Do you have to pay taxes on your Social Security benefits?

The simplest answer is yes: Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefitsdepends on your income level.

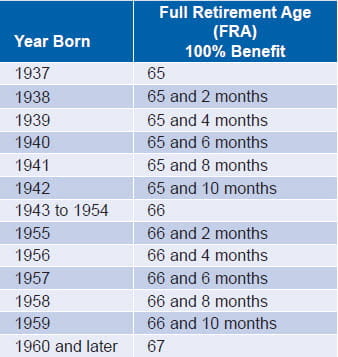

When should I start taking Social Security benefits?

- If you were born on January 1 st, you should refer to the previous year.

- If you were born on the 1 st of the month, we figure your benefit (and your full retirement age) as if your birthday was in the previous month. ...

- You must be at least 62 for the entire month to receive benefits.

- Percentages are approximate due to rounding.

When should you start claiming Social Security benefits?

You get flexibility when it comes to filing for Social Security. Whether you should file upon retirement ... age 65 but don't need your benefits right away to pay your bills, then it could make sense to hold off until FRA to claim then.

How much of my social security benefit may be taxed?

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

How do I stop the IRS from garnishing my Social Security?

How Do I Stop the IRS From Garnishing My Social Security?Resolve the debt and pay in full.Negotiate an alternative payment method (installment agreement, Offer in Compromise).Declare non-collectible (financial hardship) status.File for an appeal on the decision made by the IRS.

Can IRS take money from your Social Security if you owe back taxes?

Under the FPLP, the IRS can garnish up to 15% of your Social Security benefits each time you receive your check. The IRS will apply this amount to your taxes owed. The IRS will continue to garnish your benefits until you pay your back taxes in full.

Is the IRS and Social Security Connected?

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits.

How Much Can IRS levy from Social Security?

15 percentUnder the FPLP, the IRS is able to levy up to 15 percent of your Social Security benefits each month; there is no similar restriction on how much the IRS can receive from manual levies. There is an exemption amount, however, for reasonable living expenses.

Can the IRS take your retirement money?

Put simply, yes. If you owe back taxes, the IRS can legally garnish your pension, 401(k), and other classifications of retirement accounts. Not only is the IRS legally authorized to garnish your pension and retirement accounts, but it is their duty to recompense unpaid debts from taxpayers.

Does IRS forgive tax debt after 10 years?

In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations.

Can Social Security benefits be garnished?

If you have any unpaid Federal taxes, the Internal Revenue Service can levy your Social Security benefits. Your benefits can also be garnished in order to collect unpaid child support and or alimony. Your benefits may also be garnished in response to Court Ordered Victims Restitution.

What is the most the IRS can garnish?

Under federal law, most creditors are limited to garnish up to 25% of your disposable wages. However, the IRS is not like most creditors. Federal tax liens take priority over most other creditors. The IRS is only limited by the amount of money they are required to leave the taxpayer after garnishing wages.

Is there a one time tax forgiveness?

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn't for you if you're notoriously late on filing taxes or have multiple unresolved penalties.

Can your Social Security be garnished for back taxes?

The U.S. Treasury can garnish your Social Security benefits for unpaid debts such as back taxes, child or spousal support, or a federal student loan that's in default. If you owe money to the IRS, a court order is not required to garnish your benefits.

What is IRS Fresh Start Program?

What Is the IRS Fresh Start Program? The IRS Fresh Start Program is an umbrella term for the debt relief options offered by the IRS. The program is designed to make it easier for taxpayers to get out from under tax debt and penalties legally. Some options may reduce or freeze the debt you're carrying.

Can the IRS collect after 10 years?

Generally, under IRC § 6502, the IRS will have 10 years to collect a liability from the date of assessment. After this 10-year period or statute of limitations has expired, the IRS can no longer try and collect on an IRS balance due.

What is the FPLP program?

The Federal Payment Levy Program (FPLP) is a U.S. Department of the Treasury program that mandates the IRS to collect delinquent federal tax debt . The program places an ongoing levy on eligible federal payments to taxpayers who have failed or refused to pay their taxes.

What is the IRS notice for garnishment?

Before the IRS moves to garnish your social security benefits, they will first send you a notice that indicates your tax balance due and the need to pay off your tax debt to avoid social security garnishment . This notice also indicates your right to appeal if you had not been issued a notice before. If you fail to respond, the IRS sends an additional notice, CP 91 or CP 298, Final Notice Before Levy on Social Security Benefits, that explains your social security benefits might be levied.

What is an OIC?

Submit an Offer in Compromise (OIC): Submit an offer to the IRS to settle your tax debt for less than the full amount and stop the levy of your social security benefits. The IRS can approve your Offer in Compromise if the settlement amount offered is the most the agency can expect to collect.

How much of your Social Security check is taken out?

As mentioned earlier, the IRS typically takes 15 percent of your social security benefits payments. Losing a portion of your social security check can result in larger financial problems, especially if you depend solely on your social security benefits check for income.

Can the IRS take money from Social Security?

If you are a delinquent taxpayer owing money to the IRS, the agency can seize some of your assets, including taking money directly from your social security benefits. The IRS leverages the Federal Payment Levy Program (FPLP) to take 15 percent of your social security benefits payments to satisfy the tax debt, regardless of the amount of money you are left with.

Can you pay off your tax debt in one payment?

Pay Your Full Tax Debt: You can use your savings or liquidate assets and pay off your full tax debt in a single payment.

Why is FPLP used?

Because the FPLP is used to satisfy tax debts, the IRS may levy your Social Security benefits regardless of the amount. This is different from the 1996 Debt Collection Improvement Act which states that the first $750 of monthly Social Security benefits is off limits to satisfy non-tax debts. Fifteen percent of the Social Security benefit will be levied through the FPLP regardless of whether or not the remaining benefit sent to you is less than $750.

How long do you have to pay your taxes before you can deduct 15 percent?

You have 30 days from the date of this notice to make arrangements to pay your tax debt before we begin deducting 15 percent from your monthly benefit. See Publication 594, The IRS Collection Process PDF, and Publication 1, Your Rights as a Taxpayer PDF, for additional information.

When did Social Security start paying a 15 percent levy?

Beginning in February 2002, Social Security benefits paid under Title II - Federal Old-Age, Survivors and Disability Insurance Benefits will be subject to the 15-percent levy through the Federal Payment Levy Program (FPLP); to pay your delinquent tax debt.

Is a lump sum death benefit included in the FPLP?

The lump sum death benefits and benefits paid to children are not included in the FPLP. Additionally, Supplemental Security Income (SSI) payments, under Title XVI, and payments with partial withholding to repay a debt owed to Social Security are not levied through the FPLP. Beginning February 2011, the FPLP excludes certain delinquent taxpayers who receive social security payments if their income falls at or below certain established levels, based on the Department of Health and Human Services poverty guidelines.