Will unemployment garnish my tax refund?

— This impacts roughly 175,000 people who received unemployment benefits. If you can’t pay back the money you owe, the state can garnish your federal or state tax refund. Stoogenke says, unfortunately, there’s not much you can do to stop it, and that’s why it’s important to make sure you do everything correctly from the beginning.

Is IRS still sending out unemployment refunds?

The IRS says it plans to hire more employees, which could deviate the problem. IRS still hasn’t processed millions of unemployment benefit refunds. Thousands of Americans overpaid the IRS for unemployment benefits received in 2020. That’s because of changes made by the last stimulus package was signed into law.

Can unemployment take federal taxes?

Yes, they can take both state and federal refunds. State Unemployment Insurance Compensation debts are now eligible for referral to Treasury Offset Program. The Department of Treasury's Bureau of the Fiscal Service (BFS) issues IRS tax refunds and Congress authorizes BFS to conduct the Treasury Offset Program (TOP). Through the TOP program, BFS may reduce your refund (overpayment) and offset it to pay:

Will unemployment affect my taxes?

Unemployment benefits are generally taxable. Most states do not withhold taxes from unemployment benefits voluntarily, but you can request they withhold taxes. If you are receiving unemployment benefits, check with your state about voluntary withholding to help cover your income taxes when you file your tax return.

Can I get a tax refund if I didn't work?

Refundable tax credits can provide you with a tax refund even when you do not work. For example, you may qualify for the Earned Income Tax Credit or the Additional Child Tax Credit, which are refundable tax credits.

What are the negatives of unemployment?

Common disadvantages of unemployment for individuals include:Reduced income. ... Health problems. ... Negative familial effects. ... Mental health challenges. ... Don't deny your feelings. ... Think of unemployment as a temporary setback. ... Reach out to friends and family. ... Start networking.More items...•

Do you have to file taxes if unemployed?

You may have received unemployment benefits or an EIP (stimulus check) in 2021 due to the COVID-19 pandemic. Unemployment compensation is considered taxable income. You must report unemployment benefits on your tax return if you are required to file.

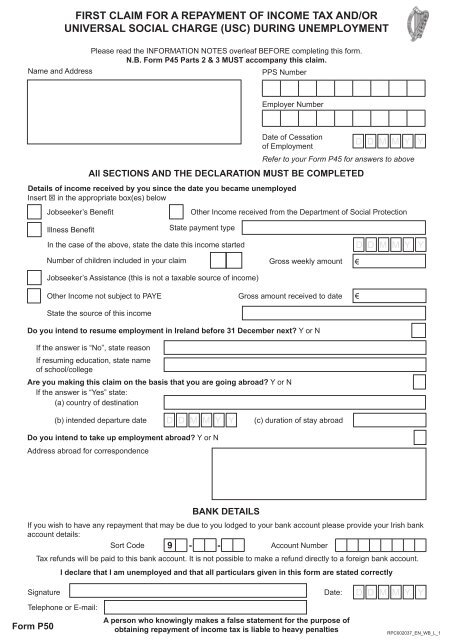

How do I get my 1099G?

Call our Automated Self-Service Line at 1-866-333-4606 and follow the instructions to get your Form 1099G information or to request that your 1099G be mailed to you. This option is available 24 hours a day, 7 days a week. Form 1099G tax information is available for up to five years.

What are the three consequences of unemployment?

Syllabus: Consequences of unemploymenta loss of GDP,loss of tax revenue,increased cost of unemployment benefits,loss of income for individuals, and.greater disparities in the distribution of income.

Does collecting unemployment hurt your credit score?

If you're worried that filing for unemployment benefits will affect your credit score, don't be — this income isn't reported to credit bureaus. Job loss, however, could lead to missed payments or increased credit card use, both of which can hurt your credit score.

Will I get a tax refund if I made less than $10000?

If you earn less than $10,000 per year, you don't have to file a tax return. However, you won't receive an Earned-Income Tax Credit refund unless you do file.

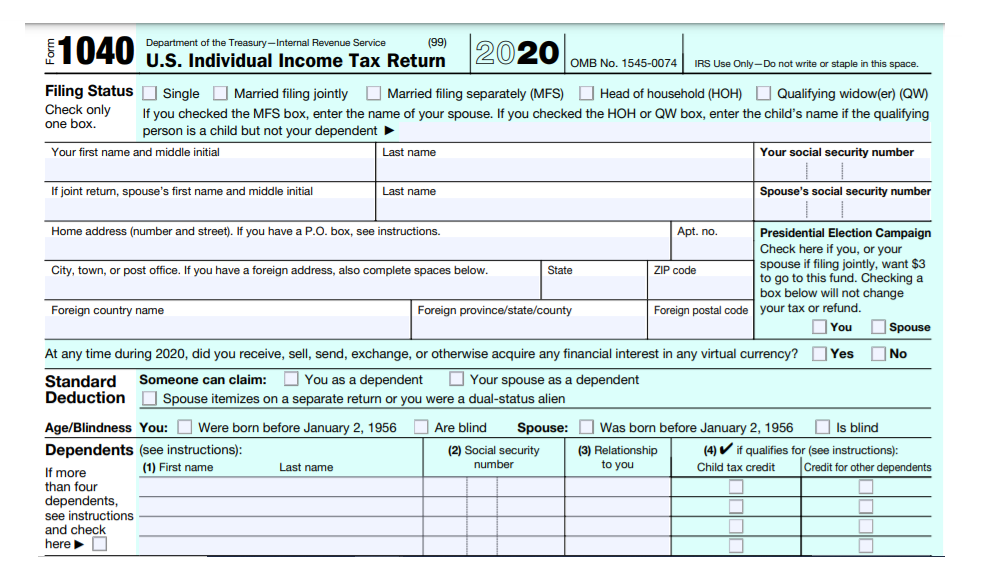

What is the minimum income to file taxes in 2020?

Minimum income to file taxes Single filing status: $12,550 if under age 65. $14,250 if age 65 or older.

What is the minimum income to file taxes?

If you are single and under the age of 65, the minimum amount of annual gross income you can make that requires filing a tax return is $12,550. If you're 65 or older and plan on filing single, that minimum goes up to $14,250.

Can I get a tax refund with a 1099?

It is possible to receive a tax refund even if you received a 1099 without paying in any estimated taxes. The 1099-MISC reports income received as an independent contractor or self-employed taxpayer rather than as an employee.

Can I file my taxes without a 1099-G?

You are required and responsible for reporting any taxable income you received - including state or local income tax refunds - even if you did not receive Form 1099-G.

Does everyone get a 1099-G?

You will receive a Form 1099G if you collected unemployment compensation from us and must report it on your federal tax return as income. This income is exempt from California state income tax.

1. What is the unemployment tax?

The IRS states, “Only employers pay FUTA (Federal Unemployment Tax Act) tax. Do not collect or deduct FUTA tax from your employees’ wages.” Employers have to pay both federal and state unemployment taxes to fund the unemployment insurance system.

2. How much can I get?

Unemployment benefits are paid for with FUTA taxes and state unemployment taxes collected under the State Unemployment Tax Act (SUTA). The unemployment tax refunds are determined by the employee’s earnings, the length of time on unemployment, and the state’s maximum benefit amount.

3. When will I get my unemployment tax refund?

On Nov 1, the IRS announced that it had issued approximately 430,000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. ( 1) You do not need to take any action if you file for unemployment and qualify for the adjustment.

4. Happy news for unemployed

If you are a freelancer and are unemployed, you are ineligible for an unemployment tax refund from the IRS. Moreover, the Covid-19 pandemic wiped out your savings and made your life more difficult. Don’t be concerned; you are not alone.

5. Related questions about an unemployment tax refund

You can use the IRS online tracker applications, the Where’s My Refund, and Amended Return Status tools. Still, they may not provide information on the status of your unemployment tax refund. Viewing your tax records online is a quick way to determine if the IRS processed your refund.

You May Be Able To Deduct Job

Job-hunting expenses are deductible as miscellaneous deductions on your tax return. Youll need to have substantial job-hunting or other miscellaneous deductions before they actually reduce your income tax bill.

You Could Get A Hefty Tax Refund This Year

On the other hand, if youve been having income tax withheld from your pay for a substantial portion of the year already, you may be way ahead on paying taxes for this year.

Will Unemployment Take My Taxes For Overpayment

Will my federal income tax refund be taken in the future for my benefit overpayment? Your unpaid Unemployment Insurance benefit fraud overpayment will be taken from all your future federal income tax refunds until the overpayment is paid in full.

Will I Get My Unemployment Compensation Tax Refund This Summer

Since May, the IRS has awarded more than a million unemployment benefits totaling more than $10 billion. The IRS will continue to review and adjust tax returns for this category this summer. The IRS’s efforts have focused on easing the burden on taxpayers so that most people don’t have to take extra steps to obtain refunds.

What Are The Ohio Unemployment Benefits

Ohio unemployment benefits. For example, unemployment benefits in Ohio include: 1. Checking weekly benefits. 2. Professional orientation. 3. Brokerage Services. 4. Professional and professional recycling services. 5. Information about other resources and services. 6. Help write a resume and learn how to get a good job interview.

About The Unemployment Compensation Exemption

The American Rescue Plan Act, which was enacted in March, exempts up to $10,200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than $150,000 on their 2020 tax return.

What To Know About 971 846 776 And 290 Transcript Codes

Some taxpayers who’ve accessed their transcripts report seeing different tax codes, including 971 , 846 and 776 . Others are seeing code 290 along with “Additional Tax Assessed” and a $0.00 amount.

When do you get your tax refund?

Getting a Refund. Just like any other taxpayer, you'll get a refund at the end of the tax year if you paid more than what you owed. You might be able to increase your chances of getting a refund if you keep track of all your job search costs throughout the year.

Does unemployment count as earned income?

However, unemployment benefits don 't count as earned income so they don't qualify you for the earned income credit, the additional child credit or the child and dependent care credit. References. IRS.gov: Unemployment Compensation. MSNBC: For the Unemployed Too, The Taxman Cometh. TIME: Tax Tips for the Unemployed.

Is unemployment taxed on W-2?

Federal, state or District of Columbia unemployment benefits are included in Form 1099-G, but if your former employer provides its own supplemental unemployment payments these are taxed as regular wages and reported on Form W-2.

Is unemployment income taxed?

All government unemployment benefits are counted as income, according to the IRS. If your only income for the year is your unemployment , the only tax form you'll receive is Form 1099-G. The easiest way to pay your taxes on this income is to file Form W-4V with whichever government agency sends your unemployment checks.

Do you get a tax credit if you have dependent children?

If you have any dependent children, you might also be eligible for the child tax credit. This credit reduces the amount of taxes you owe, so it increases your chances of getting a refund, according to the question and answer page on the H&R Block website. However, unemployment benefits don't count as earned income so they don't qualify you for ...

Do you have to pay taxes on unemployment?

If you receive any unemployment payments from a private fund to which you voluntarily made contributions, you only have to pay taxes on those benefits if you end up receiving more than what you paid.

If I paid taxes on unemployment benefits, will I get a refund?

Congress made up to a $10,200 in jobless benefits payment in 2020 tax-free for people earning less than $150,000 a year. People might get a refund if they filed their returns with the IRS before Congress passed the law exempting a portion of unemployment payments from tax. The IRS started issuing jobless tax refunds in May.

When will I get my jobless tax refund?

The IRS normally releases tax refunds about 21 days after you file the returns. However, many people have experienced refund delays due to a number of reasons. First, the IRS is working through a huge backlog.

How much will I get in unemployment tax refund?

The amount the IRS has sent out to people as a jobless tax refund averages more than $1,600. The size of the refund depends on several factors like income level and the number of unemployment benefits received. With the federal stimulus payment program stopped, people are counting on jobless tax refunds to pay living expenses.

What are the unemployment tax refunds?

The American Rescue Plan Act, which was signed on March 11, included a $10,200 tax exemption for 2020 unemployment benefits.

How to get the refund

If you are owed money and you've filed a tax return, the IRS will send you the money or use it to pay off other owed taxes automatically.

When will I get the refund?

Unemployment tax refunds started landing in bank accounts in May and ran through the summer, as the IRS processed the returns.

How to check the status of the payment

One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

What happens if you owe on your tax return?

If you owed on your original return and paid the amount in full, the refund from the exclusion adjustment will take into account the additional payment you made to your account. The additional payment will be processed and any overpayment resulting from the exclusion adjustment will be refunded when your account is corrected but can be applied to other federal or state debts you owe.

What to do if you disagree with a change in your tax return?

If you disagree with the changes, you may call the toll-free number listed on the top right corner of your notice. If you are due a refund, allow the timeframe provided in the notice to receive it. If you owe, pay the amount you owe by the due date on the notice's payment coupon.

Is the exclusion from adjusted income a refundable tax credit?

The exclusion from adjusted income is not a refundable tax credit. However, the exclusion could result in an overpayment (refund) [of income taxes/of the tax paid on the amount of excluded unemployment compensation]. Q2.