Do Gi Bill Benefits Count As Income? The GI Bill does not provide benefits and taxes for veterans. Tuition assistance or the GI Bill are not taxable, regardless of whether you received it through the Montgomery GI Bill

G.I. Bill

The Servicemen's Readjustment Act of 1944, also known as the G.I. Bill, was a law that provided a range of benefits for returning World War II veterans. It was passed by the 78th United States Congress and signed into law by President Franklin D. Roosevelt on June 22, 1944. The origi…

Is GI Bill considered an income?

programs may qualify as temporary, nonrecurring or sporadic income in accordance with PHA policy. 2. The Post 9/11 Veterans Educational Assistance Act of 2008 (Post 9/11 VEAA, also referred to as the Post 911 GI Bill) provides benefits for veterans pursuing a course of education in the forms of tuition assistance, book stipends, and a monthly housing

Is GI Bill taxable income?

No. Payments from all GI Bill programs are tax-free. This is true for you, your dependents, and your survivors. Tax-free education benefits include: Tuition; Training fees; Test fees for licenses and certifications; Money to pay for a tutor; Work study; Books; Housing; Please don’t include education benefit payments as income when you file your taxes.

Do you have to claim GI Bill money on taxes?

You may wonder if you have to report your GI Bill benefits as income on your taxes, well the good news is that the answer is NO. GI Bill benefits are NOT taxable and should NOT be reported on your tax return as income. You will not receive a W-2 from the VA. According to IRS Publication 970:

Is GI Bill considered income for child support?

The monthly stipend is treated as income when calculating child support or alimony, but not the tuition assistance or book stipend. In re: Marriage of Tooker, 2019 COA 83, a retired veteran was receiving GI Bill benefits while attending college, specifically the tuition assistance, the book/supply stipend, and the monthly housing allowance.

Does the GI Bill count as earned income?

The short answer is no, these benefits are NOT taxable and should NOT be reported on your tax return as income. Just like VA health benefits, education benefits are connected to your service and not reported to the IRS.

Are VA education benefits considered income?

Provisions. Payments you receive for education, training, or subsistence under any law administered by the VA are tax free. Don't include these payments as income on your federal tax return.

Do military benefits count as income?

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes. However, military disability retirement pay and Veterans' benefits, including service-connected disability pension payments, may be partially or fully excluded from taxable income.

Does VA benefits count as gross income?

When Do VA Benefits Not Count As Income? The IRS defines Gross Income in Section 61 as: Compensation for services, including fees, commissions, and similar items. According to the IRS, disability benefits received from the VA should not be included in your reported gross income and are not taxable at the federal level.

Do I need to report GI Bill on my taxes?

You may wonder if you have to report your GI Bill benefits as income on your taxes, well the good news is that the answer is NO. GI Bill benefits are NOT taxable and should NOT be reported on your tax return as income. You will not receive a W-2 from the VA.

Is the GI Bill considered a grant?

Q: Is the GI Bill considered Financial Aid? A: Not in the traditional sense. In most cases, the school's financial aid department does not consider the GI Bill financial aid. This means that you are eligible for student loans, scholarships, and Pell Grants along with the GI Bill.

Do I get a 1098 t if I use the GI Bill?

However, for U.S. tax reporting purposes, GI Bill recipients are issued a Form 1098-T from the University reflecting the total tuition and fee payments by multiple sources (including GI Bill paid by VA), not just items personally paid out-of-pocket.

Do you get a 1099 for VA benefits?

If you have taxable income from the VA, you will receive Form 1099-R referencing amounts for reporting for your federal income taxes. The VA does not report some forms of non-taxable income to the IRS, and you do not need to report it on your Form 1040.

Do veterans get paid for life?

The SSA evaluates military records when claimants apply for benefits, and qualifying veterans can get a lifetime earnings credit for wages during service. Eligibility is based on length of service.

Will I lose my VA disability if I get a federal job?

What Is the Bottom-line? If you are working and receive service-connected compensation, you will not be penalized by the VA. Working veterans will only run into problems with the VA if they are receiving TDIU and their work is considered to be substantially gainful.

Do I have to disclose my VA disability?

9. Do I have to disclose an injury or illness that is not obvious during an interview or indicate on a job application that I have a disability? No. The ADA does not require you to disclose that you have any medical condition on a job application or during an interview.

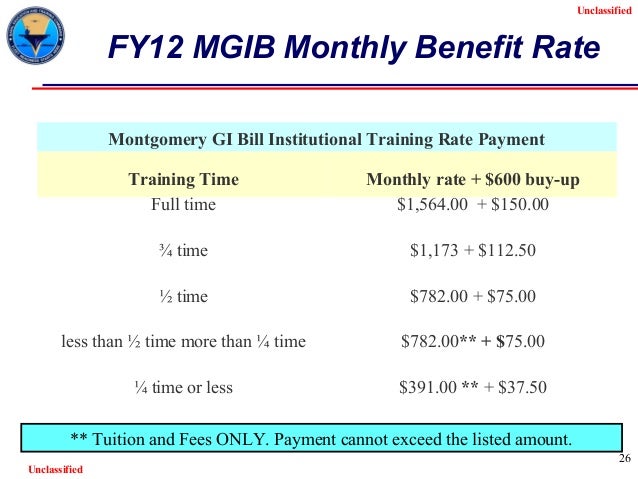

Benefit rates and ways you can use your benefits

Learn more about education benefit rates for tuition and books for qualifying Veterans and their family members.

Other GI Bill programs you may qualify for

If you served at least 2 years on active duty, find out if you qualify for benefits under the Montgomery GI Bill Active Duty program.

More GI Bill benefits and information

Find out if your school participates in the Yellow Ribbon Program, which can help pay tuition costs that the Post-9/11 GI Bill doesn’t cover.

What is considered effective income for VA loan?

Stability and consistency are key when it comes to income and VA loans. There are various forms of income that lenders can count as effective income toward a mortgage, including base pay and housing allowances during active service; retirement income; rental income; and more.

Is GI Bill short term?

The problem is GI Bill income is by its nature short term. You're not likely to be in school for a huge chunk of time, at least within the larger picture of a 30-year mortgage. This income may also be subject to change, and that's a particularly worrisome thought for lenders.

Who can get GI Bill benefits?

While the primary purpose is to help veterans after their military service, the GI Bill benefits are available to members still serving in the military, as well as family members.

How long do you have to use GI Bill benefits after discharge?

Members discharged before January 1, 2013 must use their post-9/11 GI Bill benefits within 15 years of discharge, but there is no deadline for using them if discharged after that date. 38 U.S. Code §3321 (a).

How long do you have to serve in the military to transfer benefits?

At the time of the election, the member must have at least 6 years of active duty, and agree to serve another 4 years. 18 U.S. Code § 3319 (b), which means the election must be made while the member is still on active duty.

How long can a child use the military benefits?

Though the election may be made while the member has 6 years of service, a child may not commence using benefits until the member has served at least 10 years on active duty. 18 U.S. Code §3319 (g) (2). The child must use the benefits before the age of 26. 18 U.S. Code §3319 (h) (5) (A). Revocation of Transfer.

What is the post-9/11 GI bill?

Code §3301, et seq, introduced the Post-9/11 GI Bill as a complete revamp of the traditional Montgomery GI Bill. Other than sharing the purpose of helping veterans attain their education, and a (similar) name, they really have nothing in common.

Is a spouse entitled to a stipend?

Code §3319 (c) (1). Because the spouse is treated the same as the military member, note two caveats: If the member is still on active duty while the spouse is in college, the spouse is not entitled to the monthly stipend. 18 U.S. Code §3319 (h) (2) (A).