What is untaxed income?

Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. Oftentimes, students may work jobs with minimal earnings (i.e. babysitting), and are not required to file a tax return.

What is parents untaxed income and benefits?

What is parents untaxed income and benefits? Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. Oftentimes, students may work jobs with minimal earnings (i.e. babysitting), and are not required to file a tax return.

What is taxable and nontaxable income?

What is Taxable and Nontaxable Income? 1 Employee Compensation. Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, ... 2 Fringe Benefits. 3 Business and Investment Income. 4 Partnership Income. 5 S Corporation Income. More items

What untaxed income is not reported on Schedule 1?

Other untaxed income not reported in items 92a through 92g, such as workers’ compensation, disability benefits, untaxed foreign income, etc. Also include the untaxed portions of health savings accounts from IRS Form 1040 Schedule 1—line 12.

What counts as untaxed income and benefits?

Untaxed income can be identified as any income that has been earned by a student or parent which does not appear on a Federal tax return. Oftentimes, students may work jobs with minimal earnings (i.e. babysitting), and are not required to file a tax return.

Where is untaxed income and benefits for 2020 income not reported on your federal tax return?

Other untaxed income not reported in items 44a through 44g, such as workers' compensation, disability benefits, etc. Also include the untaxed portions of health savings accounts from IRS Form 1040 Schedule 1 ----line 12.

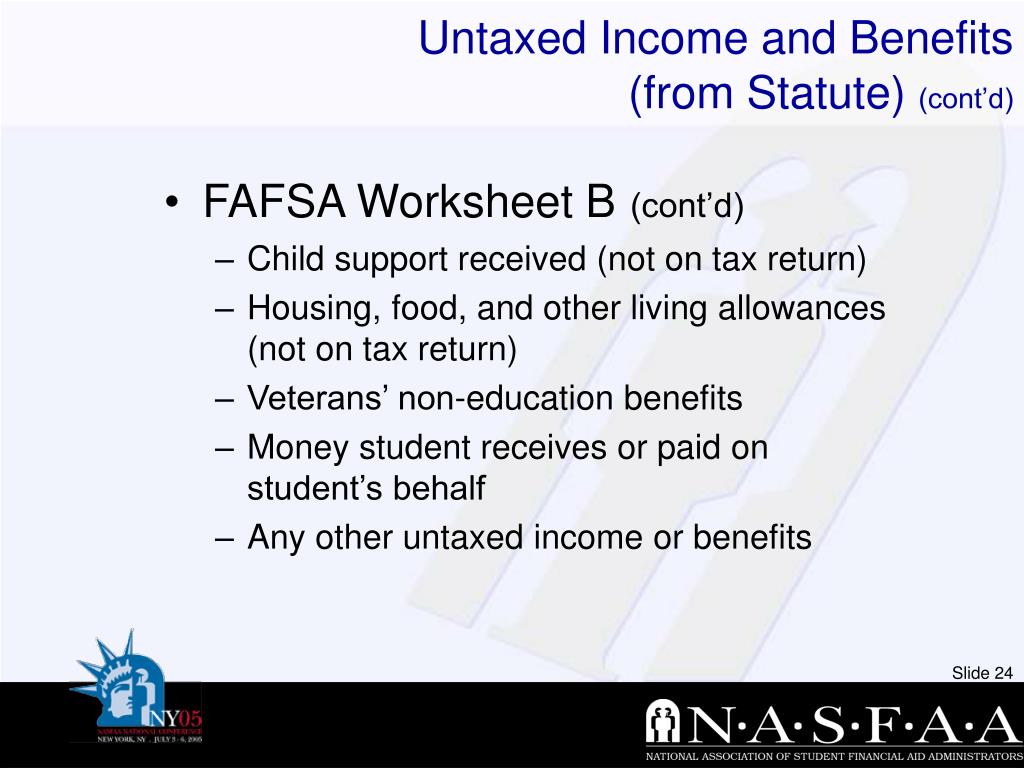

What counts as untaxed income on FAFSA?

If you or your parents received payments to tax-deferred pensions and savings plans (paid directly or withheld from earnings) as reported on the W-2 form, Box 12 with codes D, E, F, H or S, this is untaxed income. The untaxed income should be included on the FAFSA.

What is untaxed income and benefits on W-2?

The term “untaxed income” means any income excluded from federal income taxation under the IRS code. For an application selected for verification, you must verify up to six types of untaxed income and benefits as shown to the left.

How does untaxed income affect FAFSA?

Eligibility for need-based financial aid is reduced by as much as half of untaxed income to the student. For example, a $10,000 distribution from a grandparent-owned 529 plan will reduce aid eligibility by as much as $5,000.

How do I find out if my income is non taxable?

The lender must verify that the particular source of income is nontaxable. Documentation that can be used for this verification includes award letters, policy agreements, account statements, or any other documents that address the nontaxable status of the income.

What is untaxed income and benefits CSU application?

Untaxed income is income not reported on a tax return, such as: Child support. Untaxed portions of pensions. Housing, food, and other allowances paid to military, clergy, and others, including cash and cash value.

Is untaxed income the same as gross income?

Gross income is all income from all sources that isn't specifically tax-exempt under the Internal Revenue Code. Taxable income starts with gross income, then certain allowable deductions are subtracted to arrive at the amount of income you're actually taxed on.

What does no income tax mean?

Living in a state with no income tax means that less money comes out of your paycheck each month, and come tax season you only have to submit a federal return.

Where do I find parents untaxed income and benefits on 1040?

Enter your parents' untaxed portions of pension distributions. This amount can be calculated from IRS Form 1040 (line 16a minus 16b) or 1040A (line 12a minus 12b).

1. Educational assistance from your boss

You can exclude from your income up to $5,250 of qualified employer-provided educational assistance.

2. Adoption help from your employer

If your company helps you cover the cost of adopting a child, that’s usually not taxable income. For the 2020 tax year, the tax-free employer-provided adoption assistance was $14,300 per child. In 2021, it's $14,440. The amount you can exclude depends on your modified adjusted gross income.

4. Payments for caring for children

Government payments to foster parents for their care of children officially placed in their homes generally are tax-free income.

5. Workers' compensation

If you get benefits for a workplace-related illness or injury under federal or a state’s compensation law, that money is tax-exempt. However, if part of your workers' compensation reduces Social Security or railroad retirement benefits you’ve received, that part may be taxable.

6. Life insurance proceeds

When these are paid to you because of the death of the insured person, the amount usually is not taxable. There are exceptions; IRS Publication 525 has the details.

7. Some canceled debts

If a lender cancels debt you owe, you may be able to exclude it from your gross income if the debt was canceled in a bankruptcy case, was canceled when you’re insolvent, was qualified farm debt, was debt associated with a qualified real property business, was intended as a gift or was for your home.

8. Energy conservation subsidies

You upgraded your home's air conditioning system and got a rebate from your electric service provider as a reward for your energy-saving efforts. That financial thank you, either as a direct or indirect subsidy for the purchase or installation of a home energy conservation measure, is generally tax-free income.

Many can benefit from realizing gains in the right year

Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.

Capital Gains Tax Opportunities

Let’s say you’re married and your taxable income this year, calculated after subtracting your itemized deductions or standard deduction, is going to be about $60,000. You have about $20,400 of room for more income before you hit the 15% long-term capital gains bracket.

How To Harvest Your Capital Gains

There are several tips you should know as you consider reaping the benefits of your capital gains.

Benefits of Harvesting Gains for Retirees

Gain harvesting can be an effective way to realize tax-free gains, but you must build a habit of projecting taxes and looking for tax opportunities by the end of each year to make it work. You can reduce your tax bill during your retirement years by doing this consistently, which means more of your retirement income goes in your pocket.

Do capital gains count as income?

Capital gains will count toward your adjusted gross income for tax purposes. Capital gains income can bump you up into a higher tax bracket if you earn enough through investing and trading.

What is the capital gains tax rate on stocks held one year or less?

Short-term capital gains are taxed as normal income at your normal income tax bracket rate.

Employee Compensation

Fringe Benefits

Business and Investment Income

Partnership Income

S Corporation Income

- In general, an S corporation does not pay tax on its income. Instead, the income, losses, deductions, and credits of the corporation are passed through to the shareholders based on each shareholder's pro rata share. You must report your share of these items on your return. Generally, the items passed through to you will increase or decrease the bas...

Royalties

Virtual Currencies

Bartering