Which states don't tax Social Security benefits?

37 States That Don’t Tax Social Security Benefits

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

What is the maximum Social Security benefit After retirement?

The maximum possible Social Security benefit for someone who retires at full retirement age is $3,148 in 2021. However, a worker would need to earn the maximum taxable amount, currently $142,800 for 2021, over a 35-year career to get this Social Security payment. 10 Ways to Increase Your Social Security Payments.

What taxes will I owe in retirement?

Your 2020 Federal Income Tax Comparison

- Your marginal federal income tax rate remained at 22.00%.

- Your effective federal income tax rate changed from 10.00% to 9.81%.

- Your federal income taxes changed from $5,693 to $5,580.

Do you pay Social Security taxes in retirement?

You probably won't pay any taxes in retirement if Social Security benefits are your only source of income, but a portion of your benefits will likely be taxed if you have other, additional sources of income. A formula determines the amount of your Social Security that's taxable.

News about Do You Pay Taxes On Retirement Social Security Ben…bing.com/news

Videos of Do You Pay Taxes on Retirement Social Security Benefitsbing.com/videos

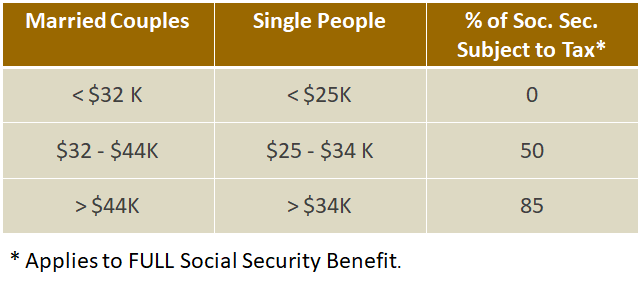

How much of my Social Security retirement income is taxable?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Do retirees pay income tax on Social Security?

Up to 50% of Social Security income is taxable for individuals with a total gross income including Social Security of at least $25,000 or couples filing jointly with a combined gross income of at least $32,000. Retirees who have little income other than Social Security generally won't be taxed on their benefits.

Does the federal government tax Social Security?

The simplest answer is yes: Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Does Social Security benefits count as income?

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

Why is Social Security taxed twice?

The rationalization for taxing Social Security benefits was based on how the program was funded. Employees paid in half of the payroll tax from after-tax dollars and employers paid in the other half (but could deduct that as a business expense).

Do I need to file taxes on Social Security?

Some people have to pay federal income taxes on their Social Security benefits. This usually happens if your clients have other substantial income (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return) in addition to their benefits.

How much can a retired person earn without paying taxes in 2021?

In 2021, the income limit is $18,960. During the year in which a worker reaches full retirement age, Social Security benefit reduction falls to $1 in benefits for every $3 in earnings. For 2021, the limit is $50,520 before the month the worker reaches full retirement age.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

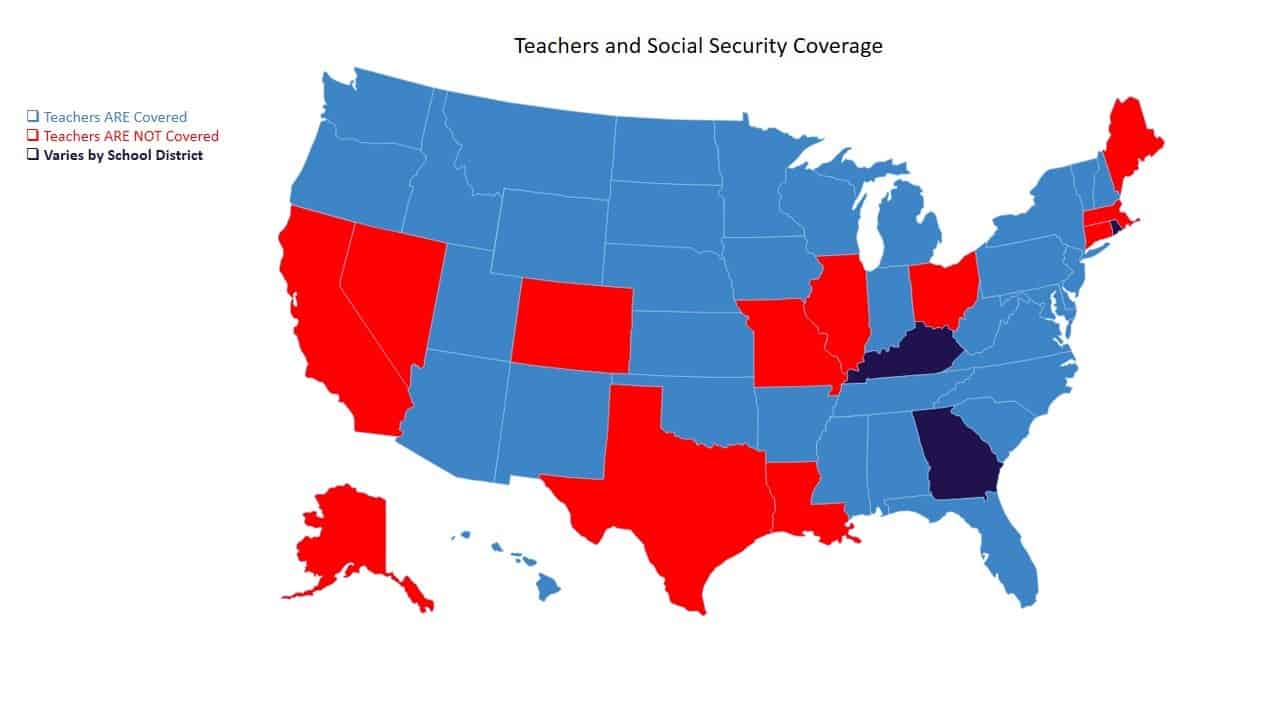

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...