How much income can you earn on Social Security disability?

Unearned income includes:

- interest income

- dividends

- rent from property you don't actively manage

- income that your spouse earns

- pensions

- state disability payments

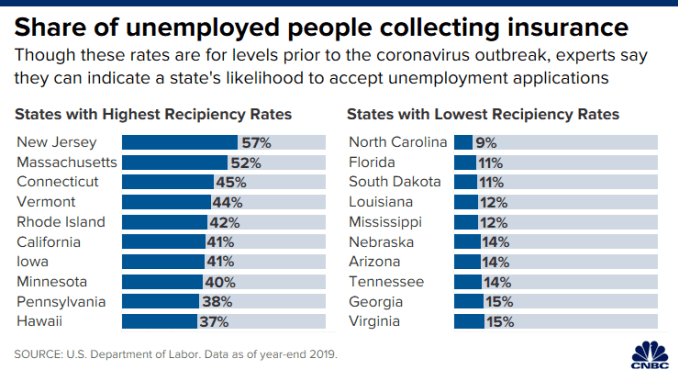

- unemployment benefits, and

- cash or gifts from friends and relatives.

How much can you work while receiving SSI disability benefits?

Your countable income is made up of the following:

- wages you are paid from your job (some of which is excluded)

- the value of free food and shelter provided for you

- support money from family or friends (though not all of your spouse's earnings are counted against you), and

- payments from other sources, like veterans benefits or unemployment.

What qualifies you for Social Security disability?

- Lupus

- Vasculitis

- Scleroderma

- Connective Tissue Disease

- Inflammatory Arthritis

Does unearned income affect SSDI?

You (and your spouse, if you're married) can have an unlimited amount of unearned income. Unearned income includes: cash or gifts from friends and relatives. Any type of gifts, even expensive ones, don't affect SSDI benefits at all.

What happens if you work while collecting Social Security disability?

If you have a qualifying disability and work despite your disability, you may continue to receive payments until your earnings, added with any other income, exceed the SSI income limits. This limit is different in every state.

How many hours a week can I work while collecting Social Security disability?

When you work for yourself, you can work hours without receiving an hourly wage. In that case, the SSA will look at how many hours you've worked, plus your monthly income. Social Security typically allows up to 45 hours of work per month if you're self-employed and on SSDI. That comes out to around 10 hours per week.

How many hours am I allowed to work on disability?

There is no restriction on the number of hours you can work. Social insurance payments: Invalidity Pension and Illness Benefit are social insurance (PRSI-based) payments. You cannot work while you are getting these payments (with the exception of voluntary unpaid work).

What is the monthly amount for Social Security disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

How long does it take for SSI to reinstate?

If your SSI payments stop because you earn too much money (that is, if your countable income is over $794 per month), but you are subsequently forced to quit work because of your disability, the SSA will reinstate your benefits without the need for a new application for a period of five years.

How many hours can you work to get SSDI?

If you are self-employed, any month where you work more than 80 hours can also be considered a trial work month. Once you have completed the nine-month trial work period (the months need not be consecutive), you can still receive SSDI for any month where your earnings fall below the SGA level, for a period of 36 months.

How long is the trial work period for SSDI?

For the nine-month trial work period, SSDI recipients are entitled to test their ability to work and continue to receive full benefits regardless of whether they make more than the SGA amount. For 2021, the Social Security Administration (SSA) considers any month where a person has a monthly income of more than $940 to be a trial work month. ...

Can I work for more than SGA?

To encourage SSDI recipients to go back to work, however, Social Security has created some exceptions to this rule. SSDI recipients are entitled to a trial work period during which they can make more than the SGA amount without losing benefits. For the nine-month trial work period, SSDI recipients are entitled to test their ability to work ...

Can you get SSDI if you are blind?

Generally, SSDI recipients can't do what's considered "substantial gainful activity" (SGA) and continue to receive disability benefits. In a nutshell, doing SGA means you are working and making more than $1,310 per month in 2021 (or $2,190 if you're blind). To encourage SSDI recipients to go back to work, however, Social Security has created some exceptions to this rule. SSDI recipients are entitled to a trial work period during which they can make more than the SGA amount without losing benefits.

Can I report my wages to Social Security?

SSDI and SSI recipients can now report wages online using their Social Security account, and SSI recipients can now also report wages with a smartphone app. Social Security's website has more information on telephone wage reporting and online wage reporting.

Does the SSA take the $85 off of your income?

If your only income is from your job, the SSA does not include the first $85 you earn toward your countable income. After taking the $85 adjustment off of your income, the SSA will deduct, from your monthly benefits, 50 cents for every dollar you earn.

What does SGA mean for disability?

SGA means you are doing competitive work and making more than $1,220, pre-tax, per month in 2019 (or $2,040 if you’re blind). There are some exceptions to this rule, however. If you are approved for SSI, you can also work and continue to receive your disability benefits as long as your wages and other resources do not exceed ...

Can I still work and receive disability?

Yes, you can still work and receive disability benefits, but there are limitations on this for both SSDI & SSI. Generally speaking, SSDI recipients can’t start doing what’s considered “substantial gainful activity” (SGA) while receiving disability benefits. SGA means you are doing competitive work and making more than $1,220, pre-tax, ...

Receiving Benefits While Working

You can work while you receive Social Security retirement or survivors benefits. When you do, it could mean a higher benefit for you and your family.

How Much Can I Earn and Still Get Benefits?

When you begin receiving Social Security retirement benefits, you are considered retired for our purposes. You can get Social Security retirement or survivors benefits and work at the same time. However, there is a limit to how much you can earn and still receive full benefits.

How We Deduct Earnings From Benefits

In 2021, if you’re under full retirement age, the annual earnings limit is $18,960. If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520.

What is the difference between SSDI and SSI?

The difference between SSI and SSDI is that SSI encourages recipients to work as much as they can. Only about half of your income is counted towards the SSA’s income totals, so the $794 limit is often closer to $1,500 per month. The amount of your monthly payment depends on your income.

How long can I work and still get Social Security benefits?

If you do choose to go back to work, you will still be able to receive benefits for any month you don’t make over the SGA limit for 36 months. If, at any point during the 36 months you decide you can’t work, then you need to call the SSA and they will reinstate your benefits.

How many hours can I work on SSDI in 2020?

In 2020, any month that you make more than $940 or work more than 80 hours if you’re self-employed is considered a trial month. If it is determined that you cannot work after your trial period, you can go back to receiving SSDI as normal.

How long is the SGA trial period?

To make it easier for you to go back to work, they offer a nine-month trial period. You can receive full benefits for nine months while making over the SGA for nine months to test if you are able to work with your disability.

Can I get SSDI if I work full time?

Social Security Disability Insurance. For SSDI, you can only receive benefits if you cannot work a full time job, or enough to be considered substantial gainful activity ($1,310 per month, $2,190 if you’re blind). Therefore, most recipients receive SSDI in place of working.

Can I keep my medicaid if I have no SSI?

If you income increases, your payments will be decreased. Even if you are making enough that you are no longer eligible for SSI benefits, you may still be able to keep your Medicaid. It is also possible to apply to buy Medicaid from the state Medicare agency if you have high medical costs. Get My Free Evaluation.

Is there a limit on how many hours you can work on SSI?

There are strict financial limits to be eligible for SSI, but it’s not based on work history. There is no limit on how many hours you can work on SSI, rather a limit on how much you can make in a month.

What is the SGA limit for 2021?

In 2021, the SGA limit is $1,310 per month. (For blind SSDI applicants, the limit is $2,190, and for blind SSI applicants, there is no SGA limit, though they are still subject to the income limits of the SSI program). In addition to the amount of money you make, Social Security may look at the number of hours you're able to work. ...

What is the SGA limit for Social Security?

In 2021, the SGA limit is $1,310 per month.

How much is the SGA limit for SSI?

If you're receiving SSI, the $1,310 SGA limit applies only during your first month of benefits. After that, the SSI income limit applies instead. Because of the way earned income is counted (more than half of it doesn't count toward the limit), there is no set SSI income limit for those who work part-time. But the more you earn, the lower your SSI ...

How many hours can you work in a week to get SGA?

For instance, someone making the federal minimum wage ($7.25 per hour) can work 32 hours per week and have their earnings come under the SGA amount, while someone who makes significantly more (say $42 per hour) can work only five hours per week without becoming ineligible for benefits.

How long can you work on SGA?

This is a period of nine months during which you can more than the SGA limit. For more information, see our article on the trial work period.

Does Social Security look at work?

In actuality, Social Security can look at things that affect the "worth" of an individual's work that might influence whether or not an individual is engaging in SGA-level work activity, even if the individual is earning over the monthly earnings limit.

Can a judge think you can work part time?

Or a judge may think that you are working part time only because you can't find full-time work, not because of a medical condition.

How much is SGA in 2021?

SGA, as it’s known, is defined in 2021 as earning more than $1,310 a month (or $2,190 if you are blind). If your income exceeds those caps, you cannot collect disability benefits, unless you are taking part in one of Social Security’s "work incentives" — programs and trial periods aimed at helping SSDI recipients transition back into ...

When is SGA adjusted?

The SGA limits are adjusted annually based on national changes in average wages. Some work incentives are specific either to SSDI or SSI, while others, like Ticket to Work, are available to both types of beneficiary. Updated December 24, 2020.

How long is the Social Security trial period?

The trial months can be spread out over five years , and during these months you can get your full benefit regardless of your earnings. You’ll find more information on these and other work incentives in the Social Security publication "Working While Disabled — How We Can Help.".

Does ticket to work waive SGA?

As do other work incentives, Ticket to Work temporarily waives the SGA earnings limits, so you continue collecting your disability benefits while you engage in trial work with employers who have signed up to participate. If you get a job through the program, you go off disability benefits.

Can I collect disability if my income exceeds my Social Security cap?

If your income exceeds those caps, you cannot collect disability benefits , unless you are taking part in one of Social Security’s "work incentives" — programs and trial periods aimed at helping SSDI recipients transition back into the workforce without sacrificing their benefits.

How old do you have to be to get Social Security?

Also known as Supplemental Security Income (SSI), you can receive Social Securityretirement benefits as long as you’re at least 62 years old and have at least 40 work credits.

What is the full retirement age?

Full retirement age is 67 for anyone born after 1960, but you can opt for early retirementbenefits at age 62. For disability, the age requirements are quite different. You only need to be at least 18 years of age to qualify, and SSA guidelines require you to prove that: You can’t do the work that you’ve done before.

When will Social Security be replaced with Social Security?

And if you haven’t yet reached early or full retirement age and you’re receiving SSDI, those benefits will be replaced with Social Security income once you reach age 62. But exceptions apply to those who take early retirement before being approved for SSDI benefits. Tips for Getting Retirement Ready.

Can you get both disability and early retirement?

The Exception to the Rule. You may be able to get both benefits if you opted for early retirement before you received disability benefits. These are also known an concurrent benefits. This exception would be applicable in a situation where an individual retired early due to serious medical conditions.