If someone receiving Social Security benefitsearns money by working, the Social Security Administration may reduce the amount of that person’s benefits. This only affects people who start taking benefits before reaching full retirement age. And only income earned from working has this effect.

Full Answer

How are Social Security benefits affected by your income?

Key Points

- Your marital status could affect Social Security benefits.

- Divorce can sometimes leave you with a reduced Social Security check.

- Eligibility for spousal benefits and survivor benefits can depend how long you were married.

Which incomes reduce Social Security benefits?

Which Incomes Reduce Social Security Benefits?

- Full Retirement Age. The age at which you retire from your job and receive full retirement benefits is referred to as the normal retirement age (NRA).

- Social Security Benefits Eligibility. ...

- Early Retirement Earnings Test. ...

- SSA and Earned Income. ...

Does earned income affect social security?

You can collect Social Security benefits if you are still working and earning income. But if you earn more than a certain amount from your work—and haven't reached your full retirement age—your benefit will temporarily be smaller. Here's a rundown of how earned income can reduce your Social Security benefits.

Does Social Security redistribute income?

The average Social Security recipient pays less money into the system than he or she takes out. In that sense, it can help to redistribute income. But there is also a cap on earnings above which Social Security taxes are not taken. This limits the degree to which any redistribution can happen.

How much will Social Security be in 2022?

3 For 2022, that maximum is $4,194 a month (up from $3,895 a month in 2021). 4 5

What is the purpose of Social Security?

The Social Security Administration (SSA) keeps a record of your earned income from year to year, and the portion of your income that is subject to Social Security taxes is used to calculate your benefits in retirement. The more you earned while working (and the more you paid into the Social Security system through tax withholding), ...

Will Social Security be reduced after FRA?

Starting with the month when you attain FRA, your benefits will no longer be reduced. Note that these dollars are not lost forever; instead, your Social Security benefit will be increased to account for them after you reach your FRA. 12

Is Social Security considered earned income?

Your Social Security benefits are determined by a number of factors , but your earned income over the course of your working life is probably the most important—so the more the better. Is Social Security considered earned income? Unfortunately, the answer is “no.” 1

Is Social Security Taxable?

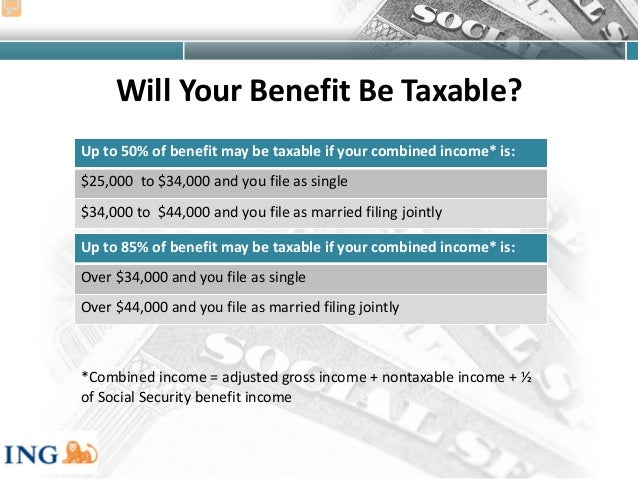

Your income from Social Security can be partially taxable if your combined income exceeds a certain amount. “Combined income” is defined as your gross income plus any nontaxable interest that you earned during the year, plus half of your Social Security benefits. For example, if you’re married, file a joint tax return with your spouse, and your combined income ranges from $32,000 to $44,000, then you may have to pay tax on up to 50% of your Social Security benefits. If your combined income is greater than $44,000, then up to 85% of your benefits may be taxable. For single filers, those income numbers are $25,000 to $34,000 and greater than $34,000. 13

What happens if Social Security benefits are reduced?

If benefits get reduced because an underage Social Security recipient earns more than the cap amount, the money isn’t actually lost. It’s only delayed. After the recipient reaches full retirement age, Social Security will recalculate the benefit. The new benefit will be higher to make up for payments that were withheld because of excess earnings.

How much does Social Security reduce?

Once annual earnings reach the cap amount, for every $2 a Social Security recipient under retirement age earns from working, the total annual benefit gets reduced by $1. For instance, say a recipient gets $1,000 a month in benefits and starts a part-time job that pays $20,000 a year. Subtracting $18,060 from $20,000 yields $1,040. Dividing $1,040 by 2 gives $520. This is the amount by which Social Security will reduce the annual benefit.

When does income count against cap?

In addition, income only counts against the cap until the month before full retirement age is reached. This means a person who reaches full retirement in November after earning $50,000 during the first 10 months of the year would have no reduction in benefits.

Is all income equal to Social Security?

Not all income is equal when it comes to Social Security earnings caps. Generally, any income that comes from employment counts against the earnings cap. Here are examples of the kinds of income that count against the cap:

Can you get Social Security if you work?

If someone receiving Social Security benefits earns money by working, the Social Security Administration may reduce the amount of that person’s benefits. This only affects people who start taking benefits before reaching full retirement age. And only income earned from working has this effect. Other types of income, such as dividends, interest and capital gains from investments, aren’t counted by Social Security for this purpose. If you’ve got questions about working while getting Social Security benefits consult a financial advisor for expert guidance.

Does Social Security increase your income?

Sometimes, earning money while receiving Social Security can also increase your benefit amount. This can happen if, during a year you receive Social Security benefits, you earn enough money to make the year one of your highest earning years. Social Security calculates benefits based on a worker’s highest earning years. So adding a new high level to your earnings record could cause your benefit to increase.

Does back pay count as income on Social Security?

Note that income earned before starting to receive Social Security does not count either. This could include stock options, back pay, bonuses and payments for unused vacation or sick leave. Even if these payments arrive after starting to receive benefits, they aren’t included against the cap as long as they were earned before benefits started.

What is the maximum amount you can earn before retirement in 2021?

If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

What is included in the deductions for self employed?

We include bonuses, commissions, and vacation pay. We don't count pensions, annuities, investment income, interest, veterans, or other government or military retirement benefits.

Can you report a change in earnings after retirement?

If you need to report a change in your earnings after you begin receiving benefits: If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online.

How long after you turn 21 can you collect Social Security?

Your Social Security benefit is based on your top 35 earning years after you turn 21. Social Security benefits are based on your top 35 earning years after you turn 21. This creates two possibilities for how your Social Security benefit will be calculated:

What happens if you file for Social Security before you hit FRA?

If you file for and begin receiving Social Security benefits before you hit your FRA, your lifelong Social Security benefit will drop (and perhaps by a LOT). In this situation, you will begin receiving Social Security benefits earlier in retirement, but at a reduced amount. The second is if you file for benefits but continue working ...

How many years of earnings do you have to have to be 0?

If you haven’t accrued 35 years of earnings, each year you fall short will count as $0 earned for that year.

Does Social Security reduce after retirement?

After you’ve passed your full retirement age, no amount of income you earn will reduce your benefits . Keep in mind however, the reduction in benefits prior to FRA are never fully lost. The benefit you receive at your full retirement age will be increased to offset the reduced Social Security benefits from your earned income.

Can your Social Security benefits be reduced?

We had a client into the office the other day. During the course of our planning conversation, she voiced an interesting Social Security question.

How much of Social Security is replaced by preretirement?

Passionate advocate of smart money moves to achieve financial success. Social Security benefits are designed to replace only 40% of preretirement income, but many seniors rely on them to provide most of the money they need each month. In fact, according to the Social Security Administration ...

Why is the Social Security formula progressive?

The Social Security benefits formula explained above is a progressive formula because lower earners receive a larger share of AIME than higher earners do. If you worked at a government job and didn't pay Social Security tax on wages, you might appear to have a low income in this formula because none of your earnings from the government count toward AIME. But you might not actually have a low income if you get a hefty government pension.

Why is my AIME low?

In some cases, your AIME will be low because you didn't work much. If you're eligible for spousal or survivors benefits, it may be possible for you to claim benefits based not on your own work record but on your current or former spouse's.

How much is the SSA withholding?

The SSA will withhold benefits equal to half this amount: $13,180. If you'd have received a monthly benefit of $1,000, you'd have your entire annual check withheld. If you'll hit FRA in 2019 and earn $44,000 from working, you won't hit the income limit, so no benefits would be withheld.

What is the income limit for FRA?

For 2019, the income threshold is $17,640. If you're working in the year you hit FRA, annual benefits are reduced by $1 for every $3 earned above a higher income limit. For 2019, the limit is $46,920. If you won't hit FRA in 2019 and you earn $44,000, you've exceeded the $17,640 limit by $26,360.

What happens if you work at a government job that provides you with a pension and doesn't withhold?

The windfall elimination provision: If you work at a government job that provides you with a pension and that doesn't withhold Social Security taxes, any Social Security benefits you're entitled to from working other jobs could be reduced.

How long do you get a check if you lose 3,000?

If you'd lose $3,000 of your annual benefit because of working, and your monthly check is $1,000, you'd get no benefits checks for the first three months of the year. After that, you'd get your full $1,000 benefit. Remember, you get credit for money withheld.

How much less might my Social Security income be if I retire early?

However, as a rough estimate, a medium to high earning individual might reduce their Full Retirement Age benefit by about $50 a month by stopping work in their mid to late 50s as opposed to around their Full Retirement age. Fifty dollars a month doesn’t sound like a ton, but it adds up. You could have an extra $600 a year which would pencil out to $18,000 over 30 years of collecting benefits.

How can I figure out what my Social Security benefits will be if I retire (stop working) early?

If you intend to stay at your current income up until at least age 62, then you can get a simple and fairly accurate projection of your benefits by reviewing your Social Security Statement or on My Social Security online. If you need a more customized projection, you can use the Social Security Estimator . This tool will allow you to try scenarios where you stop working early, take a break from work or work part time and see the long term impact on your benefits.

When should I start benefits?

The amount of money you stand to receive from social security benefits does increase over time if you choose to delay your benefits past the minimum age of 62. The full explanation of how the system works can be found here: In short: Starting Early: If your full retirement age is 66, then the amount you qualify for at age 62 is roughly 26% less than your “full” retirement benefits, which you would receive at age 66. Waiting to Claim Later: If you choose to delay the benefits beyond your full retirement age, then you will receive a bonus of between 3 and 8% (depending on your birth-year) to your social security for every year that you delay your benefits up to the age of 70.

What is the PIA for Social Security?

PIA equals the amount of money you will receive in social security benefits per month if you choose to wait until full retirement (which I guess is 66 for you) to receive benefits. Your FRA is determined by your birth year and it is between 66 and 67 for most people.

Does Social Security increase if you stop working?

Do Social Security benefits increase if you stop working? Your PIA amount will not increase. However, the longer you delay the start of benefits, the higher your monthly benefit amount will be. Without continued work, your Social Security benefit amount will be based on your existing work history.

Do I need to start Social Security when I stop working?

Absolutely not. You can stop and start working whenever you want. And, you can start Social Security at anytime between ages 62 and 70.

How to calculate Social Security if you are not 62?

Because of how the wage indexing formula works, if you are not yet age 62, your calculation to determine how much Social Security you will get is only an estimate. Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward, and use those to create an estimate.

How Is Social Security Calculated?

There is a three-step process used to calculate the amount of Social Security benefits you will receive.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

What is the process used to determine how to adjust your earnings history for inflation?

Social Security uses a process called "wage indexing" to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3

How to find average indexed monthly earnings?

Total the highest 35 years of indexed earnings, and divide this total by 420, which is the number of months in a 35-year work history, to find the Average Indexed Monthly Earnings.

When is a reduction applied to PIA?

A reduction is applied to your PIA if you begin benefits before your FRA. A credit, referred to as a "delayed retirement credit," is applied if you begin to receive benefits after your FRA.