How much does unemployment insurance pay in NJ?

Who Pays My Unemployment Compensation in New Jersey?

- Identification. The New Jersey Department of Labor and Workforce Development oversees the state’s unemployment laws.

- Employer Requirement. Your employer’s state unemployment tax rate depends on whether he’s a new employer and his unemployment benefits history.

- Employee Requirement. ...

- Unemployment Compensation. ...

- Considerations. ...

What is the maximum unemployment benefit in New Jersey?

Why You Can Trust Us

- We match 50,000 consumers with lawyers every month.

- Our service is 100% free of charge.

- Nolo is a part of the Martindale Nolo network, which has been matching clients with attorneys for 100+ years.

How do I get my 1099 from NJ unemployment?

- Your Date of Birth

- Your name as it was entered on your last New Jersey Income Tax return filed (last name first)

- Your Zip Code (if address is in USA, otherwise enter 00000)

How to pay unemployment insurance for employees in New Jersey?

- See NJCivilRights.gov for more information about NJFLA or to file a complaint.

- See DOL.gov for more information about the FMLA.

- See IRS.gov for information on tax credits for employers that provide federal paid sick leave and childcare leave.

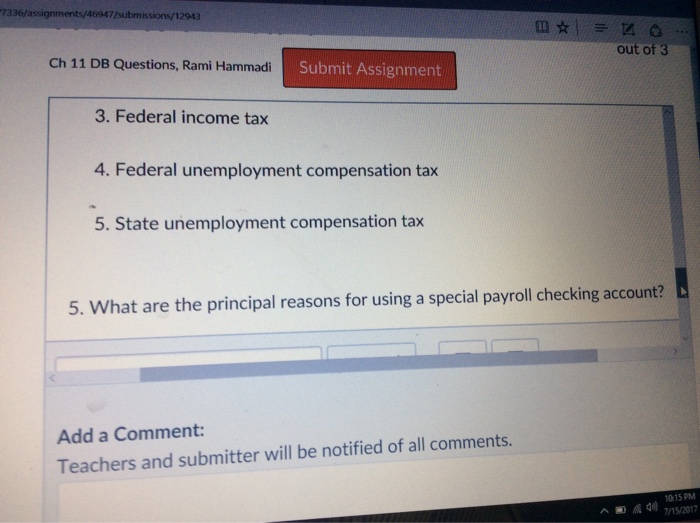

Do you have to pay taxes on unemployment benefits in New Jersey?

New Jersey does not tax unemployment insurance payments, but they are subject to federal income tax. However, under the federal stimulus bill called the American Rescue Plan, certain New Jersey workers aren't required to pay taxes on up to $10,200 in unemployment benefits received last year.

Who is exempt from NJ unemployment tax?

The law exempts certain services if they are performed for public or non-profit institutions exempt under Section 501(c)(3) of the Internal Revenue Code. They are: Services performed in the employ of a church or organization operated primarily for religious purposes.

Is stimulus money taxable in NJ?

NJ Taxation Economic Impact Payments (stimulus payments) are issued by the federal government to help ease the economic burden created by COVID-19. These stimulus payments are not subject to Income Tax in New Jersey and should not be reported on your New Jersey Income Tax return.

Is the extra 600 unemployment taxable NJ?

The additional $600 per week from the CARES Act is taxable. The $600 emergency federal unemployment benefits you may have received each week on top of your regular unemployment benefits is part of your taxable income for federal taxes and possibly for state taxes.

What happens if you don't withhold taxes on unemployment?

If you don't have taxes withheld from your unemployment benefits and you fail to make estimated payments, you'll have to pay any lump sums and penalties by tax day (usually April 15), when your tax return is due.

Is cares Act money taxable?

If governments use Fund payments as described in the Fund Guidance to establish a grant program to support businesses, would those funds be considered gross income taxable to a business receiving the grant under the Internal Revenue Code (Code)? A. Yes.

Is the HHS stimulus payment taxable income?

Yes. HHS considers taxes imposed on PRF payments to be “healthcare related expenses attributable to coronavirus” that are reimbursable with PRF money, except for Nursing Home Infection Control Distribution payments.

Who is eligible for the $500 NJ rebate?

Ed Durr (R-Gloucester) and other Republican legislators would offer a $500 rebate to joint tax filers making up to $250,000 annually, with a $250 award and $125,000 cap for single filers. The rebates would be paid on 2021 tax bills, with credits retroactively applied for residents who have already filed.

Division of Taxation

Construction related problems in the Trenton area are causing temporary issues with our automated systems. At this time, we do not know when service will be fully restored. We appreciate your patience.

NJ Income Tax - Exempt (Nontaxable) Income

Certain items of income are not subject to New Jersey tax and should not be included when you file a New Jersey return. Below is a partial list of such items.