De Minimis Fringe Benefits

- Cash Benefits. Cash is generally intended as a wage, and usually provides no administrative burden to account for. ...

- Gift certificates. Cash or cash equivalent items provided by the employer are never excludable from income. ...

- Achievement awards. ...

What are the principles and types of fringe benefits?

fringe benefit

- Presentation on By Kareena Bhatia Id no-GB054

- oFringe benefits are rewards given to employees as an extra to their wage or Salary. ...

- Definition: Fringe benefits are those monetary and non monetary benefits given to the employee during and post employment period which are connected with employment but not to the employees ...

What is considered a fringe benefit?

A fringe benefit is something that your employer offers you that is above and beyond your annual salary or other wages. These are perks that employers offer in order to attract and retain the best talent.

What are some examples of common fringe benefits?

What Are Some Examples of Common Fringe Benefits?

- Understanding Fringe Benefits. Most employers offer their employees competitive wages and salaries. ...

- Insurance Coverage. The most common fringe benefits offered to employees include combinations of insurance coverage. ...

- Retirement Plan Contributions. ...

- Dependent Assistance. ...

- Bonus Compensation. ...

- Other Fringe Benefits. ...

- Fringe Benefits FAQs. ...

- The Bottom Line. ...

How do fringe benefits count as income?

Section 2 of Publication 15-B provides a list of excludable benefits, including:

- Accident and Health Benefits. These benefits include premiums the employer pays toward health insurance and long-term care insurance. ...

- Achievement Awards. ...

- Adoption Assistance. ...

- Athletic Facilities. ...

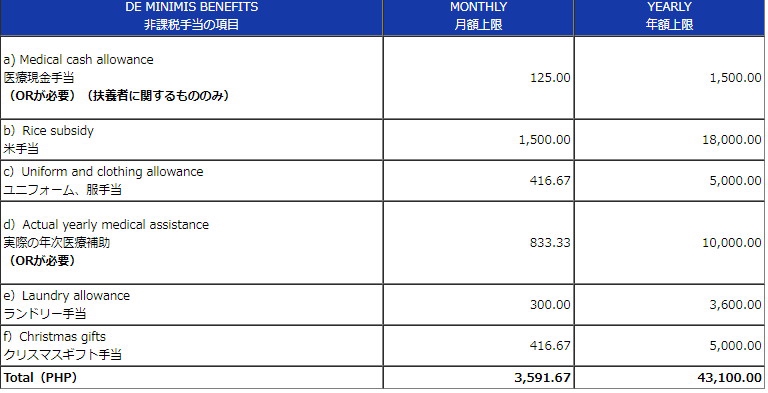

- De Minimis Benefits. ...

- Dependent Care Assistance. ...

- Educational Assistance. ...

- Employee Discounts. ...

- Employee Stock Options. ...

- Employer-Provided Cellphones. ...

What is considered a de minimis fringe benefit?

In general, a de minimis benefit is one for which, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical.

What are examples of de minimis benefits?

What is a De Minimis Benefits Example?Meals, meal vouchers, or meal money provided to employees working overtime.Refreshments purchased for staff meetings or to boost team spirit in the office.Award luncheons or dinners for employees.Personal use of company-owned resources, such as printers and copiers.More items...

What are fringe benefits examples?

Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

What is the de minimis rule?

DE MINIMIS RULE BASICS The de minimis rule states that if a discount is less than 0.25% of the face value for each full year from the date of purchase to maturity, then it is too small (that is, de minimis) to be considered a market discount for tax purposes.

Why are some fringe de minimis benefits not taxable income?

De minimis benefits are not subject to income tax as well as to withholding tax on compensation income of both managerial and rank-and-file employees. When given to employees, no deduction for taxes will be made by the employer; thus, the employee profits from the whole amount of the benefit.

How are de minimis benefits calculated?

How to Determine which Form of Tax is PaidMultiply the face value (bond price when issued) by 0.25%.Take the result above and multiply it by the number of full years between the time you purchased the discounted bond and its maturity.Subtract the result from face value. It will determine the minimis threshold.

Do fringe benefits count as income?

Fringe benefits are generally included in an employee's gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes.

What are the 7 fringe benefits?

These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

What fringe benefits are not taxable?

Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

What is the de minimis limit?

De minimis definition The de minimis limit is the threshold below which the exempt input tax is regarded as insignificant. The main test for the de minimis limit is supplemented by two simplified tests; if either simplified test is passed, there is no need to apply the main test.

What is de minimis fringe benefit?

De minimis fringe benefits are low-value perks provided by an employer ; de minimis is legal Latin for "minimal". Perks that are determined to be de minimis fringe benefits may not be accounted or taxed in some jurisdictions as having too small value and too complicated an accounting.

Is a free meal considered de minimis?

One free meal given to all employees once a year would qualify because the meals are infrequently provided. One free meal provided to a different employee each week throughout the year would not qualify.

Is cash de minimis fringe?

Under Section 1.132-6 (c) of the Treasury Regulations, cash never qualifies as a de minimis fringe. Cash or gift certificates provided to an employee so the employee may buy a theater ticket does not qualify. It would qualify, however, if the employer purchases the theater ticket, provides the actual theater ticket to the employee, ...

Can an employee report de minimis fringe benefits?

Tax consequences for the employee. If the property or services provided to the employee qualify as a “de minimis fringe” benefit, then the employee is allowed not to report the amount.

What is de minimis fringe benefit?

De minimis fringe benefit is a non-wage compensation method that has been used by several businesses for decades.

Why are fringe benefits not taxed?

When tax season starts, these benefits are not taxed because they are not considered to have a high face value by the Internal Revenue Service (IRS).

What to do if you don't have a de minimis gift?

If you still don't feel comfortable assessing whether or not specific gifts are considered de minimis, you should seek professional help. Your accounting firm will answer your questions clearly and resolve your doubts. If you don't have an accounting firm you usually work with, you can contact the IRS directly for a quick answer.

What to do if you don't feel comfortable assessing whether or not specific gifts are considered de minimis?

If you still don't feel comfortable assessing whether or not specific gifts are considered de minimis, you should seek professional help. Your accounting firm will answer your questions clearly and resolve your doubts.

Is de minimis fringe benefit tax free?

De minimis fringe benefit is tax-free for both the organization and the employee. It is not necessary to report it as compensation on tax returns due to:

Can you get de minimis if you have over $100?

The IRS has ruled in the past that amounts over $100 should not qualify for de minimis status. Here are some of the most common examples of de minimis fringe benefits: Holiday presents. Cocktail parties.

Is de minimis fringe tax deductible?

De minimis fringe benefits are also tax-deductible. It means that businesses can report the money spent on these fringe benefits as an expense. It can help businesses reduce their end-of-year tax bill.