Do people on welfare have to pay taxes?

Welfare payments are not considered earned income and so are untaxed. Some folks on welfare have jobs & pay taxes but are usually eligible for the Earned Income Tax Credit ( Earned income tax credit - Wikipedia) so they wind up paying no taxes even on their earned income.

Is welfare considered income for taxation?

Welfare income may be taxable in certain special circumstances. The IRS says that a person who receives welfare income as compensation for services rendered must include that income on a tax return. In addition, welfare income obtained fraudulently is considered taxable income.

What do taxes pay welfare?

- $1.68 trillion from individual income taxes

- $1.17 trillion from payroll taxes

- $204.7 billion from corporate income taxes

- $95.0 billion from excise taxes

- $175.9 billion from other

Does Welfare affect income taxes?

You can receive many different benefits that fall under the broad category of welfare. Programs such as Temporary Assistance for Needy Families (TANF), food stamps and heating assistance are all welfare program funds that are not taxable. All forms of welfare, including those from state and local agencies, are not taxed.

Does welfare count as taxable income?

Welfare and Income Taxes According to the IRS, governmental benefit payments received from a public welfare fund that gives funds based upon need such as to low income individuals, the blind or disabled, are not taxable income.

Are welfare benefits included in federal gross income?

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits.

Are welfare benefits reported on a federal tax return?

The Internal Revenue Service considers public welfare assistance to be nontaxable income. This determination means that individuals who receive welfare payments are not required to include the assistance in their taxable income for the year.

Are welfare payments excluded from income?

Payments made under social benefit programs for promotion of general welfare are excludable from gross income under a concept known as the general welfare doctrine. This applies only to governmental payments out of a welfare fund based upon the recipient's need, and not as compensation for services.

What income is nontaxable?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

What amount of income is not taxable?

In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return.

Is cash aid considered income?

According to the Internal Revenue Service, cash assistance programs are generally not a form of taxable income. If you receive these payments, you should not include them in your gross income on a federal income tax return. An exception is made for welfare assistance that is provided as a form of compensation for work.

Is employment and support allowance taxable?

Income-related ESA is not taxable. Contribution-based ESA is taxable so you may have to pay tax.

What is included in taxable income?

Taxable income is more than just wages and salary. It includes bonuses, tips, unearned income, and investment income. Unearned income can be government benefits, spousal support payments, cancelled debts, disability payments, strike benefits, and lottery and gambling winnings.

What is the general welfare exclusion act?

Tribal General Welfare Exclusion Act of 2014 - Amends the Internal Revenue Code to exclude from gross income, for income tax purposes, the value of an Indian general welfare benefit.

What happens if you don't report your income to TANF?

If so, or if it discovers that you have fraudulently received welfare payments during the year, your welfare benefits will no longer be exempt from taxes. You will need to report at least a portion of the public assistance benefits income you received on your taxes, depending on the amount of overpayment and the circumstances under which you were overpaid. Consult a tax professional to ensure that you are complying with all tax laws in your specific circumstances.

What is welfare program?

Welfare is a common name for a federal financial assistance program called Temporary Assistance for Needy Families (TANF). Since 1997, TANF has continued the work of the previous federal program, Aid to Families with Dependent Children, providing cash payments to needy families whose income falls at or below the eligible income limits.

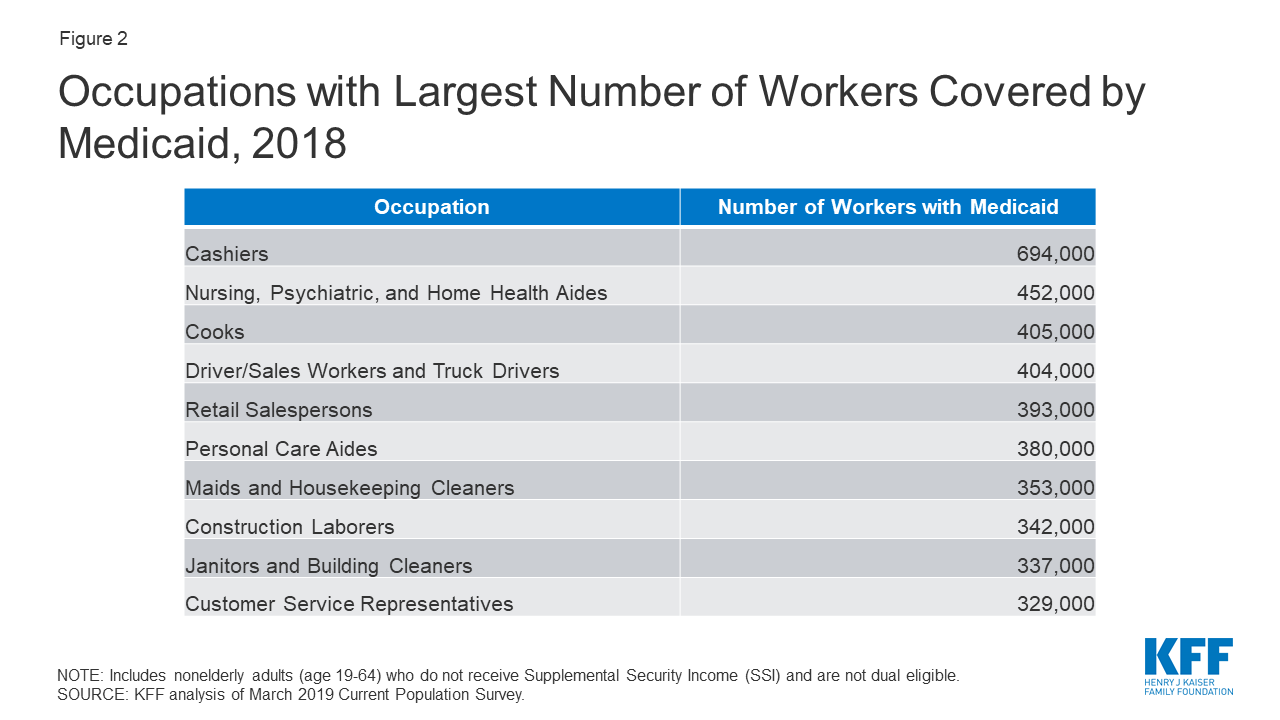

Can you deduct TANF on your taxes?

Many, if not most, TANF recipients receive some kind of public medical insurance benefits as well. If you receive Medicaid, Medicare or any other medical assistance benefits along with your TANF payments, do not deduct medical expenses on your tax returns if they were covered by your medical insurance benefits.

Do you have to include welfare to work on your tax return?

Welfare-to-Work Payments. If you are a part of a welfare-to-work program and earn income from a work training program or a job attained through such a program , you don't need to include this income on your tax return, as long as the income doesn't exceed the payments you would have received as a welfare recipient.

Is eldercare taxed?

In addition to welfare, you are not taxed on any hospital insurance benefits for eldercare. Disability and Social Security benefits are not taxed either. If you receive disability and you also work, you will have to report the portion earned from work. The one exception to this is if you received work-related training due to a disability or as an accommodation to your disability; you will not be taxed on this income.

Is welfare income taxable?

There are two exceptions to the rule about welfare being nontaxable . The first is any welfare funds that were obtained fraudulently. The second is any compensation for services performed through a job or workfare program, which counts as employment.

Is Medicare taxable?

Other nontaxable benefit programs include Medicare benefits, the Home Affordable Modification Program, food benefits that are part of nutrition programs for elderly people and programs to help reduce your winter heating bill. If you received benefits to help with medical expenses, food, dental, housing, loss of personal property, transportation or funeral expenses from a natural disaster, these funds are not taxable either. However, you might have to have been in a federally declared disaster area to qualify.

Do you have to pay taxes on Social Security?

If you receive disability or Social Security and you also work , you might have to pay income tax on a portion or all of your income earned from work. The rules in this category depend on things like income thresholds, filing status and age. IRS Publication 3966 provides further guidance on this topic.

Do you have to pay taxes on disability?

You do not have to pay taxes on worker’s compensation or any money awarded to you due to damage from a no-fault car accident. Accelerated benefits from a life insurance policy due to a terminal illness are also not taxable.

Is food stamps taxable?

Programs such as Temporary Assistance for Needy Families (TANF), food stamps and heating assistance are all welfare program funds that are not taxable. All forms of welfare, including those from state and local agencies, are not taxed.

Do you have to pay taxes on welfare?

All forms of welfare, including those from state and local agencies, are not taxed. If you receive any type of temporary cash assistance from a government agency, then you do not even have to report it on your tax return. You also will not have to pay taxes on any assistance you receive if you are disabled or blind.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

What is included in income amounts you're awarded in a settlement or judgment for back pay?

These include payments made to you for damages, unpaid life insurance premiums, and unpaid health insurance premiums. They should be reported to you by your employer on Form W-2.

Do you have to include childcare in your income?

If you provide childcare, either in the child's home or in your home or other place of business, the pay you receive must be included in your income. If you're not an employee, you're probably self-employed and must include payments for your services on Schedule C (Form 1040), Profit or Loss From Business. You generally aren’t an employee unless you're subject to the will and control of the person who employs you as to what you're to do, and how you're to do it.

Is alimony included in gross income?

Alimony received will no longer be included in your income if you entered into a divorce or separation agreement on or before December 31, 2018, and the agreement is changed after December 31, 2018, to expressly provide that alimony received isn't included in your income. Alimony received will also not be included in income if a divorce or separation agreement is entered into after December 31, 2018. For more information, see Pub. 504.

Is a bonus on a W-2 taxable?

If the prize or award you receive is goods or services, you must include the FMV of the goods or services in your income. However, if your employer merely promises to pay you a bonus or award at some future time, it isn’t taxable until you receive it or it’s made available to you.

What are the exempt programs from tax?

Here are some benefits the IRS lists as exempt from taxation: Medicare benefits received under title XVIII of the Social Security Act; Home Affordable Modification Program payments; food benefits from the Nutrition Program for the Elderly;

What is the responsibility of the Internal Revenue Service?

The Internal Revenue Service is responsible for collecting federal income taxes in the United States on a variety of income sources from wages and salaries, to royalties, interest and dividends.

Is a welfare check taxable?

According to the IRS, governmental benefit payments received from a public welfare fund that gives funds based upon need such as to low income individuals, the blind or disabled, are not taxable income.

Do you have to pay taxes on food stamps?

In other words, people who receive cash aid or benefits from programs like Supplemental Security Income, Temporary Assistance for Needy Families and food stamps do not have to pay tax on those payments or benefits.

Is a disaster relief grant taxable?

The IRS says that disaster relief grants and payments that a person uses to pay for necessary expenses or needs such as medical, dental, housing, personal property, transportation or funeral expenses are not included in taxable income.

How much of your Social Security check can you add to your other income?

Add one-half of your Social Security benefits to all your other income, including any tax-exempt interest. You could see taxes taken out of your Social Security check if you made more than: $32,000 if you are filing married filing jointly. $25,000 if you are single, a head of household, a qualifying widow or widower with a dependent child, ...

Is Social Security taxed?

Part of your Social Security benefits could be taxed, but it depends on your tax filing status and income. Social Security tax is based on how much income you had during the year from all sources, as well as your filing status.

Is unemployment taxable income?

Unemployment benefits are fully taxable as regular income. Disaster relief payments under the Disaster Relief and Emergency Assistance Act can’t be included in income if they’re to help meet necessary expenses for medical, dental, transportation, personal property or funeral expenses.

Is Medicare deductible?

Medicare – The costs for medical care under Medicare are tax free, and the premiums are tax deductible (if you itemize deductions). Jury duty pay is taxable. Food stamps are not taxable. It’s not too good to be true. See what others are saying about filing taxes online with 1040.com. Trustpilot Custom Widget.

What is a 419 E?

A 419 (e) plan allows employers to select the benefits they offer their employees. Employers can add new benefits to the plan which can be used to supplement existing benefits. For example, if an employer provides a benefit plan that includes group term life insurance, they could add disability insurance to offer a range ...

What is the downside of 419 E?

The downside of 419 (e) welfare benefit plans is that they are complex and typically require an actuary to setup and implement .

What is an irrevocable cash contribution?

Employers make irrevocable cash contributions on behalf of their employees on a periodic basis. A third-party administrator arranges actuarial certification of funding and benefits and approves the plan's administration. The Internal Revenue Service (IRS) issued revised guidance in October 2007 that excluded some benefits for plans funded ...

What is an employee benefit?

Employee Benefit: Employees receive piece-of-mind knowing that their family is protected if they encounter an untimely death. In retirement, they have many of their medical expenses covered. For example, if their plan includes post-retirement health care, they are unlikely to receive any large medical bills.

Does a 419 E plan cover health care?

A 419 (e) Welfare Benefit Plan may include health care even after retirement. A 419 (e) Welfare Benefit Plan must cover every employee (with the exception of sub-contracted workers like self-employed individuals). Experts recommend that business owners hire a reputable third party to design and set up a 419 (e) Welfare Benefit Plan.

Who holds 419 E?

The assets in 419 (e) benefit plans are usually held by an independent trustee and are exempt from seizure by any creditors the company may have. The same company pays for all of the benefits of the plan and does not pool benefits among employees of other companies. Employers make irrevocable cash contributions on behalf ...

Can a beneficiary be named in a 419 E?

Beneficiaries can be named in a 419 (e) Welfare Benefit Plan. 1. Experts recommend that business owners hire a reputable third party to design and set up a 419 (e) Welfare Benefit Plan.

Is unemployment considered earned wages?

Unemployment benefits are considered to be earned wages by the federal government, and the Internal Revenue Service assesses income tax on them accordingly.

Is fringe benefit taxable?

If you receive other types of fringe benefits from the US government, these benefits may also be considered taxable earned wages. Furthermore, depending upon the value of the benefits, you may be required to report them as earned income and pay federal income tax on them. For example, if the government pays for certain types of pleasure travel, provides tickets to certain events or puts you up in a hotel, these benefits may be declared as earned wages and you may have to pay taxes on them.

Is Social Security income taxable?

Social Security taxes have been taxable since 1983. However, social security benefits are only taxable when certain conditions are met. For example, individuals that receive Social Security benefits and earn less than $25,000 a year are exempt from federal income tax on their Social Security benefits. Likewise, married couples that file jointly and earn less than $32,000 per year are excluded from paying federal income taxes on their social the Social Security benefits as well.

How is the value of personal use determined?

The value of the personal use is determined according to the benefit's fair market value.

Does Paul pay taxes on his computer?

If Paul uses the computer 100% for his work, it is tax free to him. But if he uses it only 50% of the time for work and 50% of the time for personal purposes, he would have to pay income tax on 50% of its value. The value of the personal use is determined according to the benefit's fair market value.

Is clothing given to employees that is suitable for street wear taxable?

Clothing given to employees that is suitable for street wear is a taxable fringe benefit. Excessive education reimbursements. Payments for educational assistance that is not job related or that exceed the allowable IRS exclusion are taxable. Awards and Prizes.

Is fringe income taxable?

Any fringe benefit provided to an employee is taxable income for that person unless the tax law specifically excludes it from taxation. Taxable fringe benefits must be included as income on the employee's W-2 and are subject to withholding. Fortunately, there is a long list of fringe benefits that are tax free and need not be included in ...

Is a meal a fringe benefit?

For example, meals given to an employee who is required to be away from home overnight for rest are a tax-free fringe benefit. But non-overnight meals do not comply with this rule and are therefore taxable.

Is cash award taxable?

Awards and Prizes. Cash awards are taxable unless given to charity. Non-cash awards are taxable unless nominal in value or given to charity. Expense reimbursements without adequate accounting. An employee must provide an adequate accounting for any expense reimbursement or it will be taxable income.

Is a working condition fringe benefit tax free?

A working condition fringe benefit is tax free to an employee to the extent the employee would be able to deduct the cost of the property or services as a business or depreciation expense if he or she had paid for it. If the employee uses the benefit 100% for work, it is tax free.