The short answer is that you cannot collect both your own Social Security benefits and survivor benefits at the same time. Can a widow collect Social Security from two deceased husband's? Yes, you can.

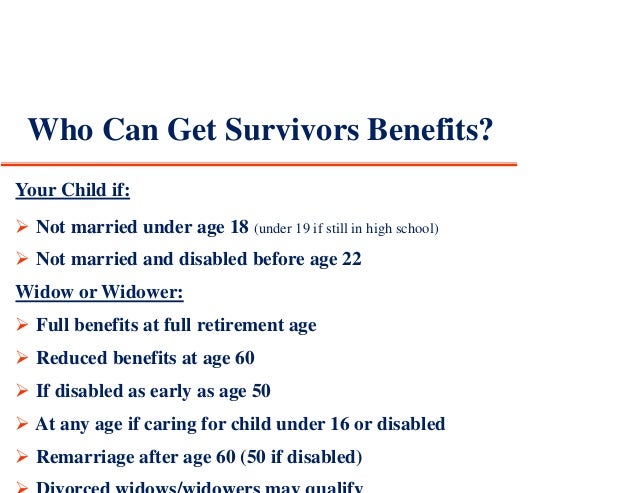

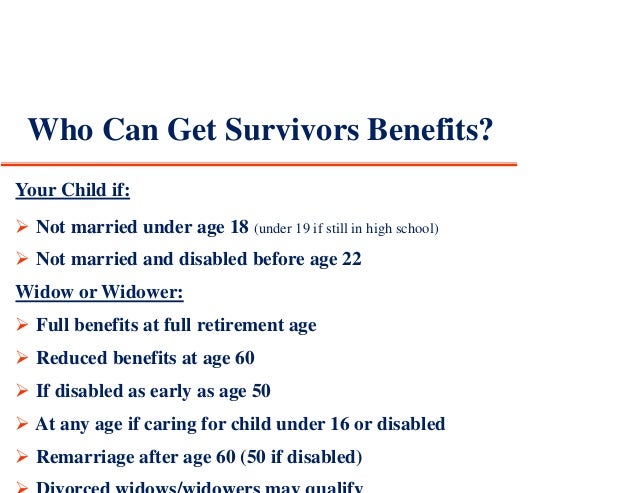

Who qualifies for Social Security survivor benefits?

- Widows and widowers typically get Social Security survivor benefits when their spouse dies.

- LGBTQ+ widows and widowers were historically denied survivor benefits, but they are now available as of February 2022.

- Mention emergency message codes EM-21007 SEN REV, code 529 and EM-20046 SEN REV 2 for faster service at Social Security field offices.

How are Social Security survivor benefits calculated?

You can expect the following when applying for Social Security spousal benefits:

- You can receive up to 50% of your spouse’s Social Security benefit.

- You can apply for benefits if you have been married for at least one year.

- If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

- Starting benefits early may lead to a reduction in payments.

How much is survivors benefits SSA?

Specifically, if you file as early as possible (age 60), then your benefit as a survivor will be 71.5% of what it would have been if you waited until your survivor FRA. From there, your survivor benefit increases proportionately until you reach your survivor FRA.

How your spouse earns Social Security Survivors Benefits?

How your spouse earns Social Security Survivors Benefits Social Security work credits are based on your total yearly wages or self-employment income. You get one credit quarterly for every $1,470 dollars you earn in 2021, and you can earn up to four credits .

Can I collect my deceased spouses Social Security and my own at the same time?

Can I Collect Both My Deceased Spouse's Social Security and My Own at the Same Time? No. Even if you are eligible to receive both benefits, Social Security will pay out only the higher of the two.

Can you collect 1/2 of spouse's Social Security and then your full amount?

Your full spouse's benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to begin receiving spouse's benefits before you reach full retirement age, your benefit amount will be permanently reduced.

Are survivors benefits more than Social Security?

Many people think of Social Security only as a retirement program. But some of the Social Security taxes you pay go toward survivors benefits for workers and their families. In fact, the value of the survivors benefits you have under Social Security is probably more than the value of your individual life insurance.

Can you draw widows benefits and Social Security?

In many cases, a widow or widower can begin receiving one benefit at a reduced rate and allow the other benefit amount to increase. If you will also receive a pension based on work not covered by Social Security, such as government or foreign work, your Social Security benefits as a survivor may be affected.

Can I collect my own Social Security and then switch to spousal benefit?

In this case, you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files. Social Security will not pay the sum of your retirement and spousal benefits; you'll get a payment equal to the higher of the two benefits.

How long does a spouse get survivors benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

Can I collect survivor benefits and wait until I am 70 to collect my own Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Do survivor benefits end at 65?

As of age 65, if a person receives the maximum retirement pension payable under the Québec Pension Plan for that year, payment of the surviving spouse's pension will end.

Are survivor benefits considered income?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

What happens when both spouse's collect Social Security and one dies?

Many people ask “can I collect my deceased spouse's social security and my own at the same time?” In fact, you cannot simply add together both a survivor benefit and your own retirement benefit. Instead, Social Security will pay the higher of the two amounts.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Should I take survivor benefits at 60?

If both payouts currently are about the same, it may be best to take the survivor benefit at age 60. It's going to be reduced because you're taking it early, but you can collect that benefit from age 60 to age 70 while your own retirement benefit continues to grow.

What age can you collect survivor benefits?

Monthly survivor benefits are available to certain family members, including: 1 . A widow (er) age 60 or older (age 50 or older if they are disabled) who has not remarried. A widow (er) of any age who is caring for the deceased's child (or children) under age 16 or disabled.

How long can you be eligible for survivor benefits?

Eligible for Benefits in the Last 12 Months. There's an exception for those who recently applied for retirement benefits. If you became entitled to retirement benefits less than 12 months ago, you might be allowed to withdraw your retirement application and apply for survivor benefits only.

When do kids get their survivor benefits?

The kids themselves qualify for benefits (paid to the surviving parent) until they turn 18 (or 19 if they are still in school). But between the child's 18th birthday (when their survivor benefits cease) and the spouse's 60th birthday (when their benefits resume), no one in the family is eligible to collect. That's what's known as a blackout period. 1

What is the amount of a survivor's benefit based on?

Benefit amounts are based on the survivor's relationship to the deceased and other factors.

What documents do you need to apply for survivor benefits?

Applying for survivor benefits may require you to submit specific documents, such as a death certificate, marriage certificate, proof of citizenship, or a divorce decree, so rounding them up beforehand will help expedite the process.

How long does a widow get Social Security?

As her son's caregiver, she is entitled to collect Social Security benefits for 14 years, until his 16th birthday. After that, her son continues to receive his survivor benefits for two more years, until he's 18. His mom will be 48 at that point, leaving the ...

How many credits do you need to be a survivor?

The younger you are, the fewer credits you need, but the maximum you will ever need is 40 credits. For most people, it is necessary to work and pay Social Security taxes for at least 10 years to accrue the required amount.

How do survivors benefit amounts work?

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

What happens if the sum of the benefits payable to family members is greater than this limit?

If the sum of the benefits payable to family members is greater than this limit, the benefits will be reduced proportionately. (Any benefits paid to a surviving divorced spouse based on disability or age won't count toward this maximum amount.)

How much is a lump sum death payment?

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if he or she was living with the deceased; or, if living apart, was receiving certain Social Security benefits on the deceased’s record.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

What happens if you die on reduced benefits?

If the person who died was receiving reduced benefits, we base your survivors benefit on that amount.

Who gets lump sum when spouse dies?

Generally, the lump-sum is paid to the surviving spouse who was living in the same household as the worker when they died. If they were living apart, the surviving spouse can still receive the lump-sum if, during the month the worker died, they met one of the following:

How to report a death to Social Security?

To report a death or apply for survivors benefits, use one of these methods: Call our toll-free number, 1-800-772-1213 (TTY 1-800-325-0778 ). Visit or call your local Social Security office. More Information. If You Are The Survivor. Survivors Benefits.

How much is a death benefit for dependent parents?

Parents age 62 or older who received at least one-half support from the deceased can receive benefits. One-time lump sum death payment. A one-time payment of $255 can be made only to a spouse or child if they meet certain requirements.

How old do you have to be to get unemployment benefits?

Unmarried children can receive benefits if they are: Younger than age 18 (or up to age 19 if they are attending elementary or secondary school full time). Any age and were disabled before age 22 and remain disabled.

What age can you take care of a child of a deceased person?

At any age if they take care of a child of the deceased who is younger than age 16 or disabled.

Can you get Social Security if you die?

When you die, members of your family could be eligible for benefits based on your earnings. You and your children also may be able to get benefits if your deceased spouse or former spouse worked long enough under Social Security.

What is the minimum age to collect survivor benefits?

(If you are disabled, the minimum age is 50.) 75 percent if you are caring for a child from the marriage who is under 16 or disabled, regardless of your own age.

How to apply for survivor benefits after husband dies?

Otherwise, you will need to apply for survivor benefits by phone at 800-772-1213 or in person at your local Social Security office .

Can you add Social Security and Social Security benefits together?

When you are eligible for two Social Security benefits — such as a survivor benefit and a retirement payment — Social Security doesn’t add them together but rather pays you the higher of the two amounts. If that’s the retirement benefit, then the retirement benefit is all you’ll get.

Can a survivor's Social Security exceed my own Social Security?

Whether that survivor benefit exceeds your own Social Security payment will depend on the amount of your late spouse’s benefit and your own age and family situation. You are entitled to:

Does Social Security pay the survivor benefit first?

If that’s the retirement benefit, then the retirement benefit is all you’ll get. If the survivor benefit is higher, Social Security pays the retirement benefit first and tops it up to match the amount of the survivor benefit. Whether that survivor benefit exceeds your own Social Security payment will depend on the amount ...

What happens if a deceased spouse files for Social Security?

If the Deceased DID File for Benefits. If the deceased spouse filed for benefit on or after their full retirement age, and the surviving spouse is at full retirement age, the benefit amount payable to the survivor will remain unchanged.

How much Social Security can a 62 year old woman get?

From age 62 to 69, she could receive $1,200 per month as a survivor’s benefit. Once her own benefit has grown to the maximum, at age 70 and beyond, she can simply take that and receive $1,860 per month for the rest of her life. The Social Security Administration discusses this strategy at this link.

Why is knowing when you are full retirement important?

Why? Because if the survivor benefit is the highest benefit you’ll be entitled to, there is generally no benefit to delaying your filing beyond that age.

How long do you have to be married to receive Social Security?

In general, spouse survivor benefits are available to: Surviving spouses, who were married at least 9 months, beginning at age 60. Benefit amount may depend on the age at which you file ...

What is a surviving spouse?

A surviving spouse, who was residing with the deceased spouse, or. A surviving spouse, who was not residing with the deceased, but was receiving benefits based upon the work record of the deceased spouse, or who becomes eligible for benefits after the death of the spouse , or.

How long does it take to get a death benefit if you are not receiving it?

Even though $255 isn’t a lot, who wants to pass on money that’s rightfully theirs? If the eligible spouse or child is not receiving benefits at the time of death, they must apply for benefits within two years in order to receive the death payment.

What age can a spouse care for a deceased child?

Surviving spouses, of any age, caring for the deceased’s child aged 16 or younger or disabled.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

How old do you have to be to apply for retirement?

If you are at least 62 years of age and you wish to apply for retirement or spouse’s benefits, you can use our online retirement application to apply for one or both benefits.