Do pensions pay after death?

We say generally because there is a condition which needs to be met for the payments to be free of income tax – the pension fund has to be paid to your beneficiaries within two years of your death. This can be confusing as it does not mean that they have to take all of the money out of your pension.

What happens to a pension after death?

- the amount and form of benefits (in other words, lump sum or installment payments under an annuity );

- whether death benefit payments from the plan may be rolled over into another retirement plan; and

- if a rollover is possible, the method and time period in which the rollover must be made.

Who gets pension after death?

After the death of the pensioner ... that a daughter shall become ineligible for family pension under this sub Rule from the date she gets married. Furthermore, the Rule also stipulates that ...

What happens to my pension when I Die?

What happens to my pensions if I die? The main pension rule governing defined benefit pensions in death is whether you were retired before you died. If you die before you retire your pension will pay out a lump sum worth 2-4 times your salary.

Do pension plans have death benefits?

If you are eligible to receive payments as the beneficiary. of a pension plan participant, it is important that you also designate a beneficiaryGenerally, a person designated by a pension plan participant, or by the plan's terms, to receive some or all of the participant's pension benefits upon the participant's death. ...

Do pensions have beneficiaries?

Designating your beneficiaryGenerally, a person designated by a pension plan participant, or by the plan's terms, to receive some or all of the participant's pension benefits upon the participant's death. is very important, even if you have not yet begun to receive pension payments.

Who gets your pension when you pass away?

If you do not designate a beneficiary, death benefits will be paid to the first surviving of the following: (1) your surviving Spouse, (2) your surviving children, (3) your surviving brothers and sisters, (4) your surviving parents, (5) any other person who is the object of your natural bounty as determined by the ...

Do most pensions have survivor benefits?

For example, 68 percent of the plans provided multiple joint-and-survivor options ranging from 25 to 100 percent of the pension paid prior to the retiree's death, with at least one option of. 50 percent or more . of 49 percent of the accrued pension.

Does next of kin get pension?

If no beneficiaries are named for a pension it is up to the pension provider to decide who inherits your pension. This is usually the next of kin and any dependents.

Can I claim my deceased father's pension?

If the deceased hadn't yet retired: Most schemes will pay out a lump sum that is typically two or four times their salary. If the person who died was under age 75, this lump sum is tax-free. This type of pension usually also pays a taxable 'survivor's pension' to the deceased's spouse, civil partner or dependent child.

What happens when a pensioner dies?

In case of the death of the recipient of pension benefits, please inform the Pension Fund Association of that fact promptly. The Pension Fund Association will send the "Notification of Death" form.

Can you pass your pension to your child?

The new pension rules have made it possible to leave your fund to any beneficiary, including a child, without paying a 55% 'death tax'. Many people want to leave their assets to their family when they pass, and a pension is now a tax-efficient way to do this.

What happens to a pension if the person dies before retirement?

The pension payout If you were to die before you retire, your surviving spouse or other named beneficiary must contact your employer or the plan's administrator to make a claim on any available benefits. At that time, the plan administrator will generally request a copy of the death certificate.

Can I get my mother's pension after her death?

The deceased person may have been entitled to pension benefits from a private company, government agency, or union. Some pensions end at death, but many pensions provide for payments to a surviving spouse or dependent children. Survivors may be entitled to part of the payments the person would have received.

What happens to my husband's government pension when he dies?

As previously noted, if you have reached full retirement age, you get 100 percent of the benefit your spouse was (or would have been) collecting. If you claim survivor benefits between age 60 and your full retirement age, you will receive between 71.5 percent and 99 percent of the deceased's benefit.

Do pension benefits go to surviving spouse?

What is a survivor's benefit/widow's pension? The federal pension law, the Employee Retirement Income Security Act (ERISA), requires private pension plans to provide a pension to a worker's surviving spouse if the employee earned a benefit.

What is pension plan?

Pension plans are a type of retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker's future benefit. The pool of funds is invested on the employee's behalf, and the earnings on the investments generate income to the worker upon retirement. Pension plan options typically offer a lump-sum ...

What are the different types of pension plans?

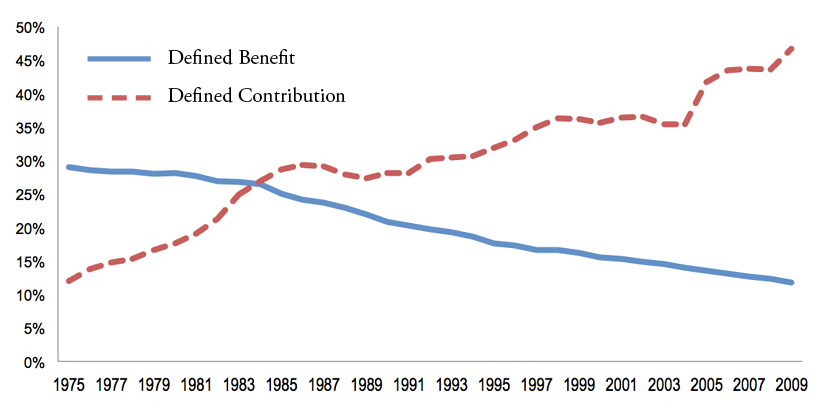

Types of Pensions. There are two main types of pension plans: defined-benefit and defined-contribution . A defined-benefit plan is what people normally think of as a "pension.". It is an employer-sponsored retirement plan in which employee benefits are computed using a formula that considers several factors, such as length ...

How to notify a spouse of a death?

"When a plan participant dies, the surviving spouse should contact the deceased spouse’s employer or the plan’s administrator to make a claim for any available benefits. The plan will likely request a copy of the death certificate. Depending upon the type of plan, and whether the participant died before or after retirement payments had started, the plan will notify the surviving spouse as to: 1 the amount and form of benefits (in other words, lump sum or installment payments under an annuity); 2 whether death benefit payments from the plan may be rolled over into another retirement plan; and 3 if a rollover is possible, the method and time period in which the rollover must be made." 3

What is a period certain annuity?

Period Certain Annuity. A period certain annuity option allows the customer to choose how long to receive payments. This method allows beneficiaries to later receive the benefit if the period has not expired at the date of the member's death.

What is defined contribution plan?

A defined-contribution plan is a retirement plan that's typically tax-deferred, like a 401 (k) or a 403 (b) , in which employees contribute a fixed amount or a percentage of their paychecks to an account that is intended to fund their retirements. The sponsor company will, at times match a portion of employee contributions as an added benefit.

Why is defined benefit called defined benefit?

It is called "defined benefit" because employees and employers know the formula for calculating retirement benefits ahead of time, and they use it to set the benefit paid out. The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferred account.

Can a non-spouse beneficiary be a child?

However, in limited instances, some may allow for a non-spouse beneficiary, such as a child. According to the Internal Revenue Service (IRS): The Employee Retirement Income Security Act of 1974 (ERISA) "protects surviving spouses of deceased participants who had earned a vested pension benefit before their death.

What happens to pension plan when owner dies?

If a pension plan owner dies prior to retirement, designated beneficiaries may receive a lump sum payment. The amount typically reflects a multiple of the deceased’s yearly salary.

Who can help with pension death?

Older Americans looking to gain an understanding of pension death benefits and tax consequences for estate planning purposes should consult an estate planning attorney, who can provide advice and guidance going forward.

What is pension payout?

A pension from a union, private company or government agency may provide monetary benefits to surviving spouses or dependent children upon the death of the plan participant. Known as pension death benefits or inherited pension benefits, these payouts typically take the form of ongoing payments representing a percentage of the amount ...

What happens if my retirement plan is approved?

You should also be notified about whether the payout can be rolled over into another retirement plan.

Is pension death taxable?

Some death benefits purchased through a pension plan function similarly to life insurance, which means they’re only taxable if the payout amount exceeds the purchase price. If the payout does exceed the original purchase price, only the amount over what was paid is taxable.

Can you roll over 401(k) to new retirement?

Rollovers. If pension death benefits involve a defined-contribution plan such as a 401 (k) or are paid as a lump sum distribution, there may be an option to roll them over into a new retirement plan.

Who can explain the terms of a pension?

If you are the spouse or dependent child of somebody who's passed away, your loved one’s employer or the plan administrator can explain the terms of the pension and help you determine if you qualify for death benefits.