Are unemployment benefits taxable IRS?

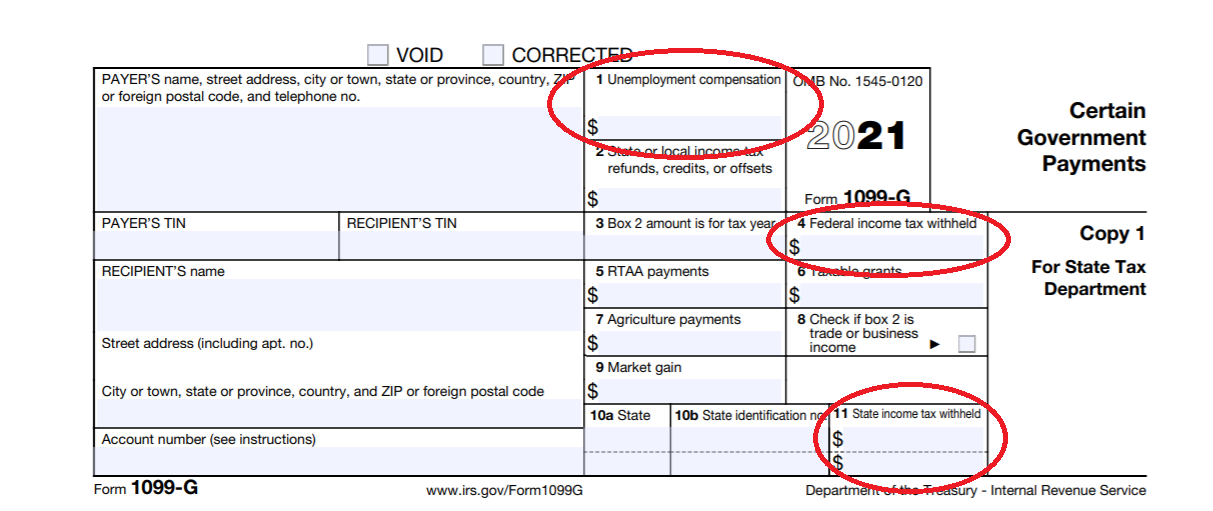

In general, all unemployment compensation is taxable in the tax year it is received. You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you. See How to File for options, including IRS Free File and free tax return preparation programs.

Is the unemployment stimulus taxable?

By law, unemployment payments are taxable and must be reported on your federal tax return, according to the IRS. This includes the special unemployment compensation authorized under the COVID-19 relief bills.

How much of the 600 will be taxed?

The second stimulus check from the $900 billion relief package is not taxable. The $600 stimulus payment is also considered an advance of a tax credit for the 2020 tax year and is not considered part of your taxable income.

What happens if you don't withhold taxes on unemployment?

If you don't have taxes withheld from your unemployment benefits and you fail to make estimated payments, you'll have to pay any lump sums and penalties by tax day (usually April 15), when your tax return is due.