Can Social Security benefits be stopped or suspended?

You may have a letter from the Social Security Administration (SSA) about suspending or terminating your benefits. While it’s easy to determine why payments stopped in some circumstances, others aren’t so clear. In fact, the SSA can stop your benefits without you expecting any changes and with little or no communication.

When can Social Security stop my benefits?

You can also appeal the IRMAA charges if your income has declined in 2020 as a result of a life-changing event such as marriage, divorce, retirement, reduced work hours or widowhood. The Hold Harmless Act prevents a net decline in Social Security benefits ...

Why would my social security be suspended?

Why is this? Thanks, Steve Hi Steve, Social Security retirement benefits are based on an average ... benefits at 62 in 2011 in the amount of 1,379. At 66 in 2016, I suspended my benefits for 22 months. I started my benefits again in late 2017.

Will Social Security stop paying benefits?

Social Security will base your retirement benefit rate on an average of your highest 35 years of Social Security covered wage-indexed earnings. So your benefit rate wouldn't really drop if you stop working early, it just won't increase like it would if you replaced your lower earnings years with higher earnings years.

Can I suspend my Social Security and restart later?

If you change your mind about starting your benefits, you can cancel your application for up to 12 months after you became entitled to retirement benefits. This process is called a withdrawal. You can reapply later. You are limited to one withdrawal per lifetime.

Can you pause your Social Security benefits?

Once you reach your full retirement age, you can suspend your Social Security benefit. Your benefit will grow for each month that it's suspended. You can restart your benefit any month that you choose up to age 70 when it will automatically restart.

What happens when you file and suspend your Social Security?

During a suspension, you earn delayed retirement credits, which boost your eventual benefit by two-thirds of 1 percent for each suspended month (or 8 percent for each suspended year). When you resume collecting Social Security, you'll have locked in a higher monthly payment for life.

How long can I delay taking Social Security?

If you start receiving retirement benefits at age: 67, you'll get 108 percent of the monthly benefit because you delayed getting benefits for 12 months. 70, you'll get 132 percent of the monthly benefit because you delayed getting benefits for 48 months.

What happens if you collect Social Security and go back to work?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

Who is eligible for file and suspend Social Security?

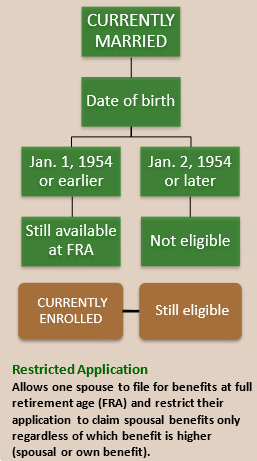

Congress made two major changes in the law. Your spouse or children cannot collect benefits on your work record while your own benefits are suspended. Under “deemed filing” rules, married people filing for Social Security at any age are automatically claiming both their retirement and their spousal benefit.

What does it mean to suspend benefits?

(i)For purposes of this subsection, the term “suspension of benefits” means the temporary or permanent reduction of any current or future payment obligation of the plan to any participant or beneficiary under the plan, whether or not in pay status at the time of the suspension of benefits.

When does Social Security suspension begin?

The suspension would begin the month after you make the request. Social Security benefits are paid the month after they are due. So, for example, if you contact the Social Security Administration in June and ask to suspend your benefits, you will still receive your June benefit in July.

How much is Survivor Benefits worth?

Survivor benefits are worth up to 100% of what a deceased worker was collecting or entitled to collect at the time of death. Initially, Randy collected just 75% of his full retirement age benefit because he claimed Social Security four years early, at age 62.

Does Randy's wife have Social Security?

In Randy’s case, his wife is 62 and has not yet claimed Social Security, so his decision to suspend his benefits would not affect her at the moment but it could create a larger survivor benefit in the future. Survivor benefits are worth up to 100% of what a deceased worker was collecting or entitled to collect at the time of death.

Can you receive spousal benefits on someone else's record?

And you cannot receive benefits on someone else’s record, such as spousal benefits on your mate’s earnings record, during the suspension. There is one exception: A divorced spouse can continue to receive benefits on your earnings record even after you suspend your benefits.

When do retirement benefits end?

The suspension ends with the earlier of the month before you turn age 70; or the month after your request to resume benefits is made. For more information, see Suspending Your Retirement Benefit Payments .

What happens if you are 6570?

If you have reached full retirement age, but are not yet age 70, you can ask us to suspend your benefits to earn delayed retirement credits. If your benefits are suspended, you will not be able to receive benefits on someone else’s Social Security record.

How to suspend Social Security benefits?

How to Suspend Your Social Security Benefits#N#Suspending your Social Security benefits is an easy and straightforward process and there are several different ways to begin the process, including: 1 Calling the Social Security helpline at 1-800-772-1213. 2 If you wish to make the request in person or want extra help with the process, you can visit your local Social Security office, too. Here's a link to a search tool that will help you find the branch closest to where you live.

Why do people depend on Social Security?

Tens of millions of Americans depend on their Social Security benefits to provide them with income during their golden years, making it one of the government's most important and widely used social programs.

What are the questions that Social Security recipients will eventually have to figure out?

One of the key questions that all Social Security recipients will eventually have to figure out is when they want their benefits to start, as there are positives and negatives to tapping your benefits early or waiting.

Can you suspend Medicare if you have Social Security?

Choosing to suspend your Social Security benefits will not have an impact on your ability to receive Medicare benefits, but you can choose to stop them if you wish. There is one important point to keep in mind: If your Medicare Part B premiums are being deducted from your Social Security check and you choose to suspend your benefits, ...

How to stop Social Security payments?

Make an oral or written request to the SSA to stop Social Security benefits. You must contact the SSA orally or in writing if you want to restart payments before age 70. In the month you turn 70, however, your suspended benefits will be automatically reinstated. 6

What happens if you delay your Social Security payment?

If you delay your retirement until past your FRA but before you turn 70, you become eligible for delayed retirement credits, which incrementally boost your monthly payout. For example, if you were born in 1943 or after, you get an 8% annual increase in the principal insurance amount of your Social Security benefit, which results in a payout increase of two-thirds of 1% every month. 2 So, you may want to stop Social Security payments and restart them after some years.

What happens if you withdraw your Medicare application?

If you withdraw your application, you must repay what you received so far. Be aware that this also includes benefits that your spouse or children received, federal tax that was voluntarily withheld from your benefit, and money withheld from your benefit for Medicare Part B, C, and D premiums.

How much tax do you pay on Social Security?

If your combined income is between $25,000 and $34,000 as an individual or between $32,000 and $44,000 as joint filers , you may pay tax on up to 50% of your Social Security benefits. If you earn above the upper limit of these ranges, you may pay tax on up to 85% of your benefits. 4

Does Social Security withdrawal affect veterans?

Changes in Other Government Benefits. If you are entitled to railroad or veteran's benefits, your withdrawal may affect those benefits. Check with the relevant authority, either the Railroad Retirement Board or the Department of Veterans Affairs, to determine whether stopping Social Security would negatively impact your finances.

Do you have to reach full retirement age to receive Social Security?

You Have not yet Reached Your Full Retirement Age (FRA) You are entitled to your full Social Security benefit amount at your FRA, which is based on your birth year. If, for example, you were born in 1957 and started benefits at 62, you would have received a lower benefit then at your FRA of 66 years and 6 months.

How long do you have to pay back Social Security?

Social Security rules allow you to repay your benefits within a year of filing. If you can do this, Social Security would erase your application, and you could wait up until age 70 to file. If you did so, your benefit would be much higher than it is now.

When will my wife's spousal benefit reach its maximum?

Your wife’s spousal benefit will reach its maximum if she waits to file until she reaches her full retirement age. Also, her benefit will be larger than you think, because it will be based on your FRA benefit, not the smaller benefit you actually receive.

What to know before withdrawing your retirement?

There are a few things to know before deciding to withdraw your application. Anyone else who receives benefits based on your application must consent in writing to the withdrawal. You must repay all the benefits you and your family received from your retirement application. This includes:

What happens if you withdraw from tricare?

Information for TRICARE Beneficiaries. If you have TRICARE and your withdrawal includes your Medicare Part A coverage, you may lose your TRICARE coverage. If you do not withdraw your Medicare Part A coverage, you may need to stay enrolled in Medicare Part B to keep your TRICARE coverage.

What do you do if you are entitled to railroad benefits?

If you are also entitled to railroad or veterans benefits, you should check with the Railroad Retirement Board (RRB) and the Department of Veterans Affairs (VA) about how your withdrawal affects those benefits. The RRB and the VA make their own determinations and are responsible for their own programs.

How many withdrawals can you make per lifetime?

You are limited to one withdrawal per lifetime. If you cannot withdraw your application and you have reached full retirement age but are not yet 70, you can ask us to suspend benefit payments. Learn more about: What Happens When You Withdraw Your Application.

Does Medicare Part A or B affect Medicare Advantage?

Withdrawing from Medicare Part A or Medicare Part B can also affect your coverage under a Medicare Advantage plan (previously known as Part C) and Medicare Part D (Medicare prescription drug coverage). Your Medicare Advantage enrollment will automatically end if you withdraw from Medicare Part A, Part B, or both.

Does Medicare Advantage end?

Your Medicare Advantage enrollment will automatically end if you withdraw from Medicare Part A, Part B, or both. You will no longer be eligible for Medicare Part D if you withdraw from Medicare Part A and Part B. You will pay a penalty if you enroll in Medicare Part D in the future.

Do you pay a penalty if you enroll in Medicare Part D?

You will pay a penalty if you enroll in Medicare Part D in the future. If you keep Part A or Part B, you are still eligible for Medicare Part D. The Centers for Medicare & Medicaid Services (CMS) will handle your future bills for Part B premiums if you decide to keep that coverage.

How to request a suspension of Social Security?

You can request a suspension by calling Social Security at 800-772-1213 or visiting your local office. [Editor’s note: Local Social Security offices are currently closed to walk-in visits due to the COVID-19 pandemic. Many Social Security services are available online and by phone.

How often can you withdraw Social Security?

You can only withdraw benefits once in your lifetime. Updated October 23, 2020.

What does it mean when Social Security says you have to pay?

When Social Security says you must “repay benefits,” it means not just what you’ve received but any payments to your spouse and children. They must consent in writing to your application for withdrawal.

Can I withdraw my Social Security benefits?

If you claimed Social Security retirement benefits within the previous 12 months, you can apply for a “withdrawal of benefits.”. You will have to repay what you have received so far, and Social Security will treat your application for early benefits as if it never happened. You can apply to withdraw benefits with Social Security form SSA-521.

Can I withdraw from Social Security at full retirement age?

You can no longer withdraw from benefits, but when you reach full retirement age, you can voluntarily suspend your retirement benefits. That will have the effect of earning you delayed retirement credits, which will ultimately increase your Social Security payment when you resume collecting benefits (which you must do by age 70).

Can I update my Social Security number online?

Many Social Security services are available online and by phone. If you have a "dire need situation" regarding your benefits or need to update information attached to your Social Security number, such as your name or citizenship status, you may be able to schedule an in-person appointment.

How long can you suspend your Social Security benefits?

If you have received benefits for more than one year and are no longer eligible for withdrawal of benefits, you are allowed to suspend benefits once you reach full retirement age. Delayed retirement credits will accrue annually until you resume taking benefits or reach 70. 6.

How long do you have to change your mind about Social Security?

Now, if you collect any time before your full retirement age, you have only 12 months to change your mind—and if you do, you'll have to pay back the monies received. In addition, you can only do this once, and it is considered a withdrawal of benefits by the Social Security Administration. 5. There is another option.

What is the start stop start approach to Social Security?

Social Security expert Larry Kotlikoff, an economics professor at Boston University, named the ‛start, stop, start’ Social Security approach. The strategy allowed you to receive a benefit at age 62 for a while, suspend benefits, and resume them again later. 4 . The decision to postpone receiving benefits past full retirement age will result in ...

How did the Social Security Act affect married couples?

It maximized benefits for married couples where one spouse reached full retirement age and hadn’t filed for Social Security. In essence, it allowed one spouse to collect a spousal benefit and delay their own benefits, which continued to accrue delayed retirement credits.

How old is David when he collects his spousal benefits?

Since David is age 66 , he can collect half of the full retirement spousal benefit. He then waits until age 70 to start collecting his larger benefit on his own account. From then on, David collects his own larger retirement for the remainder of his life.

What age do Jenny and David file for Social Security?

Here is an example of how it worked, for a married couple named Jenny and David. At age 62, Jenny files for Social Security. When David reaches age 66, his full retirement age, he decides not to collect his own Social Security benefits.

How old do you have to be to collect Social Security?

In theory, Social Security seems really simple. You reach age 62, and you can start collecting benefits. Or you wait until normal retirement age (66 for most) to collect a larger benefit. 2 For an even bigger monthly check, wait until age 70. 3 But there are some intricacies of when and how you collect Social Security that can have ...