4 Unexpected Ways You Can Lose Your Social Security Benefits

- Working too few years. Most people know their wages throughout their working life determine how much they'll receive from Social Security.

- Claiming benefits at the wrong time. Retirees can choose to claim Social Security benefits any time between 62 and 70, with those who claim earlier getting more (but smaller) ...

- Living in the wrong place. ...

How much can I earn without losing Social Security benefits?

- If you work and earn $6,000 throughout the year, you have not hit the $17,640 annual earnings that would trigger withholding of some of your Social Security benefits. ...

- If you work and earn $35,000, you have exceeded the $17,640 limit by $17,360. ...

- If you work and earn $80,000, you have exceeded the $17,640 limit by $62,360. ...

Is it ever smart to suspend your Social Security benefits?

If you suspend your Social Security benefits after you reach full retirement age, then you can earn delayed retirement credits. That can be useful if you claimed early and had your payment reduced but now want to get a bigger payout.

Should you reset your Social Security benefits?

The challenge of saving enough for retirement grows more difficult by the year, so it's no surprise that people want to squeeze as much guaranteed money from Social Security as possible. There are plenty of levers you can pull to boost your benefits before ...

Should you withdraw and reapply for Social Security benefits?

Withdrawing Both Social Security and Medicare Benefits

- Your Medicare Advantage enrollment will automatically end if you withdraw from Medicare Part A, Part B, or both.

- You will no longer be eligible for Medicare Part D if you withdraw from Medicare Part A and Part B. ...

- If you keep Part A or Part B, you are still eligible for Medicare Part D.

What are the three ways you can lose your Social Security?

3 Ways You Can Lose Your Social Security BenefitsClaiming your benefits too soon. The Social Security checks in your future are not fixed. ... By falling victim to a scammer. Another way to lose Social Security benefits is to fall for a scam or have your identity stolen. ... If Social Security isn't bolstered.

What can cause you to lose your Social Security benefits?

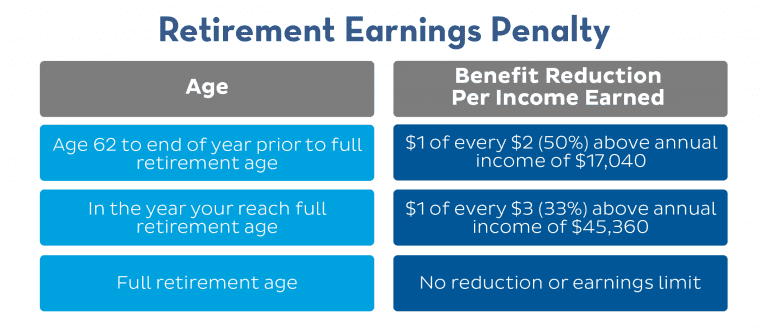

If you earn too much after taking benefits early In 2019, the cap is $17,640. For every $2 you earn over that, you lose $1 in benefits. During the year you turn your full retirement age, the cap rises to $46,920. One dollar is withheld for every $3 earned above the threshold.

How long will my Social Security last?

As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.

Can you outlive your Social Security benefits?

Social Security provides an inflation-protected benefit that lasts as long as you live. Social Security benefits are based on how long you've worked, how much you've earned, and when you start receiving benefits. You can outlive your savings and investments, but you can never outlive your Social Security benefit.

Is Social Security permanent?

In general, we pay monthly benefits to people who are unable to work for a year or more because of a disability. Benefits usually continue until you can work again on a regular basis.

What happens to unused Social Security benefits?

Any unused money goes to the Social Security trust funds, not a personal account with your name on it. Many people think of Social Security as just a retirement program. Most of the people receiving benefits are retired, but others receive benefits because they're: Someone with a qualifying disability.

How much money can you have in the bank on Social Security retirement?

$2,000You can have up to $2,000 in cash or in the bank and still qualify for, or collect, SSI (Supplemental Security Income).

Can a person who has never worked collect Social Security?

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.

What would happen if Social Security was raised to 69?

If full retirement were raised to 69, benefits claimed at age 62 would be reduced by 40% , according to Urban Institute calculations reported by Reuters. 10.

How to protect yourself from SSA?

Protect yourself by creating a mySocialSecurity account at SSA.gov. Check it regularly for suspicious activity. You can hold the account long before you're ready to claim benefits.

How much of your spouse's benefit can you get if you claim it early?

If you claim a spousal benefit early — say at 62 — you may receive as little as 32.5% of your better half's benefit.

What happens if you retire at 62?

If your full retirement age is 67 but you file at 62, your monthly benefit will be reduced by 30%. The reduction is permanent unless you withdraw your claim within a year and pay back any early benefits you received. 2. If you earn too much after taking benefits early. Advertisement.

What is the cap on retirement income?

In 2019, the cap is $17,640. For every $2 you earn over that, you lose $1 in benefits. During the year you turn your full retirement age, the cap rises to $46,920. One dollar is withheld for every $3 earned above the threshold.

How much do you get paid a month when you retire?

Much depends on when you were born, when you retire, and many other factors. Though $2,861 a month is this year's max for someone leaving the workforce at normal retirement age, you could find yourself collecting far less.

What is the normal age to retire?

What Social Security calls normal or full retirement age is somewhere between 66 and 67, depending on the year you were born. At that age, you can claim everything you’ve got coming to you based on your work record.

Why do seniors lose Social Security?

Around 50% of seniors lose some of their benefits to the IRS . Losing out on Social Security benefits because of taxes or poor timing on claiming benefits is a big problem if you need them to help make ends meet. Understand how benefits work to make an informed choice about when to claim them.

How much of Social Security benefits are taxed?

Up to 85% of your benefits could potentially be taxed at the federal level. Combined income includes half your Social Security benefits, some nontaxable income, and all taxable income including distributions from traditional 401 (k) and IRA accounts. Around 50% of seniors lose some of their benefits to the IRS .

What happens if you work less than 35 years?

On the other hand, if you've worked less than 35 years, there will be $0 wages included in your average. This means that by either working for less than that time or stopping work during prime earning years and not having your high salary factored in, you'll be giving up some benefits you could've received.

How many years do you have to work to get Social Security?

1. Working too few years. Most people know their wages throughout their working life determine how much they'll receive from Social Security. What may come as a surprise is that the Social Security Administration (SSA) always considers the same number of working years when determining your benefits. Whether you worked for 25 years ...

What does it mean to stop working during prime earning years?

2. Claiming benefits at the wrong time.

What happens if you live in a state and are subject to the IRS?

If you live in one of them and are subject to the tax, you'll lose some of your retirement money to your local government. If you're struggling to get by, it may make sense to relocate to a state that won't take a cut -- especially if it's a state with a lower cost of living as well. 4. Having income above IRS limits.

Is Social Security a source of retirement?

Passionate advocate of smart money moves to achieve financial success. Social Security benefits are a major source of retirement money for most American s. But they aren' t enough to live on without outside funds even under the best of circumstances.

What happens to your retirement benefits if you lose your earnings test?

Once you reach full retirement age, your benefit will be permanently increased as a result of these withholdings .

When will Social Security increase?

Current law says that a retirement benefit will increase by 8% per year beyond full retirement age, until as late as age 70.

What is combined income for Social Security?

So if you have $30,000 in other income and a $20,000 annual Social Security benefit, your combined income is $40,000.

How many states tax Social Security?

There are currently 13 states that tax Social Security benefits, and most of them don't have the same guidelines as the IRS. However, if you live in one of these states and have significant non-Social-Security income, taxes could take a significant bite out of your retirement benefits. The Motley Fool has a disclosure policy.

Is Social Security income taxable?

If your combined income is below $32,000 (married filing jointly) or $25,000 (everyone else), your Social Security benefits are not considered taxable income.

Can Social Security be withheld?

To name a few, the Social Security earnings test can cause some or all of your benefits to be withheld, not understanding the rules for spousal benefits could be costly, and taxes could eat up more of your retirement benefits than you're anticipating.

Can you delay your spouse's retirement?

Because there's no such thing as delayed retirement credit for spousal benefits, it's generally not a good idea for a primary-earning spouse to delay his or her own retirement benefit past the spouse's full retirement age, if a spousal benefit is expected.

When does Medicare Advantage end?

Your Medicare Advantage enrollment will automatically end if you withdraw from Medicare Part A, Part B, or both.

What happens if you withdraw from tricare?

Information for TRICARE Beneficiaries. If you have TRICARE and your withdrawal includes your Medicare Part A coverage, you may lose your TRICARE coverage. If you do not withdraw your Medicare Part A coverage, you may need to stay enrolled in Medicare Part B to keep your TRICARE coverage.

What to know before withdrawing your retirement?

There are a few things to know before deciding to withdraw your application. Anyone else who receives benefits based on your application must consent in writing to the withdrawal. You must repay all the benefits you and your family received from your retirement application. This includes:

What do you do if you are entitled to railroad benefits?

If you are also entitled to railroad or veterans benefits, you should check with the Railroad Retirement Board (RRB) and the Department of Veterans Affairs (VA) about how your withdrawal affects those benefits. The RRB and the VA make their own determinations and are responsible for their own programs.

How many withdrawals can you make per lifetime?

You are limited to one withdrawal per lifetime. If you cannot withdraw your application and you have reached full retirement age but are not yet 70, you can ask us to suspend benefit payments. Learn more about: What Happens When You Withdraw Your Application.

Does Medicare Part A or B affect Medicare Advantage?

Withdrawing from Medicare Part A or Medicare Part B can also affect your coverage under a Medicare Advantage plan (previously known as Part C) and Medicare Part D (Medicare prescription drug coverage). Your Medicare Advantage enrollment will automatically end if you withdraw from Medicare Part A, Part B, or both.

Do you pay a penalty if you enroll in Medicare Part D?

You will pay a penalty if you enroll in Medicare Part D in the future. If you keep Part A or Part B, you are still eligible for Medicare Part D. The Centers for Medicare & Medicaid Services (CMS) will handle your future bills for Part B premiums if you decide to keep that coverage.

When will children stop receiving SSI?

Children who are receiving SSI will have their condition reevaluated according to the adult SSI standards when they turn 18, and depending on the SSA’s finding, this could cause their benefits to stop.

What are the factors that affect SSI income?

Some factors include, but are not limited to, an increase in income, free food or shelter, increase in assets, spousal income, and/or parental income.

How long does it take for a disability to be reviewed by the SSA?

Briefly, the SSA periodically reviews the case of all beneficiaries (usually in 3 or 7 year increments) to determine if they are still disabled. These “continuing disability reviews” are generally less strict than the standards used when applying for disability, and most disability beneficiaries continue to receive benefits after their review.

What happens if you are incarcerated?

4) Being Incarcerated or Institutionalized (SSD) If you are confined to a prison or other penal institution after being convicted of a crime, your disability benefits will stop for the period of time you are incarcerated. In addition, sometimes a felony conviction will lead to a cessation of benefits as well.

What is the income limit for SSI?

In 2015, the individual income limit for SSI is $733 per month , and the asset limit is $2,000. While SSI recipients should be aware of these limits, determining whether you are over the income limit can be a complex issue due to a number of factors. Some factors include, but are not limited to, an increase in income, free food or shelter, increase in assets, spousal income, and/or parental income.

Does SSI stop if you return to work?

SSI benefits will stop if the recipient returns to work and engages in SGA. However, trial work periods are not available under the SSI program. SSI does have a Ticket to Work Program and a “Plan for Achieving Self-Support, however.

Can you stop receiving Social Security Disability?

Once they’ve finally received their disability, the last thing anyone wants to experience is having their benefits stop. Yet, there are certain reasons why payments may cease and be taken away due to policy. Of course, SSD and SSI are very different, but it’s important to know what can cause your Social Security Disability to be terminated.

What is the maximum amount you can earn before retirement in 2021?

If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

Can you report a change in earnings after retirement?

If you need to report a change in your earnings after you begin receiving benefits: If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online.