Do the beneficiaries of death benefits pay taxes?

There are no immediate taxes for the beneficiary because of its tax-deferred status. A lump sum payment is an option for the spouse. This is a viable alternative for other beneficiaries. If the owner paid for the annuity and received a death benefit, then the beneficiary will be responsible for paying taxes on the difference between the two.

Are death proceeds from life insurance taxable?

In most, but not all cases, life insurance death benefits are not taxable income. Whether you receive a lump sum or periodic payments, as long as the amount does not exceed the death benefit specified in the policy, the proceeds are not taxable income.

Is my life insurance part of my taxable estate?

Under the estate tax rules, insurance on your life will be included in your taxable estate if: Your estate is the beneficiary of the insurance proceeds, or You possessed certain economic ownership rights (called “incidents of ownership”) in the policy at your death (or within three years of your death).

Is a death benefit considered income?

Whether you receive a lump sum or periodic payments, as long as the amount does not exceed the death benefit specified in the policy, the proceeds are not taxable income. However, should you receive more than the stated death benefit, the additional funds are considered interest and treated as income for tax purposes.

Do I have to pay taxes on money received from a life insurance policy?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received. See Topic 403 for more information about interest.

Do you pay taxes on death insurance claims?

Life insurance death proceeds are not taxable with respect to income tax as long as the proceeds are paid out entirely as a lump-sum, one-time payment. However, if your beneficiary receives the life insurance payment as a series of installments, the insurer will typically pay interest on the outstanding death benefit.

Do you get a 1099 for life insurance proceeds?

You won't receive a 1099 for life insurance proceeds because the IRS doesn't typically consider the death benefit to count as income.

How much tax do you pay on life insurance payout?

Is a life insurance payout taxable? One of the perks of a life insurance policy is that the death benefit is typically tax-free. Beneficiaries generally don't have to report the payout as income, making it a tax-free lump sum that they can use freely.

Is 1099 R death benefit taxable?

When a taxpayer receives a distribution from an inherited IRA, they should receive from the financial instruction a 1099-R, with a Distribution Code of '4' in Box 7. This gross distribution is usually fully taxable to the beneficiary/taxpayer unless the deceased owner had made non-deductible contributions to the IRA.

Is a lump sum death benefit taxable?

While some forms of death benefits, such as life insurance payments, are not subject to income tax, the IMRF lump sum death benefit is taxable. Payments from insurance are not subject to income tax because the member paid the premiums on the policy using previously taxed money.

Who claims the death benefit on income tax?

A death benefit is income of either the estate or the beneficiary who receives it. Up to $10,000 of the total of all death benefits paid (other than CPP or QPP death benefits) is not taxable. If the beneficiary received the death benefit, see line 13000 in the Federal Income Tax and Benefit Guide.

Can the IRS take life insurance proceeds from a beneficiary?

If the insured failed to name a beneficiary or named a minor as beneficiary, the IRS can seize the life insurance proceeds to pay the insured's tax debts. The same is true for other creditors. The IRS can also seize life insurance proceeds if the named beneficiary is no longer living.

Why did I get a 1099-R from my life insurance policy?

If you own a life insurance policy, the 1099-R could be the result of a taxable event, such as a full surrender, partial withdrawal, loan or dividend transaction. If you own an annuity, the 1099-R could be the result of a full surrender, a partial withdrawal or the transfer of the contract to a new owner.

Do you have to report inheritance money to IRS?

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

What happens when life insurance goes to the estate?

Generally, death benefits from life insurance are included in the estate of the owner of the policy, regardless of who is paying the insurance premium or who is named beneficiary.

What happens when you die and you sell your life insurance?

The deal gives the owner money to make his last years bearable; when he dies, the buyer collects the policy payout.

How much is life insurance worth?

Life insurance policies have a face value, such as $100,000, $200,000 or $1 million. When the insurer pays you the face value, it's tax-free. Many policies, however, give you more than the face value because of the interest the premiums earned over the years.

Is $26,000 taxable on a 1040?

If the insurer pays, say, $226,000 on a $200,000 face-value policy, the $26,000 is taxable. You report the $26,000 on your 1040, just like your other interest or dividend income.

Do you pay taxes on life insurance?

You don't usually pay taxes on insurance payouts. Insurance isn't income: it's reimbursement for something you've already lost. Life insurance is sometimes an exception. Most of the money should be tax-free, but part of it may be taxable. The deceased's estate may also have to pay tax on it.

Is a $2,000 monthly payment taxable?

If, for example, you're a beneficiary on a $200,000 policy and get 100 monthly payments, anything over $2,000 a month is interest, and therefore taxable.

Is a lump sum insurance payout taxable?

That part is taxable. If the policy doesn't have a stated value, you report any payout that's more than the total value of the premiums. Taking payment in installments requires more math. If, for example, you're a beneficiary on a $200,000 policy and get 100 monthly payments, anything over $2,000 a month is interest, and therefore taxable.

Who is the primary beneficiary of unlimited marital deduction?

A spouse would typically be the owner of a policy if they bought life insurance on their own life. That individual's life is insured, and the other spouse is named as the primary beneficiary.

What is the owner of an insurance policy?

Ownership of the Policy. An insurance policy is a contract between the owner of the policy and the insurance company. The terms of the contract provide that the insurance company will pay a death benefit to a beneficiary designated by the owner in exchange for the payment of premiums. Payment of death benefits is made as of the date of death ...

What is unlimited marital deduction?

The unlimited marital deduction covers the value of all property that passes to a surviving spouse. There's no estate tax payable until the death of the survivor. The estate would not be taxed twice, first as it passes to the surviving spouse and then again when it transfers to the surviving spouse's heirs. The surviving spouse has access ...

Is life insurance tax free?

Life insurance proceeds are tax-free to some extent, but that isn't always the case. Death benefits aren't normally subject to income tax, but they can add to the value of the decedent's estate and become subject to the federal estate tax. 1 That would occur if certain rules weren't met, and the overall value of the estate exceeds ...

Can a child receive death benefits if the spouse is deceased?

Their children might be contingent beneficiaries, to receive the benefits if the surviving spouse were also deceased. That might be the case if the parents died in a common event, for example. The death benefit would be paid to the surviving spouse if the owner/insured spouse were to die first, and the full value of the death benefit would be ...

Is death benefit included in estate?

The whole amount of the death benefit is included in the estate and subject to estate tax if the deceased both owned and was insured by the policy on their date of death. 4. Most people name individuals as beneficiaries, so the death benefit doesn't become part of their estate. The second consideration is usually what causes an estate ...

Is death benefit taxed on second death?

It wouldn't be subject to an estate tax if the benefits were spent by the time of the second death. The death benefit would be included in the estate and would be subject to estate tax if it were paid to the children, because the father was the owner of the policy. The full value of the death benefit is subject to estate tax if there's not ...

How to remove life insurance from taxable estate?

Using Life Insurance Trusts to Avoid Taxation. A second way to remove life insurance proceeds from your taxable estate is to create an irrevocable life insurance trust (ILIT). To complete an ownership transfer, you cannot be the trustee of the trust and you may not retain any rights to revoke the trust.

What happens if you get a death benefit of $500,000?

If the death benefit is $500,000, for example, but it earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth. According to the IRS, if the life insurance policy was transferred to you for cash or other assets, the amount that you exclude as gross income when you file taxes is limited to ...

How to transfer insurance policy?

Here are a few guidelines to remember when considering an ownership transfer: 1 Choose a competent adult/entity to be the new owner (it may be the policy beneficiary), then call your insurance company for the proper assignment, or transfer of ownership, forms. 2 New owners must pay the premiums on the policy. However, you can gift up to $15,000 per person in 2020, so the recipient could use some of this gift to pay premiums. 4 3 You will give up all rights to make changes to this policy in the future. However, if a child, family member, or friend is named the new owner, changes can be made by the new owner at your request. 4 Because ownership transfer is an irrevocable event, beware of divorce situations when planning to name the new owner. 5 Obtain written confirmation from your insurance company as proof of the ownership change.

What happens when you transfer a life insurance policy?

In transferring the policy, the original owner must forfeit any legal rights to change beneficiaries, borrow against the policy, surrender, or cancel the policy, or select beneficiary payment options. Furthermore, the original owner must not pay the premiums to keep the policy in force.

What happens when you name an estate as a beneficiary?

However, when you name the estate as your beneficiary, you take away the contractual advantage of naming a real person and subject the financial product to the probate process. Leaving items to your estate also increases the estate's value, and it could subject your heirs to exceptionally high estate taxes .

Does a life insurance beneficiary have to pay taxes?

Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the beneficiary does not have to pay taxes on it. However, a few situations can exist in which the beneficiary is taxed on some or all of a policy's proceeds. If the policyholder elects not ...

Is life insurance income taxable?

Income earned in the form of interest is almost always taxable at some point. Life insurance is no exception. This means when a beneficiary receives life insurance proceeds after a period of interest accumulation rather than immediately upon the policyholder's death, the beneficiary must pay taxes, not on the entire benefit, but on the interest.

What is death benefit?

Death Benefits. A death benefit is a sum of money paid to one or more beneficiaries when the owner of the death benefit dies. Do not confuse death benefits with the wealth already existing in an account. Rather, death benefits are life insurance payouts on top of the assets accumulated in the decedent’s account.

How long do variable annuities pay out?

Annuities accept contributions up to a certain date and then start paying out assets for a set number of years or until the death of the annuity owner. Most variable annuities come with a death benefit that pays beneficiaries upon the death of the annuitant (who need not be the owner). It is important to separate the payments ...

Can a 401(k) be used for life insurance?

Qualified Retirement Accounts. Certain retirement accounts such as 401 (k)s (but not IRAs) can hold life insurance policies with death benefits that pay beneficiaries when the account owner dies. Each year, the account owner must pay income tax on the insurance premiums attributed to pure life insurance protection, ...

Do insurance policies pay taxes on death benefits?

Insurance Policies. In just about all cases, the death benefits paid by insurance policies are free from income tax. However, tax may be due on any interest earned by the death benefit. This situation occurs when the payout of death benefits is delayed.

Can you get death benefits from an annuity?

Death benefits are tied to life insurance policies, retirement plans and annuities. Death benefits can be paid out as lump sums either immediately or at some future date, or they might be paid out in installments over time, as is the case with annuities.

Is an annuity taxed on death benefit?

It is important to separate the payments that stem from the annuity’s investment value and the payments arising from a death benefit. Taxes on annuity payouts are assessed only on the money earned in the annuity and not on the original contributions, which are returned tax-free. Similarly, if the annuity has a death benefit, ...

How much can you give away if you die in 2018?

This means your estate will only be subject to the estate tax if, over the course of your life (and including your estate when you die), you gave away more than $11,180,000 in excess of the yearly exemption amount.

What happens if you die in 2018?

To illustrate this using simple math: if you die in 2018 having never given away any money to anyone, and you leave an estate worth $10 million, the estate will not be subject to the federal estate tax. This includes any of the taxable events related to life insurance policies. On the other hand, if you gave your niece $2 million in 2017 ...

What is term life insurance?

Term life insurance policies, which are the standard life insurance everyone usually thinks of when they hear "life insurance," have no cash value. The only value in a term life policy is to the beneficiary, who receives the death benefit. To the contrary, some life insurance policies, such as whole life policies and universal life policies, ...

Is life insurance taxable if you have a death benefit?

If your employer provides you with a term life insurance policy with a death benefit of $50,000 or less, the premiums the employer pays on your behalf are not considered taxable income to you. However, if your employer-sponsored life insurance has a death benefit that exceeds $50,000, you may have to pay taxes on a portion ...

Is the $50,000 in a life insurance account taxable?

In that case, the life insurance company will hold the $50,000 in an interest-bearing account and make payments to the beneficiary as you requested. Although the original $50,000 is not taxable income, any interest earned in the account is taxable, and the beneficiary will have to report the interest as income and pay taxes on it.

Do you have to pay taxes on life insurance when you die?

If you have a life insurance policy when you die, your designated beneficiary will receive the money. In most cases, the beneficiary will not have to pay taxes on the money she receives from the policy; however, that isn't always the case, and in certain situations, your estate will owe taxes on a life insurance policy even if your beneficiary ...

Is cash value life insurance taxable?

If you take money out of a cash value life insurance policy, the money you take out is only taxable income in excess of your cost basis. Your basis is generally the amount you've already paid in premiums; that is, the cost you've already expended into the policy. If you've spent $10,000 on your policy premiums and cash out your policy for $10,000, you won't have to pay taxes on it, since you didn't make any money. These policies do keep your money in interest-bearing accounts, however, and all the interest you earn will be considered taxable income when you withdraw it.

Who owes taxes on a policy?

The named beneficiary on the policy, either you or another individual, would owe taxes on the benefits if you paid anything in exchange for ownership of the policy.

What is life insurance?

Updated September 29, 2020. Life insurance is a critical part of ensuring that beneficiaries have a measure of financial stability after their loved one dies. A death benefit can help you replace your loved one’s income and pay for their end-of-life expenses.

How to calculate taxable interest on a 3,000 loan?

You can calculate the taxable portion by dividing the total amount on deposit with the insurance company by the number of installment payments you’re to receive. The result is how much of your installment payment is tax-free.

Do you have to report life insurance on taxes?

You won’t pay taxes as the beneficiary of a life insurance policy (term, whole, or other type of policy) provided you take the money and don’t invest it or put it in an interest-earning account. Per the IRS, you don’t have to report the money as income on your federal tax return.

Do you have to pay taxes on life insurance?

In most cases, you won’t have to pay taxes on a life insurance benefit you receive from the passing of a loved one. However, there are specific situations that may be taxed.

Is life insurance taxable to the beneficiary?

Key Takeaways. The date-of-death value of life insurance proceeds is not taxable to the beneficiary. A beneficiary would have to report and pay taxes on any interest earned or taxable gains made from the life insurance proceeds after receiving the money. Delayed payouts could be taxable if the payout earned interest during the delay.

Why do you need cash value life insurance?

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy. When you pay premiums, the payments generally go to three places: cash value, the cost to insure you, and policy fees and charges.

What is a cash value life insurance policy?

There’s a market for existing life insurance policies, especially cash value life insurance policies that insure people who are terminally ill or have short life expectancies. Transactions involving terminally ill policy owners are called “viatical settlements.” These involve an investor, such as a company specializing in buying policies, paying you money for the policy, becoming the policy owner, and then making the life insurance claim when you pass away.

What are the upsides of life insurance?

Compare Life Insurance Companies. One of the primary upsides to life insurance is that the payout is made to your beneficiaries tax-free. Since life insurance death benefits can be in the millions of dollars, it’s a significant advantage to buying (and receiving) life insurance. But there are other aspects to life insurance ...

What is taxable amount on a loan?

The taxable amount is based on the amount of the loan that exceeds your policy basis. Remember, policy basis is the portion you’ve paid in as premiums. Amounts “above basis” are based on interest or investment gains on cash value.

Is a viatical settlement taxable?

Viatical settlements are typically used as a way for patients to get money for medical bills, especially when selling a life insurance policy will mean getting more money than simply surrendering it for the cash value. Fortunately, the IRS doesn’t treat any portion of what you receive for a viatical settlement as taxable.

Can you take the surrender value of a life insurance policy?

There can be times when a policy owner no longer wants or needs the life insurance policy. You can take the surrender value of the policy, and the insurer will terminate the coverage. The amount you receive is your cash value minus any surrender charge.

Is surrender fee taxable?

Surrendering a policy ends the life insurance coverage. A portion of the money you receive may be taxable if it includes investment gains.

Interest Income

Estate and Inheritance Taxes

- One poor decision that investors seem to frequently make is to name "payable to my estate" as the beneficiary of a contractual agreement, such as an individual retirement account (IRA), an annuity, or a life insurance policy. However, when you name the estate as your beneficiary, you take away the contractual advantage of naming a real person and subject the financial product t…

Using An Ownership Transfer to Avoid Taxation

- Federal taxes won't be due on many estates; due to the Tax Cuts and Jobs Act (TCJA) of 2017, the exemption amount was increased to $11.7 million for 2021 and $12.06 million for 2022. Meanwhile, the maximum estate tax rate is capped at 40%.4 For those estates that will owe taxes, whether life insurance proceeds are included as part of the taxable estate depends on the owner…

Using Life Insurance Trusts to Avoid Taxation

- A second way to remove life insurance proceeds from your taxable estate is to create an irrevocable life insurance trust (ILIT). To complete an ownership transfer, you cannot be the trustee of the trust, and you may not retain any rightsto revoke the trust. In this case, the policy is held in trust, and you will no longer be considered the owner. Therefore, the proceeds are not inc…

Regulations on Life Insurance Policy Ownership

- The IRS has developed rules that help determine who owns a life insurance policy when an insured person dies. The primary regulation overseeing proper ownership is known in the financial world as the three-year rule, which states that any gifts of life insurance policies made within three years of death are still subject to federal estate tax. This applies to both a transfer of ownership …

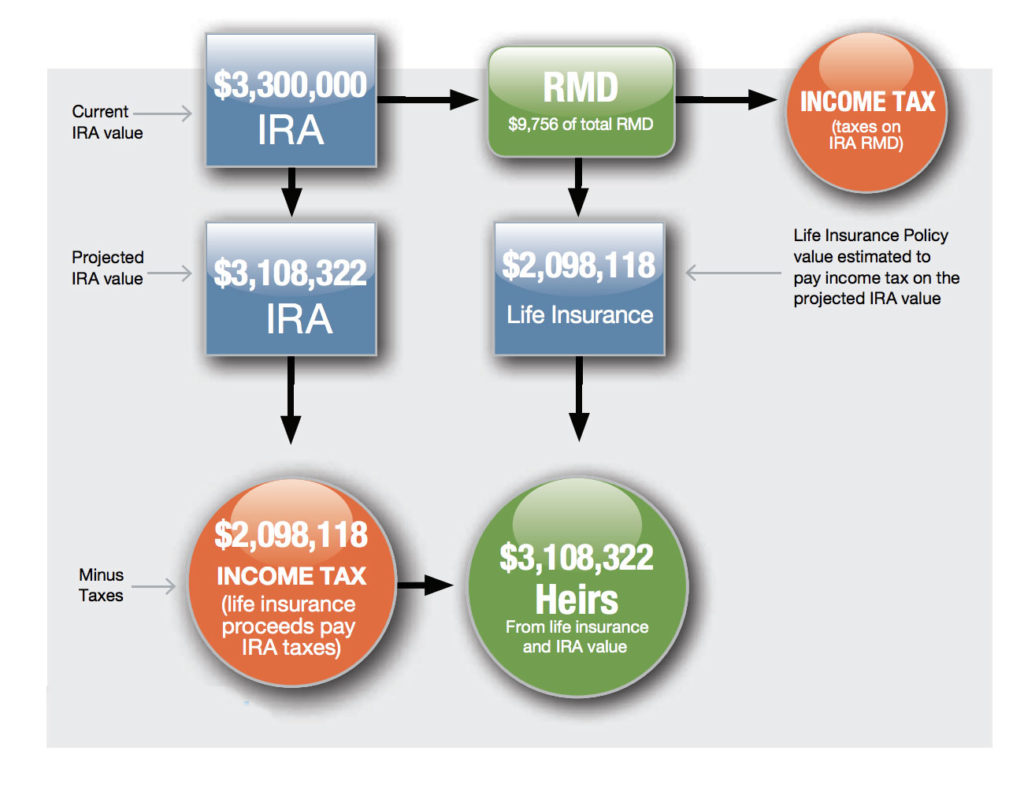

The Bottom Line

- It's not uncommon for individuals to be insured under a life insurance policyfor $500,000 to several million in death benefits. Once you add in the value of your home, your retirement accounts, savings, and other belongings, you may be surprised by the size of your estate. If you factor in more years of growth, some individuals may be facing an estate tax issue. A viable solu…