While the IRS is not able to take all your Social Security benefits, they can take a portion each month until the debt is paid. For back taxes, for example, the IRS can take up to 15 percent of your Social Security benefits. They cannot take benefits paid to your children or lump sum death benefits, though.

Do you have to pay taxes on your Social Security benefits?

The simplest answer is yes: Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefitsdepends on your income level.

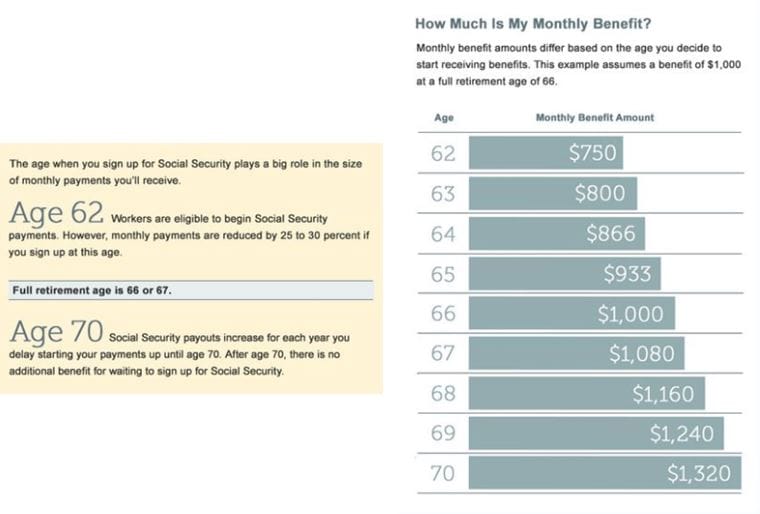

When should I start taking Social Security benefits?

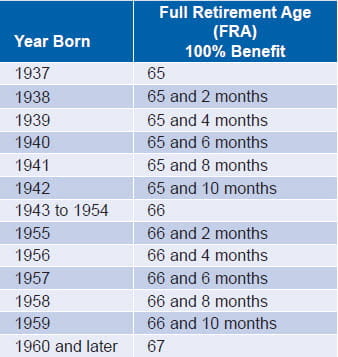

- If you were born on January 1 st, you should refer to the previous year.

- If you were born on the 1 st of the month, we figure your benefit (and your full retirement age) as if your birthday was in the previous month. ...

- You must be at least 62 for the entire month to receive benefits.

- Percentages are approximate due to rounding.

When should you start claiming Social Security benefits?

You get flexibility when it comes to filing for Social Security. Whether you should file upon retirement ... age 65 but don't need your benefits right away to pay your bills, then it could make sense to hold off until FRA to claim then.

How much of my social security benefit may be taxed?

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

How do I stop the IRS from garnishing my Social Security?

How Do I Stop the IRS From Garnishing My Social Security?Resolve the debt and pay in full.Negotiate an alternative payment method (installment agreement, Offer in Compromise).Declare non-collectible (financial hardship) status.File for an appeal on the decision made by the IRS.

Can the IRS take your Social Security if you owe back taxes?

Under the FPLP, the IRS can garnish up to 15% of your Social Security benefits each time you receive your check. The IRS will apply this amount to your taxes owed. The IRS will continue to garnish your benefits until you pay your back taxes in full.

How Much Can IRS levy from Social Security?

15 percentUnder the FPLP, the IRS is able to levy up to 15 percent of your Social Security benefits each month; there is no similar restriction on how much the IRS can receive from manual levies. There is an exemption amount, however, for reasonable living expenses.

Can the IRS take my retirement money?

Yes, the IRS can take your 401(k) or other retirement funds in order to satisfy outstanding tax debts. However, if you have a current or pending repayment plan in order, they are not authorized to impose a tax levy on your account.

Does IRS forgive tax debt after 10 years?

In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations.

Can Social Security benefits be garnished?

If you have any unpaid Federal taxes, the Internal Revenue Service can levy your Social Security benefits. Your benefits can also be garnished in order to collect unpaid child support and or alimony. Your benefits may also be garnished in response to Court Ordered Victims Restitution.

Is there a one time tax forgiveness?

One-time forgiveness, otherwise known as penalty abatement, is an IRS program that waives any penalties facing taxpayers who have made an error in filing an income tax return or paying on time. This program isn't for you if you're notoriously late on filing taxes or have multiple unresolved penalties.

Does IRS and Social Security share information?

The IRS may therefore share information with SSA about social security and Medicare tax liability if necessary to establish the taxpayer's liability. This provision does not allow the IRS to disclose your tax information to SSA for any other reason.

What was the Social Security off limit in 1996?

Prior to 1996, there was a $750/month "off limits" amount that had to be left for the Social Security recipient. However, that changed with the introduction of the Federal Payment Levy Program, which allowed for 15% of the total monthly payment to be collected - regardless of the amount.

What percentage of Social Security is cut?

You Could See a 15% Cut In Your Social Security. If you owe money to the IRS, and you are receiving Social Security benefits due to: Federal Old-Age and Survivors Trust Fund (or) Disability Insurance Benefits. The IRS can take 15% of your Social Security payments to satisfy your tax debt.

How long does it take to respond to IRS tax return?

The IRS must send you a "Final Notice - Notice of Intent to Levy and Notice of Your Right to a Hearing" form. At this point you'll have 30 days to respond. You have a few choices at this point - you can either: Pay the tax. Negotiate an alternative payment method (payment plan, partial payment plan, Offer-in-Compromise)

How many IRS offers in compromise were accepted in 2006?

However, be forewarned - the IRS only accepted 16% of Offers-in-Compromise in the year 2006. To increase your chances of having your offer accepted, it would be a very good idea to have your paperwork prepared by a competent tax attorney.

How long does Social Security levy stay in effect?

The levy will remain in effect until the tax is paid off, or until you make other arrangements.

What is federal employee retirement annuity?

Federal employee retirement annuities, Federal payments made to you as a contractor/vendor doing business with the government (including Defense contracts), Federal employee travel advances or reimbursements, Some federal salaries.

Is Social Security a federal payment levied?

Additionally, Supplemental Security Income (SSI) payments, under Title XVI, and payments with partial withholding to repay a debt owed to Social Security will not be levied through the Federal Payment Levy Program.

Why do people rely on Social Security?

Many people rely on their social security benefits as a way to bridge the gap between their retirement income and their monthly expenses. For others their social security may be their only source of income in retirement.

How long does it take for Social Security to be released?

Generally if a release of levy is granted by the IRS you can expect the release to be reflected on your social security income after a month or two.

What is lump sum death benefit?

The lump sum death benefits and benefits paid to children. Supplemental Security Income payments and payments with partial withholding to repay a debt owed to Social Security. As of 2011, the IRS will exclude certain taxpayers where their income is deemed to be below the poverty guidelines.

Does the IRS have a FPLP?

In short: Yes. The IRS uses what is called the Federal Payment Levy Program (FPLP). This program is used to implement a continuous levy on federal payments issued by the Bureau of Fiscal Services (BFS). Payments from the BFS include: Federal employee retirement annuities,

Is it bad to ignore Social Security levy notices?

CONCLUSION. Having a levy placed on your Social Security benefits will often times cause a financial hardship. Ignoring the notices is never a good idea because the longer the issue goes unresolved, the longer it will take to fix.

Does the IRS levy Social Security?

The IRS doesn’t automatically levy your social security income the moment you start receiving it. In fact, they will go through all of the normal steps of notifying you of your past due taxes before taking collection action. A Final Notice of Intent to Levy is generally the last notice before the IRS takes collection action but, ...

How much of Social Security can the IRS take?

Under this program, the IRS may take up to 15 percent of your Social Security benefits each time you receive them and apply the amount toward your tax debt.

What happens if you receive a final notice of intent to levy Social Security?

Whether you receive a final notice of intent to levy or not, if you are receiving or expect to receive Social Security benefits and know you owe the IRS, it is to your advantage to make other arrangements with the IRS to resolve your debt.

What is the final notice of intent to garnish Social Security?

Final Notice. In addition to other letters you may receive concerning your tax bill, before the IRS can garnish any portion of your Social Security benefits, it must mail you a final notice of intent to levy your benefits. This letter will state it is a "final notice," and it will have a CP 91 or CP 298 letter number in the corner.

What happens when you owe back taxes?

When someone owes back taxes to the Internal Revenue Service, it is common for the IRS to take some types of government payments automatically, such as federal tax refunds, to pay down the debt.

How to contact IRS about non-collectible payments?

It also prevents the IRS from attaching your benefits, bank accounts or other sources of income to pay your bill. Contact the IRS at 1-800-829-1040 to establish a payment plan or to seek "noncollectible" status.

Does Social Security debt affect your eligibility?

Benefit Eligibility. If you're eligible to receive Social Security benefits, your tax debt does not affect your eligibility, or the amount of benefits the Social Security Administration calculates for you. You may still collect the benefits the agency determines you should receive. Although the IRS may be able to take a portion of your payment, ...

Does the IRS automatically deduct back taxes?

This does not change the gross amount of benefit you're scheduled to receive. IRS entitlement to your benefits is not automatic when you owe taxes, so you may not immediately notice a deduction for back tax debt when you start receiving benefit payments.