min read. A sole proprietorship is the most common type of business in the United States.

What is a sole proprietorship?

Sole Proprietorship Gives You Complete Control. A sole proprietorship is an unincorporated business that's owned and operated by just one person. And it's not a legal entity that is formed with the state. As the owner, you make all the decisions and call all the shots.

What are the drawbacks of being sole owner?

Here are two major drawbacks that you should be aware of: Being the sole owner, you are entitled to all the profits. The downside is that you are also held responsible for all of your business debts, liabilities, and losses.

Is it easier to file taxes as a sole proprietor?

Filing Taxes Is Also Simpler With a Sole Proprietorship. For tax purposes, you and your business are viewed as one. The business income is your personal income, so your business isn't taxed separately like with a corporation. As the sole owner, you benefit from what's called "pass-through taxation.". The tax liability belongs to you and "passes ...

Can a single member LLC have a partner?

There are no partners to consult with or a board of directors to answer to. However, you should know that as a single-member LLC, you also won't have partners to consult or a board of directors to answer to. And you'll have the personal liability protection that a sole proprietorship cannot provide.

What are the advantages of sole proprietorship?

5 advantages of sole proprietorship 1 Less paperwork to get started. 2 Easier processes and fewer requirements for business taxes. 3 Fewer registration fees. 4 More straightforward banking. 5 Simplified business ownership.

Why is sole proprietorship important?

Therefore, another one of the crucial advantages of sole proprietorship is the ability to save on registration fees.

Why is it harder to sell a business?

It's harder to sell your business. 1. No liability protection. Since sole proprietors don’t need to register as a business with their state of operation , they also don’t get any of the benefits that come from having a legal business entity.

What is a sole proprietorship?

With a sole proprietorship, you don’t have to concern yourself with some of the other components included in an LLC or corporation, such as company officers or registered agents. As the sole business owner, you have total control over decisions, finances and anything else involved with how your company functions.

Can a sole proprietor take a personal loan?

But as a sole proprietor taking out a personal loan, you’re signing a personal guarantee and putting up your own personal assets as collateral, and there’s no protection to keep the bank from taking your property if your business is in trouble and you can't pay back the loan. 3. It’s harder to sell your business.

Is sole proprietorship a disadvantage?

Although this can certainly be considered one of the benefits of sole proprietorship, it can also be a notable disadvantage. Without the legal protections associated with incorporating your business, you're personally liable for any of your company’s legal, financial or tax problems.

Can you sell a sole proprietorship to someone else?

Since a sole proprietorship is attached to an individual by nature, it’s all but impossible to sell or hand down your business to someone else. Therefore, your business ends in the event of your death, or if you decide that you no longer want to run the company.

What are the advantages of sole proprietorship?

Despite its simplicity, a sole proprietorship offers several advantages, including the following: 1. Easy and inexpensive process. The establishment of a sole proprietorship is generally an easy and inexpensive process. Certainly, the process varies depending on the country, state, or province of residence.

What is a sole proprietorship?

A sole proprietorship (also known as individual entrepreneurship, sole trader, or simply proprietorship) is a type of an unincorporated entity that is owned by one individual only. It is the simplest legal form of a business entity. Note that, unlike the partnerships or corporations. Corporation A corporation is a legal entity created by ...

Can a sole proprietorship be a separate entity?

, a sole proprietorship does not create a separate legal entity from the owner. In other words, the identity of the owner or the sole proprietor coincides with the business entity.

Is the owner of a business liable for all liabilities?

Because of this fact, the owner of the entity is fully liable for any and all the liabilities incurred by the business. The simplicity of a sole proprietorship makes this form of business structure extremely popular among small businesses, ...

Does a sole proprietorship pay income tax?

Tax advantages. Unlike the shareholders of corporations, the owner of a sole proprietorship is taxed only once. The sole proprietor pays only the personal income tax on the profits earned by the entity. The entity itself does not have to pay income tax.

What is the limit for a 2012 SEP IRA?

The 2012 SEP IRA contribution limit is $50,000. Contributions are normally 100 percent tax deductible. This is one of the most appealing tax benefits available to sole proprietorships and partnerships.

Is health insurance premium deductible?

Premiums are deductible on the individual's personal tax return. Furthermore, small business Health Care Tax Credits may be available for contributions made to employees' health care premiums for up to 35 percent of individual premiums paid. Retired investigator Chris Bradford has been writing since 1988.

Is a contribution to a sole proprietorship tax deductible?

Contributions are normally 100 percent tax deductible. This is one of the most appealing tax benefits available to sole proprietorships and partnerships.

Is a sole proprietorship a partnership?

The central tax advantage of sole proprietorships and general partnerships is that neither form of business is considered a legal entity, thus no sole proprietorship or partnership taxes are levied. Income is taxed once and it is declared on the personal tax return of a sole proprietor or on each partner's personal tax return.

What is the difference between a sole proprietorship and an LLC?

In a sole proprietorship, there’s no difference between your personal income and your business income. In an LLC, there’s no difference between your personal income and your share of the company’s profits. Other business entities require that you file separate taxes for both your business and your personal finances. But under a sole proprietorship or LLC, you’ll only have to file a single return. But there are minor tax differences between the two entities that you should be aware of.

What form do you submit to the IRS for sole proprietorship?

You’ll report these on the Schedule C form, which you’ll submit to the IRS attached to Form 1040 . Use this equation to find out how much of your business income is taxable:

What deductions can I claim for LLC?

If you’re filing sole proprietorship and LLC taxes in 2019, the most significant deduction you can claim is the Pass-Through Tax Deduction. This tax deduction was created by the 2017 Tax Cuts and Jobs Act. The Pass-Through Tax Deduction allows sole proprietors and partnerships (for multi-member LLCs) to deduct up to 20% of their net business income. If your income is over $315,000 (married filing jointly) or $157,000 (single), you must have employees or depreciable business property to claim this deduction. If you’re making more than $415,000 (married filing jointly) and $207,500 (single), you can’t claim this deduction if your pass-through business is a personal service firm. A personal service firm encompasses:

What is it called when an LLC is not sharing profits?

If your LLC is not sharing profits in this way, it’s called a “special allocation.”. Special allocations warrant their own IRS tax rules.

Is LLC a partnership?

The IRS treats multi-member LLCs as partnerships (a partnership is another type of business entity). Like a sole proprietorship, business profits are not taxed as a separate entity. Each LLC member pays taxes on their share of profits on their personal income taxes. Each member’s share of profits and losses should be stated on an LLC operating agreement. Most operating agreements stipulate that profits are proportional to percent interest in the business (so if you have a 50% share, you’ll pay taxes on 50% of the company’s profits). If your LLC is not sharing profits in this way, it’s called a “special allocation.” Special allocations warrant their own IRS tax rules. Like a sole proprietorship, each member must pay taxes on his or her entire share—even money that’s set aside in reserves or savings. Also, each member must pay taxes on their annual share of profits whether they’ve been distributed or not. So, if there’s $50,000 sitting in a company bank account that’s supposed to be distributed to a member, the member must still pay taxes on it even though they haven’t yet received a paycheck. The LLC doesn’t file a tax return, but it must file Form 1065 with the IRS. Form 1065 is an informational return that stipulates profit sharing among the LLC members. It helps the IRS determine whether or not LLC members are reporting their profits correctly.

Is an LLC a sole proprietorship?

For tax purposes, the IRS treats LLCs as either a sole proprietor or a partnership, depending on whether it’s a single-member LLC or multi-member LLC: Single-member LLCs are treated like a sole proprietorship. Multi-member LLCs are treated like a partnership.

Do sole proprietorships have to file taxes separately?

Sole proprietorships are not taxed separately from your personal taxes. When you file your annual tax return, you’ll report all your business income, expenses, and deductions all on the same tax filing as your personal finances. A sole proprietorship does not distinguish between the two.

What is the self employment tax rate?

This includes freelancers, independent contractors, and small-business owners. The self-employment tax rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare. 5

What are some examples of tax deductible startup costs?

Examples of tax-deductible startup costs include market research and travel-related costs for starting your business, scoping out potential business locations, advertising, attorney fees, and accountant fees. The $5,000 deduction is reduced by the amount your total startup cost exceeds $50,000.

What is a local lobbying expense deduction?

Local lobbying expenses deduction. Deduction of settlement or legal fees in a sexual harassment case, when the settlement is subject to a nondisclosure. A review of the most common self-employed taxes and deductions is necessary to keep you up to date on any necessary changes to your quarterly estimated tax payments.

When does the restaurant tax deduction expire?

This provision is effective for expenses incurred after Dec. 31, 2020, and expires at the end of 2022. 12 .

When will Social Security taxes be paid?

Self-employed individuals may defer the payment of 50% of the Social Security tax imposed under section 1401 (a) of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27, 2020, and ending December 31, 2020.

Is office supplies deductible?

Office supplies, credit card processing fees, tax preparation fees, and repairs and maintenance for business property and equipment are also deductible. Still, other business expenses can be depreciated or amortized, meaning you can deduct a small amount of the cost each year over several years.

Is a business car trip tax deductible?

When you use your car for business, your expenses for those drives are tax-deductible. Make sure to keep excellent records of the date, mileage, and purpose for each trip, and don't try to claim personal car trips as business car trips.